Report Overview

Lung Stent Market - Highlights

Lung Stent Market Size:

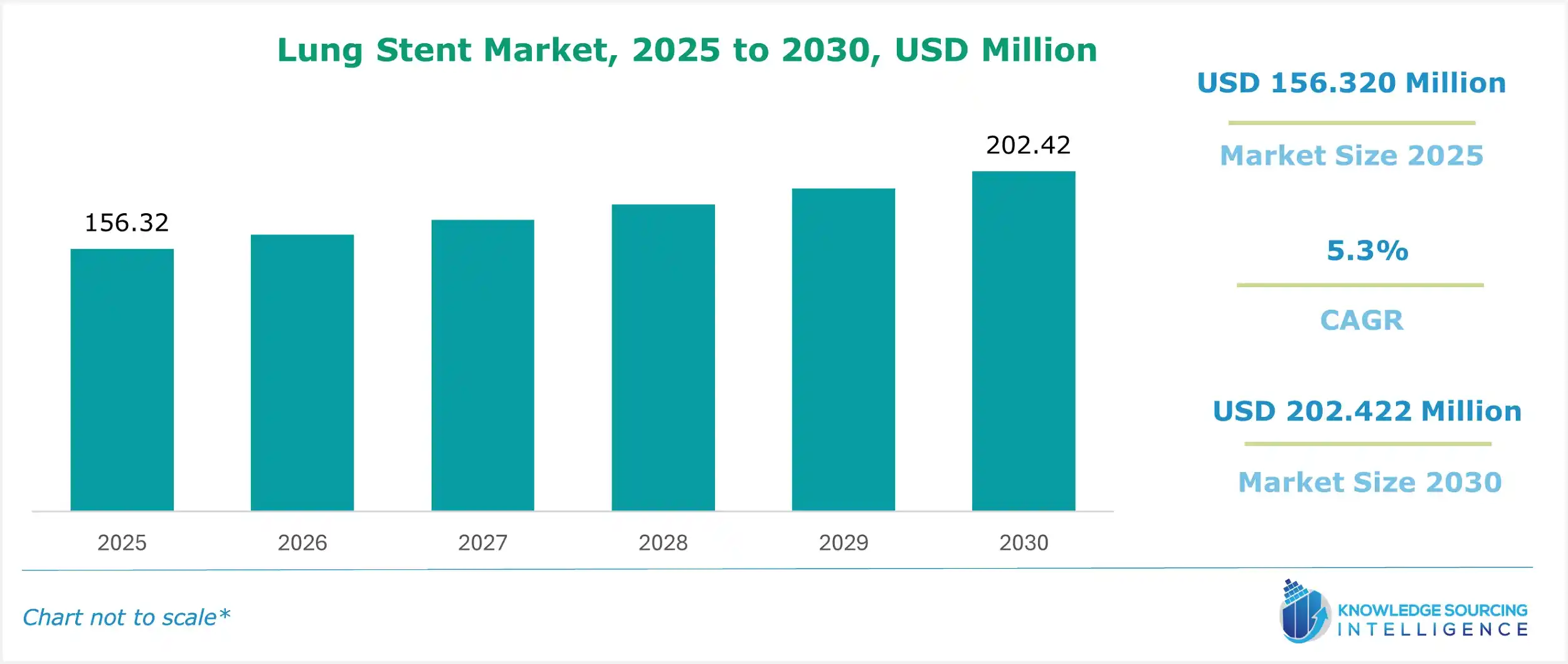

The lung stent market is estimated at US$156.320 million in 2025 and is expected to grow at a CAGR of 5.3% to attain US$202.422 million in 2030.

A lung stent is a type of hollow tube placed through the patient's airway. The lung stent helps in opening the narrowed area in the respiratory system. It is primarily used to treat airway and lung diseases, as well as chronic conditions such as asthma, central airway obstruction, chronic obstructive pulmonary disease, glaucoma, and lung cancer, among others. Irregular granulation tissue, lung cancer, metastatic malignancies, infections, TB, lymphoma, or other inflammatory illnesses can also cause narrowed or stenotic air passages. In most cases, tracheobronchial (airway) stents are devices that are used to splint narrowed airways open. The innovations of the stent technology are also among the factors propelling the lung stent market’s growth during the estimated timeline. Similarly, the changing regulatory environment for medical technology is also estimated to boost the demand for lung stents.

Lung Stent Market Overview & Scope:

The lung stent market is segmented by:

- Type: By type, the global lung stent market is categorized into tracheobronchial stents and laryngeal stents. The tracheobronchial stents category is estimated to grow significantly as they offer more efficient therapy.

- Product Type: By product type, the market is divided into self-expandable, balloon-expandable, and non-expandable. The self-expandable category is expected to grow at a greater rate.

- Product Material: By product material, the market is divided into metal, silicone, and hybrid. The metal category is estimated to grow considerably and is further categorized into nitinol, stainless steel, and others.

- End-User: By end-user, the global lung stent market is divided into hospitals, ambulatory surgery centers, and others. The hospital segment is estimated to attain a greater growth rate.

- Region: The Asia Pacific region is estimated to grow at a significant rate during the forecasted timeline in the global lung stent market. The major factor propelling the region's growth is the increasing development in the healthcare and medical technology sectors. The region witnessed major growth in its medical technology sector, especially in countries like India, Malaysia, and Japan. Similarly, the rising population of older individuals in the region is also estimated to boost the demand.

Top Trends Shaping the Lung Stent Market:

1. Introduction of 3D printing technology

- The introduction of key innovations in stent technologies, including 3D printing technology, helps in creating customized lung stents, which helps in offering more efficient solutions and patient satisfaction.

2. Shift in surgical practices

- The changing global surgical practices, which include increasing demand for minimally invasive surgical practices, are also among the key factors propelling the market's growth.

Lung Stent Market Growth Drivers vs. Challenges:

Opportunities:

- Growing prevalence of lung cancer: The increasing global cases of lung cancer are among the key factors propelling the lung stent market growth during the forecasted timeline. In lung cancer patients, these stents help open the blocked airways. The global lung cancer cases witnessed a major growth during the past few years. The Canadian Cancer Society, in its report, stated that the total projected cases of lung cancer in Canada is projected to reach 17,300, increasing from 15,800 cases in 2023.

- Growing older population: The increasing global population of older individuals is among the key factors propelling the lung stent market growth. With the increasing older population, the lung stent helps in maintaining airway patency and alleviating respiratory distress.

Challenges:

- Limited awareness: The lack of consumer awareness of the individual for airway stent treatment is among the key factors challenging market growth.

Lung Stent Market Regional Analysis:

- North America: The North American region is forecasted to attain a greater market share in the global lung stent market due to its rapid advancement in medical technologies. The region is among the most developed and fastest adopters of new-age technologies, like 3D printing technology, in the healthcare sector. Furthermore, the introduction of key governmental initiatives and policies to boost the development of healthcare infrastructure is also estimated to boost the regional market expansion.

Lung Stent Market Competitive Landscape:

The market is fragmented, with many notable players including Boston Scientific Corporation, Novatech SA, Boston Medical Products, Inc., Fuji Systems Corporation, Cook Group, Hood, E.Benson Laboratories, Inc., Merit Medical Systems, Taewoong (Olympus Global), Micro-Tech (Nanjing) Co., Ltd., S&G Biotech, Stening, MicroPort Scientific Corporation, Thoracent, Inc., and AMETEK Inc. among others.

Lung Stent Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Lung Stent Market Size in 2025 | US$156.320 million |

| Lung Stent Market Size in 2030 | US$202.422 million |

| Growth Rate | CAGR of 5.3% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Lung Stent Market |

|

| Customization Scope | Free report customization with purchase |

Lung Stent Market Segmentation:

By Type

- Tracheobronchial Stents

- Laryngeal Stents

By Product Type

- Self-expandable

- Balloon-expandable

- Non-expandable

By Product Material

- Metal

- Nitinol

- Stainless Steel

- Others

- Silicone

- Hybrid

By End-User

- Hospitals

- Ambulatory Surgery Center

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa