Report Overview

LED Driver Market - Highlights

LED Driver Market Size:

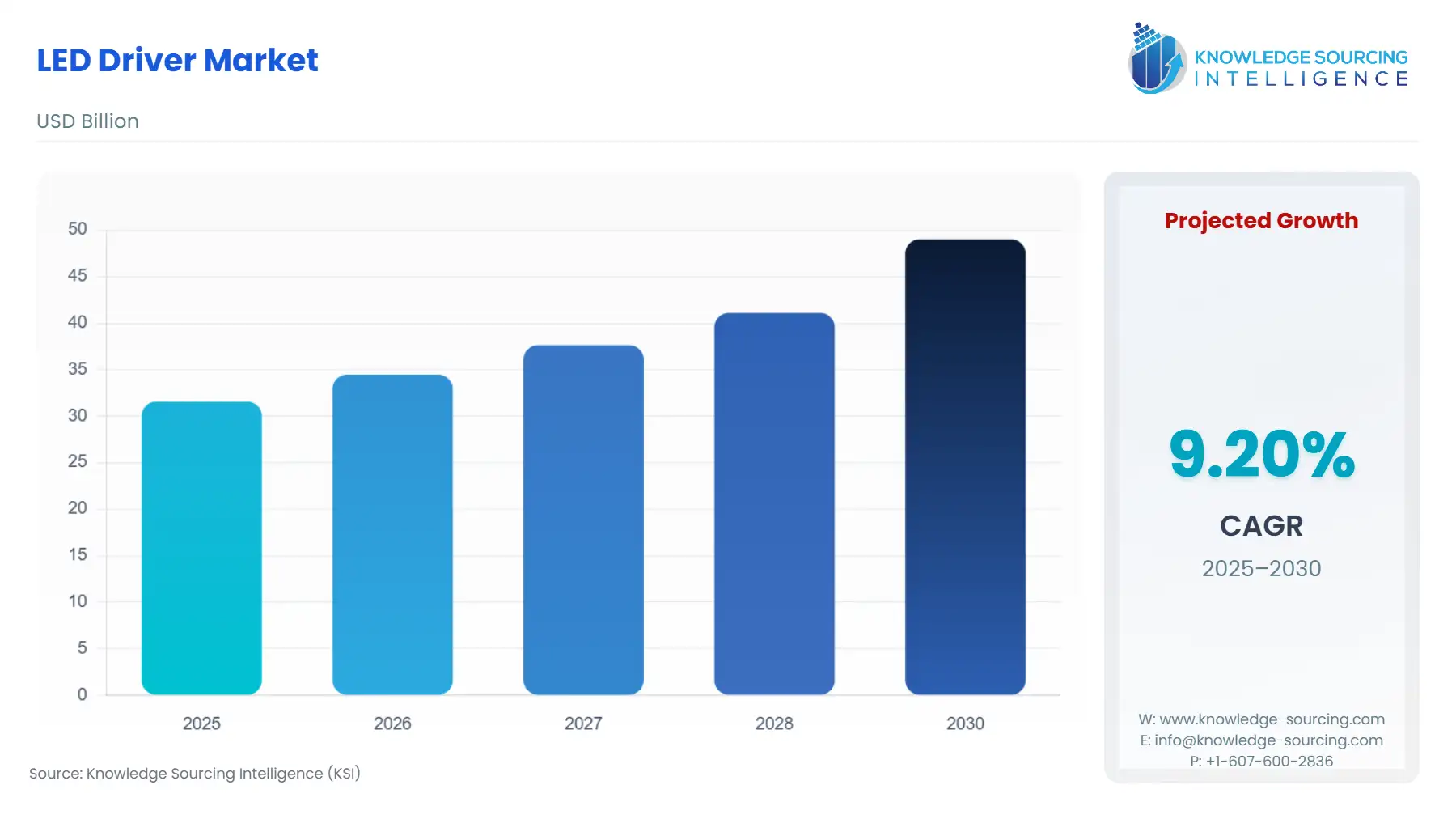

The LED Driver Market is expected to grow at a CAGR of 9.20%, reaching a market size of US$49.021 billion in 2030 from US$31.565 billion in 2025.

LED drivers are electronic devices that control the power and current delivered to Light Emitting Diodes (LEDs). LED drivers convert a power source's higher voltage AC or DC power input into a lower voltage DC output suitable for the LED device. Such LED drivers are widely used in a variety of industries, including automotive, consumer electronics, lighting, and outdoor display. Increasing automotive production and technological advancement in LED drivers pushed the LED driver market upwards.

LED Driver Market Drivers:

- Increasing automotive production bolsters the LED driver market growth.

The LED driver is essential in automotive lighting systems. LEDs (Light Emitting Diodes) are commonly used in vehicles for a variety of purposes such as headlights, taillights, turn signals, and interior lighting. LED drivers keep a consistent voltage level to ensure proper operation and prevent LED damage, as well as convert the vehicle's high-voltage electrical system to the lower voltage required by the LEDs, which makes it an essential component for vehicles. Due to the advanced voltage control capability, LED drivers are in high demand in vehicle production, and increasing automotive production contributed to the LED driver market growth. For instance, according to the European Automobile Manufacturers' Association, in 2022, 85.4 million motor vehicles were produced worldwide, a 5.7% increase over the year 2021.

- Technological advancements in LED drivers fuelled the LED driver market growth.

LED drivers are becoming increasingly essential for a variety of purposes. Continuous advancements in LED driver technology, such as the development of dimmable drivers, flicker-free drivers, and drivers with advanced control features, are positively impacting the market. These innovations contribute to enhanced performance, flexibility, and user experience, which significantly increases the LED driver market growth. Therefore, ACE LEDS offers Match-Book-Sized Drivers 0-10V Dimming LED Drivers, the smallest dimming LED drivers in the market, and 5% TRIAC/Phase-Cut Dimming LED Drivers, designed for exceptionally high efficiency.

- Government restrictions on incandescent bulbs accelerated the LED driver market growth.

Incandescent bulbs consume a lot of energy to produce light and are not as efficient as LED bulbs. Various governments around the world are enacting regulations to phase out inefficient lighting technologies such as incandescent bulbs and promote the use of LEDs. Acceptance of these regulations drives the LED driver market as manufacturers and consumers shift to LED lighting. Moreover, according to the Development Commissioner, Ministry of Micro, Small & Medium Enterprises, governments in some areas have passed laws restricting the use of incandescent bulbs for general lighting purposes, thereby replacing them with modern systems.

LED Driver Market Geographical Outlook:

- Asia Pacific is expected to grow significantly in the LED Driver market.

Asia Pacific is expected to account for a major share of the LED driver market due to the increasing automotive production in the region. For instance, according to the International Organization of Motor Vehicle Manufacturers, a total of 32477472 units were produced in China and India in the fiscal year 2022, representing a 24% increase in India and a 3% increase in China. Furthermore, a total of 3757049 units were produced in South Korea and 7835519 units in Japan in 2022, a 9% increase in South Korea over the previous year.

LED Driver Market Restraints:

- Compatibility concerns will restrain the growth of the LED driver market.

Compatibility issues are one of the challenges affecting the LED driver market; the lack of standardization in terms of form factors, control interfaces, and voltage requirements can create compatibility issues that may limit market demand and stifle the LED driver market's growth.

LED Driver Market Developments:

- November 2025: Novosense launched a portfolio of advanced automotive LED driver ICs (NSL21912/16/24, NSL23716x, NSUC1500), offering improved PWM dimming, diagnostics, and thermal management for exterior and interior vehicle lighting.

- October 2025: Texas Instruments expanded LED driver solutions with evaluation support for its LP8868Z-Q1 buck LED driver, a high-current module enabling configurable dimming and flexible automotive lighting power management.

- June 2025: Signify announced its participation in Light + Building 2026, confirming the upcoming showcase of its latest connected LED drivers and Interact IoT software for professional lighting.

- March 2025: Melexis unveiled the MLX80142 smart automotive LED driver IC featuring six-channel RGB control and the new MeLiBu® 2.0 protocol, simplifying dynamic lighting integration for vehicle interiors and exteriors.

- March 2025: Texas Instruments updated its LED driver portfolio with the LP5816 multi-channel RGBW LED driver IC, offering high-precision dimming and ultra-low power consumption for advanced lighting control.

LED Driver Market Company Products:

- AC10CD250AT2K LED Driver- ACE LEDS' AC10CD250AT2K match-book-sized 10 Watt 0-10V dimming LED drivers are the market's smallest dimming LED driver, which comes with 2.29"L x 1.2"W x 0.91"H x 2.2"M dimension and input voltage of 120 - 277 Volts. It consists of a life expectancy of 50,000 hours at a Tcase of ≤75°C and surge protection of 2 KV.

- Advance CertaDrive indoor LED drivers- Signify's Advance CertaDrive indoor LED drivers are intended to meet basic lighting requirements. These dimmable drivers are available with specific voltage-current settings and are thus optimized with application-specific specifications, making LED conversion affordable. It features 50,000+ hours of lifetime, excellent thermal performance, and high-power factor and low THD.

- MC34844- NXP Semiconductors' MC34844/A is a high-efficiency LED driver designed for backlighting LCDs ranging in size from 10" to 27" operating on 7 V to 28 V power supplies. The MC34844/A can power more than 150 LEDs in 10 parallel strings. The current in the ten strings can be programmed via the I2C/SM-bus interface and is matched to within 2%.

- AT9917 Automotive LED Driver IC- The AT9917 provided by Microchip Technology is a high-performance fixed-frequency PWM IC designed for constant-current control of single-switch, boost, SEPIC, and buck LED drivers. The AT9917 includes a +/-1A gate driver, making it suitable for high-power applications. The AT9917 features a TTL-compatible, low-frequency PWM dimming input that allows for an external control signal with an output duty ratio of 0-100% and a frequency range of several kilohertz.

LED Driver Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| LED Driver Market Size in 2025 | US$31.565 billion |

| LED Driver Market Size in 2030 | US$49.021 billion |

| Growth Rate | CAGR of 9.20% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in LED Driver Market |

|

| Customization Scope | Free report customization with purchase |

LED Driver Market Segmentation:

- By Component

- Driver IC

- Discrete Component

- Others

- By Luminaries

- Decorative Lamps

- Reflectors

- Type A Lamp

- Others

- By Application

- Automotive

- Consumer electronics

- Lighting

- Outdoor Display

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Others

- North America