Report Overview

ID Technologies Market Report, Highlights

ID Technologies Market Size:

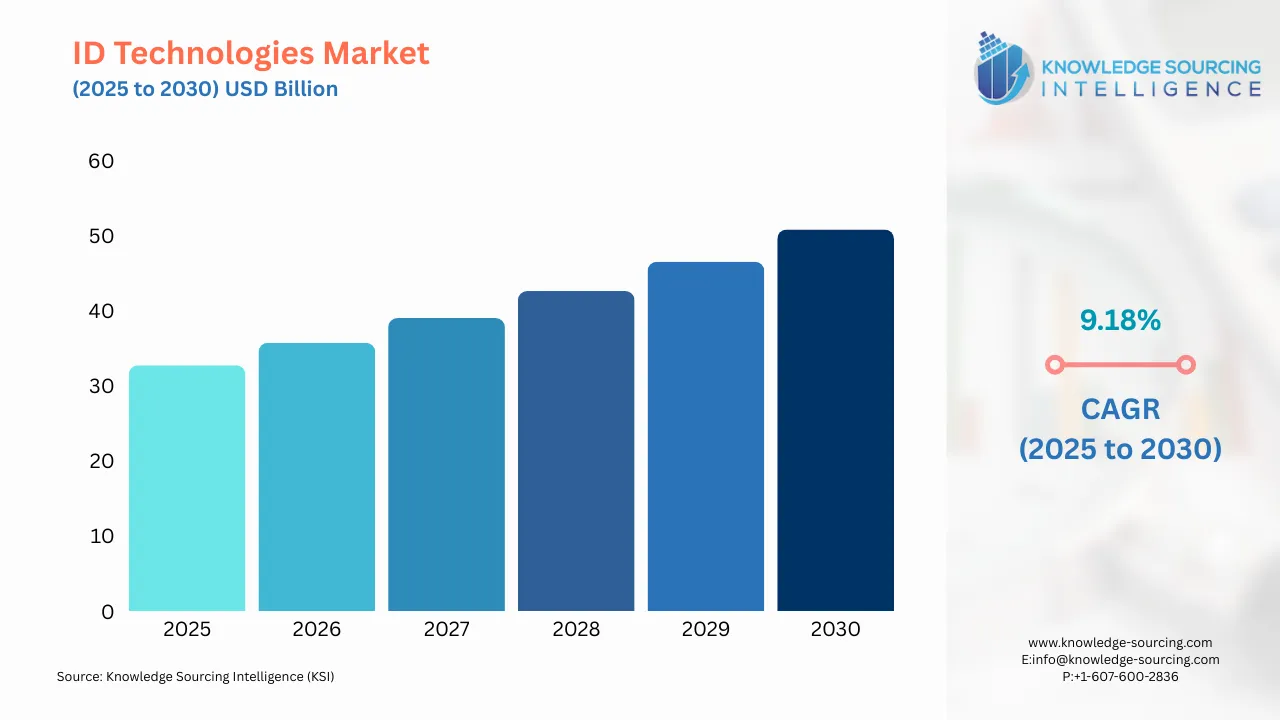

The ID Technologies Market will reach US$50.809 billion in 2030 from US$32.745 billion in 2025 at a CAGR of 9.18% during the forecast period.

ID Technologies Market Trends:

ID technology or identification technology includes smart cards, voice recognition, face recognition, biometrics, and barcodes among other techniques used to identify objects and individuals. Growing concern about data security and safety is driving the demand for ID technologies across a variety of industries.

Travel and tourism industries are booming globally, so national security uses of biometric technologies are on the rise, positively impacting the market growth of ID technologies. Emerging economies such as India are increasingly deploying centralized electronic identification systems, increasing the market's growth. Increased cyber-attack sophistication, cloud adoption, BYOD (Bring your own device) policies adopted by various organizations, and government compliance are the factors driving the ID technology market to grow.

Innovative ID technology is a top priority for many large multinationals For instance, IBM Corporation partnered with Imprivata, an IT security company, to launch a cloud-based identity and access management solution designed to help their customers manage provisioning tracking and de-provisioning of their hybrid cloud and on-premise environments.

Further, governments worldwide focus on creating stringent regulations to curb identity theft and work to secure legal identity for a global population. ID4D is an initiative of the United Nations and the World Bank aiming to provide everyone on earth with a legal identity by 2030. (Source: United Nations)

ID Technologies Market Growth Trends:

- Adoption of Blockchain Technology:

In order to create a secure platform for preventing individuals' names from being stolen and defrauded, blockchain technology has begun to penetrate the identity management market area. Businesses are using blockchain technology to handle authentication and authorization issues. It provides a decentralized and reasonably secure way to store and verify the proof of identity. Blockchain-enabled Identification Management systems in organizations assist in reducing operational risks and costs by eliminating the need for replicated identity repositories and data.

Magic, a blockchain-based identity authentication platform provider, announced it has raised $27 million to continue to commercialize the technology. As part of the round, which was led by Northzone, a host of prominent venture capital and angel investors participated, including Tiger Global, Reddit's Alexis Ohanian, and GitHub's Jason Warner.

- Increase in use of Artificial Intelligence (AI) and Machine Learning:

Identity technology continues to evolve across various critical functions, including authentication and data security, in order to meet privacy compliance requirements. Technical and non-technical employees have access to contextually relevant information, making their work more efficient. Security tactics have been improved through the use of behavioural data analysis in identity management. A machine learning system can, for instance, detect password guessing and analyze user login attempts.

The American software company Ping Identity utilizes Al-driven analysis to monitor an organization's application programming interface (API) activity. The security industry is being radically transformed by artificial intelligence and machine learning.

ID Technologies Market Restraints:

- Lack of identity standards and budgetary constraints:

Organizations across industry verticals are concerned about the increasing cyber threat landscape. Identification technology is stifled by a lack of identity standards and insufficient budget resources, as well as high installation costs. Due to the need to integrate robust security technologies, the initial investment and maintenance costs are high for this system. The insufficient budget continues to be a significant challenge to achieving ID security objectives. A number of major economies are experiencing tight budgets, such as some parts of the region, the Middle East, and Latin America, where companies are either self-funded or running with small capital.

The global ID Technologies Market report delivers a thorough analysis of the industry landscape, providing strategic and executive-level insights supported by data-driven forecasts and analysis. This regularly updated report empowers decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It evaluates demand across various technologies, including Barcodes, Radio Frequency Identification (RFID), Biometrics, Smart Cards, and others, while analyzing key components such as Data Encoder, Machine Reader, and Data Decoder. The report further explores market segmentation by application, covering Forensics, Security Checks, and others, as well as by end-user industry, including Government, Security and Defence, BFSI, and others. Additionally, it examines technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive perspective of the ID Technologies market.

ID Technologies Market Segmentations:

ID Technologies Market Segmentation by technology

The market is analyzed by technology into the following:

- Barcodes

- Radio Frequency Identification (RFID)

- Biometrics

- Smart Cards

- Others

ID Technologies Market Segmentation by components:

The report analyzes the market by components as below:

- Data Encoder

- Machine Reader

- Data Decoder

ID Technologies Market Segmentation by application

The report analyzes the market by application as below:

- Forensics

- Security Checks

- Others

ID Technologies Market Segmentation by end-user industry:

The report analyzes the market by end-user industry as below:

- Government

- Security and Defence

- BFSI

- Others

ID Technologies Market Segmentation by regions:

The study also analysed the ID Technologies Market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

ID Technologies Market Competitive Landscape:

The global ID Technologies Market features key players such as Technologies Plus, ID Technology (Promach), Datalogic, 3M, Thales Group, Fujitsu, Agilent Technologies, ImageWare Systems, Precise Biometrics, S.I.C. Biometrics, among others.

ID Technologies Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by technology, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by components, with historical revenue data and analysis.

- Market size, forecasts, and trends by application, with historical revenue data and analysis across various segments.

- Market size, forecasts, and trends by end-user industry, with historical revenue data and analysis across various segments.

- ID Technologies Market is also analysed across different regions, with historical data, regional share, attractiveness and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the ID Technologies Market to the decision-makers, analysts and other stakeholders in the easy to read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

ID Technologies Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| ID Technologies Market Size in 2025 | US$32.745 billion |

| ID Technologies Market Size in 2030 | US$50.809 billion |

| Growth Rate | CAGR of 9.18% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the ID Technologies Market |

|

| Customization Scope | Free report customization with purchase |

Our Best-Performing Industry Reports:

Navigation:

- ID Technologies Market Size:

- ID Technologies Market Key Highlights:

- ID Technologies Market Trends:

- ID Technologies Market Growth Trends:

- ID Technologies Market Restraints:

- ID Technologies Market Segmentations:

- ID Technologies Market Competitive Landscape:

- ID Technologies Market Report Coverage:

- ID Technologies Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 30, 2025