Report Overview

Hot Dogs And Sausages Market Size:

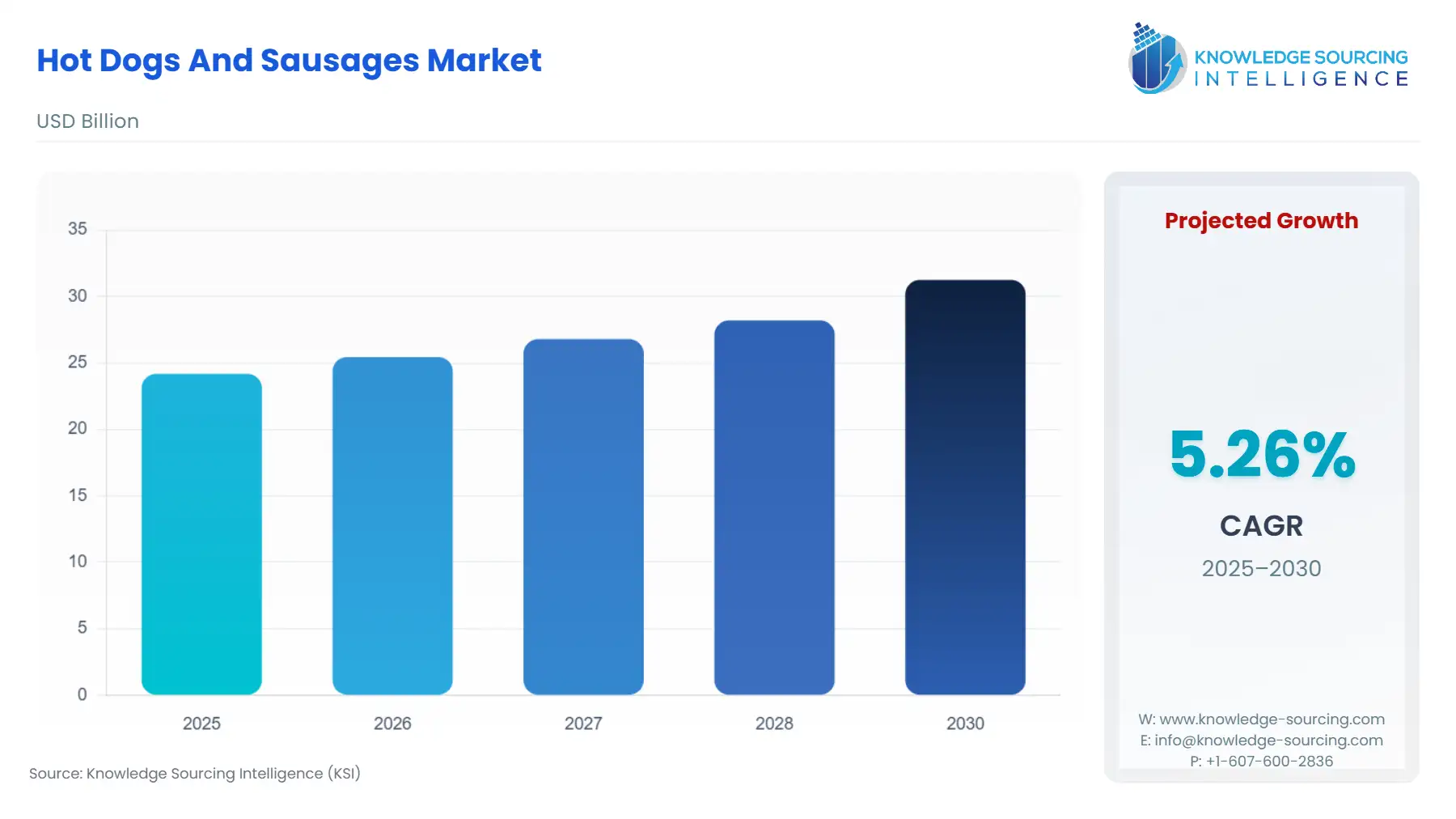

The Hot Dogs And Sausages Market is anticipated to grow from USD 24.184 billion in 2025 to USD 31.257 billion by 2030, with a 5.27% CAGR.

Hot dogs and sausages are shaped meat products packed into a casing which helps give them the desired shape and texture. Hot dogs and sausages are generally made from ground meat, pork, beef, and poultry meat and are served in snacks and lunch with bread. Changing healthcare and fitness cautiousness has encouraged the inculcation of a protein-based diet which, hence, has raised meat consumption globally. Rising meat consumption has increased the consumption of hot dogs and sausages.

Furthermore, the growing snacking habit has also encouraged the consumption of hot dogs and sausages with bread, which is expected to drive market growth. Robust growth in the fast food and ready-to-eat food industries is also expected to bring significant growth in the market. However, the rising availability of plant-based meat substitutes and rising diseases among animals are anticipated to hinder market growth.

Hot Dogs And Sausages Market Driver:

- The rising meat market is projected to drive the demand for hot dogs and sausages.

One of the prime reasons supporting the growth in the hot dogs and sausages market is rising meat consumption with increasing inculcation of a protein-based diet. Overall, the bulk of meat production growth is attributed to developing regions, which will account for 80% of the additional output. Data from FAO stats shows that chicken slaughter globally has surged to over 69.01 billion in 2019 from 61.83 billion in 2014. Pigs slaughter reached 1.48 billion in 2018, while the overall livestock population has been increasing at a noteworthy rate.

Furthermore, it is projected that beef consumption is calculated to rise to 76 Mt over the next decade and is expected to constitute approximately 16% of the net increase in global meat consumption as compared to the base period. Also, it is observed that worldwide pig meat consumption will surge at a promising rate to 127 Mt over the next years and is expected to hold 28% of the global meat market in terms of consumption. According to FAO, the meat consumption of the world was 41.3 kg per capita in 2015 and is projected to increase by around 9.7% to 45.3 kg per capita. It is anticipated that rising meat market dynamics will support the market for hot dogs and sausages during the forecasted period.

The Hot Dogs and Sausages Market is analyzed into the following segments:

-

By Framing Type

-

Organic

-

Conventional

-

-

By Ingredient Type

-

Beef

-

Chicken

-

Pork

-

Others

-

-

By Product Type

-

Cooked

-

Dried

-

Fresh

-

Smoked

-

Others

-

-

By Packaging Type

-

Boxes

-

Flow Pack

-

Jars

-

Others

-

-

By Distribution Channel

-

Offline

-

Online

-

-

By Geography

-

North America

-

USA

-

Canada

-

Mexico

-

-

South America

-

Brazil

-

Argentina

-

Others

-

-

Europe

-

Germany

-

France

-

United Kingdom

-

Spain

-

Others

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Others

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

Others

-

-