Report Overview

Heavy Duty Connector Market Highlights

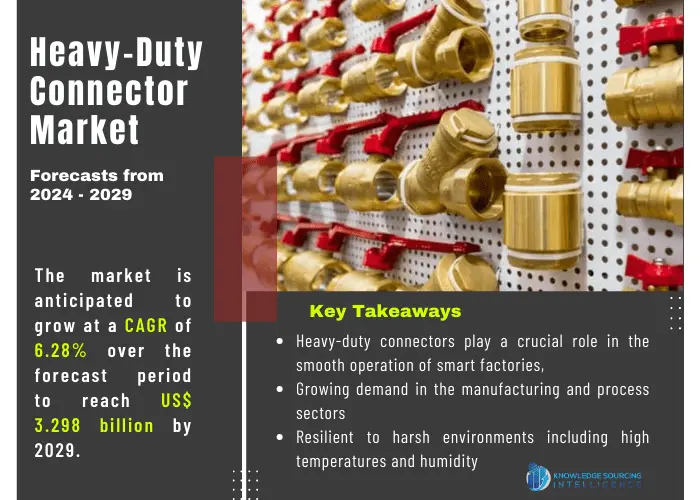

The heavy-duty connector market is evaluated at US$2.327 billion for the year 2022 growing at a CAGR of 6.28% reaching the market size of US$3.298 billion by the year 2029.

The heavy-duty connector is also known as an industrial connector or a multi-pin connector and is designed to withstand the demanding conditions of industrial settings. These connectors are known for their sturdy design and long lifespan. They can tolerate a variety of challenging circumstances, such as high or low temperatures, moisture, dust, vibration, and mechanical stress.

Heavy-duty connectors are often made of durable materials like metal or premium plastics and offer dependable electrical connections in situations where conventional connectors would not hold up. They are crucial parts of intricate industrial machinery, automation systems, and equipment because of their many pins or contacts, which enable the simultaneous transfer of signals, power, and data. Furthermore, heavy-duty connectors' modular architecture allows for easy customization and flexibility to meet a broad range of needs which increases its use in various applications.

MARKET TRENDS:

The growth of the heavy-duty connector market is majorly attributed to the wide adoption of industrial automation across numerous industry verticals. The growing focus on the safety of workers is further amplifying the demand for industrial safety solutions, which is also projected to supplement the growth of the market for the coming years. Furthermore, mandatory safety requirements and a growing emphasis on energy-efficient manufacturing are all contributing to market growth.

The burgeoning construction industry across the globe on account of the growing investments by the governments of various countries is also considered one of the prime factors driving the market significantly during the forecast period. Furthermore, the growing manufacturing activities in major developing economies such as India, China, Indonesia, and Brazil are also projected to propel the market growth opportunities for the heavy-duty connector market during the forecast period.

MARKET DRIVERS:

- Growth in industry automation and industry 4.0 is anticipated to positively impact the market.

Industrial automation is having a significant influence on the heavy-duty connection market as manufacturing and industrial processes continue to be reshaped by automation trends. Heavy-duty connections are essential for providing consistent and secure communication in automated systems due to the growing integration of sensors, actuators, and control devices. These connectors, which reliably transfer power and signals between different parts of automated machinery, are made to resist the rigors of industrial settings. Heavy-duty connectors play a crucial role in the smooth operation of smart factories, where flawless communication is necessary to optimize production processes, as industries adopt Industry 4.0 concepts.

- Rising demand in manufacturing and process industries is expected to upsurge the market.

The heavy-duty connectors market is heavily influenced by the growing demand in the manufacturing and process sectors, which highlights the vital role that these connections play in enabling dependable and strong operations. Heavy-duty connectors are crucial parts of maintaining safe and durable connections in the dynamic environments of the manufacturing and process industries. They are essential for sustaining continuous and effective manufacturing operations because of their resilience to harsh environments including high temperatures, humidity, vibrations, and exposure to dust and chemicals.

Overall, heavy-duty connectors are becoming more necessary as these sectors develop and use cutting-edge automation technology to ensure the smooth transfer of power and data between different equipment components.

MARKET RESTRAINTS:

Despite all of its benefits, heavy-duty connections have some built-in limitations and restrictions. For instance, compared to typical alternatives, their sturdy design frequently produces bigger, heavier connections, which can affect handling and installation, especially in confined locations or situations where weight is an issue. Furthermore, the complexity and costs associated with heavy-duty connectors may grow due to the need for specialized tools and knowledge for installation and maintenance due to their various pins and contacts.

Additionally, because of their larger design, heavy-duty connections may not be appropriate for applications needing exceptionally high levels of accuracy or miniaturization, even if they perform well in demanding industrial conditions which is anticipated to hamper the overall market.

The manufacturing industry is projected to show noteworthy growth.

By industry vertical, the segmentation of the market has been done based on manufacturing, oil and gas, railways, construction, energy and power, and others. The manufacturing industry is expected to show robust growth during the forecast period.

The growing adoption of automation solutions across numerous industry verticals is also projected to surge the growth of the market throughout the forecast period. In addition, the railway is also anticipated to grow at a notable rate due to the growing investments in the railway infrastructure.

Asia Pacific is predicted to account for a significant share of the heavy-duty connector market.

Regionally, the market has been divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The Asia Pacific region is expected to witness significant market growth on account of rapid industrialization and growing industrial automation in major end-use industries. Strong electrical connections that can resist challenging working circumstances are in high demand due to the tremendous industrialization and infrastructure growth occurring in countries such as China, India, Japan, and Southeast Asian nations.

The increasing use of robots, automation, and smart manufacturing solutions all of which depend on heavy-duty connections for dependable data transfer and power transmission is driving up demand for these connectors in the region. Moreover, the European region is projected to hold a notable market share on account of the early adoption of technology and well-established infrastructure.

Market Developments:

- In December 2023, a leading specialist distributor of electrical components, TTI, Inc., stocked Amphenol Industrial's CHD (Circular Heavy Duty) connectors. The robust, high-performance CHD14 series is designed for use in demanding commercial and off-road vehicle applications such as EV battery packs, inverters, and power distribution systems, where electrical connections need to be dependable and weather-resistant.

- In July 2023, with its Harnessflex® EVOTM Connector Interfaces, ABB Installation Products invented the first complete line of hinged high voltage connector backshells for heavy-duty EVs, protecting and stabilizing these connectors.

Heavy Duty Connector Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2022 | US$2.327 billion |

| Market Size Value in 2029 | US$3.298 billion |

| Growth Rate | CAGR of 6.28% from 2022 to 2029 |

| Study Period |

2019 to 2029 |

| Historical Data |

2019 to 2022 |

| Base Year | 2023 |

| Forecast Period | 2024 – 2029 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered | |

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Component

- Inserts

- Housings

- Accessories

- Base

- Hood

- By Termination

- Screw

- Crimp

- Others

- By Material

- Plastic

- Metal

- By Industry Vertical

- Manufacturing

- Oil and Gas

- Railways

- Construction

- Energy and Power

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Taiwan

- Others

- North America