Report Overview

Healthcare IT Integration Market Highlights

Healthcare IT Integration Market Size:

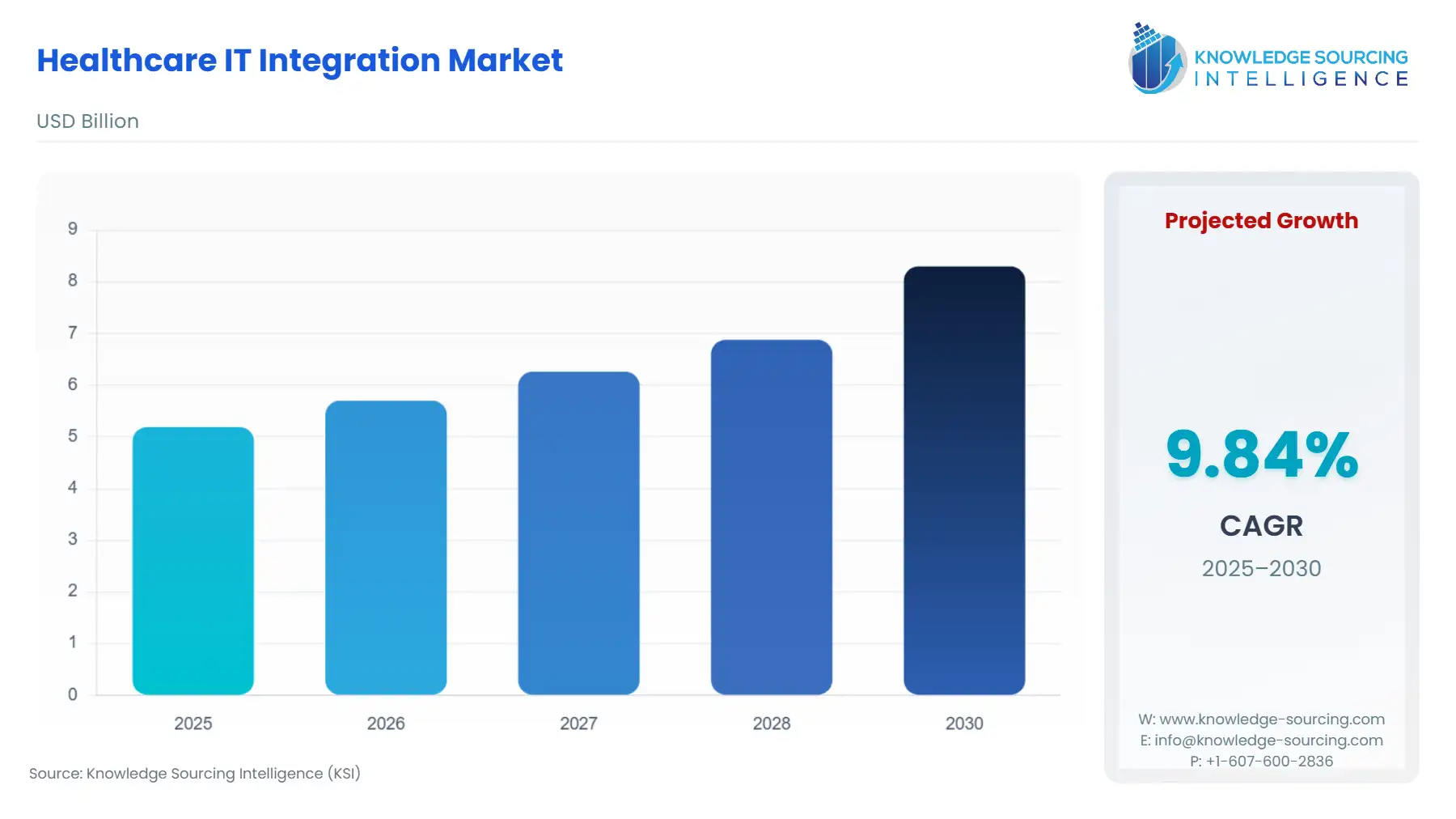

Healthcare IT Integration Market, at a 9.54% CAGR, is projected to increase from USD 5.190 billion in 2025 to USD 8.968 billion in 2031.

Healthcare IT Integration Market Trends:

The growing use of electronic health records (EHRs), the requirement for easy data sharing and interoperability among healthcare systems, and the increasing need for integrated healthcare solutions are all driving healthcare IT integration market growth. The healthcare IT integration market size is growing rapidly as healthcare organizations engage in modern IT integration solutions. Various vendors and solution providers offering healthcare IT integration solutions compete for healthcare IT integration market share, with competition increasing as new companies enter the industry. The Healthcare IT Integration healthcare IT integration market size is positioned for ongoing expansion, allowing improved patient care, simpler processes, and increased operational efficiency.

The healthcare IT integration market growth is a dynamic and continuously growing area of the healthcare business that focuses on integrating and linking various information technology systems and solutions to improve patient care, operational efficiency, and healthcare workflow optimization. With the rising digitization of healthcare data and the deployment of electronic health records (EHRs), there is a growing need to link disparate healthcare IT applications, devices, and software platforms.

Healthcare IT integration entails the smooth interchange and harmonization of data across many systems, allowing healthcare organizations to have a uniform and comprehensive picture of patient data. It includes EHRs, laboratory information systems (LIS), picture archiving and communication systems (PACS), radiology information systems (RIS), pharmacy systems, and other systems. Healthcare providers may expedite operations, decrease data input duplication, increase data accuracy, and promote efficient information exchange among healthcare professionals by linking these systems. The healthcare IT integration market size as healthcare organizations invest in sophisticated integration technology to break down data silos, improve care coordination, and provide better patient experiences. Furthermore, as the importance of data analytics and artificial intelligence in healthcare grows, integration becomes critical for realizing the full potential of these technologies to improve patient outcomes and operational efficiencies.

List of Top Healthcare IT Integration Companies:

Epic Systems Corporation: Epic provides complete healthcare IT integration solutions, such as EHR systems, interoperability platforms, and integration tools. They are primarily concerned with linking disparate healthcare systems and allowing data interchange to improve care coordination.

Veradigm LLP: Veradigm provides healthcare IT integration solutions that integrate diverse systems such as electronic health records (EHRs), laboratory systems, and pharmacy systems. Their solutions attempt to increase interoperability and data interchange efficiency.

Health Catalyst: Health Catalyst is a company that focuses on healthcare analytics and integration solutions. They provide systems that let healthcare organizations combine and analyze data from several sources, allowing for data-driven decision-making and quality improvement.

Healthcare IT Integration Market Growth Drivers:

A greater focus on interoperability and data exchange:

The need to remove data silos and enable seamless communication among healthcare systems is driving the increased emphasis on interoperability and data sharing in healthcare. It entails integrating and exchanging patient information, medical records, and clinical data across several platforms and organizations. Healthcare practitioners can get access to full patient information, increase care coordination, improve clinical decision-making, and expedite processes through fostering interoperability. Interoperability also helps with population health management, research and analytics, and the adoption of new technologies like telemedicine and artificial intelligence. Interoperability and data interchange are critical for efficient, patient-centred, and data-driven healthcare delivery.

Demand for seamless workflow and information sharing:

The desire to increase cooperation among healthcare workers, reduce operations, and improve patient care drives the demand for seamless workflow and information exchange in healthcare. Efficient communication, rapid access to pertinent data, and coordinated care delivery are all made possible through seamless workflow and information sharing.

Advancements in health information technology (hit) solutions:

Health Information Technology (HIT) advancements relate to the ongoing development and innovation of healthcare technology tools, software, and systems. Electronic health records (EHRs), telemedicine, mobile health applications, remote monitoring, and other digital technologies that improve patient care, data management, and healthcare delivery efficiency are examples of these improvements.

Healthcare IT Integration Market Segmentation Analysis:

The Healthcare IT integration market is expanding at a steady pace in the forecast period.

The market for healthcare IT integration is segmented by types of integration, deployment model, end-user, and geography. Types of integration are further segmented into application integration, data integration, device integration, health information exchange, system integration, and others. The deployment model is further segmented into implementation services, support and maintenance services, training and education services, and consulting services.

Healthcare IT Integration Market Geographical Outlook:

North America is the biggest market leader in the Healthcare IT Integration Market globally.

North America dominates the healthcare IT integration market share. The region's supremacy may be linked to factors such as a well-established healthcare infrastructure, widespread use of electronic health records (EHRs), and favourable government regulations that encourage interoperability. Because of its enormous healthcare expenditure and modern healthcare IT systems, the United States contributes considerably to healthcare IT integration market share. Europe has a significant healthcare IT integration market share because of the deployment of interoperability standards and efforts. Due to increased healthcare IT investments and the implementation of digital health technology, Asia Pacific is seeing significant healthcare IT integration market growth. Overall, the Healthcare IT Integration Market is led by North America, followed by Europe and Asia Pacific.

Healthcare IT Integration Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Healthcare IT Integration Market Size in 2025 | USD 5.190 billion |

Healthcare IT Integration Market Size in 2030 | USD 8.298 billion |

Growth Rate | CAGR of 9.84% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Healthcare IT Integration Market |

|

Customization Scope | Free report customization with purchase |

Healthcare IT Integration Market Segmentation

By Type of Integration

Application Integration

Data Integration

Device Integration

Healthcare Information Exchange (HIE)

Others

By Service Type

Implementation Services

Support And Maintenance Services

Training And Education Services

Consulting Services

By End-User

Hospitals And Clinics

Diagnostic Laboratories

Ambulatory Surgical Centers

Healthcare Payers

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others