Report Overview

Global Wheat Market Size, Highlights

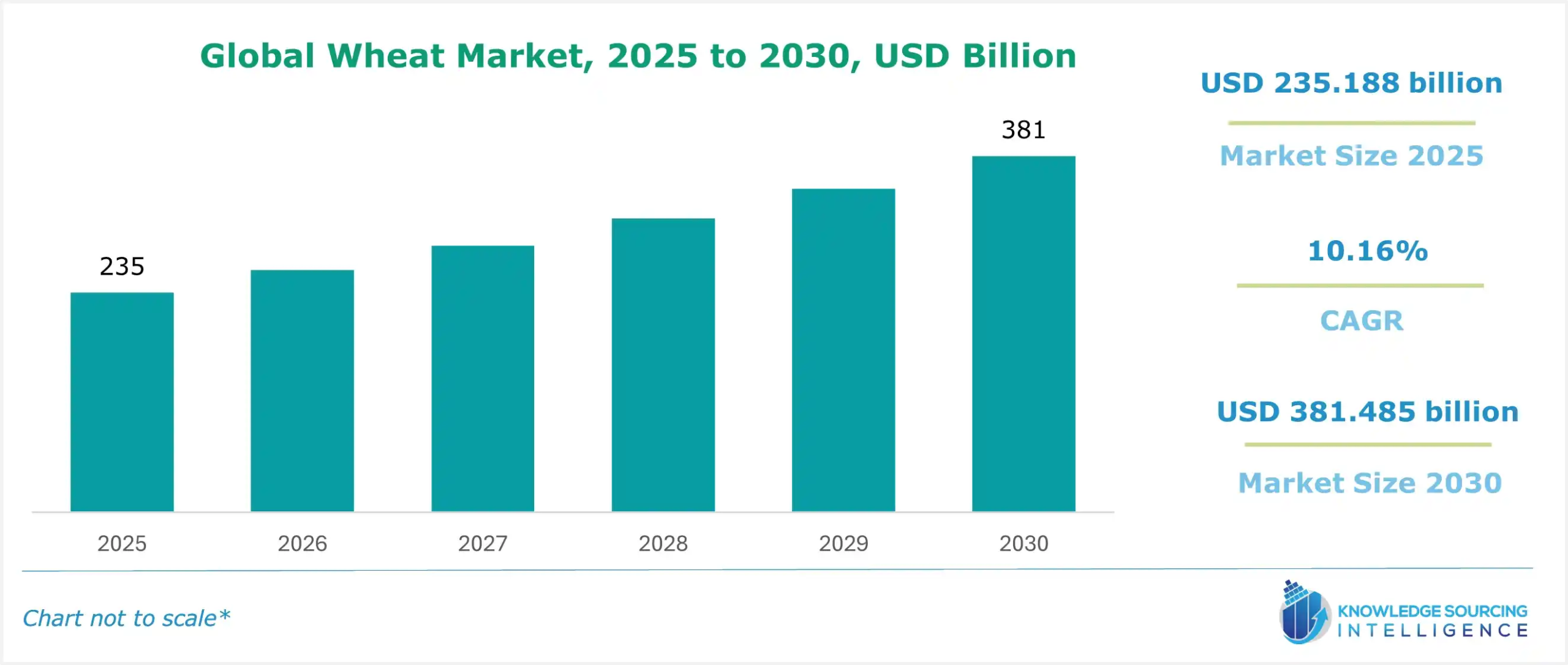

Wheat Market Size:

The global wheat market is estimated to grow at a CAGR of 10.16%, from US$235.188 billion in 2025 to US$381.485 billion in 2030.

Wheat is a type of grass that is cultivated worldwide mainly for its seed. It is among the most common cereals consumed by the majority of the global population. Wheat is among the most common sources of carbohydrates, vitamins, and minerals. The cereal also offers a higher amount of energy on consumption, as it has a higher quantity of carbohydrates, and can help in managing weight. The consumption of whole wheat also lowers the risk of cardiovascular diseases.

The wheat seed is used for multiple applications, commonly in the food and beverage sector. The wheat seeds are grinded for producing wheat flour or semolina. Various wheat varieties are cultivated worldwide, including hard red spring, soft white, hard wheat, and others. Hard red spring wheat is mainly cultivated in the North American region, whereas soft white wheat offers a high break and straight-grade flour yield. It contains lower ash and low starch damage.

The global wheat market is estimated to witness substantial growth in demand, majorly with the increasing wheat production worldwide. In the cultivation of wheat, China, India, the EU, and Russia are among the biggest producers, producing more than half of the global wheat. Similarly, the increasing consumer perception of wheat products' health benefits is also estimated to increase its market size globally.

What are the global wheat market drivers?

- Increasing production of wheat across the globe

A major factor propelling the global wheat market is the increasing wheat production globally. Wheat is among the most commonly produced food grains, and it is produced in almost every region globally. The global demand for wheat witnessed a major increase. The US Department of Agriculture, in its report, stated that the global production of wheat grew significantly over the past few years. The agency stated that in the European Union, about 134,292 thousand tons of wheat were produced in 2022, which increased to 134,865 thousand tons in 2023. Similarly, in India, wheat production increased from 104,000 thousand tons in 2022 to about 110,554 thousand tons in 2023.

USDA further stated that the production of wheat is majorly concentrated in the European and Asian regions, with China, the EU, India, and Russia producing the majority of the global wheat annually. China, the EU, and India alone occupy about 48% of the global production share of wheat. The agency stated that in the 2023-24 financial year, China and the EU occupied about 17% of the global wheat production, whereas India and Russia contributed about 14% and 12%, respectively, each in the same year.

- Growing prevalence of cardiovascular diseases

The increasing global cases of cardiovascular diseases are estimated to surge the demand for wheat. In the cases of cardiovascular diseases or CVD, it offers multiple benefits in managing the risk of the diseases. Wheat grains contain dietary fiber, which helps in reducing the risk of CVD, as it reduces the body’s absorption of cholesterol. It also helps in inhibiting plaque build-ups in the blood vessels.

Cardiovascular diseases are among the most prevalent diseases, prevalent across the globe. The global cases of cardiovascular diseases have witnessed a massive surge in recent years, majorly due to consumers’ changing dietary preferences. The Oxford University Press, in its article, stated that in Europe, cardiovascular diseases account for about 11% of the total expenditure on healthcare. The organization further noted that CVD is among the most common diseases, causing death worldwide, with about 3 million deaths per year in the EU.

Similarly, the British Heart Foundation, or BHF UK, in its report, stated that the deaths in the United Kingdom caused by heart and circulatory diseases increased significantly over the past few years. The association states that in 2021, about 318 deaths per 100,000 in men and 209 deaths per 100,000 women were caused by CVD, which increased to 326 deaths per 100,000 in men, and CVD caused 212 deaths per 100,000 in women. In both categories, the deaths per 100,000 increased from 259 in 2021 to 264 in 2022.

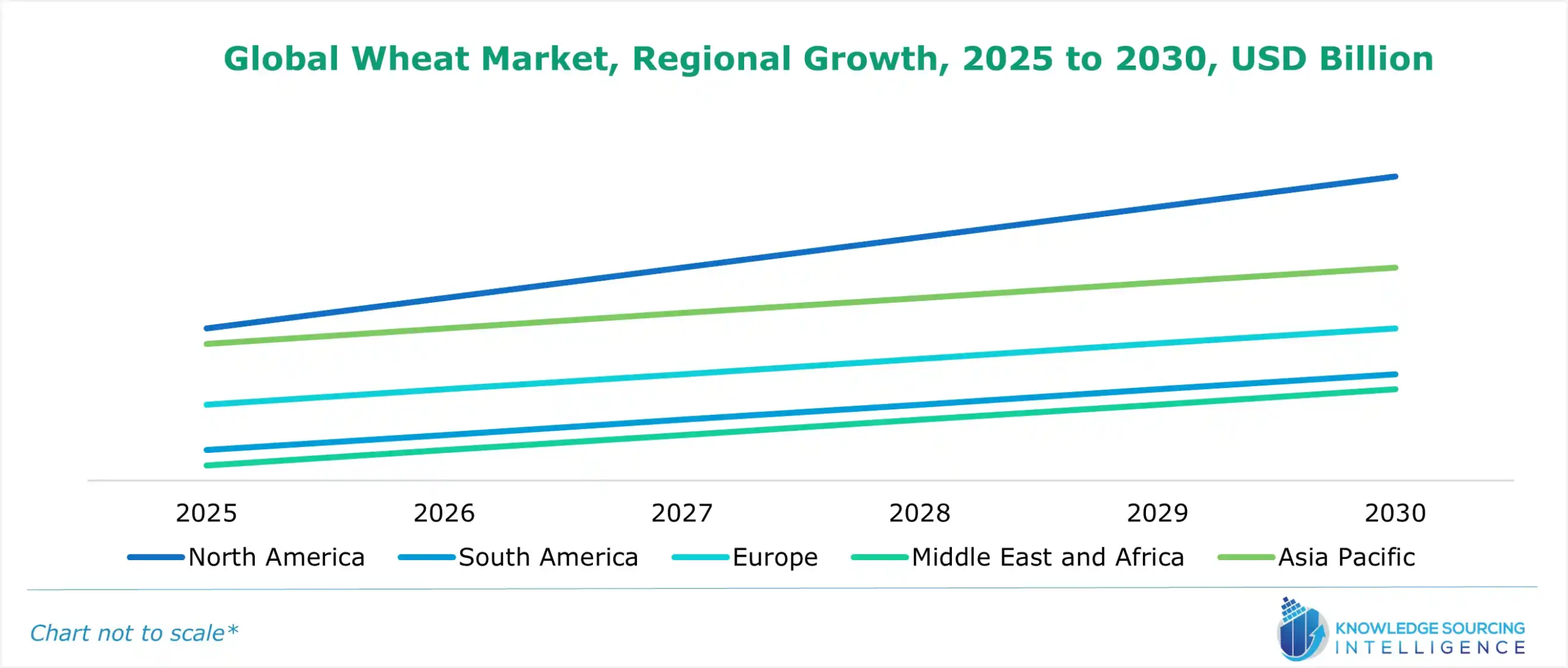

Geographical outlook of the wheat market:

- The European Union is forecasted to hold a major share of the global wheat market.

European Union is expected to grow wheat production more than any other developed country. In contrast to the developed countries, developing countries are projected to add 36 Mt to global output by 2029, representing a marginal increase in their share of global production. EU is projected to increase its wheat production largely due to its minimum support price policy, which guarantees farmers a stable income. A combination of domestically produced hybrid seeds and fertilizers, low energy costs, large commercial farms, and good soil contributed to Russian and Ukrainian production increases.

Major players and products in the global wheat market:

- Shri Mahavir Group is among the leaders in manufacturing whole wheat flour and wheat processing in India. The company offers a wide range of products, including wheat flour, wheat, basmati rice, chickpeas, and quinoa seeds, among others. The company offers five categories of wheat in the market: milling wheat, lokwan wheat, sharbat wheat, durum wheat, and Australian wheat. Similarly, in the wheat flour category, the company offers five varieties: whole wheat flour, wheat flour, tandoori, semolina course, and semolina fine.

- Shyali Products Pvt. Ltd. is an Indian agro-product manufacturer that offers a wide range of products. The company's products include dry fruits, wheat, Indian spices, tamarind pods, fresh fruits, and vegetables.

Key developments in the global wheat market:

- In June 2024, The African Development Bank Group, with Ethiopia, launched a US$94 million project aimed at boosting a Climate Resilient Wheat Value Chain Development (CREW) in Ethiopia. In this project, the African Development Banks provided a grant of US$54 million, whereas the Netherlands contributed about US$20 million. The OCP-Africa and the Government of Ethiopia contributed US$10 million each towards this project.

Global Wheat Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Wheat Market Size in 2025 | US$235.188 billion |

| Wheat Market Size in 2030 | US$381.485 billion |

| Growth Rate | CAGR of 10.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Wheat Market | |

| Customization Scope | Free report customization with purchase |

The Global Wheat Market is segmented and analyzed as follows:

- By Type

- Hard Red Wheat

- Hard Red Spring

- Soft Red Wheat

- Soft White

- Hard Wheat

- By Uses

- Flour

- Grain

- By End-User

- Household

- Commercial/Industrial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America