Report Overview

Global Vehicle Emission Sensor Highlights

Vehicle Emission Sensor Market Size:

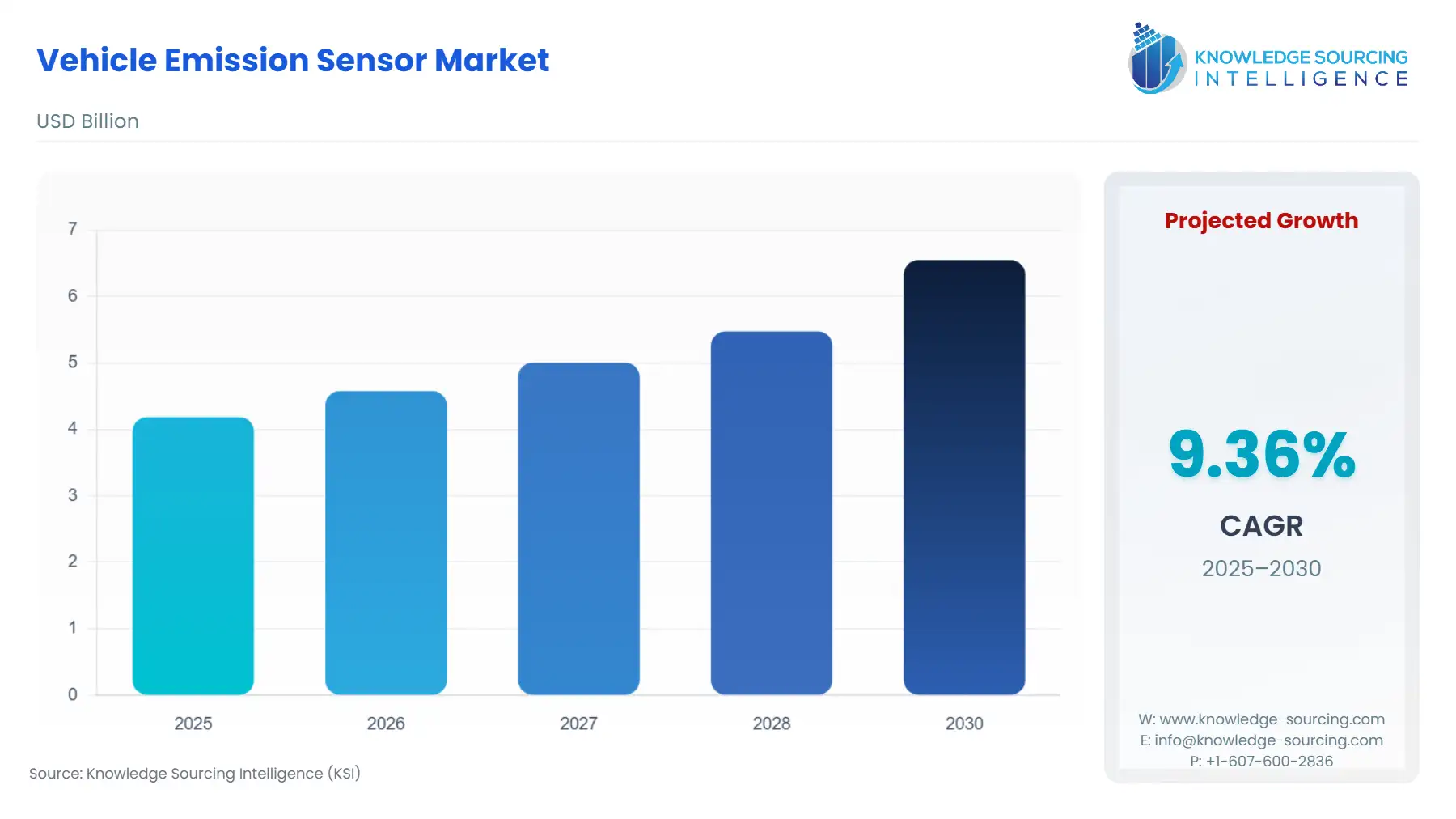

The Global Vehicle Emission Sensor Market is expected to grow from USD 4.187 billion in 2025 to USD 6.549 billion in 2030, at a CAGR of 9.36%.

Vehicle Emission Sensor Market Trends:

An emission sensor, a highly sensitive electric device, is used to detect the proportion of oxygen in the emitted gas mixture. It is located in the exhaust pipe, where it detects and measures the concentration of the exhaust gas emitted by the internal combustion engine of automobiles. Vehicle emission sensors are divided into two types based on the type of emission gases they detect and measure: Nitric Oxide sensors and oxygen sensors. Nitric Oxide is a by-product produced during fuel combustion and is a highly harmful pollutant.

The Nitric Oxide sensors detect the presence of nitrogen dioxide in the exhaust gases and produce an electric signal corresponding to the concentration of nitrogen dioxide in the emissions. As the name implies, Oxygen sensors detect and measure the concentration of oxygen levels in the gas mixture. It helps to detect how much fuel is being combusted and adjust the air-to-fuel mixture ratio accordingly. These sensors act as a check to monitor the air-to-fuel mixture and then optimize its performance based on that performance.

The other types of sensors include particular matter sensors, engine coolant matter sensors, and MAP/MAF sensors. These sensors help in keeping emission control and fuel economy in check. The market's growth is attributed to the increase in automobile demand and production and the rising pollution caused by automobile emissions.

Vehicle Emission Sensor Market Growth Factors:

- The ever-increasing demand for automobiles and the alarming increase in pollution has significantly fuelled the vehicle emission sensor market.

Furthermore, in the past few years, the automobile industry has seen an increase in the adoption of electric vehicles, which heavily use emission sensors to conserve the environment. Electric cars help protect the environment by reducing greenhouse gas emissions and promoting renewable energy sources that tend to leave a lower carbon footprint. In September 2021, the Union Cabinet approved a Rs 26,058 crore production-linked incentive (PLI) scheme to accelerate the domestic manufacturing of electric and fuel cell vehicles in India. For example, in an effort to incentivize modern-day technologies and to fulfill the COP26 pledge to reduce carbon emissions to zero by 2070, India has begun aggressively promoting the adoption of electric vehicles. India has also aimed to switch 30% of private cars, 80% of two and three-wheelers, and 70% of commercial vehicles to electric vehicles by the year 2030, further increasing the market for vehicle emission sensors in the said country. With the aim of selling 5 million electric cars globally by 2030, Stellntis has collaborated with LG Energy Solutions to invest about 4.1 billion dollars in a new facility in Canada, where the two will produce batteries for electric vehicles. Once the facility is all set up, the plant is expected to have an annual production of approximately 45 gigawatt-hours, approximately. This initiative will also create more than 2,500 new jobs. Similar initiatives are taking place in several other countries across the globe.

Furthermore, the increasingly stringent emission norms and surging penetration of diesel vehicles have also propelled the automotive exhaust sensor market’s growth. WHO predictions state that 7 million people will die globally due to various types of air pollution in 2021. Of those, 4.2 million suffer from early death each year as a result of exposure to air pollution, and 3.8 million succumb to the effects of indoor air pollution. Even stricter measures to limit CO2 emissions are anticipated with the adoption of euro VII, which will be published in 2022. Additionally, the Chinese government is actively attempting to reduce emissions throughout the whole nation.

All light-duty and heavy-duty vehicles must adhere to 6a norms beginning on January 1, 2021, and July 1, 2021, respectively. This standard's primary goal was to purge the nation's environment of thousands of tonnes of toxic pollutants. The need for car sensors has increased as a result of these norms. Asia in particular is expected to control a sizable piece of the market during the forecasted period.

Vehicle Emission Sensor Market Geographical Outlook:

- Increasing growth in the automobile industry in the Asia Pacific, particularly in India and China, is estimated to support the market’s growth during the projected period.

OICA figures show that Asia Pacific produced roughly 4, 67, 32,785 units in 2021, an increase of 4% from the previous year. China and India held the top positions in the Asia-Pacific region. In 2021, China manufactured roughly 25,225,242 units, a 3% increase over the previous year. India also manufactured roughly 4,399,112 units during the same year. With over 16 million output units, America and Europe closely followed the Asia Pacific region.

Vehicle Emission Sensor Market: Product Offerings by Key Players:

- DEP emission sensor: The Detroit Engineered Products emission sensor has a variety of uses and benefits in the automotive sector since it aids in lowering vehicle emissions, hence reducing the amount of pollution produced by automobiles. Engine efficiency will be ensured by DEP emission sensors, which also monitor emissions, take action to reduce them, and sound an alarm in the event of unusual behavior. Since DEP Sensor focuses its services on industries such as aerospace, automobile, medical equipment, and construction machinery, it is well acquainted with the various industrial settings.

- SEMTECH DS+ light-duty PEMS: The SEMTECH DS+ PEMS was designed, engineered, and manufactured for real-world emission controls of light-duty cars. It evolved from the LDV. The technology makes every step of real-world emissions testing simpler, from automated calibrating to automated report creation for regulatory compliance. Minimal connections are required for modules to function with one another.

Vehicle Emission Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.187 billion |

| Total Market Size in 2031 | USD 6.549 billion |

| Growth Rate | 9.36% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Sensor Type, Vehicle Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Vehicle Emission Sensor Market Segmentation:

- By Sensor Type

- O2 sensor

- NOx sensor

- Others

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Application

- Engine Management

- Exhaust Systems

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- The Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Taiwan

- Thailand

- Indonesia

- Others

- North America