Report Overview

Global Transparent Ceramics Market Highlights

Transparent Ceramics Market Size:

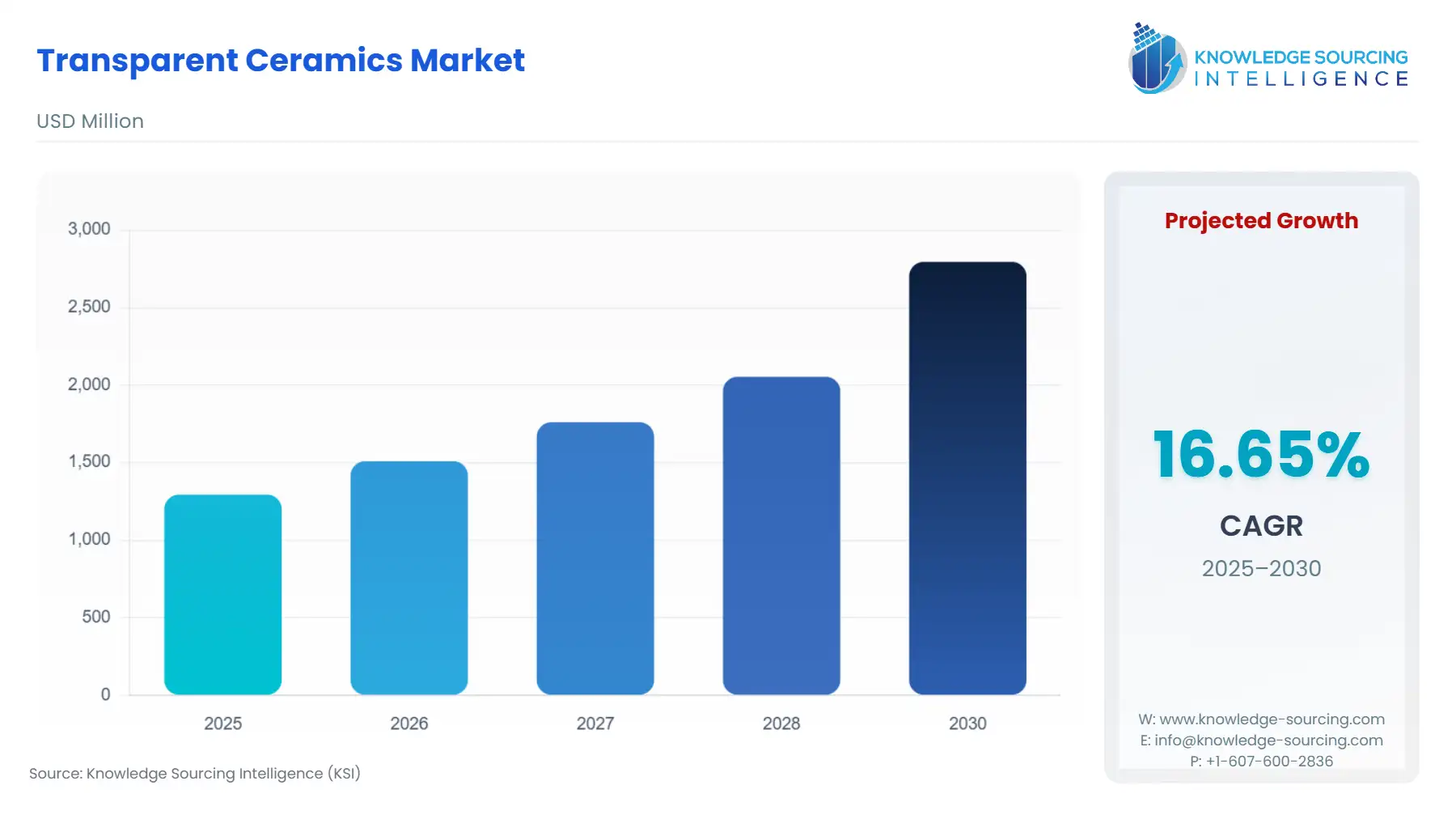

The global transparent ceramics market will grow from US$1,294.002 million in 2025 to US$2,795.345 million in 2030 at a CAGR of 16.65%.

Transparent Ceramics Market Trends:

Transparent ceramics have gotten a lot of attention in the last decade because of their significant contributions to industries like aerospace and defense, consumer electronics, optics and optoelectronics, and so on. The increased demand for their application in sensors and the use of ceramic technology in lasers are expected to be the major factors fuelling the market growth.

Some of the additional factors driving the growth performance of the transparent ceramics market are their growing demand as an alternative to traditional glass technologies, the growth of the optics and optoelectronic sector, improved efficiency, and the increasing defense expenditure. Various advancements are being made in this field, and one such advancement was made by a group of researchers at the University of California, who proposed the development of a transparent ceramic window. Such research and development are further expected to present potential growth opportunities for the transparent ceramics market.

Transparent Ceramics Market Drivers:

- Increasing defense expenditure drives the market for transparent ceramics during the forecast period.

Transparent ceramics are widely used in sensor windows and night vision systems, among other applications, due to their corrosion resistance and thermal ability. Increasing defense expenditure around the globe is expected to drive the transparent ceramics market’s growth during the forecast period.

According to IISS, Asian defense spending is said to continue growing in 2023, but China will outpace the rest of the region. According to Military Balance and data presented by the IISS, the regional defense expenditure will increase by 4.2% in real terms in 2024. This is mainly due to countries' work in overcoming fiscal and economic constraints to further maintain the uplifts to defense spending. In statistical terms, China’s 2024 defense budget reached USD 236 billion (RMB1.665 trillion) compared to the estimated defense budget of USD 298 billion spent by all other countries in the APAC region. In nominal terms, the Chinese budget further increased by 7%, with 2024 marking the 30th consecutive year for its rise.

Additionally, with the growing need in defense for transparent armor for personal protection and infrared windows, government research laboratories and defense manufacturing science and technology programs have collaborated to support the manufacturing of aluminum oxy-nitride products that provide better system performance.

Furthermore, transparent ceramic armor provides superior ballistic protection at even less than half the weight and thickness of the traditional form of armor. Due to such benefits and advantages over other materials, the market for transparent ceramics is anticipated to grow substantially in the coming years.

Transparent Ceramics Market Segment Analysis:

- Optics & Optoelectronics held one of the largest shares in the market during the forecast period.

By the end-user industry, the transparent ceramics market is segmented into optics and optoelectronics, aerospace and defense, chemicals, healthcare, consumer electronics, and energy, among others.

Optics and optoelectronics hold a significant share in the global market, growing with the increasing application of transparent ceramics in the industry. Rising demand for luxury vehicles and increasing awareness about vehicle safety drive the optoelectronics market, which is increasing demand for transparent ceramics over the forecast period. Increasing research and development in optics and optoelectronics technology and the growing demand for electric vehicles worldwide are anticipated to boost the market for transparent ceramics in the coming years.

- The United States will dominate the global transparent ceramics market during the forecast period.

By geography, the global transparent ceramics market has been segmented into the following: North America, South America, Europe, the Middle East and Africa, and Asia Pacific (APAC) regions.

North America accounts for a significant share of the global transparent ceramics market and is projected to grow significantly throughout the forecast period. This growth is attributed to the presence of big market players and growing investment in research and development for defense in the region.

According to the Peter G. Peterson Foundation and their calculations, the United States spent $916 billion on its national defense in 2023. SIPRI’s definition of defense spending has a broader perspective, including discretionary and mandatory outlays by the Department of State, Department of Energy, Department of Defense, and the National Intelligence Program.

In addition, the transparent ceramics market in the Asia Pacific region is anticipated to witness exponential growth owing to the expanding defense industry in developing countries like China and India. However, the South American transparent ceramics market will witness considerable growth during the forecast period owing to the region's limited investment in defense and research. Europe is expected to grow progressively over the forecast period due to stringent regulation and an increasing defense budget in many of its countries.

Transparent Ceramics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Transparent Ceramics Market Size in 2025 | US$1,294.002 million |

| Transparent Ceramics Market Size in 2030 | US$2,795.345 million |

| Growth Rate | CAGR of 16.65% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Transparent Ceramics Market | |

| Customization Scope | Free report customization with purchase |

The global transparent ceramics market is segmented and analyzed as follows:

- By Type

- Monocrystalline

- Polycrystalline

- Others

- By Material

- Sapphire

- Yttrium Aluminium Garnet

- Spinel

- Aluminium Oxynitride

- Others

- By End-User Industry

- Optics & Optoelectronics

- Aerospace, Defense & Security

- Chemical

- Healthcare

- Consumer Electronics

- Energy

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- Saudi Arabia

- United Arab Emirates

- Rest of the Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America