Report Overview

Substation Automation Market Size, Highlights

Substation Automation Market Size:

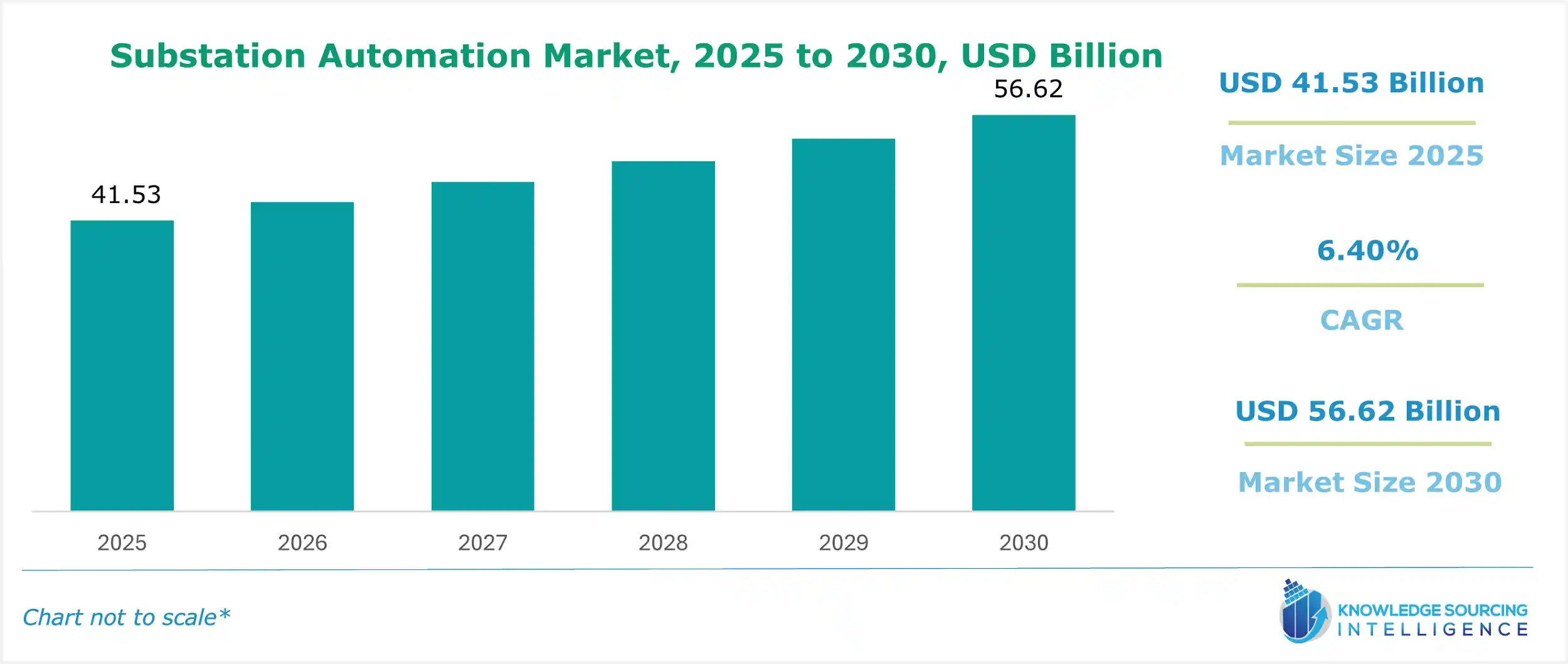

The substation automation market will grow at a CAGR of 6.40% to reach US$56.62 billion by 2030, from US$41.53 billion in 2025.

Substation Automation Market Trends:

Rapid industrialization, along with a growing need for cost-effective energy management systems throughout the world, is propelling the market forward. Automated substations control voltage variations and are an important part of energy transmission and distribution (T&D) systems, helping to reduce outages and total operating costs. Various technical advances, as well as the integration of main equipment with contemporary sensors, protective relays, programmable logical controllers, and digital transducers, are also boosting market expansion.

Furthermore, the growing trend of smart cities and the widespread use of smart grids, particularly in developing nations, is boosting the market's prospects. Other factors such as the growing retrofitting and upgrade of old substation equipment, government efforts supporting substation automation, and significant research and development (R&D) activities are expected to propel the market over the forecast period.

Substation Automation Market Growth Drivers:

- Rising investments in renewable energy projects to aid market expansion.

Solar and wind energy are now the most popular power generation choices, with most nations generating more than 29% of their electricity from these sources. Renewable energy sources accounted for 29% of global electricity generation in 2022, according to the International Energy Agency. Renewable energy will be able to provide the majority of global power demand by 2050, which is expected to be about 86 percent. Companies all across the world are putting their money into renewable energy infrastructure rather than fossil fuels. Total investment in renewable energy sources was USD 499 billion in 2023, according to the IEA's World Energy Investment 2024 report. The economic crisis caused by the COVID-19 epidemic contributed significantly to the fall in 2020. Countries all around the world are attempting to develop new renewable energy projects for power generation. They are also investing in solar and wind projects to fulfill rising electricity demand while minimizing environmental consequences, as well as non-renewable energy generation.

- Inclining new installations to accelerate the demand.

The adoption of new substation automation installations is projected to expand as the need for new power plants and smart grids in various industries grows, as does the demand for automation, IEDs, sophisticated communication technologies, HMIs, and SCADA systems. In addition, new installations provide increased operating safety and dependability while requiring less maintenance. In the substation automation market, leading firms have developed numerous new installation projects to increase power flow, improve electric reliability, improve the quality of energy supply, and modernize the power infrastructure.

- Increasing adoption in the utility sector is expected to contribute to growing market.

The use of renewable energy by utilities as an end-user is expanding rapidly, owing to increased government initiatives to modernize power networks and growing investments in renewable energy generation. In the current environment, the wind sector has a higher demand for substation automation solutions; government organizations and power-generating firms are collaborating to introduce automation to wind farm projects. General Electric (GE) and DTEK inked a deal in June 2019 to deliver high-voltage equipment for the 150 kV central power distribution station and two 150/35/10 kV substations, which would enable energy transmission from the Prymorska wind farm (Zaporizhia area) to the Ukrainian power grid. The wind farm will be home to the digital substation.

- High initial installation costs continue to remain a significant challenge.

The first phase of substation automation is capital-intensive, which may limit the worldwide substation automation market's growth. The expanding necessity to incorporate multiple IEDs in substations, as well as the increasing usage of sophisticated technologies like microprocessors and service-oriented architecture (SOA), has raised the purchasing costs of these substations. Smart substation implementation also necessitates strong cooperation beyond traditional organizational boundaries, considerable process change, and strict governance. High expenditures on smart substation deployment might add to the government's financial burden.

Substation Automation Market Geographical Outlook:

Geographically, the substation automation market continues to be dominated by North America attributed to various initiatives for electricity grid upgradation by the US and Canadian governments. Governments in North America are also contributing funding to the deployment of new energy and power technology, which will aid the region's transition to smarter, stronger, and more efficient electric grid networks. The expansion of the substation automation market in North America is fueled by aging grid infrastructure and rigorous government laws requiring the use of sustainable power technologies.

The global Substation Automation Market report delivers a comprehensive analysis of the industry landscape, providing strategic and executive-level insights supported by data-driven forecasts and detailed analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various offerings, including Protective Relays, Reclose Controllers, Load Tap Changers, and Others, while exploring industries such as Energy and Power, Mining, Travel and Transport, Steel, and Oil and Gas. The report also analyzes components like Intelligent Electronic Devices (IEDs), Communication Networks, and Control Systems, alongside voltage levels including Low Voltage, Medium Voltage, and High Voltage. Additionally, it assesses installation types such as New Substations and Retrofit/Upgradation, and evaluates technological advancements, critical government policies, regulatory frameworks, and macroeconomic factors, offering a holistic perspective of the market.

Substation Automation Market Segmentation:

Substation Automation Market Segmentation by offering:

The market is analyzed by offering into the following:

- Hardware

Substation Automation Market Segmentation by industry:

The report analyzes the market by industry as below:

- Energy and Power

- Mining

- Travel and Transport

- Steel

- Oil and Gas

Substation Automation Market Segmentation by component:

The market is analyzed by component into the following:

- Intelligent Electronic Devices (IEDs)

- Communication Networks

- Control Systems

Substation Automation Market Segmentation by voltage level:

The report analyzes the market by voltage level segment as below:

- Low Voltage

- Medium Voltage

- High Voltage

Substation Automation Market Segmentation by installation type:

The report analyzes the market by installation type segment as below:

- New Substations

- Retrofit/Upgradation

Substation Automation Market Segmentation by regions:

The study also analyzed the Substation Automation Market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain and Others

- Middle East and Africa (Saudi Arabia, UAE and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Substation Automation Market Competitive Landscape:

The global Substation Automation Market features key players such as ABB, General Electric, Siemens AG, Cisco, Toshiba Corporation, Eaton Corporation, Schweitzer Engineering Laboratories, NovaTech Automation, Cadillac Automation and Controls among others.

Substation Automation Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different offerings, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by industry, with historical revenue data and analysis.

- Market size, forecasts, and trends by component, with historical revenue data and analysis of sales based on applications.

- Market size, forecasts, and trends by voltage level, with historical revenue data and analysis across various segments.

- Market size, forecasts, and trends by installation type, with historical revenue data and analysis across various segments.

- Substation Automation Market is also analyzed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario, and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players, and recent major developments undertaken by the companies to gain a competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure the most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for the purchase?

- The report provides a strategic outlook of the Substation Automation Market to the decision-makers, analysts, and other stakeholders in an easy-to-read format for making informed decisions.

- The charts, tables, and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and emails for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports to help cater to additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Substation Automation Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Substation Automation Market Size in 2025 | US$41.53 billion |

| Substation Automation Market Size in 2030 | US$56.62 billion |

| Growth Rate | CAGR of 6.40% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Substation Automation Market |

|

| Customization Scope | Free report customization with purchase |