Report Overview

Global Samarium Cobalt Magnet Highlights

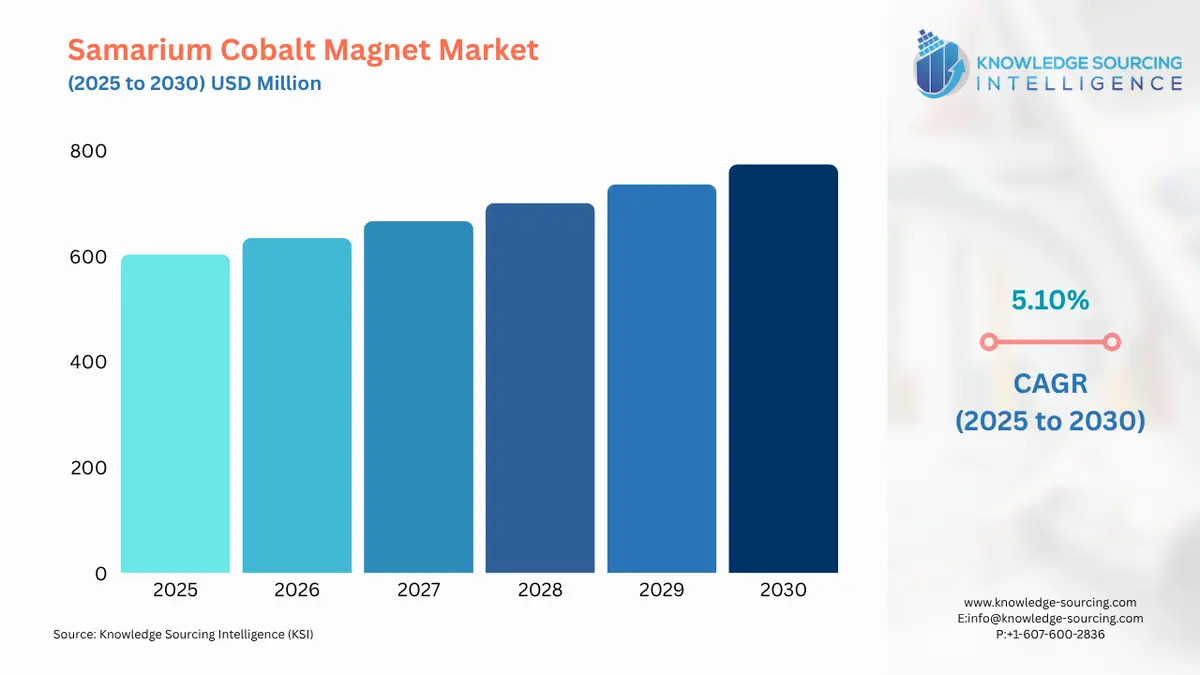

Samarium Cobalt Magnet Market Size:

The Global Samarium Cobalt Magnet Market is set to reach USD 773.893 million in 2030, growing at a CAGR of 5.10% from a valuation of USD 603.436 million in 2025.

Samarium cobalt (SmCo) magnets are a specific type of rare-earth magnet characterized by their exceptional magnetic strength and ability to withstand high temperatures. These magnets are crafted from an alloy consisting of samarium and cobalt, often combined with trace amounts of other rare earth elements like praseodymium and neodymium. The global market for SmCo magnets is gradually expanding, mainly driven by the need for high-performance permanent magnets in major consumer applications such as automotive, electronics, aerospace, renewable energy, and medical devices. The properties of SmCo magnets, including excellent thermal stability, very high magnetic strength, and good corrosion resistance, make them a useful product in electric vehicle motors, wind turbines, precision instruments, sensors, and actuators.

Regulatory changes, especially in the U.S. and China, are altering supply chains and highlighting the importance of sourcing and production that align with regulations. Despite these difficulties, ongoing research aimed at improving magnet efficiency, sustainability, and reducing dependence on critical rare-earth elements is likely to create a profitable market for manufacturers.

Samarium Cobalt Magnet Market Overview:

The global market for Samarium Cobalt (SmCo) magnets is growing steadily, driven by increasing demand for high-performance permanent magnets across end-use applications in the automotive, electronics, aerospace, and renewable energy industries. SmCo magnets are favored by end users for their excellent thermal stability, high magnetic strength, and corrosion resistance, making them suitable for applications in electric vehicles, wind turbines, medical devices, and precision instruments. The increased adoption of electric and hybrid vehicles is driving future growth for SmCo magnets, as they are key components for high-efficiency motors and generators.

According to 2023 data from Allstar Magnetics, samarium cobalt magnets in various grades offer distinct magnetic properties. SmCo 16, SmCo 24, and SmCo 26H have maximum operating temperatures of 250, 300, and 350 degrees Celsius, respectively.

The increasing use of electric and hybrid cars is having a major impact on the demand for SmCo magnets. This is because these magnets are one of the key components in high-efficiency motors and generators. Globally, 17.3 million electric vehicles were produced in 2024, representing a 25% increase from 2023. This was mostly due to China's increased production, which reached 12.4 million electric vehicles. Additionally, the electronics and telecommunications industries are also major users of SmCo magnets, installing them in sensors, actuators, and data storage devices. The use of powder metallurgy and sintering technologies in magnet manufacturing has significantly improved performance and reduced costs, thereby driving further market growth.

In the U.S., the Department of Defense (DoD) has implemented stringent rules under the Defense Federal Acquisition Regulation Supplement (DFARS) to limit the purchase of certain rare earth materials, including SmCo magnets, from countries such as China, Russia, Iran, and North Korea. According to the DFARS clause 252.225-7052, which is valid until December 31, 2026, the DoD is barred from buying SmCo and neodymium-iron-boron (NdFeB) magnets if any production step, such as melting or magnetization, is done in those countries.

The prices of raw materials required for neodymium-based magnets, with a major share being samarium and cobalt, are progressively high, and the supply chain is unstable. These factors challenge the market's expansion considerably. The leading companies in the magnetic materials industry are seeking technological solutions that would not only overcome but also turn these limitations into new opportunities. The implementation of these programs is the main cause of the development of a steady growth trend in the market of SmCo magnets worldwide.

The global market of Samarium Cobalt (SmCo) magnets is highly competitive with major players including Adams Magnetics Product Co., Arnold Magnetic Technologies, Dexter Magnetic Technologies, Eclipse Magnetics, Electron Energy Corporation, Hangzhou Permanent Magnets Group, Integrated Magnetics, Stanford Magnets (Oceania International LLC), J R Strong Magnet, Jai-Mag Industries, SDM Magnetics Co., Ltd., Sagami Chemical Metal Co., Ltd., and Toshiba Corporation. These firms leverage product innovation, cutting-edge manufacturing methods, and strategic business relations to meet the growing global demand in the sectors of automotive, aerospace, electronics, and other industries.

Samarium Cobalt Magnet Market Drivers:

Rising demand from the automotive sector

The global samarium cobalt magnet industry is anticipated to experience substantial growth in the foreseeable future due to the increasing demand for high-performance magnets across diverse industries. The primary driver of this market is the surging need for samarium cobalt magnets within the automotive sector. This keen demand can be attributed to the widespread utilization of these magnets in the production of automotive components like locking systems and windshield wipers. Furthermore, the global samarium cobalt magnet market is being propelled by the growing popularity of electric vehicles (EVs) and hybrid vehicles, as these vehicles frequently incorporate samarium cobalt magnets in their design. Additionally, significant investments made by both public and private entities in the manufacturing of advanced military weaponry are contributing positively to the market's expansion.

Increasing demand in the medical sector

The global samarium cobalt magnet industry demand is further bolstered by the widespread utilization of samarium cobalt (SmCo) in the medical sector is a significant driving force behind the market's growth. This is primarily attributed to the remarkably high-temperature resistance properties of samarium cobalt (SmCo), which make it an ideal choice for various medical devices. The deployment of samarium cobalt (SmCo) in these devices is consequently fueling global samarium cobalt magnet market expansion. For example, Arnold's RECOMA® Samarium Cobalt rare earth permanent magnets, flexible ferrites, and bio-compatible ultra-thin grade 1 titanium materials are extensively used in the medical industry. These materials can be found in a wide range of applications, including advanced diagnostic equipment, laboratory instruments, surgical tools, prosthetics, implants, drug delivery systems, and radiation shielding solutions.

Growing Demand from the Marine Industry

The global marine industry represents one of the key end-use sectors for samarium cobalt (SmCo) magnets, where these materials play an essential role due to their exceptional thermal stability, corrosion resistance, and strong magnetic performance. Samarium cobalt magnets are widely utilized in marine motors, generators, pump couplings, navigation equipment, and satellite communication systems used onboard ships and submarines. Their ability to maintain magnetic strength in high-temperature and corrosive saltwater environments makes them a preferred choice over conventional magnets. As a result, the steady expansion of the global marine and shipbuilding sectors directly correlates with a rising demand for SmCo magnets worldwide.

The shipbuilding and marine industry has grown significantly worldwide, particularly with the increase in the global logistics sector and technological developments. The Ministry of Ports, Shipping, and Waterways of the Indian Government stated that the nation's shipbuilding industry expanded over the past few years. The report noted that in the financial year 2020-21, about 69 ships were built and delivered by the nation, which grew to 113 in 2021-2022. The total number of ships built and delivered in 2022-23 was recorded at 206, a significant increase from the previous year.

This upward trend in ship production, coupled with technological innovations such as hybrid propulsion systems, electric drives, and onboard automation, is expected to sustain long-term demand for SmCo magnets across the global marine industry. As nations continue to invest in maritime trade, naval defense, and renewable ocean technologies, samarium cobalt magnets will remain integral to achieving higher efficiency, reliability, and durability in marine equipment.

Samarium Cobalt Magnet Market Segment Analysis:

By End-user: Aerospace & Defense

By end-user, the global samarium cobalt magnet market is segmented into automotive, aerospace & defense, marine, manufacturing, and others. The global military and defense expenditure has seen significant growth, reaching USD 2,718 billion in 2024, up from USD 2,443 billion in 2023. This marks the highest global total ever recorded and a 9.4% real-term increase, according to the Stockholm International Peace Research Institute (SIPRI). The increase reflects heightened geopolitical tensions and defense modernization efforts worldwide. The United States, China, Russia, Germany, and India are the top five military spenders, collectively accounting for about 60% of global defense expenditure.

Samarium cobalt magnets are crucial in the aerospace and defense sectors due to their thermal stability and resistance to demagnetization, which are essential for military applications like radars, communication devices, and missile guidance systems. The growing defense budgets and modernization efforts worldwide are projected to continue driving demand for these magnets.

Specifically for India, the defense budget for the fiscal year 2024-25 stood at approximately USD 75 billion (INR 6.22 trillion), representing a steady increase driven by capital expenditure on modernization and procurement. The government has further announced a record 9.5% increase for the 2025-26 defense budget, amounting to around USD 78.3 billion (INR 6.81 trillion), with a significant portion allocated to domestic production initiatives and reforms aimed at optimizing defense procurement and strengthening armed forces capabilities.

The increase in India’s defense budget, along with strategic procurement and production policies, will further boost the aerospace and defense industry's demand for samarium cobalt magnets due to their indispensable use in high-performance military systems.

Samarium Cobalt Magnet Market Geographical Outlook:

It is projected that the samarium cobalt magnet market in China will grow steadily.

Samarium cobalt is used mainly in the automotive segment as it has higher magnetic power and high resistance to demagnetization at higher temperatures. These properties make samarium cobalt ideal for new hybrid and electric vehicles. China is one of the leading countries in manufacturing electric automobiles, coupled with the easy availability of raw materials and a vast manufacturing industry in the country. Various subsidies and tax rebates are given by the Chinese government to encourage people to buy more electric cars. For instance, according to the official statement from the Ministry of Finance in China, the extended program for new electric vehicles (NEVs) that are purchased in the year 2024-2025 will also be eligible for exemption from purchase tax which amounts per vehicle could be a maximum of RMB30,000 or US$4,170. With the increasing need for a greener and cleaner environment and to reduce the harmful effects of pollution in the country, the government is pushing people to purchase more electric cars, which in turn is increasing the domestic samarium cobalt magnet market growth in the projected period.

According to the United States Geological Survey, China is the world’s leading producer of refined cobalt and is also considered the world’s leading consumer of cobalt, with more than 80% of this consumption being used by the rechargeable battery industry. According to the International Energy Agency, electric car sales in China, Europe, the United States, and other countries reached 8.0 million, 3.4 million, 1.6 million, and 0.9 million, respectively. The electric car sales in China are projected to reach an estimated 8.0 million in 2023. This increase in EV sales can drive the expansion of samarium cobalt magnets in China during the forecast period.

India is also expected to hold a significant market share

Samarium cobalt magnets have high applicability in motors, sensors, and other power equipment, and as India is emphasizing on enhancing its manufacturing momentum through strategic investments and collaborations in industrial sectors, the demand for samarium cobalt magnets for the end-use applications is anticipated to gain traction in the Indian market.

Moreover, the increased consumer demand, coupled with urban population growth, has further driven the need for major consumer goods, such as consumer electronics and automotive. As India is among the leading manufacturing nations, the ongoing government schemes such as Production-Linked Incentive (PLI) have further impacted overall operations.

According to the International Organization of Motor Vehicle Manufacturers, in 2024, India’s automotive production reached 6.014 million units, marking a 3% growth over 2023’s production volume and 10% increase over 2022’s production. Furthermore, the same source further stated that in addition to production, the sales volume also experienced a 2.9% growth in 2024, reaching 5.226 million units. Additionally, the country’s electronics production is anticipated to reach a valuation of USD 300 billion by 2026.

Samarium cobalt magnets are used in automotive for steering angle sensors and motors, and with the increased production & sales operations, the demand for samarium cobalt magnets is projected to grow.

Moreover, India is among the leading nations with high defense spending, and as the country aims to strengthen its military & defense capabilities, the increased defense budget is anticipated to positively impact the demand for samarium cobalt magnets used in electric warfare and high-performance motors. According to the Ministry of Defense, for the FY 2025-2026, the Union Budget allocated INR 6.81 lakh crores, representing a 9.53% over the FY2024-2025 budget. Furthermore, according to the Stockholm International Peace Research Institute, in 2024, India was the fifth largest military spender globally.

Samarium Cobalt Magnet Market Key Developments:

December 2025: Permag confirmed plans to continue expanding SmCo magnet production capacity and pursue additional investments beyond the initial expansion, supporting aerospace, defense, semiconductor, medical, and industrial markets.

October 2025: China’s Ministry of Commerce issued Announcement No. 61 (2025) requiring export licenses for certain rare-earth related items, including materials and products containing rare-earth magnets, indirectly influencing global SmCo magnet supply chains.

August 2025: Permag announced a multi-million-dollar expansion at its Electron Energy Corporation facility in Lancaster, PA, more than doubling domestic SmCo magnet production capacity to meet rising industrial and defense demand.

June 2025: Magnetic Holdings, LLC rebranded as Permag, unifying Dexter Magnetic Technologies, MCE, and EEC under one name to strengthen global rare-earth magnet production and integrated SmCo solutions.

June 2025: Dexter Magnetic Technologies (DMT), Electron Energy Corporation (EEC), and Magnetic Component Engineering (MCE) jointly announced a mid-2026 target to achieve DFARS 252.225-7052 compliance for SmCo and NdFeB magnets, ensuring U.S. defense sourcing readiness ahead of Jan 1 2027.

Samarium Cobalt Magnet Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 603.436 million |

| Total Market Size in 2030 | USD 773.893 million |

| Forecast Unit | Million |

| Growth Rate | 5.10% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Grade, Product Type, Shape, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Samarium Cobalt Magnet Market Segmentation:

By Grade

Samarium Cobalt (1-5)

Samarium Cobalt (2-17)

By Product Type

Bonded

Sintered

By Shape

Round-shaped

Bar

Square

Others

By End-User

Automotive

Aerospace & Defense

Marine

Manufacturing

Other

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Australia

Others