Report Overview

Global Packaging Printing Market Highlights

Packaging Printing Market Size:

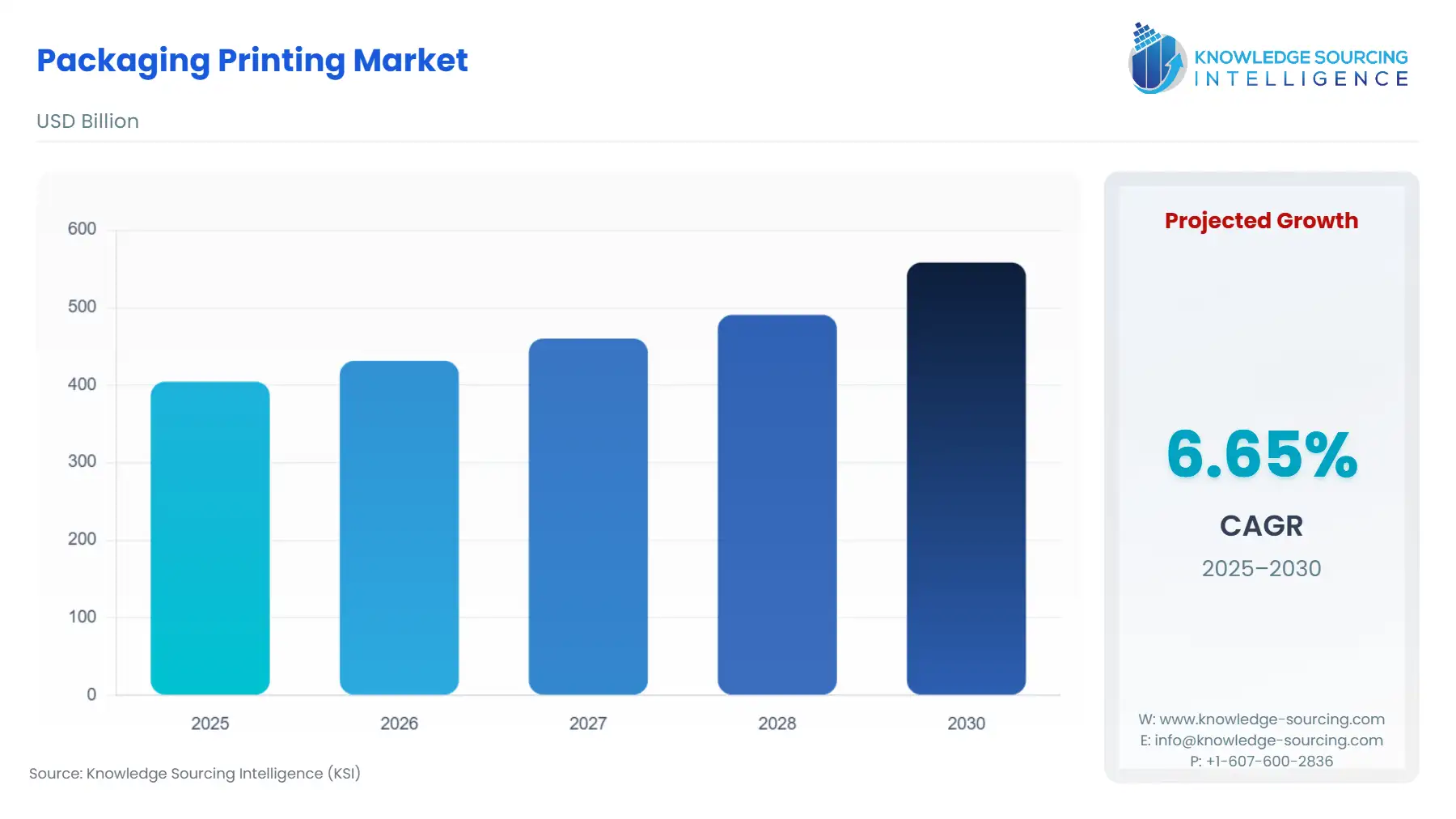

Global Packaging Printing Market is forecasted to rise at a 6.45% CAGR, reaching USD 588.608 billion in 2031 from USD 404.520 billion in 2025.

Packaging Printing Market Trends:

The Global Packaging Printing Market encompasses all activities related to applying graphics, text, and critical regulatory information onto packaging substrates. This includes processes across Plastic, Paper & Paperboard, Glass, and Metal formats for end-user industries such as Food & Beverages and Pharmaceuticals. The market is experiencing a profound transition, moving beyond simple aesthetics to become an integral component of brand strategy, supply chain management, and regulatory compliance. The function of printing now extends to enabling smart packaging features like QR codes and anti-counterfeiting serialization, directly supporting product traceability and consumer engagement across diverse global supply chains.

Global Packaging Printing Market Analysis

Growth Drivers

The primary catalyst for market expansion is the global proliferation of e-commerce, which directly increases demand for pre-printed and digitally customized corrugated boxes and flexible packaging to facilitate logistical tracking and enhance the unboxing experience. Concurrently, the consumer-driven requirement for greater product transparency and brand differentiation compels companies to adopt variable data and high-quality graphics, intensifying the demand for Digital Printing solutions capable of cost-effective, short-run customization. Furthermore, escalating regulations in the Pharmaceuticals sector, mandating unit-level serialization for traceability, drive non-negotiable demand for digital and hybrid printing methods to embed unique identification codes across high-volume production lines.

Challenges and Opportunities

The critical headwind facing the market is the sustained volatility in the pricing of raw materials, particularly crude oil-derived resins and specialized pigments used in Solvent-based Ink and UV-curable Ink formulations, which compresses converter margins and complicates long-term contracts. The primary opportunity centers on the sustainability imperative. Brand owners' commitments to recyclable and compostable packaging directly increases demand for printing solutions compatible with paper-based and mono-material plastic substrates. This shift drives investment in Aqueous Ink and low-migration UV ink technologies, creating a significant growth pathway for suppliers who can validate the safety and recyclability of their print chemistry.

Raw Material and Pricing Analysis

The packaging printing market relies heavily on specific chemical and material inputs, and their pricing dynamics exert direct pressure on converter profitability. Key raw materials include pigments (like Titanium Dioxide), resins, and solvents for inks, alongside the underlying paper, plastic film, and metal substrates. Volatility in crude oil pricing directly impacts the cost of Solvent-based Ink and plastic film (a major Plastic substrate for Flexography), leading to compressed margins as printers struggle to pass on costs quickly to brand owners. The demand surge for sustainable options, particularly for Aqueous Ink and bio-based resins, currently involves a cost premium, which temporarily constrains adoption but guarantees a more stable, long-term supply chain divorced from hydrocarbon price swings.

Supply Chain Analysis

The global packaging printing supply chain involves three critical layers: raw material suppliers (pigments, resins, paper pulp), equipment manufacturers (presses, cylinders), and printing converters. Key production hubs for high-volume Flexography and Rotogravure printing reside in industrialized economies like Germany, the US, and rapidly expanding centers in China and India, where labor and energy costs are favorable. Logistical complexity is centered on the intricate Ink Type chemistry, specifically the timely delivery and management of photoinitiators and specialty resins that ensure print quality, adhesion, and migration safety, particularly for Food & Beverages packaging. Dependency on chemical suppliers for regulatory-compliant ink, especially for low-migration UV-curable Ink, creates leverage for those suppliers, affecting market stability.

Packaging Printing Market Government Regulations

Regulatory bodies globally mandate printing practices to ensure product safety, consumer information, and environmental compliance, directly influencing demand for specific print technologies and ink types.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | Food Contact Materials (FCM) Regulation / EU Packaging and Packaging Waste Directive | The FCM regulation strictly limits chemical migration from Ink Type (e.g., photoinitiators, primary aromatic amines) into food products, strongly increasing demand for certified low-migration UV-curable Ink and specialized Aqueous Ink systems for Food & Beverages. The Packaging Waste Directive's recycling targets decreases demand for complex, hard-to-deink printed structures, favoring cleaner Flexography on mono-materials. |

United States | US FDA (Food and Drug Administration) / Federal Food, Drug, and Cosmetic Act (FFDCA) | The FFDCA regulates substances that may contact food, directly accelerating demand for printing Ink Type and coatings validated as safe for food contact. The FDA's forthcoming proposals regarding front-of-package (FOP) nutrition labels for packaged foods will necessitate redesign and re-print cycles, driving short-term demand acceleration for high-volume, variable data printing, which favors Digital Printing for rapid compliance updates. |

China | GB Standards for Food Contact Materials / Environmental Protection Tax Law | GB Standards impose rigorous testing and compliance requirements for packaging intended for food contact, similarly mandating the use of compliant, specialized ink formulations. The Environmental Protection Tax Law levies taxes on pollutants, including Volatile Organic Compound (VOC) emissions, which significantly decreases demand for traditional Solvent-based Ink and increases demand for low-VOC alternatives like UV-curable Ink and Aqueous Ink. |

Packaging Printing Market Segment Analysis

By Printing Technology: Digital Printing

Digital Printing is a critical growth segment, propelled by non-traditional market demands that conventional printing methods cannot economically satisfy. The technology's ability to support Variable Data Printing (VDP) directly increases demand for product serialization and brand engagement applications, such as printing unique QR codes or augmented reality triggers on every single Label or flexible pack. This capability is indispensable for the Pharmaceuticals sector, where strict traceability laws necessitate a unique identifier on primary and secondary packaging, making digital a mandatory component of their compliance strategy. Furthermore, the absence of printing plates and the minimal setup time make digital the only viable option for small-batch seasonal runs and prototype packaging, significantly accelerating brand speed-to-market in the competitive Personal Care & Cosmetics segment. This agility offsets the higher cost-per-unit for long runs, creating a new value proposition focused on customization rather than volume efficiency alone.

By End-User Industry: Pharmaceuticals

The Pharmaceuticals industry drives highly specialized and non-negotiable demand in the packaging printing market, centered entirely on regulatory compliance and product security. The imperative for anti-counterfeiting measures and patient safety mandates the use of ultra-secure printing technologies, directly increasing demand for high-resolution Digital Printing to apply small, complex serialized codes (like 2D data matrix codes) onto blister foil, folding cartons, and vials. This industry also demonstrates a critical need for high-quality, defect-free printing of regulatory text on Paper & Paperboard cartons and patient leaflets, which favors reliable, consistent processes like Offset Lithography for its high text definition. The rapid development of biologics and specialized therapies, often requiring unique, temperature-sensitive packaging formats, creates a niche, high-value demand for UV-curable Ink that offers superior adhesion and durability under demanding storage and logistical conditions.

Packaging Printing Market Geographical Analysis

North America (United States)

The US market is characterized by high operational speeds and a massive e-commerce infrastructure, which intensely drives demand for automated, high-speed Digital Printing and hybrid presses for corrugated and flexible packaging. The key demand factor is the need for brand differentiation and high-impact graphics on short-run promotions, particularly in the highly segmented Food & Beverages and Personal Care & Cosmetics sectors. Regulatory scrutiny from the FDA regarding food-contact materials accelerates the adoption of safer Aqueous Ink and compliant UV-curable chemistries, leading to a premium on certified and traceable ink supply chains.

South America (Brazil)

Brazil’s packaging printing market is fueled by expanding domestic consumption and the urbanization of its population, which increases demand for packaged goods, primarily in the Food & Beverages sector. Demand is concentrated in highly cost-effective printing methods, with Flexography and Rotogravure dominating flexible film and Plastic packaging. The market exhibits slower adoption of premium Digital Printing technologies outside of major metropolitan brand hubs, constrained by high capital equipment import costs, though local players are strategically investing to meet growing demands for serialization.

Europe (Germany)

Germany, driven by its leadership in the machinery and automation industry, places maximum emphasis on environmental compliance and resource efficiency. Demand is heavily influenced by the EU's mandates on packaging recyclability, aggressively shifting preference toward mono-material structures and water-based ink solutions, directly increasing demand for highly efficient, low-VOC Flexography and high-definition Offset Lithography on Paper & Paperboard. The robust Pharmaceuticals sector here drives mandatory demand for advanced serialization and anti-counterfeiting printing.

Middle East & Africa (South Africa)

South Africa’s market is growing due to rising standards of living and increasing organized retail, driving demand for modern, shelf-ready packaging, particularly in Food & Beverages. The market is segmented, with high-volume Flexography catering to mass-market Plastic and flexible packaging. There is a nascent but rapidly growing, high-margin demand for premium, digitally-printed Labels and specialized packaging for imported Personal Care & Cosmetics brands, leveraging the technology’s high-impact aesthetic capability.

Asia-Pacific (China)

China represents the largest and fastest-growing market globally, propelled by its immense manufacturing and export capacity, and a massive, growing domestic consumer base. The proliferation of local and international brands intensely accelerates demand across all printing technologies, with Rotogravure dominating the vast flexible packaging segment due to its speed and print quality on films. Strategic government initiatives to reduce industrial pollution are forcing demand away from solvent-based inks toward Aqueous Ink and UV-curable alternatives, creating a massive, rapid re-tooling imperative across the local printing ecosystem.

Packaging Printing Market Competitive Environment and Analysis

The Global Packaging Printing Market is highly fragmented yet commanded at the equipment and advanced materials level by a few multinational giants, alongside numerous local and regional print converters. Competition is focused on innovation in sustainable ink chemistry, the speed and automation of digital presses, and total cost of ownership for high-volume Flexography equipment.

HP Inc.

HP Inc. is a dominant force in the high-growth Digital Printing segment, primarily through its Indigo and PageWide platforms. The company’s strategic positioning is centered on providing on-demand, variable data, and highly customized printing solutions for Labels, flexible packaging, and corrugated board. This strategy directly targets the demand from consumer goods and Pharmaceuticals companies seeking to reduce inventory, cut waste from obsolescence, and execute high-impact promotional campaigns with personalized packaging. HP's product launches consistently focus on improving speed and expanding the substrate compatibility of their digital inks.

Koenig & Bauer AG

Koenig & Bauer AG maintains a core strategic focus on traditional high-volume printing, notably Offset Lithography and Rotogravure, essential for large-format Paper & Paperboard and flexible packaging, respectively. The company’s strength lies in providing highly automated, robust, and reliable press technology that meets the stringent quality requirements of the Food & Beverages sector and consumer goods giants for maximum speed and consistent color matching on long runs. The company’s innovation strategy is concentrated on hybridization and automation features that allow for shorter setup times, enhancing the cost-efficiency of its core printing technologies.

Siegwerk Druckfarben AG & Co. KGaA

Siegwerk holds a crucial position as one of the world's leading suppliers of printing inks and coatings, a critical raw material segment. The company's strategic positioning is entirely dedicated to regulatory compliance and sustainability. Their focus on the development and production of low-migration UV-curable Ink and safe, low-VOC Aqueous Ink formulations for food and pharmaceutical applications directly caters to the regulatory-driven demand across the Food & Beverages and Pharmaceuticals industries. This commitment positions them as a key enabler for brand owners transitioning to circular economy-compatible packaging materials.

Packaging Printing Market Developments

Significant strategic moves in the market underscore the continued consolidation among major players to achieve global scale and vertical integration.

Early 2025: International Paper and DS Smith Merger Completion

The completion of the merger between International Paper and DS Smith formed a major new entity in the packaging sector. This development combines International Paper’s strength in containerboard production with DS Smith’s expertise in sustainable, corrugated packaging solutions. The move directly increases the capacity and geographical reach of the combined entity’s printed Paper & Paperboard offerings, creating a more integrated supplier for e-commerce and fast-moving consumer goods (FMCG) clients globally.

February 2024: Heidelberg Gallus One Digital Label Press Launch in Asia Pacific

Heidelberg introduced its Gallus One inkjet press, the company’s first fully digital label press, to the Asia Pacific market. This product launch directly targets the region’s growing need for high-speed, cost-effective Digital Printing solutions for Labels and flexible packaging. The addition of a new, high-performance digital capacity in the dominant regional market accelerates the competitive pressure on traditional Flexography for medium-to-short runs.

Global Packaging Printing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Packaging Printing Market Size in 2025 | USD 404.520 billion |

Packaging Printing Market Size in 2030 | USD 558.207 billion |

Growth Rate | CAGR of 6.65% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Packaging Printing Market |

|

Customization Scope | Free report customization with purchase |

Packaging Printing Market Segmentation:

By Printing Technology

Offset Lithography

Rotogravure

Flexography

Digital Printing

Screen Printing

By Ink Type

Solvent-based Ink

UV-curable Ink

Aqueous Ink

By End-User Industry

Food & Beverages

Pharmaceuticals

Personal Care & Cosmetics

Others

By Packaging Type

Label

Plastic

Glass

Metal

Paper & Paperboard

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others