Report Overview

Global Online Gambling Market Highlights

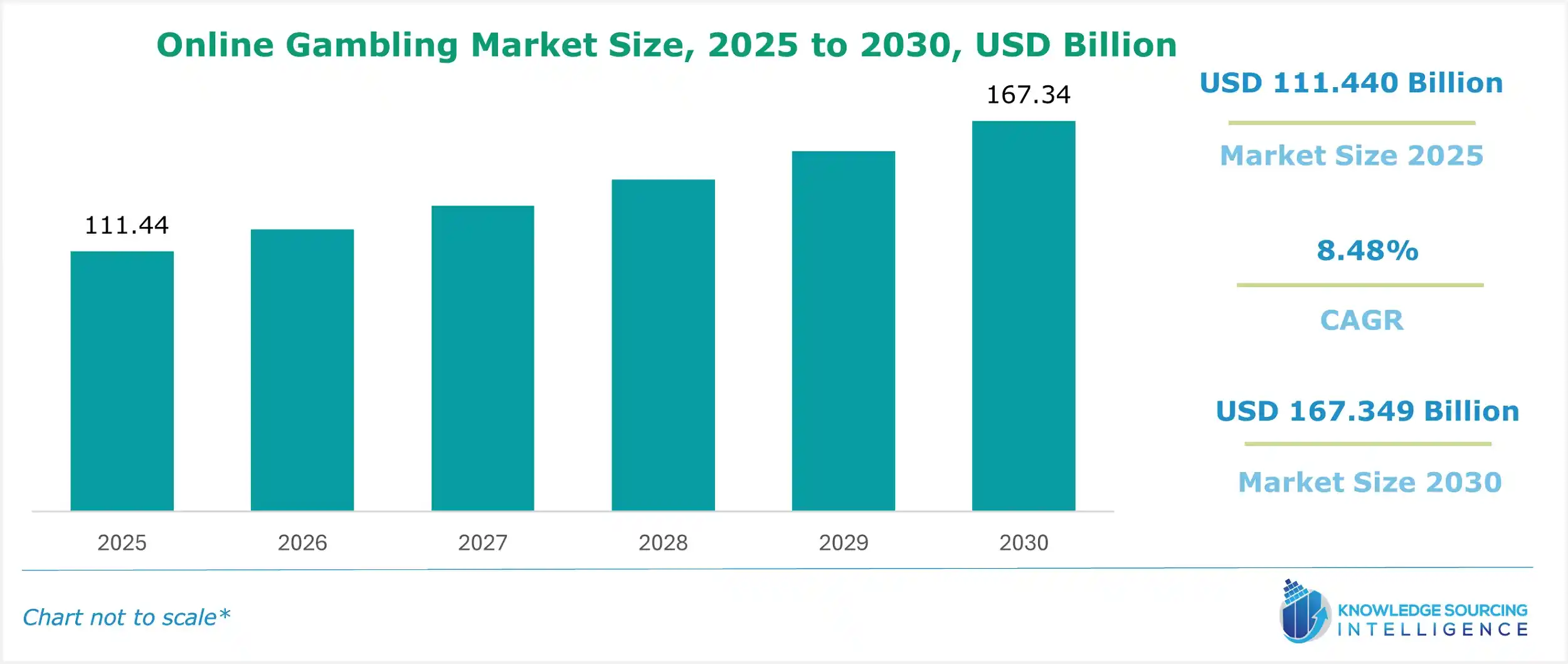

Online Gambling Market Size:

The global online gambling market is valued at USD 111.440 billion in 2025 and is expected to grow at a CAGR of 8.48% over the forecast period to reach USD 167.349 billion in 2030.

Online Gambling Market Highlights:

- Increasing smartphone adoption is driving accessibility to online gambling platforms globally.

- Growing live casino popularity is enhancing immersive online gaming experiences.

- Europe is leading the market with strong regulatory frameworks and user trust.

- Advancing AI technologies are personalizing gaming and improving user engagement.

- Rising sports betting demand is fueling growth in mobile betting platforms.

- Expanding internet penetration is boosting online gambling in the Asia-Pacific region.

- Evolving regulatory reforms are opening new markets for online gambling operators.

Online Gambling Market Trends:

The global online gambling market is experiencing robust growth, fueled by the increasing popularity of betting across diverse regions worldwide. This surge is driven by the convenience of digital platforms, widespread smartphone adoption, and expanding internet access, which have made online gambling, including sports betting, iGaming, and online casinos, more accessible than ever. The integration of advanced technologies like artificial intelligence (AI) for personalized gaming experiences and secure payment systems further enhances user engagement, contributing to the market’s rapid expansion.

In the United States, the commercial gaming industry continues to set new benchmarks. According to the American Gaming Association, October 2024 marked the 44th consecutive month of year-over-year revenue growth, with a 1.9% increase compared to October 2023. Data from state regulators indicates that combined revenue from traditional casino games, sports betting, and iGaming reached a record high of $5.81 billion for the month. Sports betting, in particular, has seen significant traction, with mobile betting platforms driving growth due to their ease of use and real-time betting options. The legalization of sports betting in states like New York, Ohio, North Carolina, and Vermont has further propelled this sector, with 30 states now permitting online sports betting as of 2025.

Globally, regions like Europe and the Asia-Pacific are also key contributors to the market’s growth. Europe benefits from established regulatory frameworks, fostering consumer trust and market stability. In the Asia-Pacific region, rising internet penetration and a young, tech-savvy population are boosting demand for online casinos and sports betting platforms. Emerging markets, such as Brazil and India, are witnessing rapid growth due to regulatory reforms and increasing digital infrastructure. For instance, Brazil’s move toward full sports betting regulation by early 2025 has attracted major operators, further expanding the market.

Technological advancements, including live dealer games, virtual reality (VR), and AI-driven personalization, are enhancing user experiences, attracting both casual and professional gamblers. The rise of mobile gambling, accounting for a significant portion of transactions, underscores the shift toward digital convenience. As regulatory landscapes evolve and technology continues to innovate, the global online gambling market is poised for sustained growth, driven by accessibility, innovation, and increasing consumer acceptance.

Online Gambling Market Growth Drivers:

- An increasing number of partnerships

The online gambling industry is witnessing a dynamic change owing to the increasing number of collaborations and partnerships among key market players. These strategic alliances are allowing companies to expand their geographical reach, penetrate untapped markets, and enhance their service offerings to attract a wider customer base. By pooling resources, leveraging advanced technologies, and sharing expertise, these collaborations are fostering innovation and strengthening market competitiveness.

Moreover, such initiatives help operators comply with diverse regulatory landscapes, optimize their operations, and build brand loyalty. These partnerships are expected to continue propelling the global online gambling market throughout the forecast period, thus creating new opportunities and solidifying its position as a rapidly expanding industry.

- An increasing number of live casinos is expected to fuel the global online gambling market in the projected period

The rising number of live casinos around the world is greatly transforming the online gambling landscape. It caters to the growing consumer preference for online live casinos over traditional land-based counterparts in countries where both offline and online gambling are legal. This shift is mainly due to convenience, accessibility, and the immersive experiences that online live casinos provide. The migration of players from offline to online casino offers the opportunity for immense growth for online casino operators; they can expand their customer base as well as their range of offerings.

Live casinos resemble the appeal of real, physical casinos with their atmospheric and suspenseful nature, added to extra convenience. Professional gamers are very attracted to playing in live casinos because they are able to better track their opponents' moves and strategies for a fuller and transparent gameplay. Features like real-time games with live dealers, interactive live chat options, and the flexibility to play from virtually any location at any time make these sites even more attractive for users.

Other developments in streaming technologies, accompanied by the depth of broadband and mobile penetration, have also facilitated the smooth delivery of high-quality gaming to the user from live casinos with that ultimate sense of realism and engagement that may be achieved while using live gaming. Sophisticated features like customizable interfaces, multiple language options, and various game themes ensure that users all over the world will get a tailored and inclusive experience. All the factors combined are actively driving the rapid growth and popularity of live casinos worldwide.

Online Gambling Market Geographical Outlook:

- Europe will hold a significant share of the online gambling market in the coming years

The online gambling market is experiencing robust global growth, segmented into North America, South America, Europe, the Middle East and Africa (MEA), and Asia-Pacific (APAC). Europe is projected to hold a significant share, driven by legalization, regulatory frameworks, and consumer confidence, while Asia-Pacific is expected to grow at the fastest compound annual growth rate (CAGR) due to digital adoption and demographic trends.

Europe, led by countries like the United Kingdom, Germany, and Sweden, dominates the online gambling market due to its well-regulated environment. The UK Gambling Commission enforces safe gambling practices, fostering user trust and market expansion (UK Gambling Commission, 2023). Legalized online casinos, sports betting, and poker in multiple European nations support growth, with innovative platforms offering live betting and mobile gaming. Consumer demand for digital entertainment and secure payment systems further drives the market.

Asia-Pacific is the fastest-growing region, propelled by smartphone penetration, increasing internet access, and a young population inclined toward online gambling. Countries like New Zealand promote platforms such as TAB and NZ Lotto, diversifying gaming portfolios to include lotteries and sports betting (New Zealand Gambling Commission, 2023). India and China show rising interest in mobile gambling, supported by e-commerce growth and digital payment systems like UPI. Government policies in select APAC countries encourage regulated gambling, boosting market potential.

North America exhibits steady growth, with U.S. states like Pennsylvania, New Jersey, West Virginia, Nevada, and Delaware legalizing online casinos, poker, and sports betting (American Gaming Association, 2024). Rising disposable incomes, internet accessibility, and a shift toward digital entertainment drive demand. Canada also contributes through regulated online platforms. South America and MEA are emerging markets, supported by urbanization and digital infrastructure.

Challenges like regulatory complexities and responsible gambling concerns persist, but secure technologies and blockchain-based payments enhance user safety. The online gambling market thrives on legalization, digital transformation, mobile gaming, and regional innovation, with Europe and Asia-Pacific leading the charge.

Online Gambling Market Key Developments:

- In October 2024, Caesars Entertainment, Inc., the legendary casino brand dedicated to delivering first-class customer satisfaction, took the digital space by storm with the launch of Horseshoe Online Casino. This new online casino app and desktop platform are all set to cater to high-end casino players, bringing Caesars' hallmark player-centric experience to the online world. With its new, high-tech features and strong emphasis on experienced players, Horseshoe Online Casino aims to redefine digital gaming with excellence and the brand's legacy.

- In October 2024, BetMGM, a leading iGaming and sports betting compant, was named the 2024 Online Casino of the Year by the American Gambling Awards. This is the third consecutive win for BetMGM in this highly competitive category, underlining the brand's continued excellence and leadership in the online gaming sector.

- In January 2024, Betr Holdings, Inc. (Betr), a Miami-based sports gaming and media company, announced new market access agreements to expand its online sportsbook and casino offerings in Pennsylvania and online sportsbook operations in Colorado and Kentucky. Already having market access in Indiana and a sports wagering license application underway in Maryland, Betr continues its rapid expansion. The company already lives with its beta product in Ohio, Virginia, and Massachusetts, further solidifying its presence in the United States sports gaming landscape.

List of Top Online Gambling Companies:

Global Online Gambling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Online Gambling Market Size in 2025 | USD 111.440 billion |

| Online Gambling Market Size in 2030 | USD 167.349 billion |

| Growth Rate | CAGR of 8.48% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Online Gambling Market |

|

| Customization Scope | Free report customization with purchase |

The Global Online Gambling market is segmented and analyzed as follows:

- By Game Type

- Sports Betting

- Casino

- Lottery

- Others

- By Platform

- Desktop

- Mobile

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- Spain

- Italy

- France

- Others

- Middle East and Africa

- Nigeria

- South Africa

- Kenya

- Others

- Asia Pacific

- Japan

- China

- India

- Philippines

- Vietnam

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

- Event Management Software Market

- Appointment Scheduling Software Market

- Life Cycle Assessment (LCA) Software Market

Navigation

- Online Gambling Market Size:

- Online Gambling Market Highlights:

- Online Gambling Market Trends:

- Online Gambling Market Growth Drivers:

- Online Gambling Market Geographical Outlook:

- Online Gambling Market Key Developments:

- List of Top Online Gambling Companies:

- Global Online Gambling Market Scope:

- Our Best-Performing Industry Reports: