Report Overview

Global Non-Optical Sensors and Highlights

Non-Optical Sensors And Actuators Market Size:

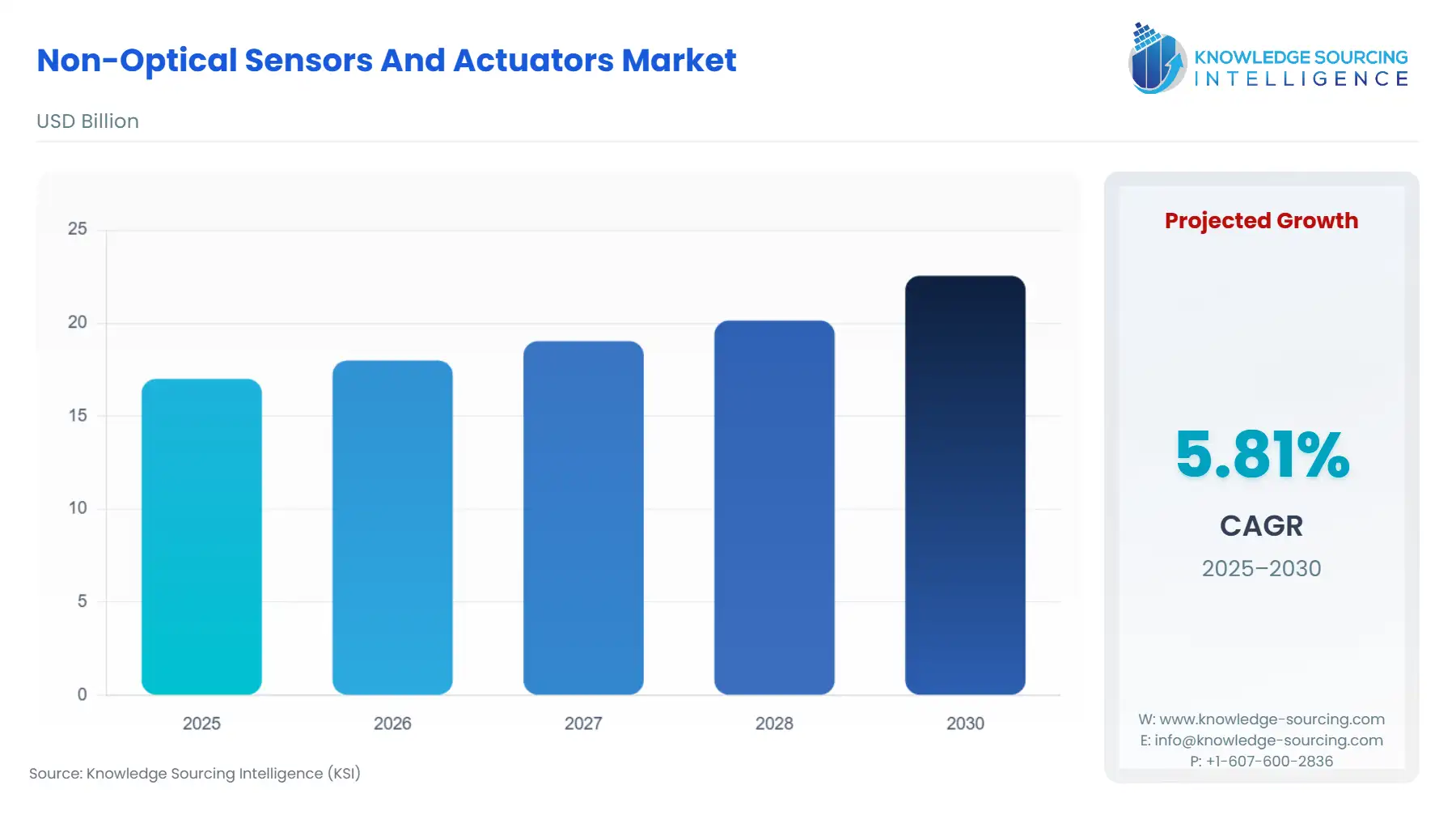

The Global Non-Optical Sensors And Actuators Market is expected to grow from US$17.003 billion in 2025 to US$22.547 billion in 2030, at a CAGR of 5.81%.

The global non-optical sensors and actuators market represents a foundational pillar of the accelerating digital and automated economy, functioning as the crucial interface between the physical world and electronic control systems. These components, distinct from imaging or photoelectric solutions, specialize in measuring and controlling parameters like pressure, motion, magnetic fields, and physical positioning across mission-critical applications. The market expansion is intrinsically tied to two macroeconomic megatrends: the ubiquity of the Internet of Things (IoT) and the comprehensive digitization of industrial processes under the Industry 4.0 paradigm. This shift transitions manufacturing and product design from rudimentary, mechanical systems to highly intelligent, networked architectures, elevating the importance of reliable, non-optical sensing for accurate data acquisition and the corresponding precise actuation for machine control.

The market is currently undergoing a strategic consolidation, where major semiconductor firms integrate sensing and actuation components into system-on-chip (SoC) solutions. This integration drives down size, power consumption, and latency, directly fulfilling the high-volume, low-cost requirements of the consumer electronics segment while simultaneously meeting the high reliability and functional safety standards demanded by the Automotive sector. This dual-market focus ensures sustained demand, positioning these components as non-negotiable inputs for next-generation systems ranging from complex robotics to mission-critical vehicle control.

Global Non-Optical Sensors and Actuators Market Analysis

- Growth Drivers

The proliferation of the Internet of Things (IoT) is a primary growth driver, necessitating billions of sensors and actuators as the essential data endpoints for interconnected systems. Every new connected device, from smart appliances to industrial equipment, generates direct, volumetric demand for non-optical sensors to measure physical inputs. Concurrently, the rigorous regulatory evolution in the Automotive sector, specifically mandating enhanced safety features like Electronic Stability Control (ESC) and Anti-lock Braking Systems (ABS), requires a defined increase in inertial and pressure sensors per vehicle. Lastly, the global adoption of Industry 4.0 compels manufacturing facilities to transition from manual or rudimentary control systems to closed-loop automation, immediately escalating demand for high-precision, connected actuators to execute automated process control and robotic movement.

- Challenges and Opportunities

A significant challenge is the critical reliance on complex semiconductor fabrication processes, primarily MEMS technology, leading to high initial R&D expenditure and susceptibility to geopolitical and logistical supply chain disruptions. This dependence creates volume constraints and pricing volatility for key components. A substantial opportunity lies in the convergence of sensors with Artificial Intelligence (AI) and Machine Learning (ML) at the edge. Integrating AI processing directly within the sensor module (Edge AI) allows for real-time data interpretation and predictive analytics (e.g., predicting actuator failure before it occurs). This transformation shifts the product from a simple component to an intelligent system, creating high-value demand in advanced industrial automation and autonomous systems.

- Raw Material and Pricing Analysis

The market's constituent products, non-optical sensors and actuators, are physical devices fundamentally reliant on high-purity silicon wafers and specialized materials for their Micro-Electro-Mechanical Systems (MEMS) structures. Polysilicon, the base material for semiconductor wafers, dictates a significant portion of the primary material cost, with price stability influenced by the global semiconductor commodity cycle. Actuators, particularly electric and piezoelectric types, depend on rare earth magnets and specialized alloys, introducing cost exposure to critical material supply chain volatility. Pricing dynamics are also heavily affected by fabrication capacity utilization; a surge in demand, particularly from the automotive sector, can rapidly drive up pricing for packaged sensors due to the high capital expenditure required for capacity expansion in advanced semiconductor foundries.

- Supply Chain Analysis

The supply chain is a multi-tiered structure characterized by high capital intensity and geographical concentration in Asia-Pacific, particularly Taiwan, China, and South Korea, where the majority of semiconductor fabrication occurs. The chain begins with raw material sourcing (silicon, specialized metals) feeding into sophisticated fabrication (foundries), followed by packaging and testing (OSATs), and finally, distribution to Original Equipment Manufacturers (OEMs) in Automotive, Industrial, and Consumer Electronics. Key dependencies include the limited number of advanced MEMS foundries and the complex, specialized equipment required for micro-fabrication. Logistical complexities arise from the necessity for stringent cleanroom environments during manufacturing and the high-value, high-security nature of transporting microelectronic components globally.

Non-Optical Sensors and Actuators Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Functional Safety Standard ISO 26262 |

This standard mandates specific requirements for the functional safety of electrical and electronic systems in vehicles, directly increasing demand for redundant, highly reliable, and certified non-optical sensors (e.g., inertial, pressure) to meet the required Automotive Safety Integrity Levels (ASIL). |

|

India |

Bharat Stage (BS) VI Emission Norms |

These norms require the integration of sophisticated On-Board Diagnostics (OBD) systems and precise engine control. This directly increases demand for non-optical actuators (e.g., electronic throttle, fuel injectors) and pressure/temperature sensors for highly accurate, real-time emission monitoring and control. |

|

United States |

Federal Communications Commission (FCC) Part 15 / ISO 13485 |

FCC regulations governing electromagnetic compatibility (EMC) necessitate that sensors and actuators designed for wireless communication and industrial control must be hardened against interference, driving demand for specific, robust component design. ISO 13485 (for medical devices) mandates high precision and reliability for non-optical sensors in healthcare applications. |

Non-Optical Sensors and Actuators Market Segment Analysis

- By Type: Inertial Sensors

The need for inertial sensors, encompassing accelerometers, gyroscopes, and magnetometers, is fundamentally driven by the pervasive need for motion tracking, orientation detection, and navigation without external reference. The Consumer Electronics sector is the largest volumetric driver, with high-volume demand generated by applications such as screen rotation, gaming motion control, and image stabilization in smartphones and wearable devices. The core growth driver here is the continued miniaturization and cost reduction of MEMS Inertial Measurement Units (IMUs), enabling their cost-effective integration into mass-market products. Furthermore, the burgeoning demand in robotics and Unmanned Aerial Vehicles (UAVs) in the Manufacturing and Automotive segments drives demand for higher-grade, more accurate IMUs that must maintain precision and low-drift performance in dynamic and vibration-prone environments, requiring greater investment in sensor fusion algorithms and temperature compensation features.

- By End-User Industry: Automotive

The Automotive sector is a primary value-driver for non-optical sensors and actuators, where demand is inelastic and dictated by safety and efficiency regulations. The transition from internal combustion engine (ICE) vehicles to Electric Vehicles (EVs) creates entirely new streams of demand. EVs require a dense concentration of non-optical sensors—including pressure sensors for battery thermal management, current sensors for power control, and position sensors for motor control—to ensure optimal range and safety. Furthermore, the rapid advancement in autonomous driving necessitates high-redundancy, high-resolution position sensors (e.g., magnetic rotary sensors) and highly reliable inertial sensors for critical functions like steering, braking, and chassis stability control. The demand is not for simple components but for components meeting rigorous quality standards (AEC-Q100) and functional safety integrity levels (ASIL), commanding a price premium.

Non-Optical Sensors and Actuators Market Geographical Analysis

- US Market Analysis

The US market for non-optical sensors and actuators is characterized by high-value demand stemming from three dominant, technology-intensive sectors: Automotive, Aerospace & Defense, and Data Centers. Local factors like the significant investment in advanced manufacturing and the Department of Defense's focus on autonomous systems create sustained, high-specification demand for high-reliability inertial and pressure sensors. The emphasis on Functional Safety (per ISO 26262) and Cyber-Physical Systems security within the industrial and automotive supply chains drives preference toward suppliers with strong North American fabrication or technical support capabilities.

- Brazil Market Analysis

The Brazilian market is primarily driven by the resource extraction (Oil & Gas) and industrial manufacturing sectors, creating specific demand for robust, high-pressure sensors and heavy-duty actuators designed for harsh, remote environments. The need for automotive components is tied heavily to local manufacturing hubs, requiring components that meet regional emission norms and affordability constraints. The adoption of advanced Industrial IoT solutions in factory automation is still gaining traction, positioning local demand largely towards proven, cost-effective pneumatic and hydraulic actuation systems rather than the premium electric or piezoelectric technologies.

- German Market Analysis

Germany maintains a leadership position in the market, anchored by its powerful Automotive sector and its national commitment to the Industry 4.0 framework. The requirement is not merely volume-based but highly focused on precision, durability, and integration. Local factors include the high regulatory pressure for vehicle efficiency and safety, which directly generates demand for sophisticated non-optical sensors in powertrain and chassis control. Furthermore, the extensive network of specialized industrial engineering firms drives continuous, high-specification demand for intelligent, electric actuators essential for complex, high-speed automated production lines.

- Saudi Arabia Market Analysis

The Saudi Arabian market is critically dependent on the requirements of the Oil & Gas sector, creating a distinct, high-performance demand profile. Local demand is concentrated on ultra-high-pressure sensors and heavy-duty, explosion-proof actuators (ATEX certified) for monitoring and control of pipelines, refineries, and drilling operations. Significant government-led investment in industrial diversification and smart city projects, such as NEOM, is beginning to generate emerging demand for connected, energy-efficient building automation sensors and actuators, shifting the market profile beyond pure resource extraction.

- China Market Analysis

China functions as the largest volumetric producer and consumer of non-optical sensors and actuators globally. Market growth is driven by the unparalleled scale of its Consumer Electronics manufacturing, which absorbs massive quantities of low-cost, high-volume sensors (e.g., magnetometers, low-cost pressure sensors). Concurrently, the government's strategic focus on localizing semiconductor production and achieving leadership in Electric Vehicles and 5G infrastructure is creating rapidly accelerating, high-specification demand for advanced, high-precision components to power next-generation industrial and vehicular systems.

Non-Optical Sensors and Actuators Market Competitive Environment and Analysis

The competitive landscape for the Global Non-Optical Sensors and Actuators Market is dominated by major vertically integrated semiconductor corporations and specialized industrial technology firms. Competition centers on technological differentiation, particularly in miniaturization (MEMS), functional safety certification (ASIL compliance), and portfolio breadth to serve diverse end-markets like Automotive and Industrial. The strategic imperative is to offer integrated system solutions that combine sensors, actuators, microcontrollers, and software (Edge AI), rather than simply selling discrete components.

- Robert Bosch GmbH

Robert Bosch GmbH maintains a strategic position as the largest global supplier in the Automotive domain, leveraging its deep expertise in vehicle control systems and MEMS technology. The company's strength lies in its high-volume production of pressure and inertial sensors, which are mission-critical for Electronic Stability Control (ESC) and airbag systems. Bosch's strategy centers on cross-domain solutions, integrating its sensor technology with control units and software for autonomous driving and Industrial IoT applications, as evidenced by its focus on incorporating AI and ML into its sensors for predictive maintenance, thereby moving up the value chain.

- Infineon Technologies AG

Infineon Technologies AG is a key player, strategically focused on the pillars of Automotive and Power & Sensor Systems. The company's core competitive advantage lies in its comprehensive portfolio of high-reliability magnetic sensors (e.g., Hall-effect and GMR sensors) used for position and current sensing, vital for motor control in electric vehicles and industrial automation. Infineon consistently drives demand by offering highly integrated solutions that combine power semiconductors with sensors and microcontrollers, enabling compact and energy-efficient designs for EV powertrains, a major long-term growth catalyst.

- NXP Semiconductors

NXP Semiconductors is strategically positioned to capture the Automotive and Industrial & IoT markets, with a strong emphasis on secure, connected systems. NXP's core focus is on providing integrated solutions that include microcontrollers, processors, and a range of non-optical sensors, such as pressure and inertial sensors, specifically designed to meet strict Automotive Safety Integrity Level (ASIL) requirements. Its strategy involves targeted acquisitions, like the recently completed Kinara acquisition, to advance AI-powered edge systems, directly increasing demand for its sensor and processing units in autonomous and smart industrial applications.

Non-Optical Sensors and Actuators Market Developments

- October 2025: NXP completed the acquisitions of Aviva Links and AI accelerator company Kinara, in deals announced in late 2024 and early 2025. This move strategically strengthens NXP's portfolio in high-speed, secure in-vehicle connectivity solutions and advances its offerings in AI-powered edge systems for both the Automotive and Industrial & IoT end markets.

- July 2025: NXP announced the new 18-channel Li-ion battery cell controller IC family, BMx7318/BMx7518. This product is specifically designed for high-voltage battery management systems in electric vehicles, as well as industrial energy storage applications, directly integrating sensing and control for critical power train components.

- January 2024: Bosch unveiled its new line of MEMS accelerometers at CES 2024, touted as the world's smallest for use in wearables and hearables. This product launch directly caters to the high-volume consumer electronics market, where extreme miniaturization and power efficiency are non-negotiable demand characteristics.

Global Non-Optical Sensors and Actuators Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 17.003 billion |

| Total Market Size in 2031 | USD 22.547 billion |

| Growth Rate | 5.81% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User Industries, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Global Non-Optical Sensors and Actuators Market Segmentation:

By Type

- Sensors

- Pressure

- Fingerprint

- Magnetometer

- Inertial

- Others

- Actuators

By End-User Industries

- Communication

- Consumer Electronics

- Automotive

- Manufacturing

By Geography

- Americas

- USA

- Canada

- Brazil

- Others

- Europe, Middle East, and Africa

- Germany

- France

- United Kingdom

- Italy

- Others

- Asia Pacific

- China

- Japan

- India

- Taiwan

- Others