Report Overview

Global Microprocessor Market Size, Highlights

Microprocessor Market Size:

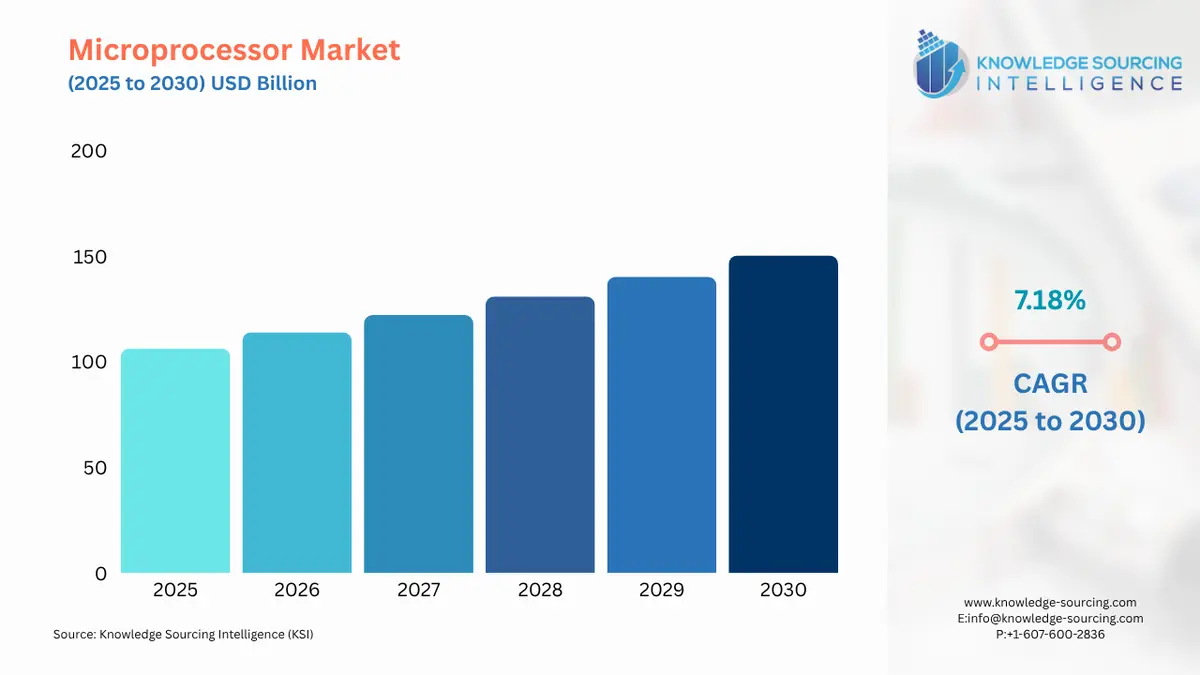

The Global Microprocessor Market is expected to grow from US$106.266 billion in 2025 to US$150.319 billion in 2030, at a CAGR of 7.18%.

A microprocessor is an electrical component that is built on a single integrated circuit (IC) and consists of millions of tiny components that operate together, such as diodes, transistors, and resistors. This chip performs a variety of tasks, including data storage, timing, and interfacing with external devices. These integrated circuits can be found in a wide range of electronic products, such as servers, tablets, smartphones, and embedded devices.

The market for smartphones and tablets is rapidly growing due to increasing disposable income, which is boosting the demand for microprocessors over the projected period. Customers increased their expenditure on mobile phones and tablets as their per capita net disposable income increased. A smartphone microprocessor improves its performance because it is utilized to improve the efficiency as well as the speed of a smartphone. The challenge for these modern supercomputers has been to design multiprocessor architectures that are easy to program and provide excellent performance without needing users to invest a lot of time. Recent multiprocessor architectural advancements have suggested solutions. In India and China, mobile subscriptions have increased dramatically due to a growing middle-class population and lower mobile data pricing. Furthermore, an all-in-one microprocessor combines the essential components of a smartphone to improve performance and efficiency, which is boosting the worldwide microprocessor market.

The significant rise in microprocessor energy consumption in wireless networks threatens the environmental conservation and long-term growth of the market. The demand for data access has risen dramatically all over the world as a result of access to high-speed internet supplied by increased smartphone usage and wireless networks, driving a dramatic expansion of network infrastructures and increasing energy consumption. Hence, high energy usage has become a major concern.

Microprocessor Market Key Developments:

Alibaba Group presented its first self-designed microprocessor in July 2019, marking a significant step forward in China's semiconductor self-sufficiency goals. The debut coincides with Chinese technology companies' efforts to resolve trade tensions with the United States. By technology, the global microprocessor market can be segmented into DSP, RISC, ASIC, Superscalar, and CISC. The RISC category is expected to dominate the market, since the RISC architecture allows developers to efficiently use semiconductor chip memory, and it also takes less time to execute than other microprocessors owing to its integrated reduced set of instructions. The ASIC market is likely to grow fast in the forecast period due to the increasing use of ICs in consumer electronics. By application, the global microprocessor market can be segmented into tablets, personal computers, servers, embedded devices, smartphones, and others. The personal computers segment is expected to have the greatest market share during the projection period owing to the increasing usage of microprocessor chips in personal computers across the world as it offers various advantages, including more storage, logical functions, and enhanced volatile memory, and lower power consumption.

By geography, the global microprocessor market can be segmented into the Asia Pacific, North America, Middle East and Africa, South America, and Europe. The Asia Pacific market is predicted to dominate the microprocessor market, attributable to a massive shift in mobile technology in countries like China, South Korea, and India. Due to the increased usage of smartphones and other electronic devices such as laptops, desktop computers, PCs, smartphones, and tablets, Asia Pacific continues to have the greatest market share and is expected to expand at the quickest rate. Because of the presence of market leaders in the United States and Canada, North America also has a significant proportion of the worldwide microprocessor market.

Global Microprocessor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Microprocessor Market Size in 2025 | US$106.266 billion |

| Microprocessor Market Size in 2030 | US$150.319 billion |

| Growth Rate | CAGR of 7.18% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Microprocessor Market | |

| Customization Scope | Free report customization with purchase |

Key Market Segments

- By Technology

- CISC

- RISC

- ASIC

- Superscalar

- DSP

- By Application

- Smartphones

- Personal Computers

- Servers

- Tablets

- Embedded Devices

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America