Report Overview

Global Microparticles Market Size, Highlights

Microparticles market size

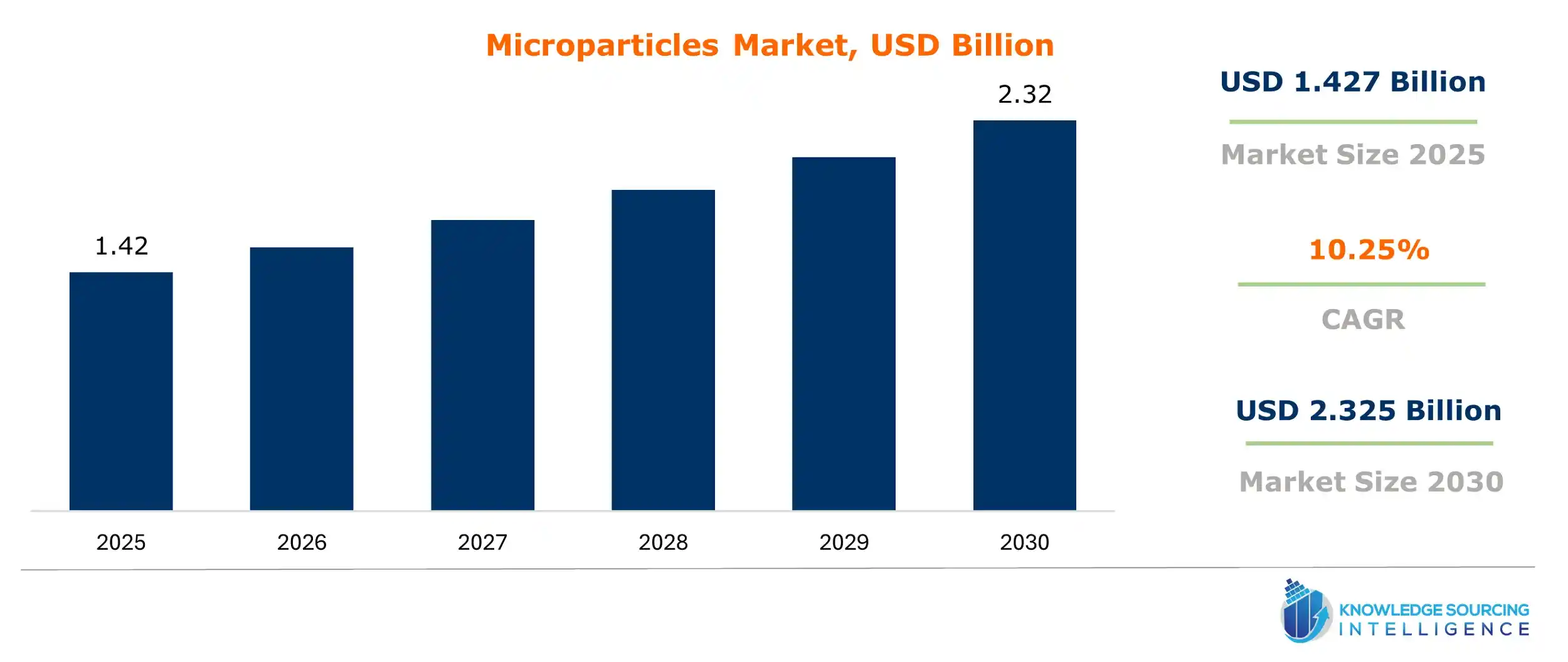

The global microparticles market is expected to grow at a CAGR of 10.25%, reaching a market size of US$2.325 billion in 2030 from US$1.427 billion in 2025.

Microparticles Market Key Highlights:

- The microparticles market is growing rapidly due to rising demand for targeted drug delivery.

- Automotive industries are adopting microparticles for lighter, stronger materials, enhancing vehicle performance.

- Asia Pacific is experiencing significant market expansion driven by pharmaceutical and automotive advancements.

- Research is advancing microparticle applications in environmental solutions like water treatment.

Microparticles are solid particles composed of synthetic or natural polymers and typically are in the order of micrometers in size (1–1000 μm). It can be prepared by dispersing, entrapping, encapsulating, or suspending the active drug within the polymer matrix. This method of encapsulation of drug and polymer leads to a more appropriate variation of the type of microparticles depending upon the drug to be encapsulated and the choice of the polymer.

Moreover, microspheres are microparticles with a wide spherical surface-to-volume ratio and homogeneously entrapping the drug in the matrix. They can also be categorized into solid and hollow types. Since the improved targeted efficiency, magnetic microspheres have also been explored for targeted drug delivery, particularly magnetic-targeted chemotherapy.

Microparticles Market Growth Drivers:

- Microparticles in pharmaceutical and drug delivery provide innovative solutions in the controlled and targeted release of drugs, ensuring high therapeutic outcomes. The encapsulation of drugs by microparticles ensures that such drugs are released in a sustained manner and also helps in delaying their release, thus allowing for the maintenance of a steady concentration of the drug in the bloodstream for longer periods. Targeted delivery is also made possible by microparticles for directing drugs to specific tissues or cells in treatments like cancer, minimizing side effects on healthy tissues. For instance, 1,777,566 new cancer cases were reported in 2021 in the United States.

Moreover, these microparticles protect vulnerable molecules like proteins and mRNA from degradation for effective delivery to intended sites. Of the various biodegradable polymers most used within the framework of microparticle systems, PLGA is safe and biocompatible. It is significantly finding notable importance in pulmonary drug delivery: Formulations that are inhalable help deliver drugs efficiently in disease treatment related to the respiratory system and reduce systemic exposure with higher precision.

- Microparticles are paving the way for innovative improvements in drugs in material science and even environmental technologies. In drug delivery systems, it is controlling targeted therapies and effectively improves cancer conditions. Material science is researching advanced, lightweight composites applied in the automotive and aerospace industries. Apart from its value in biological science, microparticles also play a considerable role in environmental science. Its applications can be seen in water treatment, making it easier to remove contaminants. Comprehensively, microparticle research and development boost current progress in healthcare, industrial materials, and environmental sustainability.

Microparticles Market Segment Analysis:

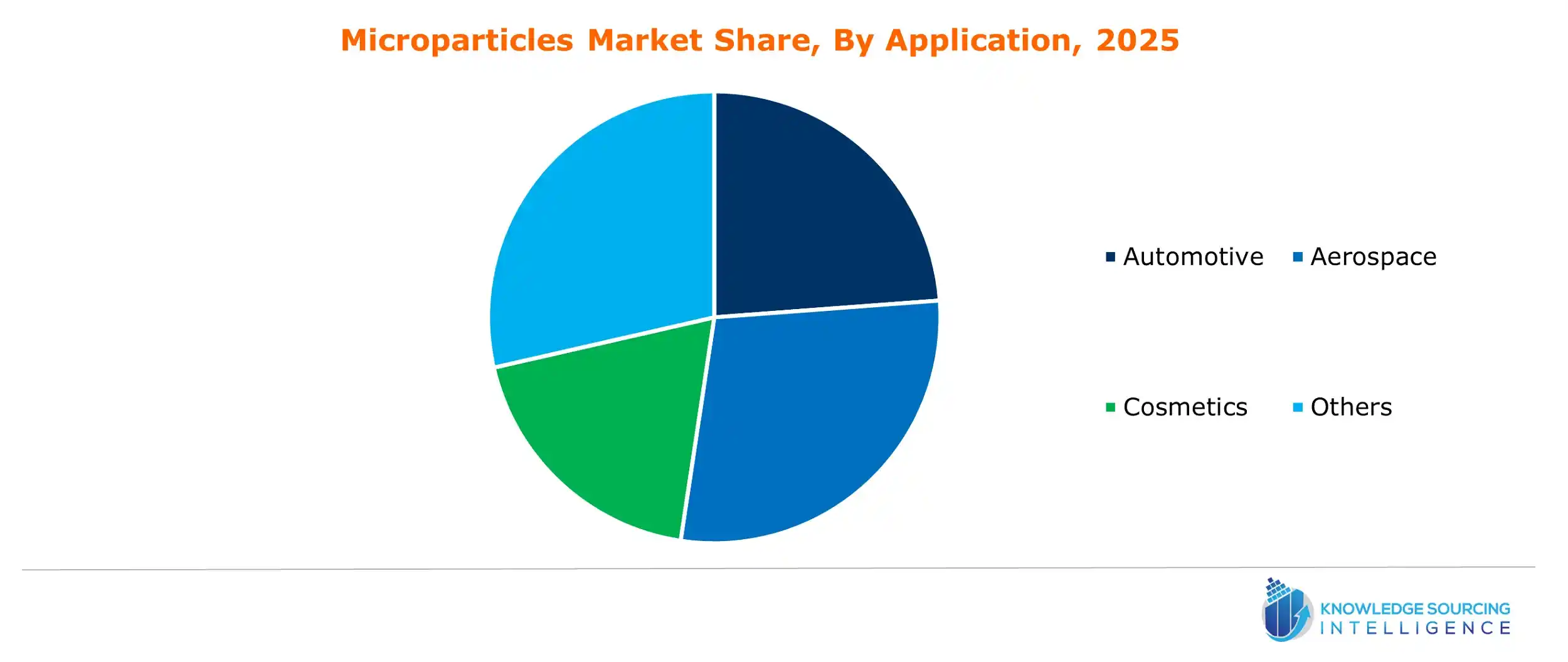

- By application, the automotive industry is anticipated to be one of the fastest-growing segments in the microparticles market.

The automotive industry is one of the fastest-growing sectors in the microparticles market. This is because of the rising need for advanced materials that will help in making vehicles lighter and stronger with improved safety. Thus, following this, in 2021, German manufacturers produced more than 15.6 million units of automobiles, as reported by GTAI (Germany Trade & Invest). This signifies that Germany is the largest automotive manufacturing industry in Europe.

Similarly, in April 2024, the total production of passenger cars, three-wheelers, two-wheelers, and quadricycles was 23,58,041. According to the India Brand Equity Fund, passenger cars, CVs, three-wheelers, two-wheelers, and quadricycles produced in the fiscal year 2024 totaled 2,84,34,742.

The industry is shifting towards electrical, which has increased market competition concerning innovative materials containing microparticles for boosting performance, thermal management, and battery’s energy efficiency. The surge in automobile development related to autonomous and connected vehicles forms a new direction for microparticle applications in sensors, electronics, and smart surfaces through the automotive business. Still, it is considered a core part of the growing market of microparticles.

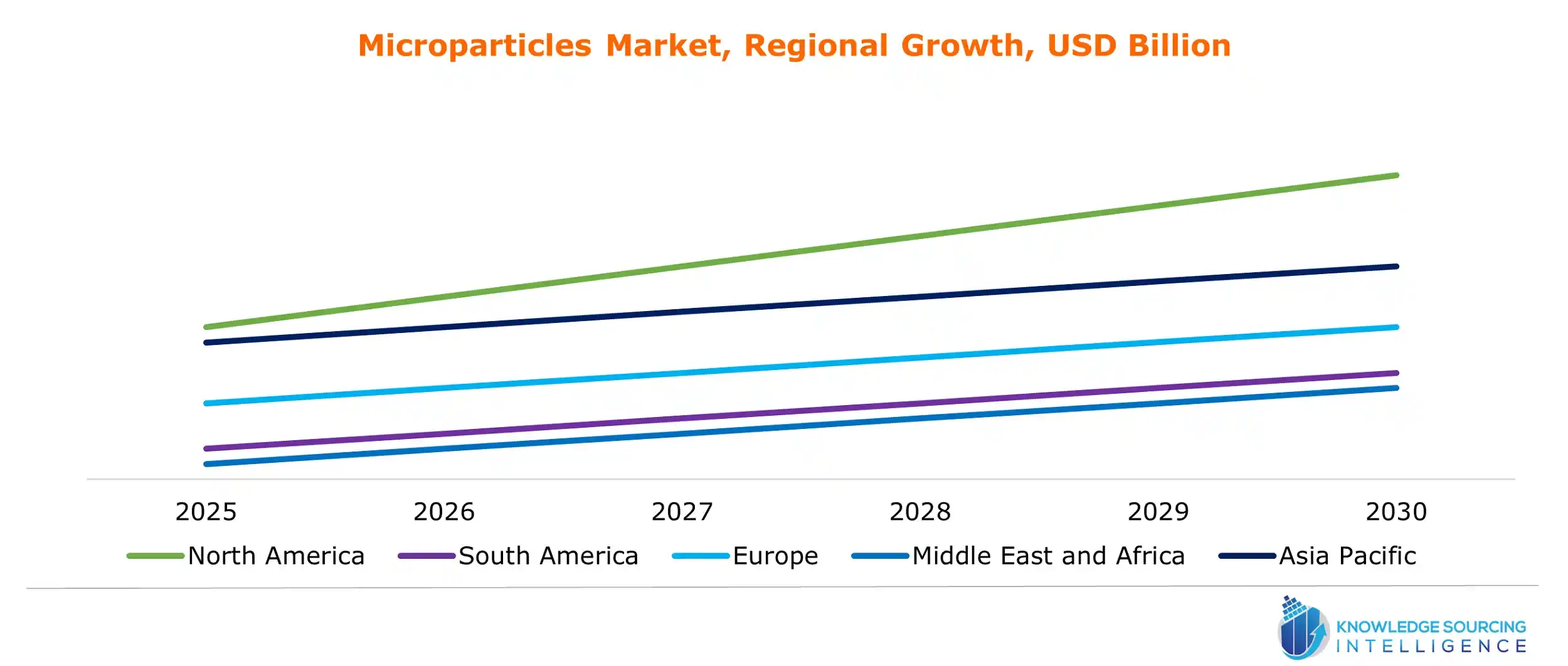

- Asia Pacific’s microparticles market is anticipated to grow significantly.

The Asia Pacific microparticles market is anticipated to expand at a rapid rate, driven by rapid urbanization and demand for advanced technologies across diversified industries. The pharmaceutical industries in China and India are some of the prime growth drivers, as investment in drug delivery systems and biotechnology research is on the rise. For instance, the total market size of the Indian pharma industry is expected to reach US$130 billion by 2030 and US$450 billion by 2047. Moreover, automobile manufacturing within the domestic market alone is projected to be well over 35 million automobiles in 2025 within China.

Similarly, according to the OICA data, automotive production has enhanced by 30% in India in 2021. The favorable government policies include the newly initiated PLI schemes, which include auto and auto components. The recently established innovative chemistry cell for auto manufacturing, the FAME-II Policy until 2024, and a newly launched Rs 76,000 crore PLI scheme on semiconductor manufacturing are boosting the microparticle market growth in the country.

Additionally, the automotive and electronics industries in Japan, South Korea, and China are increasingly incorporating microparticles into materials to improve performance, fuel efficiency, and durability. The region's focus on sustainability and environmental solutions also fuels the demand for microparticles in water treatment, pollution control, and green technologies. Data released by the American Institute of Architects’ (AIA) Shanghai office indicate that China is expected to construct ten cities similar to New York by 2025. Nonetheless, favorable government policies, growing R&D capabilities, and a large consumer base further contribute to the strong growth potential of the microparticle market in Asia Pacific.

Microparticles Market Key Developments:

- In September 2024, Industrial B2B Cleantech innovator Calyxia, a certified B Corp specializing in the production of high-performance, biodegradable microcapsules, and microparticles for use in Consumer Goods, Crop Protection, and Advanced Materials, announced that it has closed a new round of funding totaling $35 million in a Series B round.

- In September 2023, Evonik expanded its parenteral drug delivery solutions platform with three standard PLA-PEG di-block copolymers and a new nanoparticle formulation service using sonication technology. Based on decades of experience in the formulation of polymeric microparticles, liposomes, lipid nanoparticles, and micelles, Evonik is expanding its products and services portfolio.

List of Top Microparticles Companies:

- Evonik

- Oakwood Labs

- Cospheric

- Nuoryon

- Bionity

Microparticles Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Global Microparticles Market Size in 2025 |

US$1.427 billion |

|

Global Microparticles Market Size in 2030 |

US$2.325 billion |

| Growth Rate | CAGR of 10.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in the Global Microparticles Market |

|

| Customization Scope | Free report customization with purchase |

The global microparticles market is analyzed into the following segments:

- By Type

- Hollow

- Solid

- By Material

- Glass

- Polymer

- Ceramic

- Fly Ash

- Metallic

- Others

- By Application

- Automotive

- Aerospace

- Cosmetics

- Oil and Gas

- Paints and Coatings

- Medical Technology

- Composites

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of the Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America