Report Overview

Global Microcontroller Market Size, Highlights

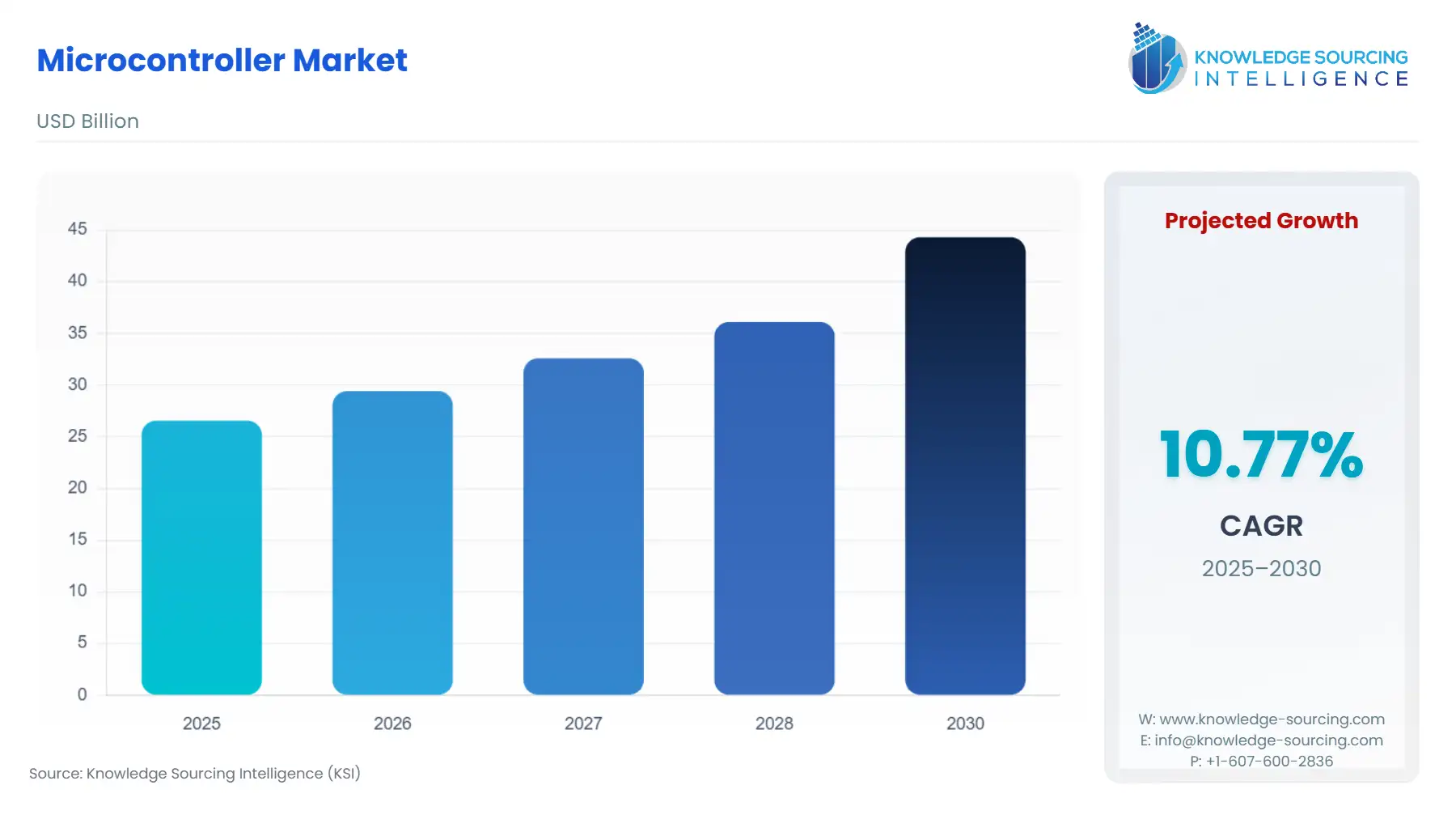

Microcontroller Market Size:

The Global Microcontroller Market is expected to grow from US$26.566 billion in 2025 to US$44.312 billion in 2030, at a CAGR of 10.77%.

Global Microcontroller Market Key Highlights

The Global Microcontroller Market serves as the foundational processing engine for an increasingly digitized world, spanning from simple consumer devices to mission-critical industrial and automotive systems. This high-growth environment is characterized by an inexorable demand for greater processing capability, lower power consumption, and enhanced security features, particularly at the network's edge. The market's structural evolution is fundamentally tied to megatrends in electrification, pervasive connectivity, and automation, which together mandate the integration of billions of MCUs across every end-user vertical.

Global Microcontroller Market Analysis

- Growth Drivers

The industrial transition toward Industry 4.0 and the expansive adoption of IoT devices are the most significant drivers. The industrial segment propels direct demand for MCUs through the deployment of smart factories, which require vast numbers of units for real-time control, data processing, and secure connectivity in robotics, Programmable Logic Controllers (PLCs), and sensor networks. Simultaneously, the consumer and infrastructure IoT boom, including smart home appliances and smart grids, necessitates billions of low-power, cost-effective MCUs to manage sensor data, execute basic control functions, and facilitate wireless communication, directly increasing unit volume demand.

- Challenges and Opportunities

A primary market challenge is the recurrent strain on the global semiconductor supply chain, which leads to extended lead times and production bottlenecks, directly constraining the ability of end-product manufacturers to meet consumer and industrial demand. This shortage condition artificially dampens immediate market unit volume. Concurrently, a major opportunity exists in the rapid architectural shift toward 32-bit and increasingly 64-bit microcontrollers, driven by the need for on-device Artificial Intelligence (AI) and Machine Learning (ML) processing. This trend creates a massive opportunity for manufacturers to realize higher Average Selling Prices (ASPs) and secure design wins in premium, performance-centric applications such as Advanced Driver-Assistance Systems (ADAS) and sophisticated medical devices, fundamentally changing the value composition of the market.

- Raw Material and Pricing Analysis

Microcontrollers are physical products, placing them squarely within the semiconductor material supply chain's complex pricing dynamics. The core material, high-purity Silicon wafers, is subject to capacity constraints from a limited number of specialized wafer manufacturing facilities globally. Furthermore, the final MCU product’s cost is heavily influenced by the availability and pricing of materials such as high-purity aluminum and copper for interconnects and specialized packaging resins. Recent geopolitical tensions and disruptions in global logistics channels have introduced volatility into the raw material procurement costs, putting upward pressure on the manufacturing costs for MCUs and consequently influencing the final price points for end-use industries like automotive and industrial automation.

- Supply Chain Analysis

The global microcontroller supply chain is highly complex and geographically concentrated, centering primarily on a few key production hubs in Asia-Pacific, specifically Taiwan, South Korea, and China. This structure creates significant logistical and geopolitical risk, as the process flow—from wafer fabrication (which requires specialized equipment dominated by US- and European-headquartered firms) to assembly, testing, and packaging (ATP)—is interdependent and highly time-sensitive. The heavy reliance on foundries for fabrication, particularly for smaller geometries, creates a key dependency point. Logistical complexities arise from the need for ultra-clean transport and just-in-time delivery models for high-value components, underscoring the vulnerability to regional instability or natural disasters.

Government Regulations

Government regulations are profoundly reshaping the microcontroller market, particularly in terms of supply chain resilience and end-product safety standards.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

CHIPS and Science Act (2022) |

Incentivizes the construction of new domestic semiconductor fabrication plants through significant subsidies and tax credits. This directly increases the demand for local manufacturing capacity and leads to the geographical diversification of the MCU supply, reducing reliance on single-source regions and supporting the domestic production of mature and legacy chips for critical infrastructure and defense. |

|

European Union |

EU Cyber Resilience Act (Proposed) |

Mandates stringent cybersecurity requirements for all digital products, including embedded devices like MCUs, placed on the EU market. This compels MCU manufacturers to integrate advanced security features, such as hardware-based trust roots and secure boot capabilities, directly increasing demand for higher-feature, security-certified MCU variants in consumer and industrial applications. |

|

Global |

ISO 26262 (Functional Safety) |

A widely adopted international standard for functional safety in road vehicles. Strict adherence to this standard for all electronic systems in vehicles, including MCUs used in ADAS, braking, and steering, forces manufacturers to design, test, and certify MCUs to the highest safety integrity levels (ASILs), significantly increasing the complexity and the intrinsic value of automotive-grade MCUs. |

In-Depth Segment Analysis

- By Application: Automotive Microcontroller

The automotive segment's escalating demand for microcontrollers is driven by two pivotal, interconnected industry transformations: the rise of the Electric Vehicle (EV) and the implementation of Advanced Driver-Assistance Systems (ADAS). EVs mandate a massive increase in MCU content per vehicle compared to traditional internal combustion engine cars. Dedicated high-performance 32-bit MCUs are essential for complex systems such as Battery Management Systems (BMS), motor control, and on-board charging, where real-time processing and functional safety (ISO 26262 compliance) are non-negotiable imperatives. Concurrently, the proliferation of ADAS features—ranging from simple parking assist to sophisticated Level 2/3 autonomous capabilities—requires a distributed network of highly reliable, high-speed microcontrollers to process sensor data (from LiDAR, radar, and cameras), execute complex algorithms, and manage fail-operational redundancy. This shift from mechanical to software-defined vehicle architectures ensures that the demand for high-performance, safety-critical MCUs will continue its upward trajectory, significantly expanding the market's total addressable volume and value.

- By End-User: Industrial Microcontroller

The Industrial segment's growth is fundamentally propelled by the digital transformation associated with Industry 4.0, which centers on automation, machine-to-machine communication, and preventative maintenance. Industrial microcontrollers are the central control elements in a vast array of equipment, including robotics, factory automation systems, smart meters, and specialized motor control units. The requirement for industrial environments necessitates MCUs with robust features such as extended temperature ranges, higher Electrostatic Discharge (ESD) protection, and guaranteed long-term product availability (often 10+ years). Moreover, the increasing adoption of industrial IoT (IIoT) requires MCUs with integrated connectivity protocols (e.g., Ethernet, various wireless standards) and embedded security to protect sensitive operational data at the edge of the network. This necessity is further amplified by government and utility mandates for smart grid infrastructure, where high-precision, secure MCUs are integral components in smart meters and grid control units, ensuring reliable data acquisition and remote management.

Geographical Analysis

- US Market Analysis (North America)

The US market for microcontrollers is significantly characterized by advanced technology adoption in high-value sectors, particularly automotive and medical devices. The US CHIPS and Science Act is a key local factor, directly stimulating demand for locally manufactured MCUs and related technologies by providing substantial financial incentives to establish domestic fabrication and R&D capabilities. Furthermore, the country's stringent regulatory environment for medical devices by the Food and Drug Administration (FDA) drives demand for specialized, high-reliability MCUs with integrated cybersecurity features for patient monitoring and diagnostics equipment.

- Brazil Market Analysis (South America)

Brazil's microcontroller requirement is primarily linked to the growth of its industrial manufacturing base and the rollout of smart city infrastructure. The local demand is robust in sectors like factory automation, where a push for localized manufacturing and modernization creates a consistent need for industrial-grade MCUs in PLCs and motor control. The market also sees growth from the consumer electronics segment, driven by a large domestic population and increasing accessibility to connected devices, although this segment remains sensitive to import duties and local economic stability.

Germany Market Analysis (Europe)

Germany, as a global automotive and industrial manufacturing powerhouse, exhibits a disproportionately high demand for high-performance and functionally safe microcontrollers. The local imperative to comply with the European Union's environmental and safety regulations, such as those governing vehicle emissions and functional safety, directly fuels the demand for high-end 32-bit MCUs in complex electronic control units (ECUs) for advanced powertrains, especially in the premium automotive segment, and for sophisticated Industry 4.0 applications.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market’s growth is heavily influenced by large-scale government-backed infrastructure projects, particularly smart city development (like NEOM) and energy diversification initiatives. These projects create concentrated demand for high-capacity MCUs in smart grid management systems, advanced building automation, and security applications. The market often favors solutions that offer a high degree of integration and long-term support to meet the scale and complexity of these national-level deployments.

- China Market Analysis (Asia-Pacific)

China is the world's largest consumer and manufacturing hub for microcontrollers, with demand generated across all major segments: consumer electronics, automotive, and industrial. Local requirement is catalyzed by an aggressive domestic policy push for self-sufficiency in semiconductor technology, leading to significant investment in indigenous MCU design and manufacturing firms. The massive scale of its electronics assembly and the rapid, state-supported adoption of New Energy Vehicles (NEVs) create unparalleled volume demand for both low-cost, high-volume MCUs for consumer goods and complex, automotive-grade chips for EV components.

Competitive Environment and Analysis

The Global Microcontroller Market operates as a consolidated yet fiercely competitive landscape, with a few integrated device manufacturers (IDMs) and specialized fabless companies holding significant market share, particularly in the premium, high-performance segments like automotive and industrial. Competition is not solely based on price, but increasingly on intellectual property (IP) blocks, the robustness of software ecosystems, development tools, and compliance with stringent functional safety and security standards. Companies continuously engage in strategic mergers and acquisitions to consolidate IP, expand product portfolios, and secure manufacturing capacity.

- NXP Semiconductors

NXP Semiconductors holds a leading strategic position in the automotive and industrial microcontroller segments. The company's strength lies in its deep expertise in secure connections and processing, which is critical for its market-leading S32 family of processors and microcontrollers designed specifically for the transition to software-defined vehicles (SDVs). NXP’s core offering focuses on delivering performance, functional safety, and robust security for applications such as ADAS, vehicle networking, and electric vehicle battery management systems. The company actively leverages its long-term relationships with Tier 1 suppliers and Original Equipment Manufacturers (OEMs) to secure platform-level design wins.

- Renesas Electronic Corporation

Renesas is a global leader, particularly in the microcontroller, analog, and power semiconductor spaces, focusing on complete system solutions often referred to as "Winning Combinations." The company's strategic positioning is anchored by its broad portfolio of MCUs, including the RX, RA, and RZ families, which target the automotive, industrial, and IoT sectors. Renesas places a strong emphasis on providing comprehensive design ecosystems and reference designs to accelerate customers' time-to-market. Its strategy involves targeted acquisitions to expand its technology and solution offerings, such as its acquisition activity in connectivity and design software.

Recent Market Developments

- December 2024: NXP Semiconductors N.V. entered into a definitive agreement to acquire Aviva Links, a provider of Automotive SerDes Alliance (ASA) compliant in-vehicle connectivity solutions. This acquisition is a strategic merger and acquisition development, expanding NXP's market-leading in-vehicle networking (IVN) portfolio with SerDes technology, supporting high-speed data rates up to 16 Gbps. This directly supports the increasing complexity and data bandwidth requirements of ADAS and infotainment systems in next-generation vehicles.

- September 2024: NXP Semiconductors N.V. announced the official establishment of VisionPower Semiconductor Manufacturing Company Pte Ltd (VSMC), a joint venture with Vanguard International Semiconductor Corporation (VIS) in Singapore. This development involves the planned construction of a 300mm wafer manufacturing facility. This is a crucial capacity addition development, specifically designed to support the supply of 130nm to 40nm mixed-signal, power management, and analog products, targeting the high-demand automotive, industrial, and consumer markets. The move aims to diversify NXP’s manufacturing base, ensuring supply control and geographic resilience.

- August 2024: Renesas Electronics Corporation completed its acquisition of Altium Limited, a global leader in electronics design systems. This M&A activity is strategically focused on digitalization, aiming to establish an integrated and open "electronics system design and lifecycle management platform." This move is intended to streamline and accelerate the design process for engineers, unifying component selection, simulation, and PCB design, ultimately enabling Renesas to offer a more seamless and integrated user experience for its microcontroller-based solutions.

Global Microcontroller Market Segmentation

By Product Type

- 8-bit Microcontroller

- 16-bit Microcontroller

- 32-bit Microcontroller

By Application

- Consumer electronics Microcontroller

- Automotive Microcontroller

- Industrial Microcontroller

- Medical Devices Microcontroller

- Military and Defense Microcontroller

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others