Report Overview

Global Footwear Market - Highlights

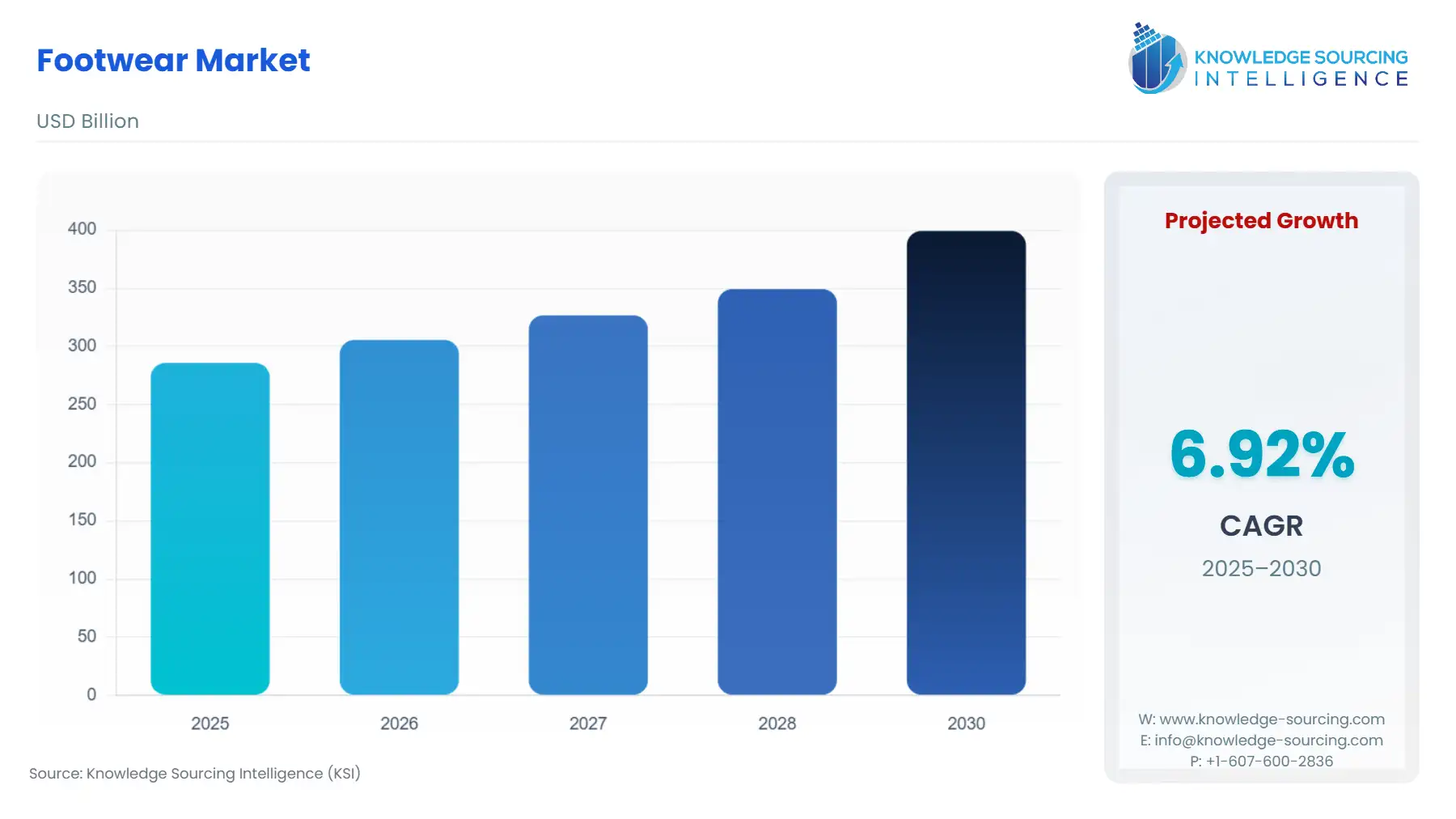

Footwear Market Size:

The global footwear market is estimated to attain a market size of USD 399.304 billion by 2030, growing at a 6.92% CAGR from a valuation of USD 285.804 billion in 2025.

The global footwear market is a dynamic sector, driven by evolving shoe market trends and consumer preferences. Online footwear sales have surged, fueled by e-commerce growth and seamless digital experiences. D2C footwear brands are reshaping the market, offering personalized, high-quality products directly to consumers, bypassing traditional retail. The premium footwear market thrives on innovation, sustainability, and luxury appeal, while mass market footwear caters to affordability and accessibility. Advanced manufacturing and design technologies enhance product differentiation across both segments. As consumer demand shifts toward convenience and customization, the footwear market continues to adapt, delivering value to industry stakeholders.

This global market will grow primarily due to the rising demand for footwear as the population increases. Furthermore, the growing awareness of shoes in underdeveloped countries and the purchasing power of the people will lead to market growth in emerging economies, such as the Asia-Pacific region. The innovation in footwear-making technology might further spur the market expansion. Athletic shoe choices with customization features will drive market expansion.

Footwear Market Trends:

The footwear market is evolving with athleisure footwear trends driving demand for versatile, stylish comfort footwear. Fashion sneakers dominate sneaker culture, blending aesthetics with functionality across the men's, women's, and kids' footwear market. Luxury footwear trends emphasize premium materials and bespoke designs, catering to affluent consumers. Wellness footwear gains traction, prioritizing ergonomic support and health-focused features. Innovations in sustainable materials and smart manufacturing enhance product appeal, aligning with consumer preferences for eco-conscious and comfortable options. These trends reflect the market’s shift toward blending style, wellness, and sustainability, offering diverse opportunities for market players.

Footwear Market Overview & Scope:

The global footwear market is segmented by:

Type: The Global Footwear Market is segmented by type into Athletic and Non-Athletic. The athletic footwear segment is anticipated to witness robust growth over the next five years, primarily due to growing health awareness among people owing to rising health concerns that have led to an upsurge in sports activities worldwide. Customers are putting greater importance on exercising; hence, there is greater demand for specific running, training, and other sporting footwear. According to a survey conducted by the Clearinghouse for Sport in 2022, 32% of women and 50% of men over 15 years in Australia participated in sport or physical activity at least once a week. The source further stated that 81% of young adults participated in sport-related activity.

In addition to this, in 2023, the government’s total spending throughout the EU on recreational and sporting services was €67.6 billion, or 0.8 % of all general spending. This important investment reflects a heightened institutional interest in encouraging physical activity and healthier living through infrastructure, programs, and community programs. Such spending increases participation in sporting and recreational pursuits and indirectly stimulates demand for athletic footwear as more people become involved in physical activities that involve appropriate equipment. By increasing access to sports facilities and promoting active living, government expenditure supports consumer trends and helps maintain long-term market momentum.

End-User: The Global Footwear Market, by end-user, is segmented into Men, Women, and Children. The men's segment will hold a higher market share due to higher spending on shoes for formal and sports events.

Distribution Channel: The Global Footwear Market, by distribution channel, is segmented into Online and Offline. Expansion of the footwear industry through online distribution channels is being driven notably by the large-scale adoption of e-commerce and shifting consumer patterns. As internet penetration and the use of smartphones continue to improve worldwide, customers are increasingly resorting to online shopping for convenience, enhanced selection of products, and time-saving. In this regard, as of March 2022, e-commerce sales in Canada amounted to approximately US$2.34 billion, as stated by Statistics Canada. It is estimated that retail e-commerce sales in the nation will total US$40.3 billion by the end of 2025. Footwear companies and retailers are improving their digital interfaces, providing users with features such as user reviews, size guides, and virtual try-on technologies to minimize uncertainty and enhance purchase confidence.

Online store retailers serve both as facilitators of access to consumers and influential brand platforms. Online retailers may be generally classified as either multi-brand marketplaces, including Amazon, Zalando, and Flipkart, or specialized footwear or fashion-specific platforms, such as Zappos, Foot Locker, and ASOS. These websites offer consumers extensive product offerings, low prices, and convenience, which are particularly appealing in an increasingly time-conscious and digitally-influenced shopping culture.

Region: The global footwear market, by geography, is segmented into regions including North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Asia-Pacific is the fastest-growing region for the global footwear market due to the large consumer base and the high population in countries like India, China, Pakistan, Bangladesh, and others. The growing economies of Asia-Pacific countries such as India, China, and others are increasing disposable income, driving the demand for premium and branded footwear for casuals and athletics.

Top Trends Shaping the Footwear Market:

1. Increasing Popularity of Athleisure and Sportswear

The smudging of boundaries between sport and streetwear has fueled the athleisure trend. Customers are preferring shoes that provide performance benefits with daily wearability. This trend is specifically dominant in the sportswear category, which is predicted to experience explosive growth until 2030.

2. Technological Innovations Strengthen Product Offerings

Advances in footwear technology are creating enhanced comfort, performance, and customization. Companies are investing in research and development to launch features such as increased cushioning, lightweight materials, and new sole designs. For example, ANTA's new PG7 midsole technology provides increased cushioning and stability for runners.

Footwear Market Growth Drivers vs. Challenges:

Drivers:

Booming Fitness Trend: The booming fitness trend among millennials has led to an upsurge in sports activities such as going to the gym, cycling, aerobics, and others. Thus, the surging trend of fitness among millennials and Gen Z has led to an upsurge in demand for active footwear such as gym and cycling shoes. This is increasing the need for lightweight and comfortable shoes for athletes.

As per the data by the Wellness Creative Co., a health and fitness marketing agency, there are 184 million gym members worldwide and 72 million gym members in the USA, which is 23.7% of the population, highlighting health and fitness awareness among people. It underscores a global shift toward health and fitness consciousness, which is significantly driving demand for footwear, particularly in the athletic and activewear segments. Consumers also demand trendy and quirky styles of footwear, especially for sneakers; hence, companies are forming creative partnerships in the market.

Growing Population Expanding Consumer Base: One of the prime factors supporting the market expansion is the increasing population worldwide. With the support of additional factors, such as increasing disposable income and comfort requirements in footwear, the demand for footwear in the market is increasing.

There is a constant increase in the global population, leading to rising demand for footwear. According to the United Nations, there will be approximately 10.3 billion people by mid-2080, from 8 billion in 2022. It is estimated to grow from 8.23 billion in 2025, 8.56 billion in 2030, to 8.85 billion by 2035. As the population rises, the number of potential footwear consumers increases proportionally, and with the increasing income and growing urbanization, the demand will accelerate. The rising demand owing to the population growth is fulfilled with the trending, creative, and innovative footwear by the prevailing market leader.

As per the World Health Organization, the population worldwide is rapidly ageing. One billion people worldwide were sixty years of age or older in 2020. By 2030, that number will increase to 1.4 billion, or one in six people on the planet. Furthermore, the population of those 60 and over is estimated to double to 2.1 billion by 2050. It is anticipated that between 2020 and 2050, the number of people 80 years or older will triple, reaching 426 million. This has led to age-related issues, driving the demand for orthopedic and comfort footwear for foot-related issues such as Arthritis, Plantar fasciitis, and others. The growing geriatric population is leading companies to expand in age-inclusive designs.

Restraints:

Volatility in Raw Material Prices: Volatility in prices of major raw materials such as leather, rubber, and man-made fibers is a big challenge for footwear manufacturers. Such volatility is usually caused by worldwide supply-demand mismatches, geopolitical tensions, and natural disasters. Volatility in input prices makes it challenging for businesses to have fixed pricing strategies and profit margins, particularly for brands that compete in the mid- and low-end price segments.

Footwear Market Regional Analysis:

North America: North America’s growth in the footwear market is driven by evolving consumer preferences, followed by technological advancements. A primary growth driver responsible for driving market growth is the rise in the demand for stylish and comfortable footwear, which is imperative in supporting active lifestyles.

Consumers, especially the younger demographics, prioritize footwear that provides ergonomic support, comfort, and durability for running, hiking, and everyday use. Nike, Adidas, and New Balance, among other brands, are cashing in on this by incorporating high-tech materials, including intelligent sneakers with fitness-tracking sensors, to address health-conscious consumers' needs. Sustainability is also a key driver of market expansion. There is a greater demand for environmentally friendly footwear produced from recycled plastics, vegan leather, and biodegradable materials due to rising environmental awareness.

Footwear Market Key Developments:

October 2025: Nike unveils Project Amplify, the world’s first powered footwear system for running and walking, featuring a lightweight motor, drive belt, and rechargeable cuff battery integrated with a carbon-fiber-plated running shoe; developed in collaboration with robotics partner Dephy.

October 2025: Nike introduces its first neuroscience-based footwear, the Mind 001 mule and Mind 002 sneaker, via its new Nike Mind platform, designed to help athletes lock in mindset by activating key sensory receptors in the feet (available January 2026).

April 2025: Puma launches the Fast-R NITRO™ Elite 3 super-shoe, based on independent biomechanical research (led by Wouter Hoogkamer) showing a 3.15 % improvement in running economy compared with its predecessor and competitor models.

January 2025: Nike launched the Pegasus Premium. It is designed with Nike’s first sculpted visible Air Zoom Unit. Air Zoom Cushioning Technology is an advanced biomechanical and cushioning engineering, improving the energy return. It has also integrated 3D Prototyping and heat molding. It has used lightweight and durable materials such as ZoomX foam and ReactX foam.

List of Top Footwear Companies:

Nike, Inc.

Adidas AG

Puma SE

Skechers USA, Inc.

Bata Corporation

Footwear Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 285.804 billion |

| Total Market Size in 2030 | USD 399.304 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, End-User, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Footwear Market Segmentation:

By Type

Athletic

Non-Athletic

By End-User

Men

Women

Children

By Distribution Channel

Online

Offline

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Taiwan

Others