Report Overview

Food Container Market Size, Highlights

Food Container Market Size:

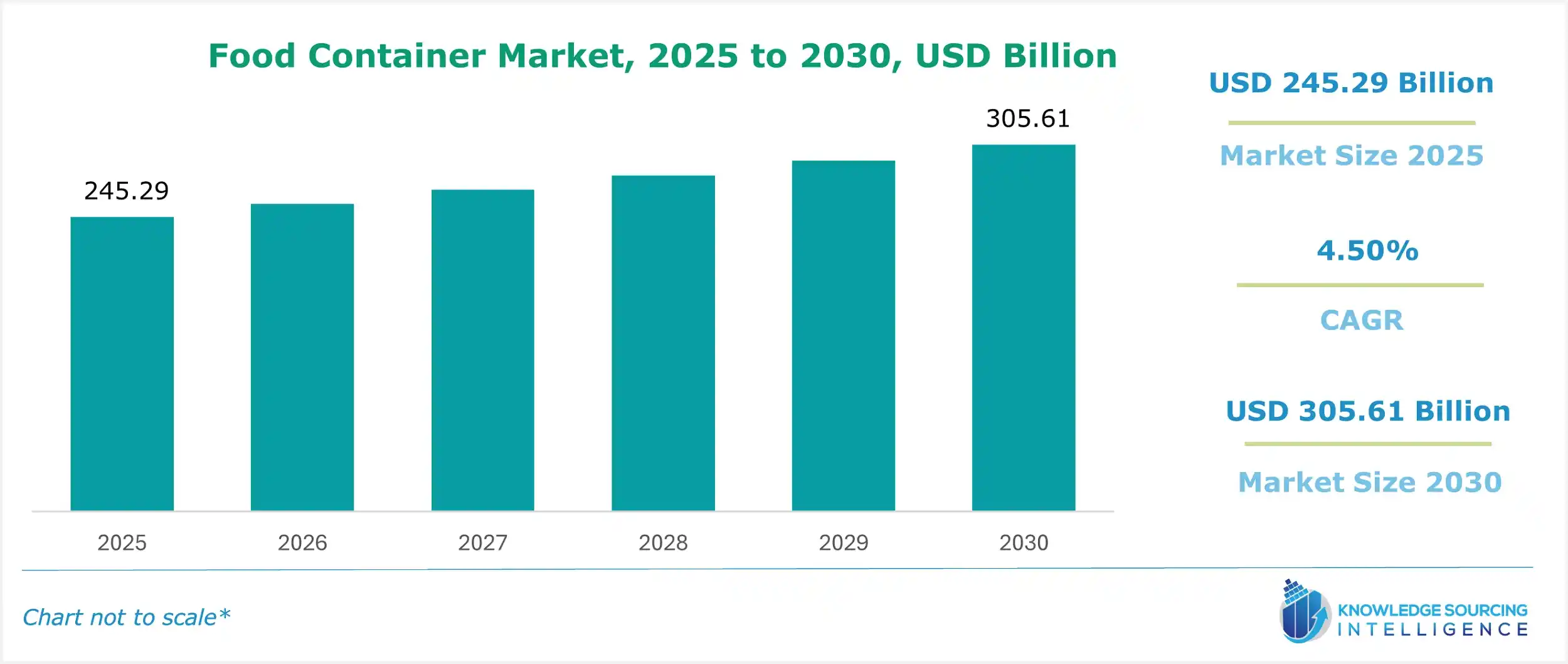

The food container market is projected to witness a CAGR of 4.50% to reach US$305.61 billion by 2030, from US$245.29 billion in 2025.

Food Container Market Trends:

A food container is used for preserving and storing food items at normal room temperature, thereby keeping their quality intact and extending their shelf life. The container comes in various options such as plastic, glass, and metal containers. Moreover, the growing awareness among people regarding sustainable packaging is expected to further stimulate the demand for food containers during the forecast period.

Government schemes promoting sustainable packaging solutions will push the market growth of the food container market.

Packaging waste is mainly created through the usage of materials such as single-use plastics, which are hard to dispose of. The growing plastic pollution is becoming a major concern that has made the governments of different countries focus on recyclable and sustainable packaging. The new policies and regulations are aimed at major sectors such as food and beverage to address these concerns.

Further, major companies are entering into strategic alliances to cater to this rising demand, which will further aid in the market development of the food container market.

The global Food Container Market report offers a thorough analysis of the industry landscape, providing strategic and executive-level insights backed by data-driven forecasts and detailed analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various products, including Plastic Containers, Glass Containers, Paperboard Containers, Metal Containers, and Bags and Pouches, while also exploring applications such as Dairy Products, Baked Food, Fruits and Vegetables, Meat Products, and Others. Additionally, the report analyzes packaging types, categorized as Rigid Packaging, Semi-Rigid Packaging, and Flexible Packaging. It further evaluates technological advancements, critical government policies, regulatory frameworks, and macroeconomic factors, presenting a comprehensive view of the market

Food Container Market Segmentation:

Global Food Container Market Segmentation by product:

The market is analyzed by product into the following:

Global Food Container Market Segmentation by application:

The report analyzed the market by Application as below:

- Dairy Products

- Baked Food

- Fruits and Vegetables

- Meat Products

- Others

Global Food Container Market Segmentation by packaging type:

The report analyzes the market by packaging type segment as below:

- Rigid Packaging

- Semi-Rigid Packaging

- Flexible Packaging

Global Food Container Market Segmentation by regions:

The study also analyzed the Global Food Container Market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain and Others

- Middle East and Africa (Saudi Arabia, UAE and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Global Food Container Market Competitive Landscape:

The global Global Food Container Market features key players such as Amcor Limited, WestRock, Mondi, Sonoco, Printpack, Pactiv LLC, Novolex, RTS Packaging, MeadWestvaco Corporation, Graham Packaging Company Incorporated, Berry Global Inc., Ball Corporation, Anchor Glass Container Corporation among others.

Global Food Container Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different products, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by application, with historical revenue data and analysis.

- Market size, forecasts, and trends by packaging type segment, with historical revenue data and analysis across various segments.

- Global Food Container Market is also analyzed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario, and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players, and recent major developments undertaken by the companies to gain a competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure the most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for the purchase?

- The report provides a strategic outlook of the Global Food Container Market to the decision-makers, analysts, and other stakeholders in an easy-to-read format for making informed decisions.

- The charts, tables, and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and emails for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports to help cater to additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Food Container Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Food Container Market Size in 2025 | US$245.29 billion |

| Food Container Market Size in 2030 | US$305.61 billion |

| Growth Rate | CAGR of 4.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Food Container Market |

|

| Customization Scope | Free report customization with purchase |