Report Overview

Foam Glass Market - Highlights

Foam Glass Market Size:

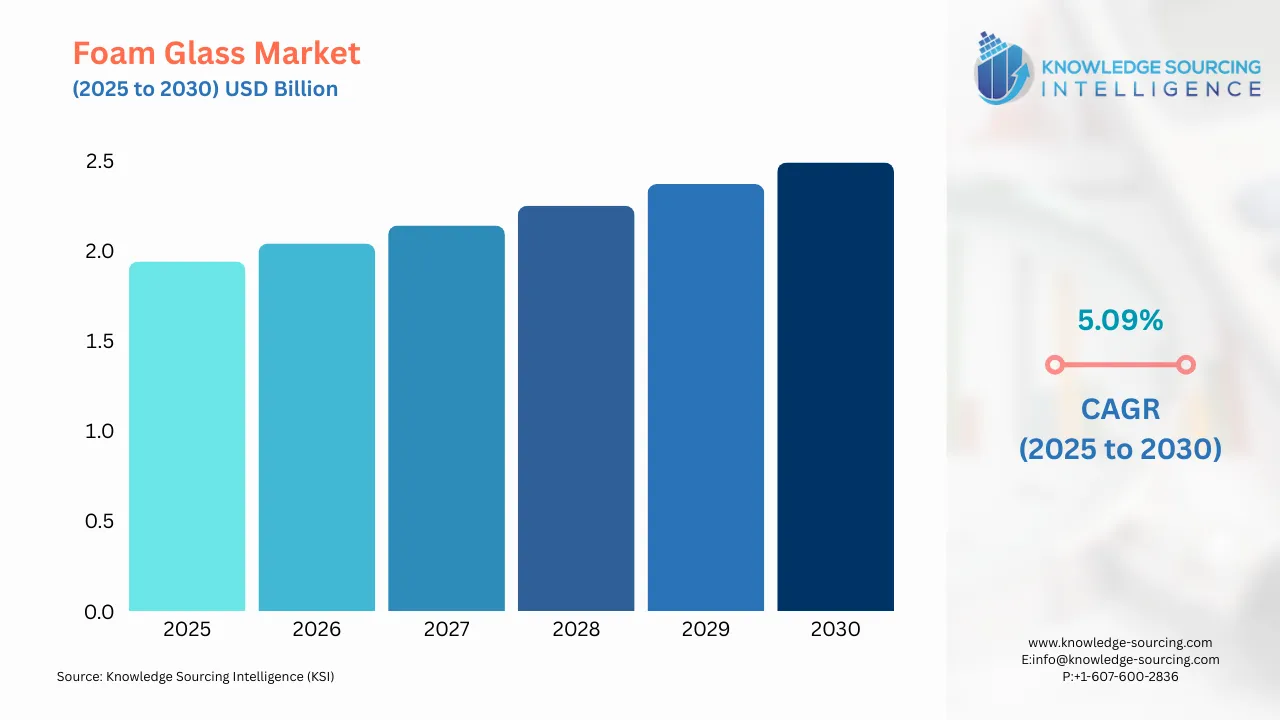

The foam glass market is projected to grow at a CAGR of 5.09% to be valued at US$2.486 billion in 2030 from US$1.940 billion in 2025.

Foam Glass Market Introduction:

The foam glass market, also referred to as the cellular glass market, is a specialized segment within the advanced materials industry, focusing on a lightweight, porous insulation material made primarily from recycled glass. Renowned for its exceptional thermal and acoustic insulation properties, fire resistance, moisture impermeability, and chemical inertness, foam glass serves critical applications in construction, industrial insulation, and infrastructure projects. Its ability to withstand extreme conditions, including temperatures from -269°C to +482°C, makes it a preferred choice for energy-efficient building designs, cryogenic storage, and geotechnical applications. The market is experiencing steady growth, driven by the global push for sustainable materials, stringent energy regulations, and infrastructure development.

Foam glass is produced by heating recycled glass with foaming agents, such as carbon or silicon carbide, to create a porous, rigid material with sealed or open cells. Closed-cell foam glass, the dominant type, offers superior thermal insulation, high compressive strength, and resistance to moisture, making it ideal for building envelopes, roofing, piping insulation, and cryogenic systems. Open-cell variants, valued for acoustic insulation, are used in applications like soundproofing walls or floors. The material’s eco-friendly composition, often comprising up to 98% recycled glass, aligns with green building certifications like LEED and BREEAM, enhancing its appeal in sustainable construction. The market serves diverse sectors, including residential and commercial construction, industrial facilities (e.g., petrochemical and LNG plants), and transportation infrastructure (e.g., roadbeds and embankments). Key players, such as Owens Corning, Uusioaines Oy, and Glapor, drive innovation through advanced manufacturing processes and expanded production capacities. Despite its advantages, the market faces challenges like high production costs and competition from cheaper alternatives. The foam glass market’s growth trajectory is shaped by technological advancements, regulatory support, and increasing demand for durable, sustainable insulation solutions.

Foam Glass Market Overview:

The foam glass market is expanding over the forecast period, propelled by its exceptional qualities as an insulation material, including low surface density, high durability, low thermal conductivity, heat resistance, minimal water absorption, soundproofing capabilities, and strong corrosion resistance, among other attributes. Made from recycled glass, foam glass is eco-friendly, further supporting the growth of the global foam glass market. Its versatile properties are driving an increase in its applications.

Regionally, the foam glass market spans North America, Europe, the Middle East and Africa, Asia Pacific, and South America. North America and Europe command substantial portions of the market. In the Asia Pacific region, demand for foam glass is growing due to population increases and economic development. Heightened environmental awareness among residents, particularly in developing nations like China, India, and Indonesia, is fueling demand for foam glass, thereby enhancing the global foam glass market’s growth.

Foam Glass Market Drivers:

Demand for Sustainable Building Materials: The global push for sustainability and green building practices is a primary driver of the foam glass market, as the material’s composition, often up to 98% recycled glass, aligns with environmental goals and certifications like LEED and BREEAM. Foam glass’s durability, recyclability, and low environmental impact make it a preferred choice for energy-efficient buildings, particularly in regions with stringent sustainability mandates. Its use in roofing, wall insulation, and flooring supports reduced energy consumption, appealing to architects and developers aiming for net-zero buildings. For instance, foam glass’s application in European green building projects has grown, driven by policies promoting circular economy principles. A recent study highlighted foam glass’s role in sustainable construction, noting its ability to reduce lifecycle carbon emissions compared to traditional insulation materials. This driver is amplified by consumer and regulatory demand for eco-friendly materials, positioning foam glass as a critical component in modern construction.

Stringent Energy Efficiency Regulations: Governments worldwide are implementing stringent building codes to reduce energy consumption, boosting demand for high-performance insulation materials like foam glass. Its low thermal conductivity and ability to maintain performance over decades make it ideal for meeting standards like the EU’s Energy Performance of Buildings Directive (EPBD), which mandates energy-efficient designs for new and renovated buildings. Foam glass is particularly valued in passive house projects, where it ensures minimal heat loss in extreme climates. In 2024, the European Commission updated the EPBD to prioritize materials with low embodied carbon and high insulation efficiency, directly benefiting foam glass adoption. This regulatory push encourages developers to choose foam glass for applications like roofing and façade insulation, driving market growth as energy efficiency becomes a global priority.

Growth in Infrastructure Projects: The expansion of infrastructure projects, particularly in transportation and urban development, is a significant driver for foam glass, especially as lightweight aggregates for geotechnical applications. Foam glass’s high compressive strength and low density make it ideal for reducing structural loads in roadbeds, bridge abutments, and embankments, improving stability and reducing construction costs. Its use in transportation infrastructure, such as Norway’s E39 highway project in 2024, demonstrated its ability to replace heavier materials, enhancing project efficiency and sustainability. Foam glass aggregates also resist moisture and frost, making them suitable for harsh climates. This driver is fueled by global infrastructure investments, particularly in emerging economies, where foam glass supports resilient, eco-friendly construction solutions.

Foam Glass Market Restraints:

High Production Costs: The energy-intensive manufacturing process of foam glass, which involves heating recycled glass with foaming agents at high temperatures, results in elevated production costs compared to alternative insulation materials like polystyrene or mineral wool. Specialized equipment and quality control further increase expenses, limiting affordability for price-sensitive markets, particularly in developing regions. These costs restrict foam glass’s adoption in residential projects and smaller-scale applications, where cheaper alternatives dominate. A 2024 study emphasized that high production costs remain a barrier to widespread use, despite foam glass’s long-term durability and performance benefits, slowing market penetration in cost-conscious sectors.

Competition from Alternative Materials: Foam glass faces stiff competition from lower-cost insulation materials, such as expanded polystyrene (EPS), extruded polystyrene (XPS), and mineral wool, which offer comparable thermal performance at reduced prices. These alternatives are widely used in residential and commercial construction due to their affordability and established supply chains, challenging foam glass’s market share. While foam glass excels in durability, fire resistance, and sustainability, its higher upfront cost deters adoption in budget-driven projects. A recent report noted that competition from these materials limits foam glass’s growth in price-sensitive markets, particularly in regions with less stringent energy regulations, requiring manufacturers to innovate cost-effective production methods.

Foam Glass Market Segmentation Analysis:

By type, the closed-cell foam glass segment is expected to witness considerable market growth: Closed-cell foam glass dominates the foam glass market by type due to its superior thermal insulation, moisture impermeability, and high compressive strength, making it the preferred choice for demanding applications in construction and industrial settings. Unlike open-cell foam glass, which is primarily used for acoustic insulation, closed-cell foam glass features sealed pores that prevent water and vapor penetration, ensuring long-term durability and performance in harsh environments. This type is widely used in building envelopes, roofing, piping insulation, and cryogenic systems, such as liquefied natural gas (LNG) storage, where its ability to withstand temperatures from -269°C to +482°C is critical. Its eco-friendly composition, often made from recycled glass, aligns with sustainability goals, enhancing its appeal in green building projects. This segment’s dominance is driven by its versatility and alignment with global energy efficiency and sustainability mandates.

By application, the Building and Industrial Installation sector is leading the market growth: The building and industrial installation segment is the leading application for foam glass, driven by its extensive use in thermal and acoustic insulation for residential, commercial, and industrial structures. Foam glass’s low thermal conductivity, fire resistance, and durability make it ideal for insulating building envelopes, roofs, walls, and floors, supporting energy-efficient designs that comply with standards like the EU’s Energy Performance of Buildings Directive (EPBD). In industrial settings, it is used for insulating pipelines, tanks, and equipment in sectors like petrochemicals and LNG, where its chemical inertness and resistance to extreme conditions are critical. The segment’s growth is fueled by global demand for sustainable construction and energy conservation, particularly in regions with stringent building codes. A 2024 study highlighted foam glass’s role in European green building projects, where it reduced energy consumption in passive house designs, underscoring its importance in achieving net-zero goals. This application’s dominance reflects its broad utility and alignment with regulatory and environmental priorities.

The industrial sector is anticipated to hold the largest market share: The industrial end-user segment dominates the foam glass market due to its critical role in high-performance insulation for sectors such as petrochemicals, LNG, and manufacturing. Foam glass’s ability to provide thermal stability, corrosion resistance, and durability in extreme conditions makes it indispensable for insulating cryogenic storage tanks, pipelines, and industrial equipment. Its non-combustible nature and resistance to chemical degradation ensure safety and longevity in harsh environments, such as LNG terminals, where it minimizes heat transfer and maintains structural integrity. The segment’s growth is driven by global expansion of LNG infrastructure and industrial facilities, particularly in North America and Asia. A 2024 U.S. Department of Energy report highlighted foam glass’s use in LNG export terminals, noting its effectiveness in maintaining low boil-off rates for cryogenic storage. This end-user segment’s leadership is reinforced by increasing industrial investments and the need for reliable, sustainable insulation solutions in energy-intensive sectors.

Foam Glass Market Key Developments:

April 2024: Foamit Group, supported by shareholders Partnera Corp. and Tesi, invested approximately $10.7 million to double the production capacity of its Onsøy, Norway, plant. This expansion aims to meet rising demand for sustainable foam glass in Nordic construction and infrastructure projects, particularly for building insulation and lightweight aggregates. The initiative enhances Foamit’s delivery capabilities for eco-friendly insulation, reinforcing the market’s growth in sustainable construction solutions.

March 2024: Uusioaines Oy, a leading Finnish foam glass manufacturer, announced improvements in its production techniques to meet increasing demand for sustainable insulation in European infrastructure projects. The enhancements focus on optimizing the use of recycled glass and reducing energy consumption during manufacturing, improving the environmental footprint of foam glass products. This development highlights the market’s emphasis on eco-friendly production processes and scalability to support green building initiatives.

January 2024: Veriso GmbH & Co. KG, formed by the merger of Schlüsselbauer and Reiling’s German foam glass operations, announced advancements in foam glass applications for infrastructure projects. The company introduced new foam glass gravel formulations for lightweight fill in road construction and geotechnical applications, improving load-bearing capacity and sustainability. This development strengthens Veriso’s market presence in Europe, driving foam glass adoption in large-scale infrastructure projects.

Foam Glass Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Foam Glass Market Segmentations:

By Type

Open-Cell Foam Glass

Closed-Cell Foam Glass

Others

By Process

Physical Process

Chemical Process

By Application

Building and Industrial Installation

Chemical System

Architectural

Ground Material

Water Holding Material

Others

By End-User

Residential

Commercial

Industrial

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others