Report Overview

Global EV Battery Separator Highlights

EV Battery Separator Market Size:

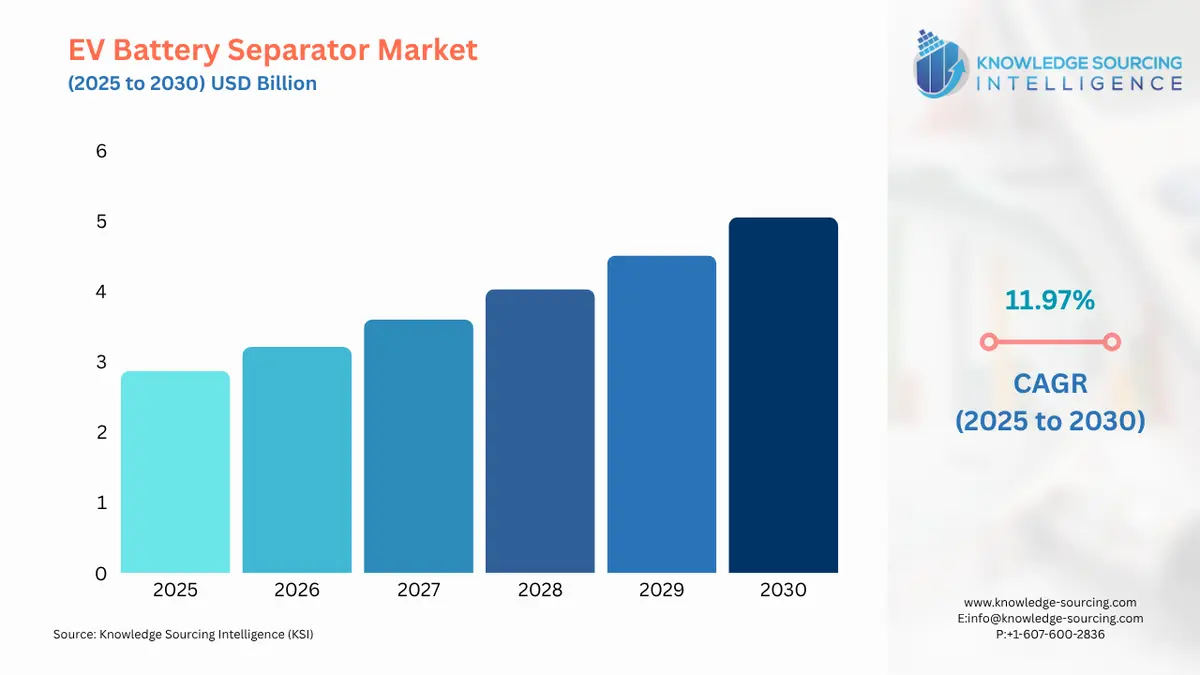

The global EV battery separator market is expected to account for a compound annual growth rate of 11.97% and increase from US$2.869 billion in 2025 to account for US$5.049 billion in 2030.

EV Battery Separator Market Trends:

Battery separators are materials that act as a barrier between the anode and the cathode and help in enabling lithium-ion exchanges. They play a critical role in the electric vehicle battery market, ensuring the safety of the battery, as they isolate anodes and cathodes. In electric vehicles (EVs), the battery separators also help in improving the performance and efficiency of the battery and in reducing waste. A multi-cell battery consists of an anode and a cathode that are separated from each other by an insulator known as the battery separator.

Additionally, the separator is soaked in an electrolyte that assists in the flow of ions from the cathode into the anode when the battery is being charged, while opposing the same process when the battery is being discharged. This type of separator is a non-conductive electrical insulator. Separators are key components within the battery components and even have to be present since they keep the anodes and cathodes apart without preventing the movement of lithium ions (Li-ion) between them. In contemporary Li-ion battery models, the cell volume occupied by the separator containing electrolyte is nearly three percent of the cell volume.

The increasing global production of electric vehicles will boost the global demand for EV battery separators. The production of electric vehicles worldwide has witnessed major growth due to the increasing governmental initiatives towards the sector.

The International Energy Agency, in its report, stated that in 2023, the total EV stock of battery electric vehicles (BEVs) in China was recorded at 16.1 million. In Europe and the USA, the total EV stock was recorded at 6.7 million and 3.5 million, respectively. The EV stock witnessed significant growth from 2022, with a total stock of BEVs in China recorded at 10.7 million, 4.4 million in stock in Europe, and 2.1 million in the USA

EV Battery Separator Market Growth Drivers:

- The growing global demand for electric vehicles is projected to propel the EV battery separator market expansion.

A major factor propelling the growth of the EV battery separator market is the increasing global demand for electric vehicles. The EV battery separator plays a critical role in offering an optimum and efficient battery performance. The global demand for EVs has increased significantly over the past few years, primarily due to the increasing consumer preferences toward sustainable automotive solutions.

The International Energy Agency, in its global EV sales report, stated that the total sales of electric vehicles witnessed a major growth. The agency stated that in 2021, the total global sales of EV batteries were recorded at 4.7 million, which increased to 7.3 million in 2022. In 2023, the total sales of EV batteries were recorded at 9.5 million.

The rising demand for EVs provides the opportunity for the availability of battery separators and more requirements for performance-oriented batteries for EVs. While these battery separators merely separate the anode from the cathode but permit ion passage, the global demand for battery separator production in the EV category rises from the need for this sustainable channel of mobility, from making efficient and reliable battery separators.

In 2023, about 14 million electric cars were sold, of which ninety-five percent found owners in Europe, China, and the United States. Compared to 2022, this figure represents a 35% increase, with 3.5 million more registered EVs. The total number of electric cars that ended up on roads worldwide rose to 40 million, according to the Global EV Outlook of the International Energy Agency (IEA). The IEA data further showed that the sale of electric cars increased from 13.7 million in 2023 to 16.6 million units by 2024.

Moreover, manufacturers are increasing battery capability so that the driving range is longer. While separators that can withstand very high energy densities and temperatures need to be developed, such research and development have been conducted with safety as the primary focus for the EV industry, clearly recognizing that short circuits and thermal runaways can be avoided with separators of very high quality. This will provide an opportunity for market expansion in the coming years.

- The rising cost of diesel and petrol is anticipated to fuel the EV battery separator market expansion.

Rising interest in electric drive vehicles (EDVs) is predicted to increase because people are demanding more fuel-efficient, high-performing, and lower-emission vehicles. The other factor of the industry is powered by lithium batteries, allowing for hybrids, plug-ins, full battery electrics, and vehicles like buses, taxis, and fleets, among others. Within this range of EDV battery cell configurations, Celgard lithium-ion battery separators have advantages in safety and energy, power performance, and optimal combinations. The company provides various separator solutions to address the several performance needs of EDV systems, including safety, chemical and dimensional stability, and cycle life.

Furthermore, Tekra’s Mylar and Melinex polyester films are provided in various thicknesses for use in lithium-ion battery insulation and separators, Kaladex films from DuPont Teijin Films are PEN films offered in considerable varieties of thicknesses alongside Teonex films from Toyobo Film Solutions Limited.

Another illustration of this is SETELA, which Toray Industries provided. This is a battery separator film of high performance and great reliability. It is often used as a separator material in secondary lithium-ion batteries in consumer electrical accessories and electric automobiles. Similarly, in November 2022, General Motors and Microvast made a joint venture to build a separator factory in the US. The new plant and separator project received support from a $200 million grant awarded to the US Department of Energy from its Battery Materials Processing and Manufacturing Initiative.

Currently, EVBs employ lithium-ion batteries only, and this trend is believed to continue in the coming years. Moreover, when designing and operating Li-ion batteries and related systems for the market, producers make sure that environmental, sustainable development issues, such as appropriate life cycle management (repair and reuse, recycling, or disposal), are addressed.

Rising demand for batteries is also expected to fuel the EV battery separator industry's growth. In 2022, the demand for automotive Li-ion batteries increased by approximately 65%, reaching 550 GWh, compared to around 330 GWh in 2021. This growth was primarily driven by a 55% rise in new registrations of electric passenger vehicles during the same period.

Additionally, there was an increase of more than 70% in battery demand for cars in China, coupled with an 80% growth in sales of EVs in 2022 as compared to 2021. However, this rise in battery demand was further mitigated by a higher percentage of plug-in hybrid electric vehicles (PHEVs). The battery consumption for vehicles in the United States went up by close to 80% in 2022, while the sales of EVs went up by about 55%. The sales volume of BEV and PHEV worldwide has started surpassing that of HEV, and as the battery capacity of BEV and PHEV is on the rise, so is their battery demand.

EV Battery Separator Market Geographical Outlook:

Based on geography, the embedded finance market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. Asia Pacific is anticipated to hold a substantial market share. The separation of EV batteries is forecast to be one of the lucrative markets in the Asia Pacific region, owing to the growing usage of EVs within the region and the subsequent increase in the number of EV manufacturing companies.

In particular, China, Japan, and South Korea will lead the nations as they provide some government policy and funding for battery development while encouraging green energy techniques. Additionally, as this region leads in EV manufacturing, high-performance battery separators that are important for boosting battery performance and safety are in high demand.

According to statistics on EV sales published by the Japan Automobile Dealers Association (JADA) and the Japan Mini Vehicle Association (Zenkeijikyo), a total of 58,813 Battery Electric Vehicles (BEV) were sold in Japan as of the end of 2022, such a rise representing a 2.7 times growth from 2021. The ratio of BEVs to total passenger car sales, also termed the BEV ratio, grew to 1.7 in 2022, an increase from 0.6 percent in 2021 before crossing the 1 percent figure for the first time. Further, BEV Sales in Japan would also cause sales of BEV motor vehicles to increase due to the strict target of 100% clean vehicles in the country set for 2035, while also considering the benefits of EVs outdoors.

Further, as stated by the IEA, it is estimated that 95% of the electric LDV lithium-ion phosphate batteries used in the region were sourced from China, with BYD holding the largest market share at 50%. Tesla provided 15%, with its share of LFP batteries growing from 20% in 2021 to 30% in 2022. LFP batteries are used in around 85% of the cars manufactured by Tesla, most of which are produced in China.

Nonetheless, battery prices depend on the region, with the lowest being in China and the highest in the remainder of the Asia Pacific region. The differences in pricing are because approximately 65 percent of battery cells are manufactured in China, while more than 80 percent of cathodes come from there. This fast-changing scenario reinforces the importance of Asia Pacific in shaping the market for EV battery separators, which is aggressively competitive in establishing and enhancing technology to meet increasing demands.

EV Battery Separator Market Recent Developments:

- December 2025: Toray Industries completed the sale of its remaining 30% stake in the LG Toray Hungary Battery Separator JV to LG Chem for approximately ¥30 billion.

- December 2025: Asahi Kasei completed the divestiture of its lead battery separator business (Daramic), refocusing resources on expanding its Hipore™ lithium-ion battery separator business in key EV markets.

- November 2025: Sumitomo Chemical announced a restructuring of its PERVIO® separator business, halting production at its Ohe Works in Japan to consolidate manufacturing in Daegu, South Korea.

- September 2025: ENTEK secured a majority stake investment by I Squared Capital (~$800 M) to expand its U.S. wet-process lithium-ion battery separator production and strengthen the EV battery supply chain.

- February 2025: SK IE Technology (SKIET) signed a long-term agreement with Gotion to supply EV battery separators for planned manufacturing facilities in Illinois, USA, and Slovakia.

List of Top EV Battery Separator Companies:

- SK Innovation Co., Ltd.

- Celgard

- Evonik Industries AG

- Asahi Kasei Corporation

- Teijin Limited

EV Battery Separator Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Global EV Battery Separator Market Size in 2025 | US$2.869 billion |

| Global EV Battery Separator Market Size in 2030 | US$5.049 billion |

| Growth Rate | CAGR of 11.97% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Global EV Battery Separator Market |

|

| Customization Scope | Free report customization with purchase |

EV Battery Separator Market Segmentation:

- By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Ceramic-Coated Separator

- Composite Separator

- Others

- By End-Use Application

- Electric Vehicles (EVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Isreal

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America