Report Overview

Global Ethanol Market Size

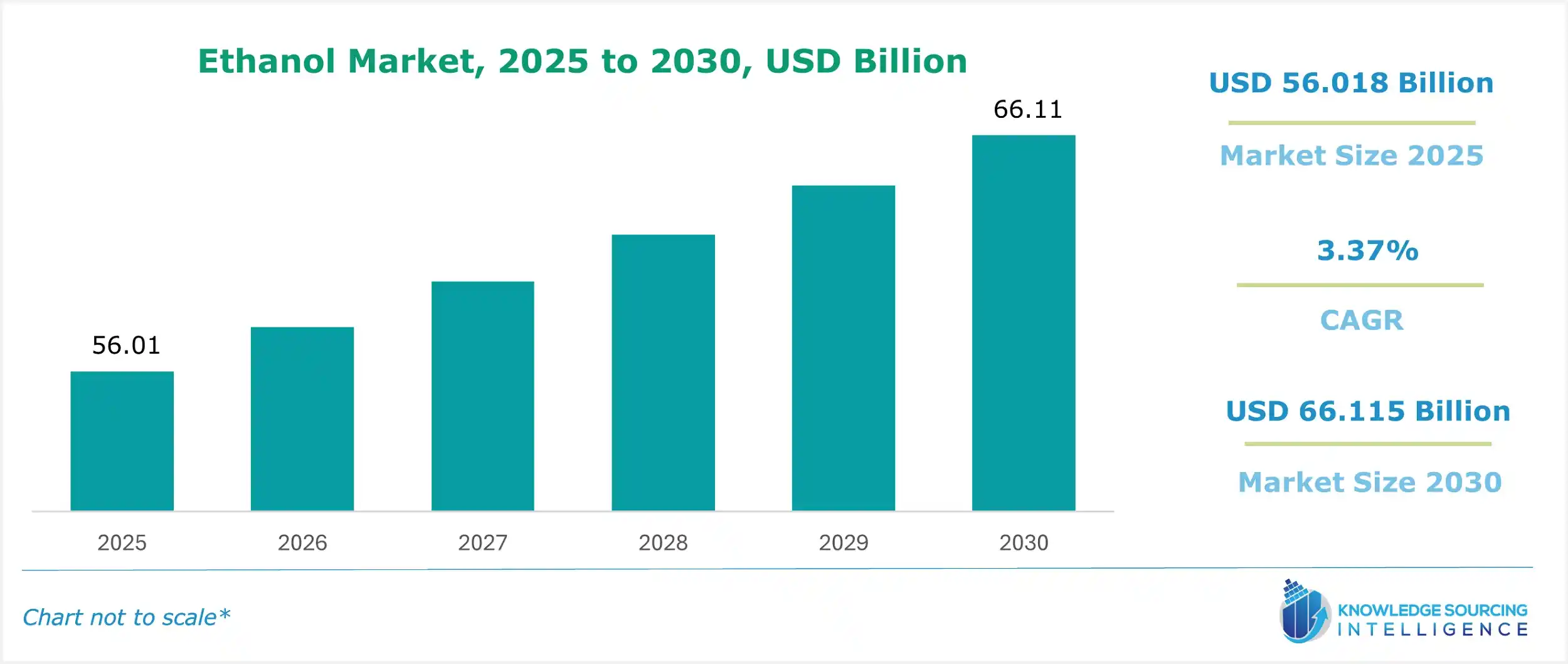

The global ethanol market is projected to grow at a CAGR of 3.37% over the forecast period, increasing from US$56.018 billion in 2025 to US$66.115 billion by 2030.

Global Ethanol Market Trends

The global ethanol market is growing because governments support renewable energy production while companies develop new ways to produce ethanol and find new product uses.

Ethanol Market Growth Drivers:

- Increasing demand for renewable energy: The global need for renewable energy pushes the demand for ethanol products. Society is setting goals to reduce fuel from non-renewable sources and start developing eco-friendly energy production methods.

In this regard, India’s installed non-fossil fuel capacity has increased 396% in the last 8.5 years and stands at more than 205.52 GW (including large hydro and nuclear), about 42% of the country’s total capacity (as of November 2024).

- Rising government policies: Ethanol market growth depends on government rules for renewable fuels. Governments worldwide have created specific strategies to encourage renewable fuel adoption. Through blending policies, the government requires producers to blend ethanol into gasoline at specified minimum percentages.

Ethanol Market Key Segments:

During the forecast period, plant-based ethanol production based on natural resources, including corn and sugarcane, will develop substantially. The rise in global renewable energy adoption and sustainability efforts matches well with governments that match incentives for biofuel use.

From the 1800s until the mid-1800s, biomass supplied more energy to US consumers than all other sources combined. In 2023, biomass accounted for about 5% of U.S. total primary energy consumption. Aligning with this, biomass is used for heating, electricity generation, and transportation fuel. It is an important fuel for cooking and heating in many countries, especially in developing countries.

- Based on the application, the pharmaceutical sector is anticipated to grow substantially during the projected period.

The pharmaceutical industry's expanding needs related to hygiene protection propel ethanol demand for medical use. According to the 2021 PMPRB Annual Report, between 2012 and 2021, the sales value of pharmaceuticals in general (non-patented and over-the-counter drugs) has risen by 56.4% in Canada to reach $34.1 billion.

Ethanol helps make different pharmaceutical building blocks and support materials, which boost the sector's growth. Rising demand in the pharmaceutical sector and increasing concern about hygiene and sanitation are surging the demand for pharmaceutical-grade ethanol. In addition, ethanol is used in the production of various pharmaceutical intermediates and excipients, further adding to this segment’s growth.

Global Ethanol Market Geographical Outlook:

- North America is forecasted to hold a major market share.

A confluence of factors drives the North American ethanol market. A cornerstone of this growth is the strong support from the U.S. government, exemplified by the Renewable Fuel Standard. This mandate necessitates blending ethanol into gasoline, significantly boosting ethanol demand. Furthermore, the abundant availability of corn, the primary feedstock for ethanol production within the region, provides a cost-effective and readily accessible resource base.

In 2022, annual U.S. renewable energy generation surpassed coal for the first time in history. Domestic solar energy generation is expected to increase by 75% and wind by 11% by 2025. The United States is a resource-rich country with enough renewable energy resources to generate more than 100 times the electricity Americans use yearly.

The increasing global focus on renewable energy sources and the need to reduce the environmental impact of fossil fuels further drive the North American ethanol market. Ethanol is an increasingly viable and domestic biofuel option as the world shifts towards cleaner energy alternatives. North America's strong infrastructure for producing and distributing ethanol facilitates efficient logistics for transporting this product from manufacturers to consumers, directly supporting the ethanol market’s growth.

Global Ethanol Market – Competitive Landscape

- ADM

- Alto Ingredients, Inc.

- POET, LLC.

- Gevo

- Valero

These companies are anticipated to dominate the market as they have strong research and development capabilities.

Global Ethanol Market's Latest Developments

- In December 2024, LanzaTech Global, Inc., the carbon recycling company transforming above-ground carbon into sustainable fuels, chemicals, materials, and protein, and ArcelorMittal S.A., the world’s leading integrated steel and mining company, announced that ethanol from ArcelorMittal's Steelanol facility in Ghent had achieved a production milestone whereby ethanol volumes reached a level which supports shipping by barge.

- In December 2024, Godavari Biorefineries Limited, a pioneer in renewable chemicals and biofuels, announced an investment in corn/grain-based ethanol to further strengthen its production capabilities.

Ethanol Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ethanol Market Size in 2025 | US$56.018 billion |

| Ethanol Market Size in 2030 | US$66.115 billion |

| Growth Rate | CAGR of 3.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Ethanol Market |

|

| Customization Scope | Free report customization with purchase |

Global Ethanol Market is analyzed into the following segments:

- By Grade

- 95% Ethanol

- Absolute (99-100%) Ethanol

- Denatured Ethanol

- By Source

- Natural

- Synthetic

- By Application

- Personal Care & Cosmetics

- Pharmaceutical

- Food and Beverage

- Transportation

- Energy

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America