Report Overview

Global Electric Heat Tracing Highlights

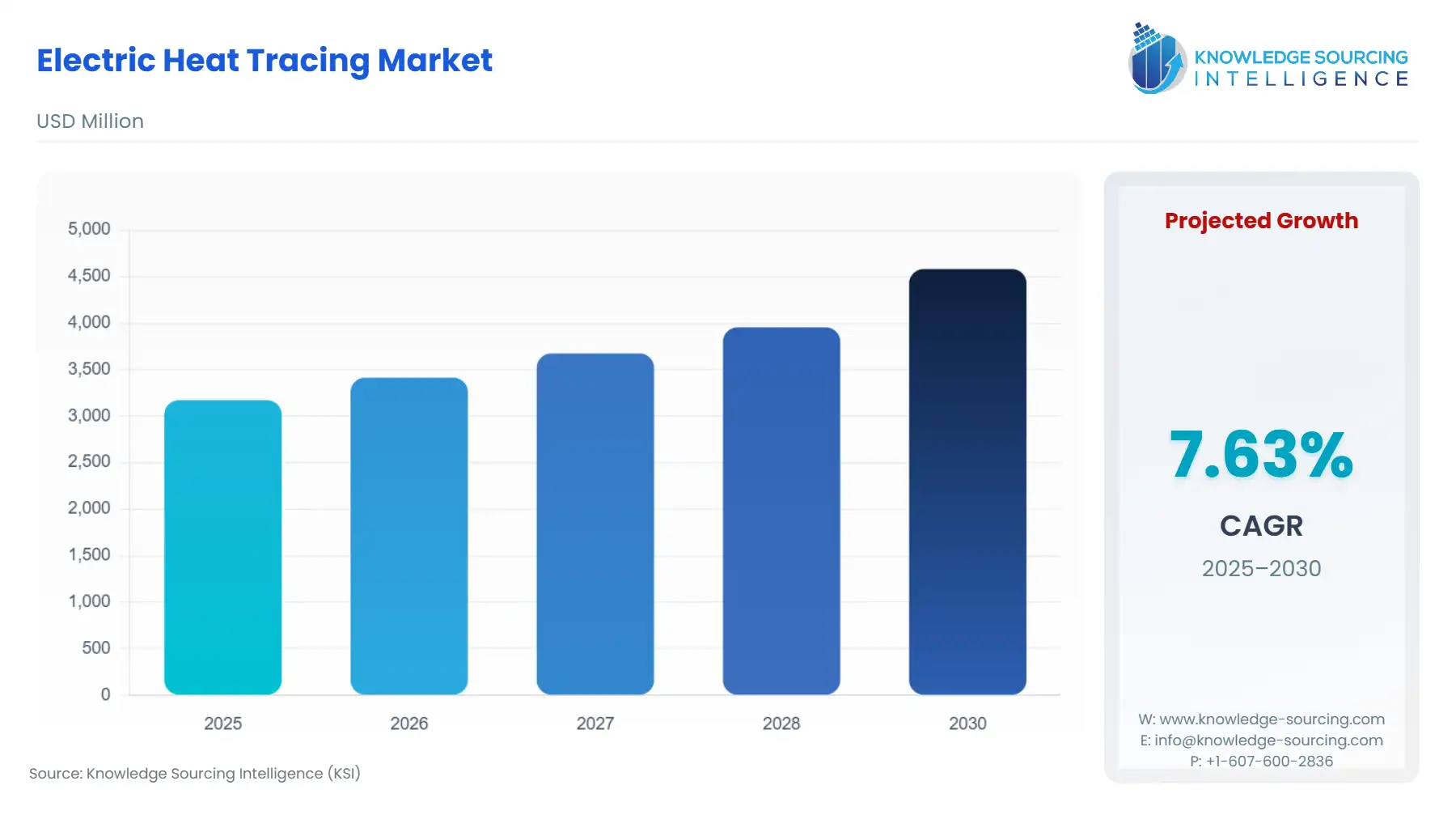

Electric Heat Tracing Market Size:

The Electric Heat Tracing Market is expected to grow from USD 3.172 billion in 2025 to USD 4.582 billion by 2030, fueled by a 7.63% CAGR.

The Global Electric Heat Tracing Market, integral to maintaining process temperatures, ensuring fluid flow assurance, and providing freeze protection across diverse industrial and commercial infrastructure, is undergoing a pivotal transformation. Historically dominated by conventional steam tracing, the sector has decisively transitioned toward electric solutions, which offer superior temperature control, enhanced safety compliance, and significantly lower lifecycle costs.

The market's growth trajectory is intrinsically tied to capital expenditure cycles within the Oil & Gas, Chemical, and Power Generation sectors, especially in cold-climate and hazardous environments where reliable temperature management is a non-negotiable operational necessity. This analysis details the market dynamics, technological drivers, and regulatory pressures shaping demand across the global landscape.

Global Electric Heat Tracing Market Analysis

- Growth Drivers

The increasing global focus on industrial safety and energy efficiency acts as a primary catalyst for EHT demand. Stricter global and regional regulations, such as those governing explosion safety in hazardous areas, compel industrial facilities to invest in certified EHT systems, directly creating demand for high-reliability components. Simultaneously, the persistent need to reduce operational costs drives a systematic shift from less efficient steam tracing to electric systems. The inherent energy efficiency of modern self-regulating cables, coupled with smart control and monitoring systems, directly lowers energy consumption for end-users, compelling them to adopt EHT solutions for both new infrastructure projects and aging facility retrofits.

- Challenges and Opportunities

A major market challenge is the high initial capital expenditure (CapEx) associated with implementing large-scale, complex EHT systems, including specialized cable installation, high-grade insulation, and sophisticated control panels, which can delay adoption in budget-constrained projects. Furthermore, a lack of standardized installation expertise across all geographies can lead to suboptimal system performance and safety risks. The key opportunity resides in leveraging the aging industrial infrastructure across North America and Europe. The imperative to upgrade and modernize these facilities, replacing outdated tracing systems, generates substantial retrofit demand. Additionally, the expansion into specialized industrial applications, such as large-scale battery manufacturing and cold chain logistics, creates entirely new demand streams for precision thermal management.

- Raw Material and Pricing Analysis

Electric heat tracing cables are physical products whose pricing dynamics are fundamentally tied to the costs of key raw materials, primarily copper for conductors and specialized polymers (like Polyolefin or PTFE) for insulation and jacketing. Copper pricing volatility, driven by global commodity market speculation and industrial demand, directly influences the final cost of the heating cable component, which represents the largest share of the system's component cost. Furthermore, U.S. trade policy imposing tariffs on steel and aluminum has indirectly led to higher costs for key metal alloys used in cable components and protective armoring. This cost pressure forces manufacturers to seek supply stability, leading to marginal price increases passed to end-users and a growing strategic focus on optimizing material efficiency in cable design.

- Supply Chain Analysis

The global EHT supply chain is concentrated yet complex, spanning raw material processing, component manufacturing, and final system integration. Key production hubs for heating cables, power connection kits, and controls are primarily situated in industrialized regions, including North America, Western Europe (e.g., Germany, UK), and increasingly, Asia-Pacific (China) for high-volume component manufacturing. Logistical complexity arises from the need to transport heavy cable reels and specialized control panels across continents to often remote industrial sites (e.g., oil rigs, Arctic pipelines). The chain is critically dependent on a stable supply of high-purity copper and specialized polymer compounds; any disruption in these streams, especially from major producers, directly impacts lead times for high-demand self-regulating cables.

Electric Heat Tracing Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

ATEX Directive (94/9/EC and 2014/34/EU) |

Mandates essential health and safety requirements for equipment and protective systems intended for use in potentially explosive atmospheres (Oil & Gas, Chemical). This creates non-negotiable demand for ATEX-certified EHT systems, elevating product quality and increasing the barrier to entry for non-compliant suppliers. |

|

International |

IECEx Scheme (International Electrotechnical Commission) |

Facilitates global trade of equipment for use in explosive atmospheres by providing a single set of internationally accepted standards. This reduces complexity for global EHT players like nVent and Thermon, enabling streamlined product design and increasing their competitive footprint in emerging markets. |

|

United States |

NEC (National Electrical Code) / NFPA 70 |

Establishes minimum requirements for safe electrical wiring and equipment installation, including specific sections (e.g., Article 427) for pipe heating assemblies. NEC compliance drives consistent demand for UL-listed or CSA-certified components and rigorous installation standards, ensuring safety and reliability in all US industrial projects. |

Electric Heat Tracing Market Segment Analysis

- By Cable Type: Self-Regulating Cables

Self-Regulating Cables (SRCs) constitute the largest component segment, a market leadership position driven by their inherent efficiency mechanism. The polymer core of an SRC exhibits a positive temperature coefficient, automatically decreasing power output as the ambient temperature rises and increasing it as the temperature falls. This technical feature fundamentally eliminates the risk of overheating and concurrent burnout, significantly lowering system maintenance costs and, more critically, reducing energy consumption by dynamically matching heat output to actual demand. For high-volume, continuous process applications, such as those prevalent in the Chemical and Oil & Gas sectors, this energy-saving capability acts as a powerful, verifiable driver for demand, making the long-term operational savings outweigh the higher initial CapEx compared to constant wattage alternatives.

- By End-User: Oil & Gas

The Oil & Gas end-user segment is the most significant consumer of Electric Heat Tracing systems, driven by the critical necessity of flow assurance and freeze protection across upstream, midstream, and downstream assets. Exploration and production activities often occur in remote, harsh cold-climate regions (e.g., Siberia, Canadian Arctic), where pipe freeze-up results in costly and dangerous operational shutdowns. EHT systems are indispensable for maintaining the viscosity of heavy crude oil and ensuring the flow of liquid natural gas (LNG) during transport and storage. The ongoing global build-out and modernization of midstream assets, including new pipelines and LNG liquefaction terminals, directly translate into large-scale, sustained demand for robust, high-reliability EHT solutions, particularly mineral-insulated cables capable of handling high-temperature process maintenance.

Electric Heat Tracing Market Geographical Analysis

- US Market Analysis (North America)

Demand in the US market is robust, largely fueled by the extensive existing infrastructure in the Gulf Coast's petrochemical industry and the cold-climate requirements of the Northeast and Midwest. A primary factor is the continued domestic energy production growth, requiring investment in new oil and gas pipeline infrastructure where freeze protection is essential. However, the market faces headwinds from U.S. trade policy; the imposition of tariffs on steel and aluminum has indirectly inflated the cost of metallic components within EHT systems, prompting procurement teams to seek non-U.S. cable and component sources to manage total installed cost, particularly for large, publicly bid projects.

- Brazil Market Analysis (South America)

The Brazilian market is primarily driven by the expansion of its domestic Oil & Gas sector, notably deep-water pre-salt exploration and production activities. This involves complex offshore infrastructure where EHT is essential for maintaining the temperature of subsea flowlines to prevent hydrate formation and waxing. Demand is highly localized and is catalyzed by major national oil company investment cycles in offshore projects. While not subject to extreme freeze protection, EHT demand focuses on high-reliability, corrosion-resistant systems for process temperature maintenance in a challenging marine environment, with purchasing decisions strongly favoring certified, high-performance technology.

- Germany Market Analysis (Europe)

German demand is characterized by a mature industrial base with a strong emphasis on industrial safety, quality, and energy efficiency, heavily influenced by the EU's environmental and safety directives. The market prioritizes EHT systems for the nation's advanced Chemical and Pharmaceutical sectors, where precise, reliable temperature maintenance is mandatory for product quality and batch integrity. Demand is particularly strong for highly efficient, ATEX-certified components that integrate seamlessly with advanced process control systems, with purchasing decisions guided by lifecycle cost analysis and alignment with rigorous national and European technical standards.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market represents a significant demand center for EHT, driven almost exclusively by the massive scale of its national Oil & Gas and petrochemical industries. EHT systems are critical for process temperature maintenance in refineries and petrochemical complexes, where extremely high ambient temperatures necessitate robust, high-temperature mineral-insulated cables. Demand is concentrated in large-scale capital projects by national entities, with a strategic focus on EHT solutions that demonstrate superior reliability, fire resistance, and long-term durability in arid, corrosive environments, rather than freeze protection.

- China Market Analysis (Asia-Pacific)

China's EHT market is experiencing rapid expansion, a growth trajectory fueled by massive infrastructure development across its domestic chemical manufacturing, Power & Energy, and Food & Beverage sectors. The primary demand factor is the sheer scale of new industrial facility construction, particularly in the northern and western provinces requiring freeze protection. Furthermore, China acts as a substantial global production hub for base EHT components, including self-regulating heating cables and power connection kits, feeding both domestic consumption and acting as a key sourcing point for international OEMs seeking lower-cost manufacturing capacity.

Electric Heat Tracing Market Competitive Environment and Analysis

The Global Electric Heat Tracing Market exhibits a competitive structure dominated by a few multinational Tier 1 specialists who possess extensive product portfolios, significant global reach, and robust regulatory compliance expertise. Competition centers on technological differentiation, particularly in smart control systems and high-performance cable materials.

- nVent Electric PLC: nVent operates through its Thermal Management segment, featuring brands like nVent RAYCHEM and TRACER. Its strategic positioning is rooted in technological leadership, specifically in self-regulating and mineral-insulated heating cables for both industrial and commercial applications, including freeze protection and process temperature maintenance. The company emphasizes smart technology integration, leveraging wireless monitoring systems to offer end-users real-time data and remote control, a key value proposition for reducing maintenance costs and improving overall efficiency.

- Thermon Group Holdings, Inc.: Thermon's strategic focus is squarely on the industrial heat tracing sector, with core expertise in high-performance heating cables and related systems for mission-critical applications in the Oil & Gas and Chemical industries. Key product lines include VSX (self-regulating cables) and MIQ (mineral-insulated cables). Thermon differentiates itself by offering comprehensive engineering design services and proprietary software tools for system sizing and heat loss calculations, positioning the company as a full-system solutions provider rather than just a component supplier.

- Spirax-Sarco Engineering plc (Chromalox): Spirax-Sarco's presence in the EHT market is channeled through its Electric Thermal Solutions division, notably its acquisition of Chromalox. Chromalox offers an extensive portfolio covering industrial heating equipment, including specialized constant wattage and mineral-insulated cables, heating elements, and sophisticated control systems. This positioning allows the company to integrate electric and steam tracing solutions, offering a unique, holistic approach to thermal management across diverse industry segments, including Power Generation and Food & Beverage.

Electric Heat Tracing Market Segmentation:

- By Cable Type

- Self-Regulating Cables

- Constant Power Cables

- Constant Wattage Cables

- By Method

- Skin Effect Tracing

- Impedance Heat Tracing

- Inductance Heat Tracing

- Others

- By End-User

- Chemical

- Food & Beverage

- Energy & Power

- Oil & Gas

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America