Report Overview

Global Drilling Machine Market Highlights

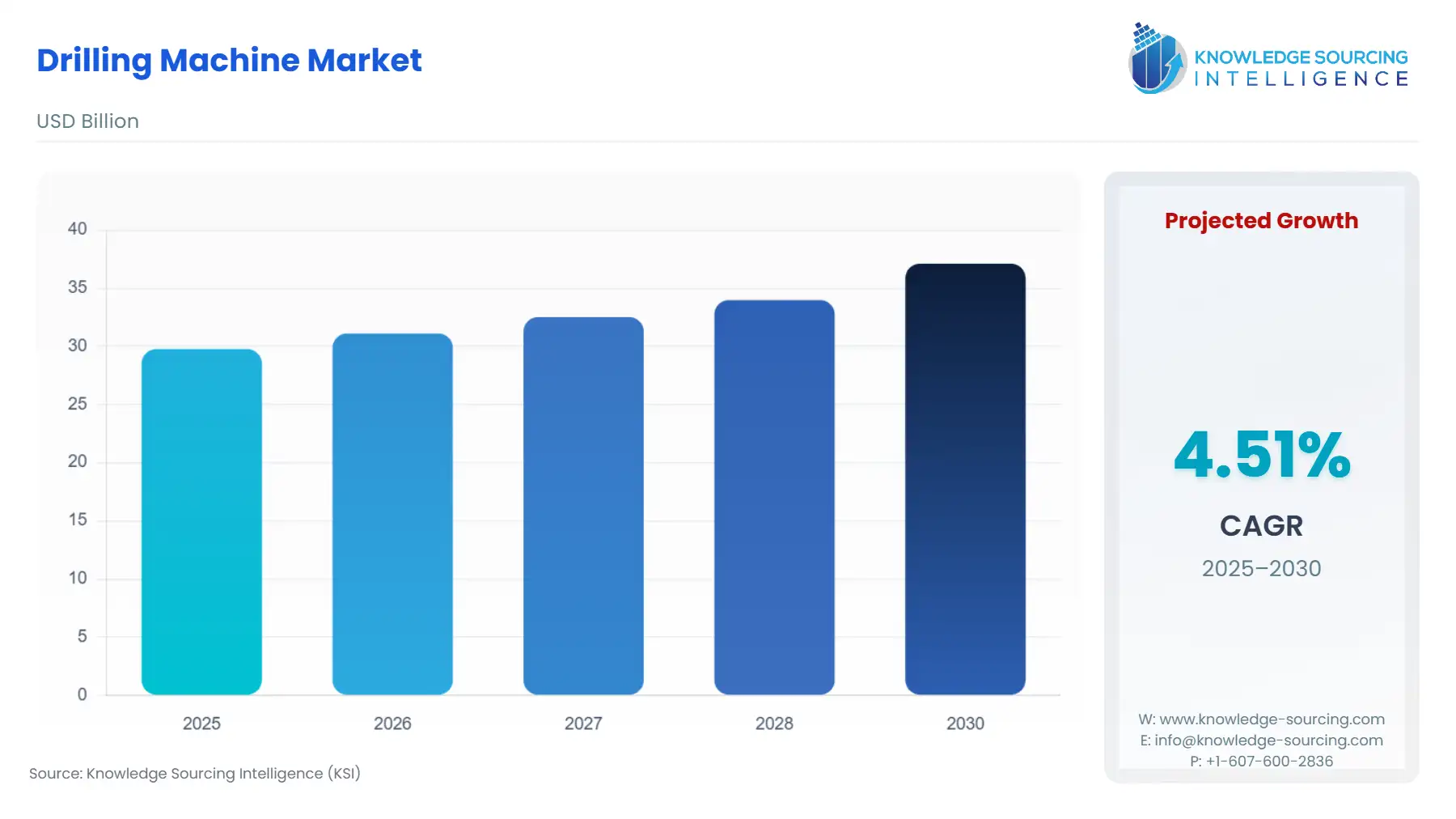

Drilling Machine Market Size:

The global drilling machine Market is expected to grow from USD 29.775 billion in 2025 to USD 37.121 billion in 2030, at a CAGR of 4.51%.

The Global Drilling Machine Market encompasses a highly diverse range of industrial equipment, from bench-mounted sensitive drilling units used for light manufacturing to massive, automated deep hole and surface drill rigs deployed in resource extraction. These machines, integral to operations such as drilling, reaming, boring, and tapping, serve as the indispensable backbone of precision manufacturing and infrastructure development worldwide. The market's evolution is not volumetric but qualitative, driven by the escalating demand for higher material hardness handling, superior hole geometry, reduced cycle times, and enhanced process automation. Investment decisions in this sector are directly correlated with industrial capital expenditure cycles, resource exploration trends, and government mandates promoting domestic manufacturing capabilities and energy efficiency.

Global Drilling Machine Market Analysis:

- Growth Drivers

The irrefutable global industrial expansion in sectors like Automotive and Construction is the foremost driver, which necessitates capital investment in reliable machinery for high-volume, precision metal fabrication, directly creating constant equipment replacement and expansion demand. Concurrently, the rapid adoption of automation and CNC technology in manufacturing settings structurally mandates the retirement of conventional drilling systems in favour of advanced, programmable machines. This technological shift increases demand for integrated drilling-milling centres, which offer superior efficiency and process integration. Furthermore, government-backed global investments in energy and infrastructure development, particularly in geothermal energy and resource exploration, propel demand for specialised, high-power Deep Hole Drilling Machines and automated surface rigs.

- Challenges and Opportunities

The primary challenge is the significant cyclical volatility in industrial capital expenditure and the fluctuation in raw material prices (e.g., steel, specialised alloys for high-strength drilling bits), which introduces pricing instability and constrains procurement budgets for new machinery. This directly dampens demand during economic downturns. However, a key opportunity resides in the accelerated technological shift toward robotic and laser-drilling solutions, particularly in high-precision Aerospace & Defence and high-volume Electronics manufacturing. This creates an opportunity for high-margin product differentiation beyond traditional mechanical drilling. Another opportunity lies in providing cost-effective retrofit and automation packages for existing machinery, addressing the demand for increased efficiency without requiring full capital replacement.

- Raw Material and Pricing Analysis

Drilling machines are complex, heavy-duty capital goods, primarily composed of High-Strength Steel and Cast Iron for their main frame and beds, ensuring rigidity and vibration dampening. The pricing structure is highly sensitive to the global commodity prices of these ferrous metals, with fluctuation in steel markets directly impacting the manufacturing cost and, consequently, the final selling price of the entire machine. Furthermore, critical components like precision linear guides, ball screws, and specialised drill bits require high-performance tool steel and tungsten carbide, whose supply and cost volatility introduces a secondary pricing pressure. The high cost and complexity of sourcing these specialised components necessitate robust supply chain risk mitigation by major machine tool builders to stabilise the final prices offered to Automotive and Aerospace & Defence end-users.

- Supply Chain Analysis

The supply chain for drilling machines is characterised by a globalised assembly model, with core manufacturing hubs located in Germany (for high-precision, high-end CNC machines), Japan, and China (for high-volume, cost-competitive machines). The logistical complexities stem from the sheer size and weight of the capital equipment, requiring specialised transportation and installation. Key dependencies exist for high-precision components like Computer Numerical Control (CNC) systems (often sourced from Europe and Japan) and high-tolerance bearings. Geopolitical constraints, including potential US tariffs on finished machine tools, force a regionalisation of assembly for US-bound products to mitigate cost increases. This trade pressure drives investment into smaller, regional assembly facilities, shifting the supply chain imperative from global efficiency toward regional resilience and tariff avoidance.

Government Regulations

Government regulations primarily impact the market by setting safety and energy efficiency standards for the operation of the machines, as well as influencing demand through industry-specific mandates.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Occupational Safety and Health Administration (OSHA) Regulations |

OSHA standards governing machine guarding and lockout/tagout procedures for safety drive demand for drilling machines equipped with integrated safety features, such as interlocked guards and emergency stops. This regulation pushes manufacturers toward modern, enclosed, and certified machinery, accelerating the replacement of older, non-compliant equipment. |

|

European Union |

Machinery Directive 2006/42/EC & Energy Efficiency Directives |

The Machinery Directive mandates strict health and safety requirements for machine tools, forcing all new drilling machines sold in the EU to meet high safety standards, increasing demand for advanced, compliant designs. Energy efficiency directives also stimulate demand for high-efficiency motors and variable speed drives in drilling machines, reducing operational costs for the Industrial & Manufacturing sector. |

|

China (Mainland) |

Made in China 2025 (Strategic Manufacturing Initiative) |

This national plan strategically increases domestic demand for high-end, domestically produced CNC machine tools, including drilling machines, for advanced manufacturing sectors like Aerospace & Defense and Automotive. The policy constrains market share growth for foreign-sourced equipment in state-backed projects while propelling R&D investment by local companies like Shenyang Machine Tool Corp. ltd. |

|

Germany |

Industry 4.0 Initiatives |

Government-backed support for digital transformation in manufacturing creates intense, specific demand for drilling machines with advanced connectivity, real-time data acquisition, and automated integration features. This regulatory push makes digital readiness a non-negotiable requirement, fueling sales of premium, networked CNC drilling centers for the local Automotive and Electronics end-users. |

|

India |

"Make in India" Campaign and Defense Procurement Policies |

The "Make in India" initiative and corresponding defense policies directly incentivize and create demand for localized production and assembly of drilling machines. This regulation requires global firms to establish a local manufacturing footprint or enter into joint ventures to tap into the large local Construction and defense-related manufacturing demand. |

Drilling Machine Market Segment Analysis:

- By Type: Deep Hole Drilling Machine

The Deep Hole Drilling Machine segment experiences critical demand driven by the stringent technical requirements of high-value components where the depth of the hole must be significantly greater than its diameter (often D:d ratios greater than 10:1). This specialised capability is indispensable across multiple high-precision end-use sectors. The Automotive industry relies on them for the precise drilling of engine blocks, camshafts, and fuel injectors to create accurate coolant passages and lubrication channels, with the continuous evolution of engine technology directly sustaining and increasing demand. Similarly, the Aerospace & Defence sector requires these machines for manufacturing landing gear components and military ordnance, where the high-strength materials and tight concentricity tolerances mandate the use of gun drilling or BTA techniques, cementing this segment's robust, high-margin demand profile.

- By End-User: Automotive

The Automotive industry is a primary and highly demanding end-user for drilling machines, with its requirements spanning the entire product range from high-volume, automated drilling centres to specialised deep hole machines. The core driver is the non-negotiable demand for dimensional accuracy and repeatability in the mass production of critical powertrain and chassis components. Precision drilling and reaming are essential for engine blocks, cylinder heads, transmission casings, and brake components, where hole quality directly impacts performance and safety. The verifiable global trend toward lightweighting vehicles intensifies demand for machines capable of working with new, harder materials like advanced high-strength steels and aluminium alloys, forcing manufacturers to invest in newer, more rigid CNC models with superior spindle power and thermal stability to handle the increased operational stress.

Drilling Machine Market Geographical Analysis:

- US Market Analysis (North America)

The US market for drilling machines is characterised by high demand for high-efficiency, automated CNC systems driven by the imperative to reduce labour costs and increase productivity, particularly in the resurgent Aerospace & Defence and Automotive manufacturing sectors. The chief local factor is the significant capital expenditure driven by "near-shoring" initiatives, which requires the installation of new, advanced machine tools to establish domestic production lines. The availability of government contracts and the strict requirement for domestic content in defence projects directly stimulates demand for locally manufactured or assembled high-precision equipment. Furthermore, the US oil and gas sector drives demand for specialised, heavy-duty mobile drill rigs, where efficiency and regulatory compliance are paramount.

- Brazil Market Analysis (South America)

The Brazilian market is a significant consumer of drilling machines, with demand primarily fueled by the strong Construction and resource exploration (mining, oil, and gas) sectors. The local factor impacting demand is the ongoing need for infrastructure modernisation and the high-volume production requirements of the domestic Automotive assembly plants. This environment creates substantial, price-sensitive demand for robust, standard-duty Radial Drilling and Sensitive/Bench Drilling Machines for general manufacturing and fabrication. Imports face structural hurdles due to local taxes and complex customs procedures, thereby favouring suppliers who establish local sales, service, and spare parts networks to ensure low operational downtime.

- Germany Market Analysis (Europe)

The German market represents the high-end benchmark for drilling machine technology. Demand is fundamentally driven by the rigorous technical standards and innovation focus of the local Automotive and precision engineering industries. Local factors include the powerful Industry 4.0 movement, which mandates demand for drilling machines with full integration into digital factory ecosystems, including real-time monitoring and advanced process control via sophisticated CNC interfaces. This focus on operational data and high-mix, low-volume production drives sales of flexible, multi-axis machining centres (like those produced by DMG Mori) over single-purpose drilling machines, prioritising technical superiority and energy efficiency.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian drilling machine market is heavily influenced by massive government-led investment in Oil & Gas extraction and diversification projects, particularly in large-scale Construction and infrastructure. The critical local demand driver is the continuous, high-intensity requirement for specialised drilling equipment in hydrocarbon exploration and extraction, demanding robust, mobile, and deep-hole drilling rigs. Additionally, the investment in new domestic manufacturing zones (as part of Vision 2030) drives initial demand for general-purpose Sensitive and Radial Drilling Machines to establish localised fabrication and repair capabilities, with Extreme operating environment durability being a non-negotiable purchasing criterion.

- China Market Analysis (Asia-Pacific)

The Chinese market is characterised by enormous scale and rapid technological transformation. The key local factor is the government's strategic imperative, embodied in the "Made in China 2025" policy, which drives demand for the wholesale upgrade of manufacturing infrastructure. This policy creates massive domestic demand for both high-volume, cost-effective standard drilling machines and, increasingly, high-precision CNC equipment to compete with Western and Japanese counterparts in sectors like Electronics and domestic Automotive. Local producers benefit significantly from state support and dominate the price-sensitive segments, while international players compete fiercely in the high-end CNC and Deep Hole Drilling segments based on performance and service reliability.

Drilling Machine Market Competitive Environment and Analysis:

The Global Drilling Machine Market features a dual competitive landscape: high-end, technologically sophisticated CNC and Deep Hole machine manufacturers (predominantly European and Japanese) compete on precision and automation, while high-volume manufacturers (largely Chinese and Taiwanese) compete on price and scale.

- DMG Mori

DMG Mori is positioned as a global technology leader in machine tools, commanding the premium segment of the market by offering integrated, highly automated, 5-axis, and multi-functional machining centres that incorporate drilling capabilities. The company's strategy, termed Machining Transformation (MX), emphasises digital integration and turnkey solutions for high-mix, high-precision sectors like Aerospace & Defence and Automotive. A key verifiable product strategy is the continuous introduction of updated universal machining centres like the DMU 60 eVo 2. Generation (launched February 2025), which offers enhanced 5-axis capabilities essential for complex drilling and milling operations. This continuous innovation drives sustained demand from customers who require maximum process reliability and future-proof digital connectivity.

- Entrust Manufacturing Technologies Inc. (UNISIG)

Entrust, through its UNISIG division, is a specialist firm that dominates the high-precision Deep Hole Drilling Machine segment. Their strategic focus is purely on complex applications requiring high depth-to-diameter ratios, primarily serving the Automotive, Medical Devices, and Aerospace & Defence sectors. The verifiable core of their offering is the integration of milling capabilities into their dedicated drilling platforms, which directly enhances the functional versatility required by customers. A notable verifiable development is the launch of new models in the USC-M series (e.g., USC-2M and USC-3M) (announced May 2020), which can perform both milling and gun drilling functions. This dual-capability design creates direct, inelastic demand by offering a consolidated solution for manufacturers of complex engine components and surgical tooling.

- Fehlmann AG

Fehlmann AG is a Swiss-based manufacturer known for high-precision drilling and milling machines, occupying a niche in the high-quality and mid-to-high volume segments. The company's strategy is centred on engineering excellence, robust machine design, and high user-friendliness, targeting toolmaking, mould making, and high-precision Electronics components. Their verifiable focus includes continuously upgrading their established product lines, such as the VERSA and PICOMAX series, which are optimised for ultra-precise drilling, milling, and grinding. The emphasis on high-performance machining centres like the VERSA 645 linear (featured in their 2023 Report) directly addresses the demand for rapid, precise hole creation in critical, expensive workpieces where machine stability and accuracy are prioritised over initial cost.

Drilling Machine Market Developments:

- December 2025: Epiroc launched the next-generation PowerROC T45 MKII, a surface drill rig featuring a 40% reduction in fuel consumption via automated engine optimization.

- November 2025: Epiroc launched the Smart DM Series, including the Smart DM45 and Smart DML blasthole drills with Rig Control System (RCS 5) for smarter, safer surface drilling.

- September 2025: Epiroc and Luck Stone deployed the first fully autonomous SmartROC D65 surface drill rig in the U.S. aggregate market with advanced automation.

- April 2025: Sandvik launched a comprehensive upgrade to its Pantera™ DPi series drill rigs at bauma 2025, enhancing uptime, efficiency, fuel economy, and digital functionality.

- February 2025: DMG Mori officially launched the DMU 60 eVo 2. Generation universal machining centre at its Pfronten Open House. This launch features enhanced 5-axis simultaneous machining capabilities and sets new standards in its class for precision.

Drilling Machine Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 29.775 billion |

| Total Market Size in 2031 | USD 37.121 billion |

| Growth Rate | 4.51% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Operation, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Drilling Machine Market Segmentation

- By Type

- Portable Drilling

- Radial Drilling

- Sensitive/ Bench Drilling Machine

- Deep Hole Drilling Machine

- Others

- By Operation

- Drilling

- Reaming

- Boring

- Tapping

- Others

- By End-User

- Construction

- Automotive

- Aerospace & Defense

- Electronics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Others

- North America