Report Overview

Global Digital Wallet Market Highlights

Digital Wallet Market Size:

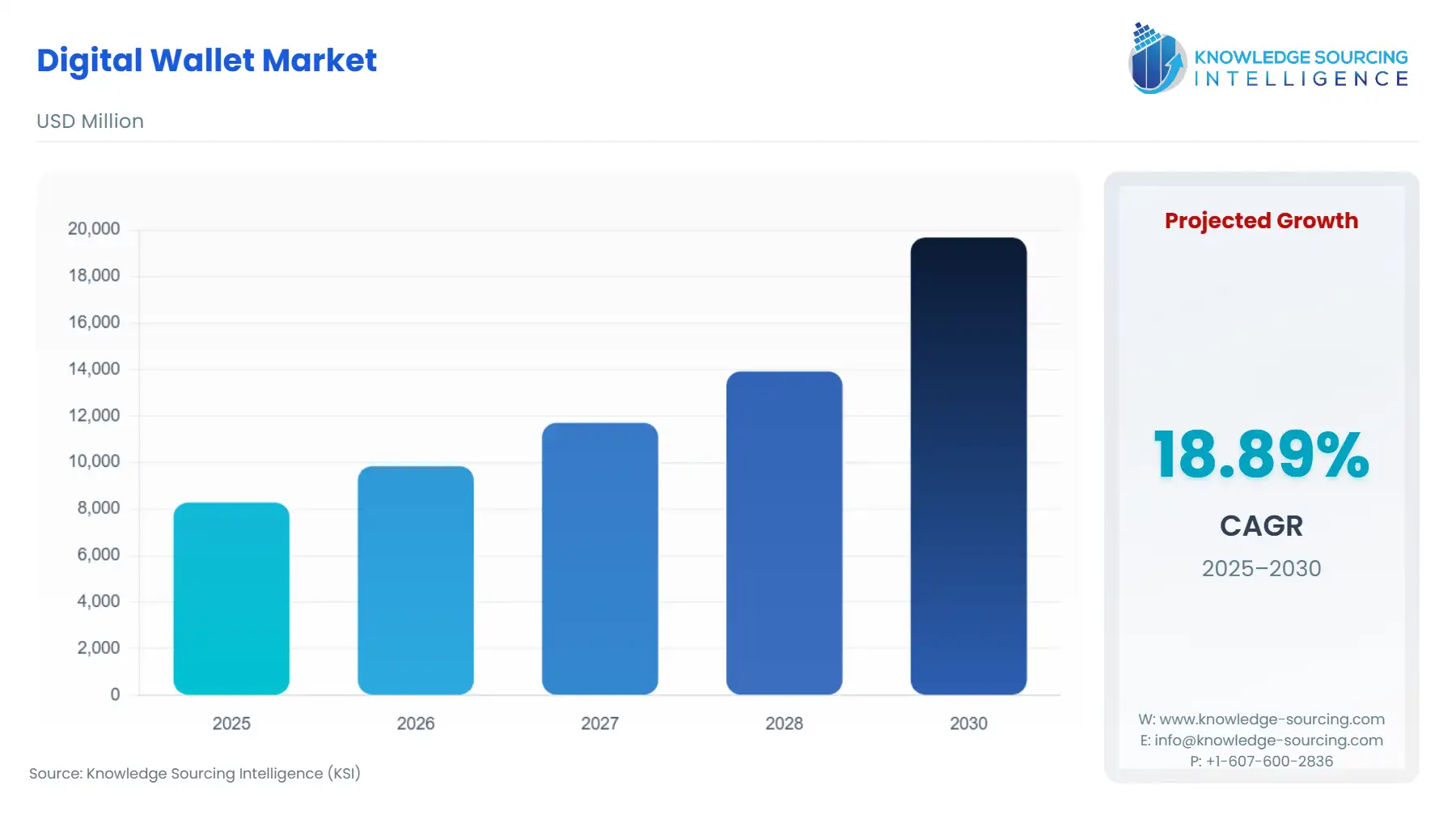

The global digital wallet transaction value is projected to grow at a CAGR of 18.88% over the forecast period, reaching USD 19,682.209 billion by 2030, up from an estimated USD 8,286.388 billion in 2025.

The digital wallet industry’s expansion is driven by users' increasing interest in using electronic wallets rather than cash, as well as the rising number of merchants/shops that accept digital wallets. Digital wallets store a user's credit card and debit card information digitally and allow the user to make payments on multiple platforms, including in-store and online purchases. In addition, technological advances, such as near field communication (NFC), QR codes (quick response codes), biometric authentication, and tokenization, have improved the security and usability of digital wallets.

Digital Wallet Market Trends:

Digital wallets, storing credit card details and bank account information on mobile devices, offer seamless mobile payments for in-store purchases, bill payments, mobile recharges, movie tickets, and travel reservations. The digital wallet market is surging due to demand for convenient payment systems and technological innovations like virtual currency and contactless payments. In developing countries, mobile payment systems drive a consumer revolution, enhancing financial inclusion.

Real-time customer data analytics boosts digital wallet adoption, enabling retailers to access user information instantly, streamlining transactions, and improving customer experience. This fosters retailer adoption, driving market growth. North America and Europe lead due to advanced fintech infrastructure, while Asia-Pacific, particularly India and China, grows rapidly. Security features like biometric authentication and encryption enhance trust, though cybersecurity risks remain a challenge. Blockchain and AI-driven fraud detection further strengthen secure transactions. The digital wallet market thrives on convenience, innovation, and digital transformation, reshaping global payment ecosystems.

Digital Wallet Market Overview:

The global digital wallet industry has become an integral part of the modern payment system, driven by the rapid transition from cash-based transactions to electronic-based transactions and the government's support of Digital Payment Systems (DPS) worldwide.

Digital wallets allow users to manage their payment methods electronically, carry out payment transactions through retail, person-to-person (P2P), and bill payment methods, by utilising mobile devices or web browsers. Digital wallets are now recognized by governments and central banks as an integral part of the nation's overall financial services infrastructure. As a result, they are subject to regulation aimed at promoting consumer protection, ensuring data security, and establishing oversight of providers' operations.

Various public agencies have reported sustained growth in the number of individuals using digital payment systems in both developed and developing markets. In India, the government has established an infrastructure for digital payments, including the UPI, which enables consumers to make digital payments, thereby reducing cash usage and increasing access to formal financial services. Central bank data confirms that UPI has accounted for a large proportion of the retail digital payment volume, thus exemplifying how public entities encourage the adoption of digital wallets through the acceptance of digital payment systems.

In the U.S. and EU, regulators are expanding their supervisory reach to cover many of the larger, non-bank providers of payment services and digital wallets. These providers will now be held to the same compliance standards as traditional financial institutions for consumer data protection and fraud prevention. With these recent developments, governments are creating regulations for these services and considering digital wallets to be regulated financial products, rather than optional forms of payment. The government is also creating a framework for digital wallets to integrate into the nation's broader payment ecosystem and facilitate cross-border digital payments globally.

The sharp rise in UPI transaction volumes reflects how public digital payment infrastructure can scale rapidly when supported by government policy, regulatory clarity, and interoperability standards. The expansion from 92 crore transactions in FY 2017–18 to over 13,000 crore by FY 2023–24 demonstrates widespread adoption of wallet-based and account-to-account digital payments. This growth strengthens the global digital wallet market by setting a replicable model for real-time payments, cross-platform compatibility, and low-cost transactions. As UPI expands internationally through bilateral linkages, it supports global digital payment integration, accelerates cashless adoption, and influences how other countries design and regulate their own digital wallet ecosystems.

Consequently, customers are increasingly demanding the best from both worlds, and internet shopping is merging into conventional store-based business. More individuals are embracing digital wallets to complete purchases owing to rising internet penetration and expanding smartphone usage. Presently, there is a wide range of e-wallet services, including GPay, PayPal, and Apple Pay, among several others. The e-wallet payment system has been modified to make transactions more convenient for consumers. An e-wallet payment system offers other services outside of processing payments to businesses, like integrating loyalty cards and serving marketing functions.

Speed - As per PayPal, cart abandonment is a major problem for retailers. 69.8% of carts are left before the checkout process is complete. This is generally when customers become irritated because there are many details to fill out.

Security - Digital wallets, according to the Identity Theft Resource Center, rely on time-tested security methods like two-factor verification and PINs that are limited to being utilized once. As a result, it is more challenging for cybercriminals to obtain this information when consumers utilize their digital wallets to purchase goods.

Convenience - According to Marqeta, 60% of consumers indicated that they will feel at ease going out with just their smartphone and not their wallet because of the high level of consumer trust in contactless banking and digital wallets. Furthermore, more than half (56%) of the consumers claimed to have become accustomed to contactless payments and find it inconvenient to enter a PIN.

Digital Wallet Market Growth Drivers:

Smartphone and internet penetration

Smartphones and internet access indicate the proportion of people who have access to a mobile device that can connect to the internet and the necessary underlying network for reliable connections. Governments and global organisations view this as one of the pillars of a modern digital infrastructure. As people gain more access to these devices, they will be able to use digital services for education, healthcare, government, and commerce. The number of people connected to the internet continues to increase.

Policies are now being implemented to create provisions for expanding mobile broadband networks, and making broadband data affordable will be an important part of achieving digital inclusion. As one solution, the Government of India has initiated the BharatNet program, which has built extensive networks of optical fibre in rural areas, helping to bridge the digital divide between urban and rural regions.

Two additional areas of focus within these initiatives are digital literacy and the availability of devices. Regulatory agencies have determined that merely providing access to a connection is inadequate for people to enjoy the benefits of using a digital device; individuals must also be capable of using a digital device safely and effectively. Digital affordability, digital infrastructure, and digital literacy are the three core areas of focus, and together these three areas will help to expand access to the digital economy for many people.

Increased smartphone and internet penetration will help bring greater economic inclusion and participation of a larger number of people into digital services and digital markets. The economic foundation that increased smartphone and internet penetration provides will assist all industries to innovate and adopt new technologies, ultimately becoming stronger and more accessible within the global economy.

High smartphone ownership among young adults, with 95.5% in rural areas and 97.6% in urban areas, is a strong indicator of digital readiness. Widespread access to smartphones expands the potential user base for digital services, enabling faster adoption of mobile-based solutions across sectors. This accessibility supports continuous connectivity, allowing individuals to engage with online platforms, apps, and services efficiently. For the digital wallet market, such penetration lays the foundation for increased transactions, seamless money transfers, and broader financial inclusion. It also encourages innovation in app features and payment infrastructure to cater to a digitally connected population.

Increasing focus on contactless payment

The higher emphasis on using digital wallets has resulted in increased demand, implying that the market will be favorable henceforth. There also continues to be a growth in the popularity of touchless payment systems because individuals need a safer mode since they deviate from the use of paper money or cards. Moreover, digital wallets are provided with almost proximity interaction (NFC) technology, enabling quick and secure contactless transactions by customers using their smartphones on POS machines. It means that prompt payment is more convenient for those who are busy. Paying for goods or services using contactless cards has seen an increased use among people in a bid to maintain cleanliness against spreading diseases like coronavirus. Businesses are spending money on NFC-capable terminals in an attempt to meet customer preferences, which has resulted in the expansion of the market.

Rising security concerns

Digital wallet providers understand that their products need to be more secure than before. Hence, they are rolling out advanced security features such as biometric authentication and tokenization to boost public trust. Moreover, authentication techniques based on biometrics create a very secure layer, thereby ensuring that only legitimate users can access or use the phone wallets that they have created. Additionally, tokenization reduces the likelihood of a data breach by making it deeper.

Some of the best-known companies worldwide have set up cutting-edge security systems to increase their customers' confidence while making various types of payments. Companies like Google or Amazon could use cutting-edge security systems to enhance consumer confidence while making online payments.

Easy checkout process

Digital wallet apps make it possible for users to store different payment methods, like debit cards and credit cards, among other cards, in one place. Because of this, there is no need to carry plastic cards around anymore, because any transaction can be quickly made. Furthermore, digital wallets simplify both online and offline payments, thus easing checkouts. Digital wallets also make it easier to check out for both in-person and online purchases. In keeping with this, consumers can finish transactions on their smartphones with a few taps, reducing time spent in line or entering payment information. Additionally, digital wallets provide tools for budgeting and tracking transaction histories. The market is growing because consumers can easily observe their spending and get insightful information about their financial habits.

Favorable government initiatives and investments

The enhancement of internet infrastructure and technological upgradation, coupled with developments in digital payment platforms, has propelled the demand for digital wallets globally. Also, favorable government initiatives to bolster digitization are further expected to accelerate the digital wallet industry's growth. For instance, the “Digital India” initiative aims to make government services more accessible to all citizens of the nation electronically. Moreover, efforts to promote digital payment platforms in several Middle Eastern countries are also being witnessed.

Digital Wallet Market Restraint:

Increasing cases of cyber crimes

Digital wallets and mobile payment applications have become more popular, which is why they have attracted the attention of cyber-criminals. Due to mobile wallet attacks, many people have lost their sensitive information, and hundreds of millions of dollars have been lost in the process. NITI Aayog data shows that such attacks have affected more than half of the Indian enterprises; a few examples are ransomware, phishing scams, Trojans, and denial-of-service attacks; all these are cyber threats that could disrupt the steady growth of the company’s business. Providers of financial technology services are more susceptible to various types of cyberattacks owing to the constant addition of new features and technologies aimed at satisfying customer demands, which could, in turn, inhibit market development.

Digital Wallet Market Segment Analysis:

The PC/ Laptops segment is anticipated to grow substantially

The global digital wallet industry for devices is bifurcated into PCs/laptops and smartphones. Contrary to mobile phones, PC/laptops are considered a safer option for transferring money as these are less susceptible to certain types of malware and phishing attacks, which can help your digital wallet and financial information. Additionally, a PC/laptop can provide a larger screen and better user interface for checking and confirming transaction information, enhancing accuracy and security while completing transactions using digital wallets, especially for larger sums or more complex transactions. Moreover, for people who cannot keep their financial transactions properly, they can easily transfer their record data into a file for keeping track or for financial analysis.

Additionally, PCs give an easy way to access and manage digital wallet services. Through the web-based interfaces or dedicated desktop apps supplied by wallet service providers, users can log in to their digital wallet accounts, check balances, review transaction history, and undertake other financial operations. Secure operating systems and huge visibility, as compared to mobile, help pay larger amounts with more confidence. Hence, the use of non-cash transactions is increasing in the US, along with various other countries, which is providing an edge for industry growth as the use of PCs or laptops is anticipated to increase for larger amounts, providing an edge for industry growth in the coming years.

By Device: Smartphones

Smartphones offer an easy way to access and manage digital wallet services through the web-based interfaces or dedicated mobile apps supplied by wallet service providers. This functionality allows users to log in to their digital wallet accounts, check balances, review transaction history, and undertake other financial operations. It offers secure operating systems and greater visibility compared to mobile, allowing users to make larger payments with more confidence.

Rapid urbanization and improvement in living standards have provided a major boost to digitization, with consumers preferring digital platforms to process their transactions, thereby eliminating the need to carry physical cards or cash. Likewise, the high convenience offered by digital wallets is driving the habitual usage, with consumers receiving weekly account notifications and security alerts. Hence, smartphones align with the given usage criteria for digital wallets, with consumers conducting transactions anywhere.

With constant economic growth and an improved frequency of smartphone users, the prevalence of usage of digital wallets is projected to show considerable growth. According to Zimperium’s “Global Mobile Threat Report”, by the end of 2024, the global number of smartphone users reached 7.2 billion. Hence, major regional economies, namely the United States, China, India, and the European Union, are witnessing considerable growth in the digital economy signifies a constant increase in smartphone adoption in such nations.

According to the July 2025 PIB (Press Information Bureau) release, the total number of Digilocker users as of June 2025 reached 53.93 crores. Additionally, according to the National eGovernance Division, as of 23rd December 2025, the number of mobile verified sign-ups in Digilocker stood at 168.64 lakhs, representing a considerable growth of 20.59% over the total number of mobile verified sign-ups recorded in the preceding year. Booming digital economic growth has further propelled the use of mobiles & smartphones for conducting transactions and accessing essential documents via digital document wallets.

Furthermore, the e-commerce sector has taken a massive leap over the years, fuelled by the growing internet penetration, especially among the younger generation and millennials who prefer online shopping through smartphones. According to the “E-Commerce Trend Report 2025” issued by DHL, it was stated that nearly 83% of millennials prefer to shop through mobile apps.

Digital Wallet Market Geographical Outlook:

Asia Pacific is projected to grow at a high rate during the forecast period

Southeast Asia is rapidly emerging as a key player in the global digital wallet market, driven by robust economic growth and a sharp rise in smartphone penetration. Historically reliant on cash-based transactions, the region is now witnessing a significant shift toward cashless payments. This transformation is being powered by a diverse ecosystem of stakeholders, including banks, ride-hailing platforms, remittance services, and fintech startups, who are expanding access to digital financial tools. While China previously led the mobile payment revolution through its advanced fintech infrastructure, Southeast Asia is quickly closing the gap by embracing digital wallets at scale.

North America: the US

The booming technological innovations have transformed the digital landscape in the United States, thereby providing new growth prospects for digital wallets, which are forming to be an effective alternative for making payments and storing necessary financial information. The new approach aligns with the national objective of promoting contactless payment options among users, offering them higher convenience. Furthermore, the improved internet penetration has also played a major role in driving the adoption trend.

Similarly, the booming e-commerce activities fuelled by the improvement in urban population, youth and millennials’ strength have further escalated the prevalence of digital platforms usage for making transactions. According to data revealed by the Census Bureau of the Department of Commerce, in Q3 2025, the total US retail e-commerce sales seasonally adjusted reached USD 310.27 billion, marking a considerable growth of 5.1% over Q3 2024. The same source also specified that e-commerce sales accounted for 16.4% of total retail sales.

Additionally, the financial institutions, realizing the growing essence of digital wallets, are investing in strategic collaborations with market players. For instance, in November 2025, Citi Bank announced its collaboration with Coinbase to bolster former’s digital asset payment, thereby enabling it to build digital infrastructure that will offer next-generation financial services for its global network of clients.

Furthermore, digital wallets are rapidly expanding their reach into various applications beyond traditional payment scenarios. For U.S. internet gaming companies, payments are a key driver of client retention. Digital wallets attempt to give operators a competitive advantage in terms of client acquisition and retention by offering an unmatched payment experience.

The huge customer base and high transactional volume, coupled with the implementation of incentives and programs to bolster the digital economy, haves made the United States a major market for online financial services. Hence, various market players, namely PayPal, Google LLC, Apple Inc., and Mastercard, among others, have a well-established presence in the US. According to the quarterly report from PayPal, in Q3 2025, the company’s total payment volume (TPV) reached USD 458,088 million, of which the United States alone accounted for USD 285,966, representing a 7.6% year-on-year growth. Such improved revenue growth showcases the growing market potential for digital wallets in the United States.

Digital Wallet Market Key Developments:

In 2026, Samsung Wallet added support for digital car keys on additional vehicle brands, including Mahindra electric SUVs (XEV 9e and BE 6), Volvo, Polestar, and Porsche models. This allows users to lock, unlock, and start compatible cars directly from their Galaxy smartphones using UWB, NFC, or Bluetooth.

In September 2025, Citi and Dandelion, a Euronet Worldwide, Inc. firm, announced a cooperation to improve cross-border payments. The collaboration is enabled by the integration of Citi's cross-border payments solution WorldLink® Payment Services with Dandelion's extensive digital wallet network.

In July 2025, PayPal announced a series of worldwide agreements that would bring together many of the world's top payment systems and digital wallets on a single platform, beginning with interoperability with PayPal and Venmo.

In January 2025, MobiKwik, India’s largest digital wallet, announced that it has launched a full version of India’s Central Bank Digital Currency (CBDC), e-rupee (e?), in partnership with Reserve Bank of India (RBI) and Yes Bank.

In 2025, Samsung rolled out a new feature allowing users to split in-store purchases into flexible instalments using existing credit cards. This card-linked option, in partnership with providers like Splitit, launched in select U.S. states in July 2025 and expanded nationwide by year-end, offering a convenient alternative to traditional financing.

In June 2023, Google revealed plans to expand Google Wallet into five additional nations. Montenegro, North Macedonia, Argentina, Albania, and Bosnia and Herzegovina. In a forum post, a company representative announced the launch and mentioned that the app was made available in 12 countries across Asia, Europe, and North America.

In June 2023, Mastercard, a payments network, and Alipay, a Chinese mobile payment platform, partnered to give foreign visitors another simple way to make cashless payments in China. Through cooperation, foreign visitors can link any Mastercard card to their Alipay digital wallet, simplifying e-payments in China.

Digital Wallet Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 8,286.388 billion |

| Total Market Size in 2030 | USD 19,682.209 billion |

| Forecast Unit | Billion |

| Growth Rate | 18.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Device, Type, Technology, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Digital Wallet Market Segmentation:

BY DEVICE

PC/ Laptops

Smartphones

BY TYPE

Open Wallet

Closed Wallet

Semi-Closed Wallet

Others

BY TECHNOLOGY

Near-Field Communication (NFC)

Biometric Authentication

QR Codes

Tokenization

Others

BY APPLICATION

Money Transfer

Recharge

Movie Booking

Food Ordering

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

France

Germany

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others