Report Overview

Global Coupled Inductor Market Highlights

Coupled Inductor Market Size:

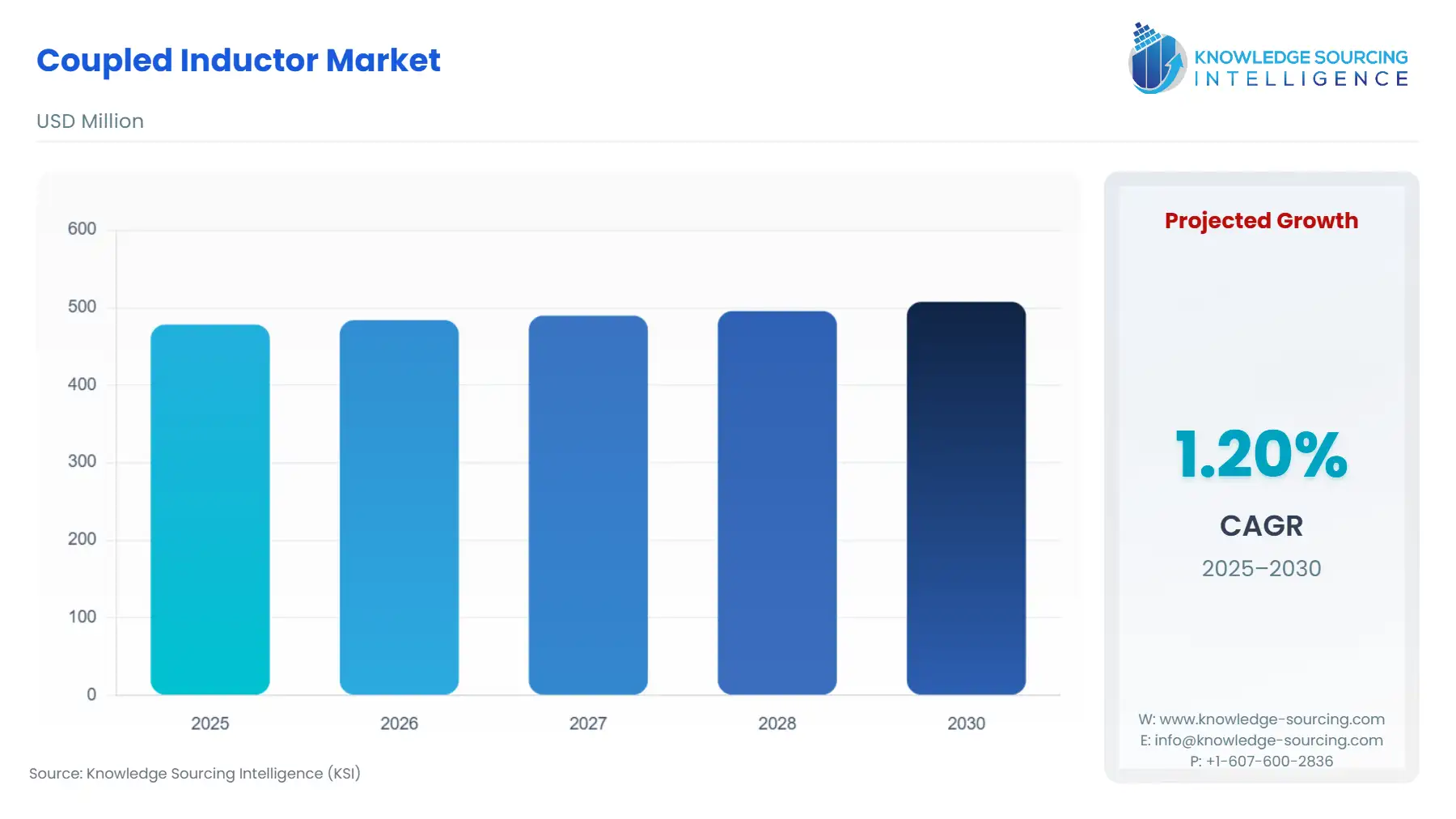

The Global Coupled Inductor Market is expected to grow from US$478.220 million in 2025 to US$507.503 million in 2030, at a CAGR of 1.20%.

Coupled Inductor Market Highlights

An inductor having two or more windings on the same core that uses magnetic coupling to influence the behavior of one winding on the other is known as a coupled inductor.

The global coupled inductor market is expected to grow steadily due to demand for compact power solutions in consumer electronics, telecommunications, and automotive systems. Coupled inductors provide energy efficiency, reduce electromagnetic interference and improve power density in modern circuits. Along with the increasing demand for DC-DC converters and other converters, voltage regulators, and modern transformers in various industries, the coupled inductor market is expected to grow rapidly due to the advancement of DC-DC and other converters. The trend towards miniaturization and technological advancement with respect to the design of materials is also aiding market growth.

Coupled Inductor Market Overview

The??? Global Coupled Inductor Market is growing steadily and is largely driven by the increasing need for compact, energy-efficient power solutions in various sectors such as automotive, consumer electronics, telecommunications, and industrial automation. Coupled inductors, which share a common magnetic core with two or more windings, are crucial components in DC-DC converters, power supply circuits, and EMI filters as they improve overall system efficiency, reduce energy waste, and lower electromagnetic interference.

The proliferation of electric vehicles (EVs) and hybrid electric vehicles (HEVs) has, therefore, escalated the demand for coupled inductors in on-board chargers, battery management systems, and DC-DC converters that require high-performance, miniaturized magnetic ???components. In??? 2024, the number of electric cars sold globally reached over 17 million, escalating by a little over 25% from the previous year. The new car sales that accounted for 3.5 million alone in 2024, compared to 2023, are more than the total number of electric vehicles sold worldwide in 2020. Electric car sales in the UK, which is the second-biggest car market in Europe, achieved a share of almost 30% as opposed to 24% in ???2023.

Several??? intercontinental rules and norms aimed at safety, performance, and ecological compatibility have a significant impact on the Global Coupled Inductor Market. The main frameworks are directives like RoHS (Restriction of Hazardous Substances Directive) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the European Union, which impose limitations on the content of hazardous substances in electronic components. The standards of IEC (International Electrotechnical Commission) and UL (Underwriters Laboratories) define the criteria for inductor safety, heat dissipation, and electromagnetic ???compatibility.

The??? ongoing technological innovation for expanding the EV ecosystem and the rising demand for energy conversion products that are environmentally friendly have established a framework for the development and utilization of power management products, including coupled inductors.

Major players in the coupled inductor market include Coilcraft, Vishay Intertechnology, Delta Electronics, Inc., Würth Elektronik GmbH & Co., etc. These companies emphasise R&D investment to enhance performance, miniaturisation, and energy efficiency. Their strategies include expanding product portfolios and strengthening partnerships to meet growing global demand across multiple industries.

Coupled Inductor Market Trends:

Due to their cost-effectiveness and reduced space requirements, coupled inductors are becoming more popular in consumer electronics and the automotive industry. This coupled inductor market demand is expected to grow throughout the forecast period. When the magnetic fields of two inductors connected to two distinct circuits are brought together, the inductors transmit energy from one to the other. Coupled inductors are inductors that are used in this way. Radiofrequency identification, transformers, wireless power transfers, electric motors, and generators, as well as induction cookers, and induction heating systems, all require coupled inductors. In addition, these inductors are employed in inductive charging devices, metal detectors, and induction loop communication systems. Increasing the use of coupled inductors in consumer electronics and the automotive industry will enhance demand during the projected period due to their cost-effectiveness and reduced space requirements.

Coupled Inductor Market Growth Factors:

- Growth of the electronics industry

The rising electronics sector is projected to boost the global coupled inductor market forward. Over the previous two decades, the global electronics industry, especially in countries like Japan, China, and India, has seen significant transformations. with the increasing adoption of consumer electronics, medical devices, and home appliances, the need for semiconductors and inductors has drastically grown. further, with huge investment in R&D, technological advancement, and automation, the demand is expected to increase. The growing adoption of the Internet of Things (IoT) and Artificial Intelligence (AI) is an additional factor contributing to the industry. Therefore, with the growth of the electronics industry, the demand for the global coupled inductor is also expected to increase significantly in the upcoming years, propelling its market growth.

- Adoption of electric and autonomous cars

Despite the decline in the automobile sector as a result of COVID-19, the industry is predicted to increase with more adoption of autonomous and electric vehicles. The government of several countries, as well as private companies, are switching to electric vehicles. In a few nations, governments are making it mandatory to utilize electric vehicles. In the United States, for example, the federal government's fleet is being converted to electric vehicles. Furthermore, states such as California and Massachusetts have pledged to phase out new gas-powered car sales by 2035. As of 2035, the European Union has proposed a ban on the sale of new petrol and diesel automobiles, accelerating the shift to electric vehicles to cut carbon emissions. Concerned about the number of carbon emissions created by fossil fuel-based vehicles, several governments are turning to an alternative source. Further, the use of coupled inductors has an increasing role to play in the automotive industry. With the growth in the automotive industry, the coupled inductor market is expected to increase.

- Growing demand for the telecom industry

Over the last several years, there has been a tremendous increase in demand for IT/telecommunication services. The rise of the IT/Telecom sector is being driven by increased digitization, increasing reliance on cloud services, and upgrading IT Infrastructure, all of which are fueling the growth of the coupled induction market. Increasing investments and innovations in the fields of IT and communications are driving up demand for coupled inductors, which help to improve hardware efficiency and durability.

- Expansion of Consumer Electronics and IoT Devices

One??? of the major impetuses for the global coupled inductor market growth is the extension of consumer electronics and IoT gadgets development, as modern digital items are acutely requiring small, energy-saving, and high-performance power management solutions.

Because of the rapid expansion of smartphones, tablets, laptops, wearables, smart home systems, and IoT-enabled industrial sensors, the demand for stable voltage regulation, electromagnetic noise suppression, and efficient power conversion has increased ???enormously. Mobile??? phone production in India has gone up drastically from ?18,000 crores in 2014-15 to ?5.45 lakh crores in 2024-25, which is 28 times ???more.

In??? addition, consumer and IoT devices powered by AI edge computing, 5G connectivity, and low-power wireless technologies will most likely require the continuation of a trend in which power distribution systems will have to be stable and efficient if they are to cater for such energy demands. As a result, coupled inductors will become a vital component in the circuit of the next generation ???of electronics.

Coupled Inductor Market Restraints:

- Conventional cars

With adoption increasing adoption of electric cars and autonomous vehicles, the demand for conventional cars is reducing. With this, the coupled inductors have been affected.

Coupled Inductor Market Segmentation Analysis

- By End-user: Automotive

Based on the end-user, the global coupled inductor market is segmented into electrical and electronics, telecommunication, automotive, and others. Coupled inductor, owing to their magnetic flux design, allows energy transfer through electromagnetic induction, and unlike standalone inductors they can determine the interaction, thereby reducing ripple currents. Due to their energy optimization features, coupled inductors are highly applicable in the automotive industry for managing battery voltage supply in different applications such as power steering, automotive LEDs, and infotainment system.

The booming technological shift towards new energy optimizing concepts, along with increasing sustainability goals has transformed the automotive sector globally. Additionally, the implementation of zero-emission policies in major economies have accelerated the transition to electric and hybrid vehicles.

For instance, according to the data provided by the International Energy Agency’s “Global EV Outlook 2025”, in 2024, the global electric vehicle sales reached 17.3 million units, marking a significant increase of more than 25% compared to the preceding year’s sales. Additionally, the same source stated that the global sales figure for 2025 is projected to reach 20 million units.

The surge in electric vehicle sales plays an integral role in driving the coupled inductors, particularly for infotainment systems and voltage boosting technologies such as ADAS (Advanced Driver Assistance System). Moreover, the well-established presence of major market players, namely TDK Corporation, which offers an extensive product range for applications such as telecommunications and automotive, has further propelled overall market expansion.

Coupled Inductor Market Geographical Outlook

- North America: the US

Ongoing energy production and expansion efforts in the United States have accelerated the development of renewable energy infrastructure. Hence, governing authorities such as the U.S. Environmental Protection Agency under government schemes and funding programs are granting billions to bolster the development and deployment of residential solar, especially for low-income communities nationwide.

Ongoing investments and the growing consumer transition toward sustainable alternative projects have positively impacted the overall installation volumes. For instance, according to the Solar Energy Industry Association, in August 2025, the monthly utility-scale solar installations for solar photovoltaic systems reached 2,126.9 MWac, marking a 12% increase compared to the installations recorded in June 2025. Coupled inductor plays an integral role in power management within the solar sector, and as installation volumes increase, the demand for such inductors will also experience a simultaneous growth.

Additionally, the growing consumer preference towards green mobility has impacted the electric vehicle adoption in the United States. According to the International Energy Agency’s “Global EV Outlook 2025”, in 2024, the electric vehicle (EV) sales in the United States reached 1.2 million units, demonstrating a 10% growth compared to the preceding year. The same source also stated that sales are anticipated to show 11% growth in sales for 2025.

With the booming industrial automation, the demand for miniaturized and power electronics is also expanding in the United States. This trend is estimated to influence the demand for coupled inductors for power management. Hence, the rollout of 5G network expansion has resulted in the development & expansion of network infrastructure, which is an additional driving factor.

Coupled Inductor Market Key Developments

- In 2023, TDK Corporation expanded its family of flat wire inductors with the high-performance EPCOS ERUC23 coupled inductor series (B82559S*).

Global Coupled Inductor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Coupled Inductor Market Size in 2025 | US$478.220 million |

| Coupled Inductor Market Size in 2030 | US$507.503 million |

| Growth Rate | CAGR of 1.20% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Coupled Inductor Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

By Phase

- Single Phase

- Multi-Phase

By Power Rating

- Up to 10 A

- 10 to 30 A

- Greater than 30 A

By Application

- Converters

- Transformers

- Regulators

- Others

By End-User Industry

- Electronics and Electrical

- Telecommunication

- Automotive

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- Italy

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others