Report Overview

Consumer Oxygen Equipment Market Highlights

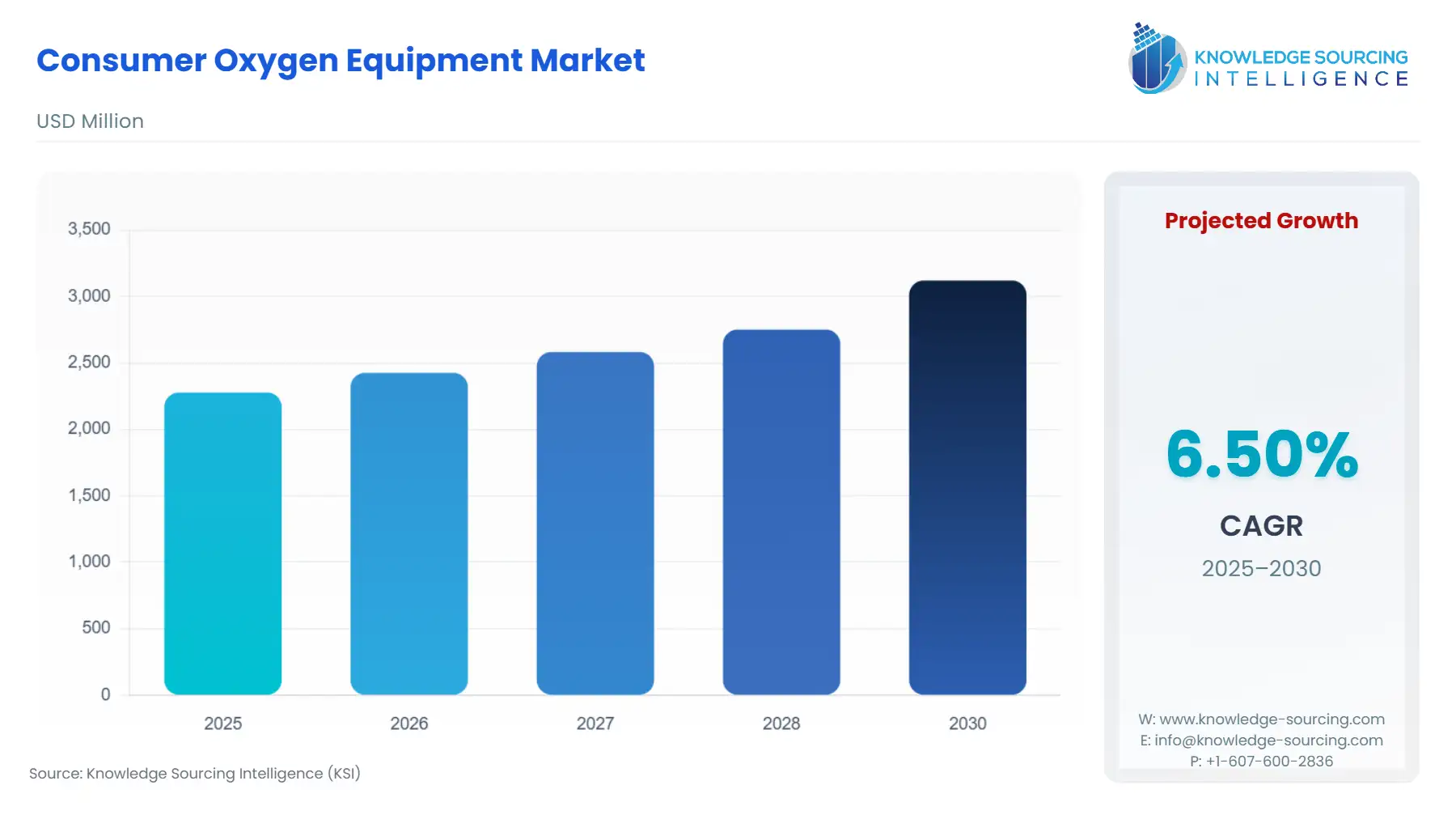

Consumer Oxygen Equipment Market Size:

The Consumer Oxygen Equipment Market is expected to grow from USD 2,278.028 million in 2025 to USD 3,121.096 million in 2030, at a CAGR of 6.50%.

The Consumer Oxygen Equipment Market is defined by products and systems utilised for supplemental oxygen therapy by patients with chronic or acute respiratory conditions outside of a traditional hospital setting. This market segment encompasses a range of technologies, including high-volume, continuous-flow Stationary Devices used overnight and lightweight, pulse-dose Portable Devices designed for ambulation. The market’s primary function is to enhance the quality of life and clinical outcomes for patients suffering from conditions such as Chronic Obstructive Pulmonary Disease (COPD), cystic fibrosis, and various interstitial lung diseases. Demand in this sector is fundamentally inelastic, driven by essential medical necessity and the growing societal preference for receiving long-term care in the home care setting rather than within expensive institutional environments. Technological evolution, particularly the transition from heavy, labour-intensive Compressed Gas Systems and Liquid Oxygen Systems to sophisticated, electronic Oxygen Concentrators, continues to redefine the competitive landscape and elevate patient expectations for mobility and independence.

Consumer Oxygen Equipment Market Analysis

- Growth Drivers

The primary catalyst propelling market growth is the accelerating rate of Chronic Obstructive Pulmonary Disease (COPD) diagnoses globally, especially as environmental factors and smoking rates contribute to respiratory morbidity. This growing patient cohort directly creates inelastic demand for therapeutic oxygen, particularly for home-based delivery systems to manage long-term conditions. Simultaneously, the rising adoption of home-based healthcare models, supported by government and insurance efforts to reduce institutional costs, strongly shifts demand from Hospitals & Clinics toward the home care segment. These models require reliable, consumer-friendly Portable Devices that enable patient independence, generating significant pull for advanced Oxygen Concentrators over bulkier predecessors. US tariffs on components, primarily from Asia-Pacific, subtly increase domestic sourcing demand for final assembly, though their primary impact is inflationary on the end-user price.

- Challenges and Opportunities

The foremost challenge facing the market is the complex and often restrictive reimbursement landscape for expensive portable devices. Stringent requirements imposed by payers, such as Medicare’s 36-month rental cap and eligibility criteria, can act as a financial constraint on patient access to the latest technology. A significant opportunity lies in the integration of telemonitoring and remote patient management capabilities into oxygen devices. Integrating Bluetooth and cellular communication into Oxygen Concentrators allows healthcare providers to remotely track usage, battery status, and oxygen saturation levels, which directly drives demand for technologically advanced units by enhancing patient compliance, enabling proactive care adjustments, and reducing the likelihood of costly hospital readmissions. This technological integration transforms the equipment from a mere medical commodity into a data-generating health solution.

Raw Material and Pricing Analysis

The Consumer Oxygen Equipment market involves physical products, with Oxygen Concentrators being the primary component. The core material dependency for this segment is the zeolite molecular sieve, a synthetic adsorbent material critical for the Pressure Swing Adsorption (PSA) process that separates oxygen from nitrogen in ambient air. Pricing for concentrators is highly sensitive to the cost and availability of high-purity zeolite, which is typically manufactured by a limited number of speciality chemical producers. Additionally, advanced Portable Devices are highly reliant on lithium-ion battery cells (for extended mobility) and durable, lightweight polymers and plastics for the device casing and Oxygen Delivery Accessories. Supply chain disruptions or tariffs on key electronics (compressors, circuit boards) or battery components can rapidly escalate final unit pricing, thereby challenging the financial viability of home care providers operating under fixed reimbursement schedules.

- Supply Chain Analysis

The global supply chain for consumer oxygen equipment is characterised by a fragmented manufacturing base for finished goods and centralised sourcing for critical components. While final assembly of Oxygen Concentrators occurs across North America, Europe, and Asia-Pacific, the key technological components—namely, the high-precision air compressors and the specialised zeolite molecular sieves—often originate from a highly concentrated number of suppliers, predominantly in Asia. This structure creates significant logistical dependencies and vulnerabilities to geopolitical risks. The reliance on specialised electronic sub-assemblies and batteries requires manufacturers to maintain complex inventory management to mitigate lead time volatility. This concentration in the component tier and the complexity of global logistics for finished goods directly drives the demand for large, vertically integrated companies like Philips and Chart Industries, which can better absorb component cost fluctuations and manage international distribution dependencies.

Consumer Oxygen Equipment Market Government Regulations

Governmental and regulatory bodies impose strict quality, safety, and operational standards that fundamentally dictate product design and market access, especially within the U.S. and E.U.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FDA (Food and Drug Administration) Class II Medical Device Classification |

The FDA designates most Oxygen Concentrators as Class II medical devices, requiring 510(k) Pre-market Notification and adherence to Quality System Regulation (QSR). This regulatory barrier ensures patient safety and efficacy, mandating higher R&D investment and slowing the pace of entry for new, potentially non-compliant manufacturers, thereby increasing the demand for pre-approved, quality-certified products from established players. |

|

United States |

Centers for Medicare & Medicaid Services (CMS) Competitive Bidding Program and 36-Month Rental Cap |

The CMS program establishes a fixed, highly controlled reimbursement rate for oxygen equipment provided to Medicare beneficiaries, coupled with a 36-month cap on rental payments followed by a two-year supplier service obligation. This system compresses supplier margins and channels demand toward the most cost-efficient devices (Stationary Devices), creating price pressure on manufacturers, even as patients express preference for the more expensive Portable Devices. |

|

European Union |

Medical Device Regulation (MDR) 2017/745 |

The MDR imposes stringent requirements on clinical evidence, post-market surveillance, and technical documentation for all medical devices sold within the EU. The regulation’s implementation timeline increases compliance costs for manufacturers and requires product re-certification, which drives demand for equipment that can demonstrate robust long-term clinical performance and adherence to elevated quality standards. |

Consumer Oxygen Equipment Market Segment Analysis

- By Portability: Portable Devices

The Portable Devices segment, primarily driven by pulse-dose Oxygen Concentrators, represents the highest-growth vector in the market. The specific demand driver is the patient imperative for maintaining an active, mobile lifestyle and minimising the psychological burden of oxygen dependency. Modern engineering has reduced the average weight of high-flow portable concentrators to less than five pounds, which directly translates into a non-negotiable demand pull from individuals with mild-to-moderate COPD seeking to travel, shop, or participate in social activities. Furthermore, the technological shift to Intelligent Pulse Dose Delivery, which senses a patient’s breathing rate and adjusts oxygen delivery accordingly, significantly extends battery life. This optimisation of oxygen delivery is a critical feature that directly accelerates demand by mitigating "battery anxiety," a key barrier to adoption for highly mobile patients. The Federal Aviation Administration's (FAA) approval of specific models for air travel also creates an important niche demand segment for travellers.

- By End-User: Homecare

The home care end-user segment is the foundational demand base for the entire market, driven by powerful demographic and economic forces. The central demand driver is the escalating prevalence of chronic respiratory diseases coupled with the global geriatric population boom. Long-Term Oxygen Therapy (LTOT) is overwhelmingly delivered in the home care setting to reduce the excessive cost burden of prolonged hospital stays. This trend is reinforced by clinical evidence demonstrating that home oxygen therapy improves patients’ quality of life and reduces mortality in hypoxemic COPD patients. The demand is further solidified by the shift in healthcare funding models towards bundled payments and care coordination, which incentivises providers to discharge medically stable patients earlier with reliable home equipment. This creates a persistent, high-volume demand for both dependable, high-purity Stationary Devices (for night-time use) and the complementary, lightweight Portable Devices (for daily ambulation).

Consumer Oxygen Equipment Market Geographical Analysis

- US Market Analysis (North America)

The US market is the largest consumer of oxygen equipment, characterised by a high prevalence of chronic respiratory illnesses and a healthcare system driven by the Centres for Medicare & Medicaid Services (CMS). Local factors impacting demand are centred on the reimbursement structure for Durable Medical Equipment (DME). Medicare's fixed-rate payment model strongly influences the purchasing decisions of DME providers, driving demand toward high-reliability, lower-maintenance Oxygen Concentrators to maximise profitability within the constrained reimbursement cap. Additionally, the strong consumer preference for independence fuels robust private-pay demand for the latest, lightest Portable Devices that offer maximum battery autonomy, often bypassing the limitations of insurance-covered models.

- Brazil Market Analysis (South America)

The Brazilian market faces a dual challenge of rising COPD prevalence and a fragmented, regionally variable public healthcare infrastructure (SUS). The primary local factor driving demand is the rapid urbanisation and associated increase in air pollution in major metropolitan areas, leading to increased respiratory conditions. However, market adoption is constrained by a significant reliance on out-of-pocket patient payments and limited insurance coverage for high-cost devices. This economic structure channels the bulk of demand toward more affordable, basic Stationary Devices and, frequently, bulkier Compressed Gas Systems due to lower initial capital outlay compared to advanced Portable Devices.

- Germany Market Analysis (Europe)

The German market is defined by a robust national health insurance system that ensures broad patient access to prescribed oxygen therapy. The key local factor impacting demand is the strict adherence to clinical guidelines and a strong emphasis on long-term therapeutic efficacy. This regulatory environment sustains demand for high-quality, continuous-flow Oxygen Concentrators that meet rigorous performance and safety standards. Furthermore, the high average age of the population creates a demographic tailwind, ensuring stable, replacement-cycle demand for both Stationary and reliable Portable Devices covered under the comprehensive social security schemes.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market is heavily influenced by government investment in healthcare infrastructure and the impact of lifestyle diseases (e.g., smoking-related illnesses). The local factor driving demand is the rapid expansion of specialised healthcare facilities and the push to modernise chronic care management. Government procurement, often prioritising reliability and bulk purchasing, generates significant demand for high-output Stationary Devices in the Hospitals & Clinics sector. A growing segment of affluence also creates niche private demand for the latest, most technologically advanced Portable Devices for private home use and travel.

- China Market Analysis (Asia-Pacific)

The Chinese market is characterised by unprecedented scale and high air pollution levels, which severely aggravate respiratory conditions. The primary factor impacting demand is the massive, government-backed expansion of the healthcare system (e.g., the "Healthy China 2030" initiative) and the sheer volume of patients. This policy-driven environment creates huge volume demand for both domestically manufactured Oxygen Concentrators and imported high-performance units. Furthermore, the ability of local manufacturers like Foshan Shunde Bond Electronics to produce cost-competitive stationary and lower-end portable devices directly increases accessibility and drives base-level demand across lower-tier cities and rural home care settings.

Consumer Oxygen Equipment Market Competitive Environment and Analysis

The Consumer Oxygen Equipment market features a high level of competition, dominated by a few multinational medical device corporations in the advanced technology segments and numerous regional manufacturers in the stationary and traditional equipment segments. Competition centres on device weight/battery life, regulatory clearances, and integrated connectivity.

- Philips Healthcare

Philips Healthcare strategically positions itself as a global leader in connected care and respiratory management. Its core competitive advantage lies in its comprehensive portfolio that spans both Stationary Devices (like the Respironics EverFlo) and high-performance Portable Devices (like the SimplyGo family). Philips leverages its established global distribution network and brand recognition to be a mandatory supplier for large Hospitals & Clinics and major DME providers. The company actively drives demand through innovation in miniaturisation and the integration of its devices into its broader digital health platforms, allowing remote patient monitoring, which is essential for capturing new payer-driven, efficiency-focused home care demand.

- Invacare Corporation

Invacare Corporation is a historic and foundational player in the Durable Medical Equipment (DME) sector, possessing a robust portfolio of oxygen equipment and related Oxygen Delivery Accessories. Invacare’s strategic positioning focuses on providing a full line of products, ranging from large-scale Stationary Devices (such as the Perfecto2 and Platinum series) to portable solutions. The company's competitive advantage is its entrenched relationship with DME suppliers globally, who rely on its established reputation for reliability and service. Invacare actively maintains demand by providing cost-effective, durable equipment that aligns well with the economic constraints imposed by fixed reimbursement models in markets like the US Medicare system.

- Inogen Inc.

Inogen Inc. operates as a specialised, pure-play market leader focused exclusively on the advanced Portable Oxygen Concentrator segment. Its strategic positioning is defined by its constant drive for miniaturisation and extended battery life, exemplified by its flagship Inogen One series. Inogen directly captures the premium segment demand driven by active, mobile patients and private-pay consumers who prioritise weight and discretion above all else. Its business model, which includes a mix of direct-to-consumer sales and partnerships with DME providers, allows it to bypass some of the pricing pressures associated with institutional procurement, thereby creating a distinct and profitable demand channel for high-end pulse-dose technology.

Consumer Oxygen Equipment Market Developments

- August 2024: Philips Launches New Connected Oxygen Concentrator with Integrated Telehealth

Philips Healthcare introduced the newest iteration of its connected Stationary Device designed for the Homecare market, featuring integrated Bluetooth and cellular connectivity for remote patient monitoring. This launch provides real-time data on patient usage and device performance directly to healthcare providers via the company's proprietary telehealth platform. This product launch directly captures the rising demand from payers and large DME providers for devices that improve patient compliance and reduce the administrative burden of monitoring long-term oxygen therapy patients, making the equipment an active component of the care management process.

Consumer Oxygen Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2,278.028 million |

| Total Market Size in 2031 | USD 3,121.096 million |

| Growth Rate | 6.50% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Consumer Oxygen Equipment Market Segmentation

- By Type

- Oxygen Concentrators

- Compressed Gas Systems

- Liquid Oxygen Systems

- Hyperbaric Oxygen Chambers

- Oxygen Delivery Accessories

- By Portability

- Stationary Devices

- Portable Devices

- By End-User

- Hospitals & Clinics

- Homecare

- Ambulatory Surgical Centers (ASCs)

- Long-Term Care Facilities

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others