Report Overview

Global Automotive Wheel Speed Highlights

Automotive Wheel Speed Sensor Market Size:

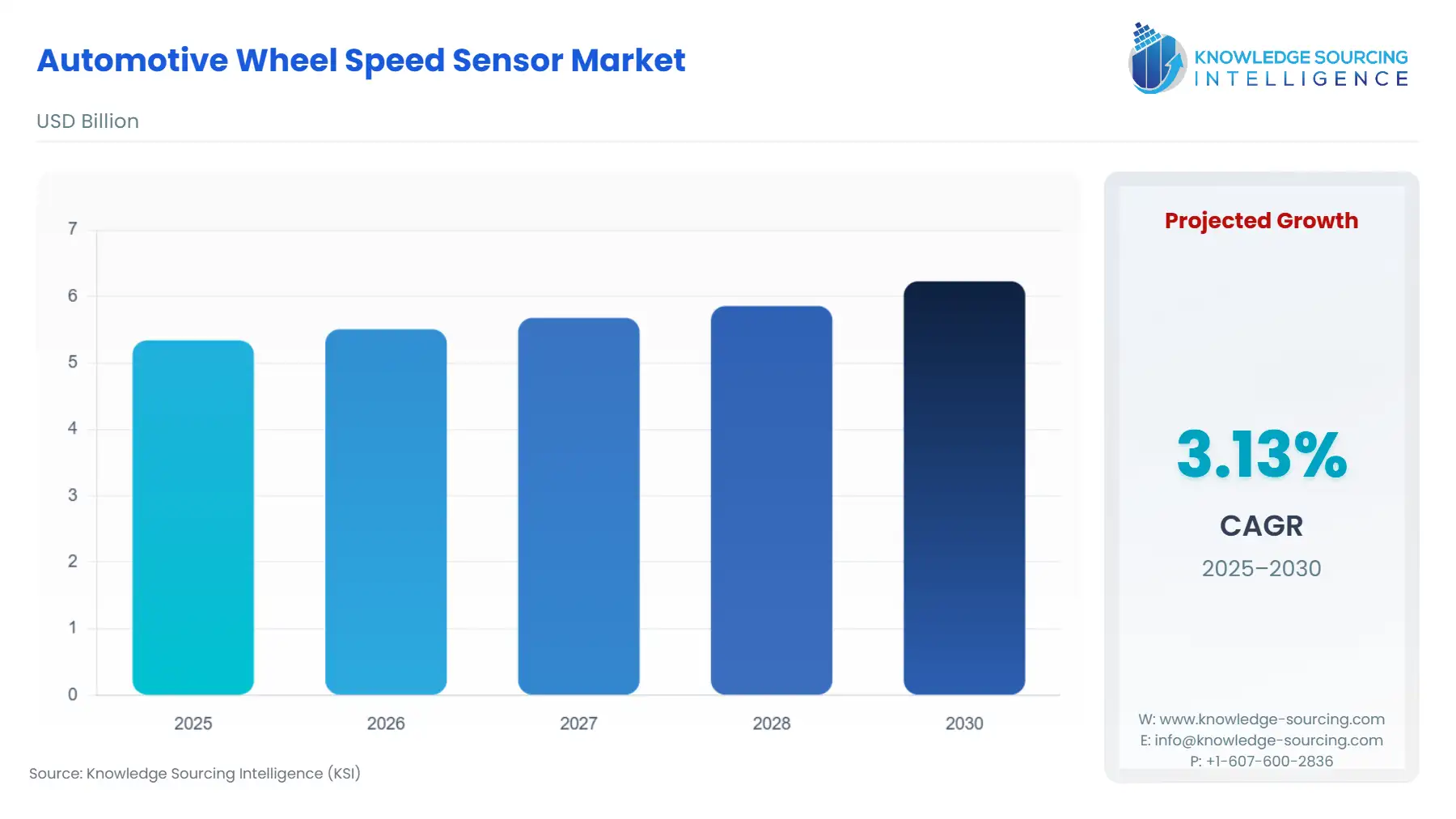

The Global Automotive Wheel Speed Sensor Market is expected to grow from USD 5.341 billion in 2025 to USD 6.230 billion in 2030, at a CAGR of 3.13%.

Automotive Wheel Speed Sensor Market Trends:

A wheel speed sensor is a device that is used to determine the acceleration or slowing down of the wheel. An increase in the adoption of the anti-lock braking system in vehicles, stringent government regulations for minimum stopping distance, and a rise in automotive sales across the globe have augmented the growth of the global automotive wheel speed sensor market.

In addition, growth in production and sales of vehicles in developing countries in Asia-Pacific is also influencing the growth of the automotive wheel speed sensor market. The automotive wheel speed sensor market’s growth is directly related to the advancement and expansion of the ABS system. The high cost of vehicles embedded with the ABS system is a major factor that restrains the growth of the automotive wheel speed sensor market. The cost of the electronic components and technology makes ABS costlier than traditional braking systems in vehicles.

Automotive Wheel Speed Sensor Market Segment Analysis:

- By Sensor Type

By sensor type, the global automotive wheel speed sensor market has been segmented as active and passive. The active sensor held a higher share of the global market due to its property hall effect principle, true zero speed capability, and precise switch point measurement that helps in reading accurate wheel movement even when the vehicle is not in motion. On the other hand, the passive segment is expected to grow at a good rate. Simple construction and developments in magnetic type to increase accuracy in operation have escalated the growth.

- By Vehicle Type

By vehicle type, the automotive wheel speed sensor market has been segmented as passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles held a major share of the market. Cumulative sales, growing disposable income, and the compulsion of the ABS system in passenger vehicles have augmented the growth of the automotive wheel speed sensors market.

By Geography

By Geography, the global automotive wheel speed sensor market is segmented as North America, South America, Europe, Middle East & Africa, and Asia-Pacific. Asia-Pacific holds the largest market share and is found to be dominant. Increasing government support for the development of the automotive industry, rapid industrialization, and a constant focus on developing newer products to meet diverse changes in consumer demands in the region have influenced the growth.

Automotive Wheel Speed Sensor Market Product Offerings:

- Bosch wheel-speed sensor: Bosch wheel-speed sensors use a non-contacting measurement approach to determine the rotating wheel speed of moving objects. The Hall-sensing element, signal amplifier, and signal processing are all combined on a single chip in Bosch wheel-speed sensor circuits. The revolving encoder, which can be either a multipole or a metal wheel, exposes the circuit to its fluctuating magnetic field. A magnet inserted inside the sensor is required for applications involving steel wheels. There are several sensor variations of the wheel-speed sensors with signal redundancy that are compatible with highly automated driving.

- Continental WSS : The anisotropic magnetoresistance effects, such as AMR (magnetoresistive) or GMR, are used to estimate the wheel speed (giant magnetoresistive). With the use of these technologies and integrated signal processing, Continental WSS (Wheel Speed Sensor) is able to communicate the rotational speed of the wheel to various control systems, including ABS, TCS, and ESC. This generation of sensors can perform a wide range of tasks due to this technique and an integrated information processing capability. It has a sturdy design, is adjustable in reading position, and was designed in accordance with ISO 26262 safety standards. However, it takes less time to develop and requires less layout variation and validation work.

Automotive Wheel Speed Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.341 billion |

| Total Market Size in 2031 | USD 6.230 billion |

| Growth Rate | 3.13% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Sensor Type, Vehicle Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Wheel Speed Sensor Market Segmentation:

- By Sensor Type

- Active

- Passive

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Application

- Anti-lock Braking System

- Electronic Stability Control

- Tire Pressure Monitoring System

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Taiwan

- Thailand

- Indonesia

- Others

- North America