Report Overview

Global Automotive Rear Seat Highlights

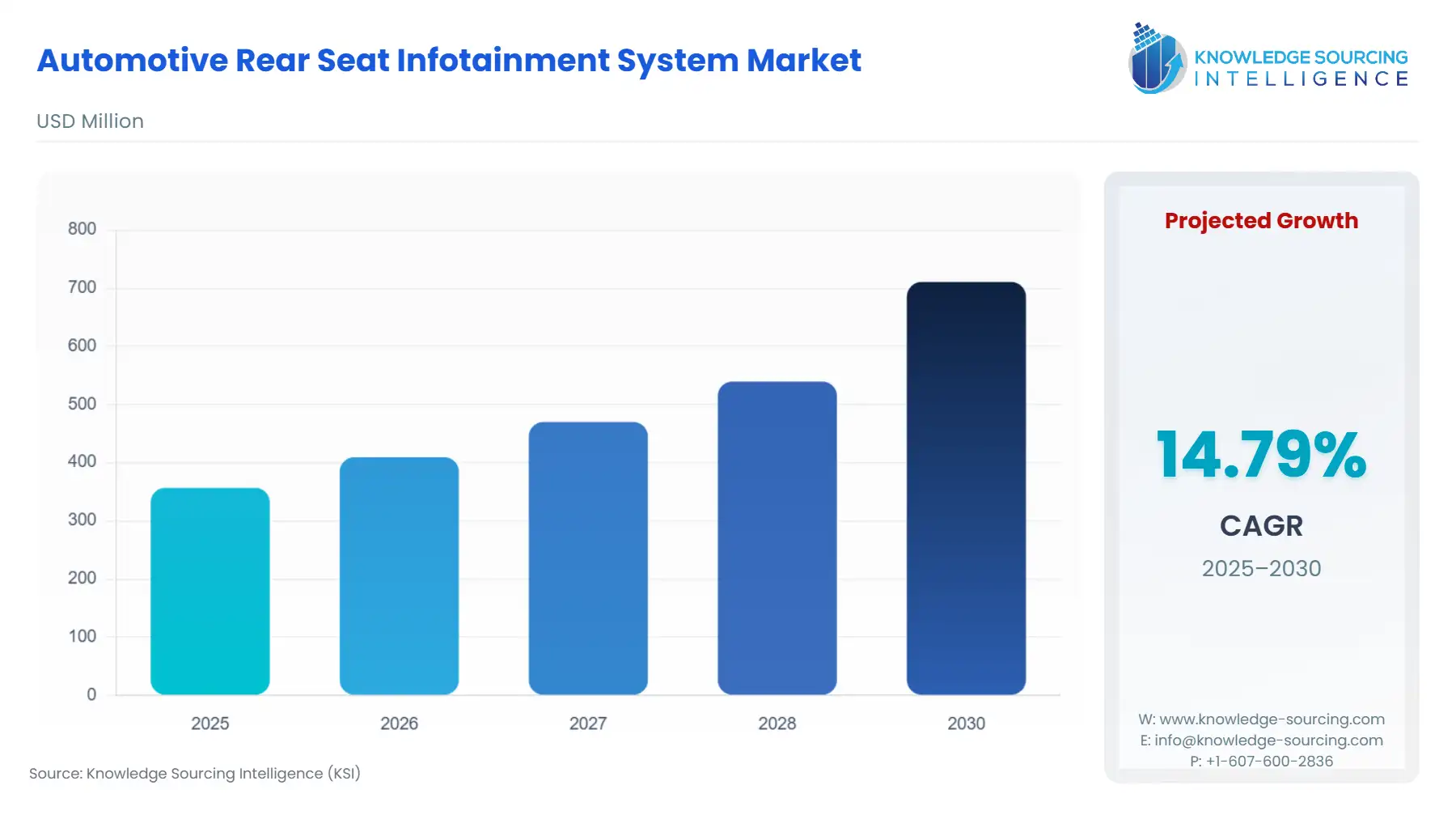

Automotive Rear Seat Infotainment System Market Size:

The Global Automotive Rear Seat Infotainment System Market is expected to grow from US$356.680 million in 2025 to US$710.884 million in 2030, at a CAGR of 14.79%.

These systems typically include features such as video screens, audio systems, and connectivity options like Bluetooth and Wi-Fi. The market for automotive rear-seat infotainment systems is driven by several factors, including the increasing demand for in-car entertainment and the growing trend of connected cars. In addition, the availability of advanced features like touchscreen interfaces and voice recognition is also driving the market growth. These systems typically include features such as video screens, audio systems, and connectivity options like Bluetooth and Wi-Fi. The market for automotive rear-seat infotainment systems is driven by several factors, including the increasing demand for in-car entertainment and the growing trend of connected cars. In addition, the availability of advanced features like touchscreen interfaces and voice recognition is also driving the market growth.

Automotive Rear Seat Infotainment System Market Growth Drivers:

- The global automotive rear seat infotainment market is driven by increasing demand for In-car entertainment.

The prime factor that is predicted to drive the growth of the global automotive rear seat infotainment market is the growing demand for in-car entertainment. Today's consumers spend more time in their cars than ever before and expect to have access to a range of entertainment options while on the road. Rear seat infotainment systems provide passengers with various features such as video screens, audio systems, and connectivity options like Bluetooth and Wi-Fi, creating a comfortable and enjoyable experience while travelling. In-car entertainment is particularly important for families with children, who may become restless and bored during long journeys. Rear seat infotainment systems can help keep children entertained and engaged, reducing distractions for the driver and making the trip more pleasant for everyone. As consumers prioritize in-car entertainment, the demand for rear-seat infotainment systems is expected to grow.

Moreover, the growing popularity of video games is one of the driving factors of the growth of the global automotive rear seat infotainment market. The video game industry has seen a significant increase in recent years, with more people than ever before playing games on consoles, PCs, and mobile devices. As a result, they require a significant amount of automotive rear seat infotainment content, including character automotive rear seat infotainments, environmental automotive rear seat infotainments, and visual effects. With video games' increasing complexity and realism, the demand for high-quality automotive rear-seat infotainment content has grown. Game developers are constantly looking for ways to enhance their games' visual appeal and gameplay, and automotive rear seat infotainment is a critical component of achieving these goals. As a result, the demand for high-quality automotive rear seat infotainment and visual effects in video games has increased, leading to a surge in demand for automotive rear seat infotainment content.

Automotive Rear Seat Infotainment System Market Segmentation Analysis:

- Based on vehicle type, the global automotive rear seat infotainment market is expected to witness positive growth in the light vehicle segment.

The global automotive rear seat infotainment system market is witnessing an increase in demand for Light Vehicles due to the rising popularity of personal automobiles and a shift in consumer tastes toward superior in-car entertainment systems. Furthermore, firms are consistently investing in R&D to develop and supply innovative rear seat infotainment systems that enable seamless connection, high-quality entertainment, and an enhanced passenger experience, which has fueled demand for infotainment systems. According to the press release in 2022, JET OPTO Chairman Jerry Lin, the problem of material scarcity upstream of in-vehicle displays has been resolved, and deliveries will begin gradually in October. JET OPTO has secured orders for in-car rear seat entertainment systems for the next two to three years.

According to the report by Telematics Technology Driven Wire in April 2022, Continental's latest display technology advances are likely to change the way passengers interact with infotainment systems in vehicles, particularly in the rear seat. For example, the dynamic display allows information to be viewed privately or publicly. In addition, the option to convert between private and shared modes also addresses privacy issues, especially while sharing a car with strangers. As a result, Continental's innovation addresses the rising need for modern infotainment systems that provide increased comfort, entertainment, and safety for all passengers.

Automotive Rear Seat Infotainment System Market Geographical Outlook:

- North America accounted for a major share of the global automotive rear seat infotainment market.

The global automotive rear seat infotainment market has been segmented by geography into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

Major growth factors responsible for market expansion are increased demand for entertainment and the integration of smartphone features into in-car infotainment systems. Further, the system manufacturers are attempting to combine processing power with competitiveness. Car manufacturers use massive amounts of data sets generated by digital services to enhance the performance of connected vehicles. Further, self-driving cars have advanced significantly, and people do more than drive their cars. Future technologies will allow the passenger compartment to be converted into a coworking space, living area, gaming room, or movie theatre. Connected services are offered by businesses like BMW and Audi to enhance client interactions and set their brands apart from their competitors.

Automakers are working to improve their display systems and driver aid systems in light of the growing trend toward driverless vehicles. The infotainment system for the back seats is one of them. For instance, in September 2021, a new rear-seat entertainment system will be available for the Flying Spur and Bentayga, two of Bentley's best-selling vehicles. The Bentley Rear Entertainment system, as it is known, features two high-definition screens. According to the Director of Electrical at Bentley Motors, the new Bentley Rear Media system blends use and functionality. It provides backseat passengers with a wide selection of entertainment through a comprehensive system that includes the most modern vehicle technology.

Automotive Rear Seat Infotainment System Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 356.680 million |

| Total Market Size in 2031 | USD 710.884 million |

| Growth Rate | 14.79% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Vehicle Type, Screen Size, Connectivity, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Rear Seat Infotainment System Market Segmentation:

- By Vehicle Type

- Light Vehicle

- Heavy Vehicle

- Passenger Cars

- Commercial Vehicles

- Others

- By Screen Size

- 5’’ to 7’’

- 8’’ to 10’’

- Above 10”

- Below 5”

- By Connectivity

- Wi-Fi

- Bluetooth

- HDMI/MHL

- USB

- 4G/5G

- By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia Pacific