Report Overview

Global Automotive Labels Market Highlights

Automotive Labels Market Size:

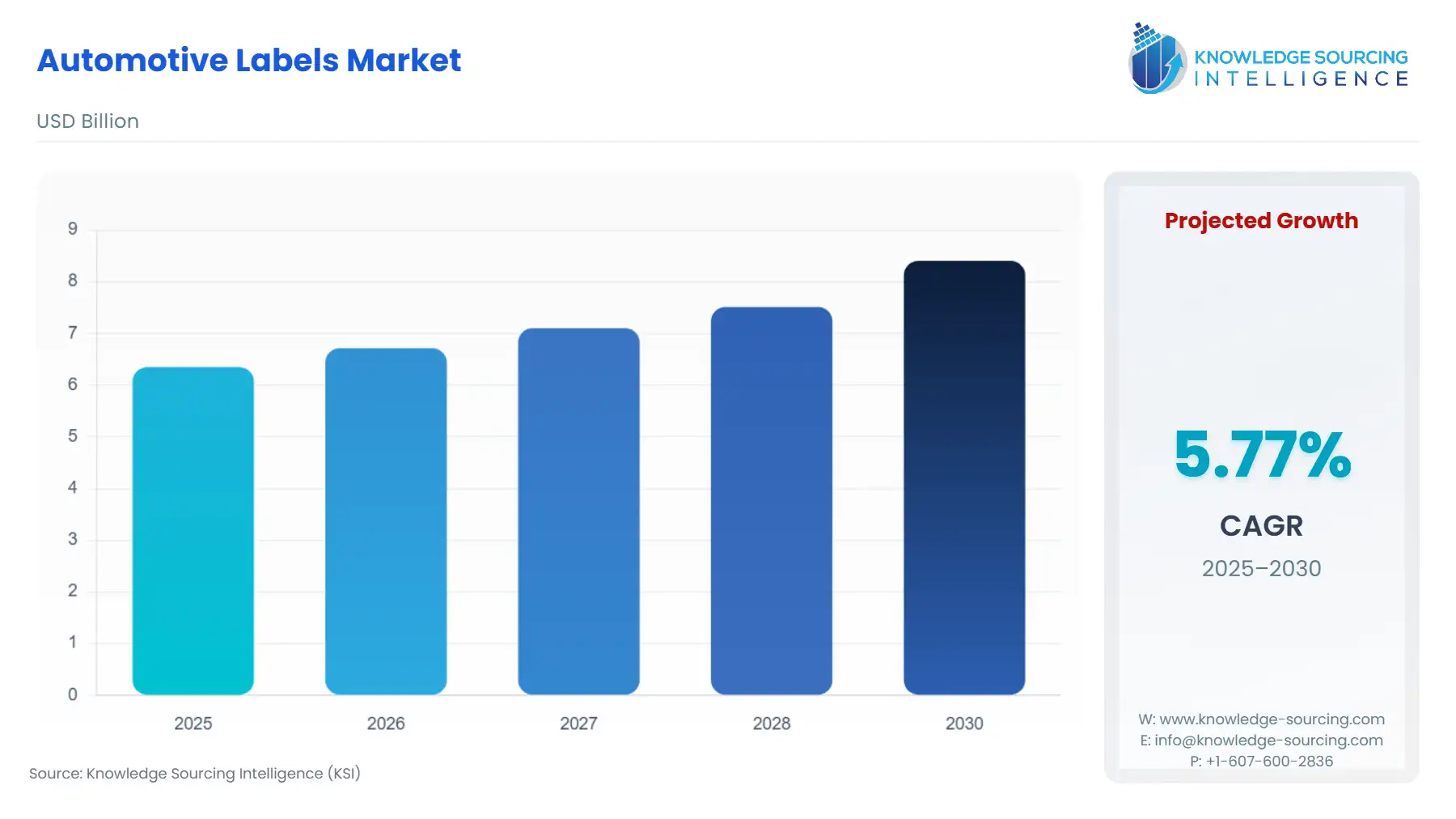

The Global Automotive Labels Market is expected to grow from USD 6.349 billion in 2025 to USD 8.406 billion in 2030, at a CAGR of 5.78%.

The global automotive labels market is a mission-critical sub-sector of the greater automotive component landscape, driven not by volatile consumer preferences but by rigorous regulatory compliance and the increasing complexity of vehicle manufacturing and logistics. These labels are no longer mere identification tags; they are engineered functional components providing essential information for safety, maintenance, inventory control, and brand integrity across the vehicle's life cycle. The market's stability is anchored by its indispensable role in satisfying global vehicle type approval requirements and facilitating efficient, automated manufacturing processes, thereby positioning the segment as a necessary expenditure for all Original Equipment Manufacturers (OEMs).

________________________________________

Automotive Labels Market Analysis:

Growth Drivers

Regulatory mandates from bodies like the NHTSA propel demand by requiring highly durable labels for safety-critical data, such as VINs and warnings, ensuring permanent, non-removable information for public safety and law enforcement. This regulatory push forces a base-level demand for exterior and engine labels across every newly manufactured vehicle. Simultaneously, the manufacturing sector's relentless pursuit of efficiency drives demand for RFID tags and advanced barcode labels, as these technologies significantly enhance supply chain visibility and reduce manual labor costs associated with tracking inventory, parts, and work-in-progress components within production facilities. Furthermore, the complex thermal management and chemical exposure requirements of electric vehicle battery systems necessitate a shift toward specialized Polyester and Vinyl materials capable of resisting extreme conditions, thus directly escalating the demand for high-performance, higher-cost label products.

Challenges and Opportunities

A primary challenge is the volatile supply and pricing of key raw materials like polypropylene and specialized pressure-sensitive adhesives, creating margin pressure for label converters and potentially constraining output during periods of scarcity. This directly impacts the cost of goods sold for automotive OEMs, who may seek to consolidate supply under long-term contracts to mitigate risk. Conversely, the market is presented with a significant opportunity in the rising consumer and legislative demand for vehicle sustainability, which necessitates material innovation in the label sector. This shift presents an opening for manufacturers specializing in bio-based, recycled-content, and easily removable label materials, directly increasing demand for products that facilitate vehicle end-of-life recycling and meet the growing preference for eco-friendly vehicle interiors. The expansion of connected and autonomous vehicle (CAV) programs offers an ancillary opportunity for embedded RFID and asset tracking labels for sophisticated component authentication.

Raw Material and Pricing Analysis

The automotive labels market is entirely dependent on the physical supply chain of materials, primarily polymer films (polyester, polypropylene, vinyl) and specialty adhesives. Pricing is dictated by the cost of petroleum-derived feedstocks, which directly influences the price of vinyl and polypropylene films, creating significant volatility and pressure on converter margins. The supply chain for these materials is highly concentrated, with a limited number of global chemical and film producers, a factor that amplifies price sensitivity and supply risk. High-performance adhesive formulations, necessary for extreme temperature or chemical resistance (e.g., engine compartment labels), represent a higher-value segment of the raw material cost structure. This segment is less sensitive to commodity fluctuations but is critical for performance-driven applications, leading to strategic sourcing of specialized resin chemistries to ensure performance specifications are consistently met.

Supply Chain Analysis

The global supply chain for automotive labels is a multi-tiered structure beginning with large petrochemical companies supplying raw polymer resins, which are then processed into film substrates by material converters. Label manufacturers, positioned as Tier 2 or Tier 3 suppliers, convert these films into the final labeled components. Asia-Pacific, particularly China and South Korea, serves as a significant production hub for both raw material films and converted labels, creating a logistical dependency for North American and European assembly plants. A key complexity is the just-in-time (JIT) delivery requirement imposed by OEMs, which necessitates robust, localized conversion and printing capabilities near major assembly clusters to prevent production line stoppages. The dependence on specialized, high-performance adhesives, often single-sourced, presents a critical dependency, increasing risk related to quality control and supply interruption.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | NHTSA Federal Motor Vehicle Safety Standards (FMVSS), specifically Part 565 on Vehicle Identification Number (VIN) requirements. | Mandates the placement, content, and durability of the VIN label, establishing a non-negotiable demand floor for highly durable exterior labels capable of resisting abrasion, temperature fluctuations, and chemicals throughout the vehicle's lifespan. |

| European Union | EU Type Approval Framework (Regulation 2018/858), particularly requirements for the statutory plate and conformity of production markings. | Requires labels to carry essential safety, environmental, and vehicle type-approval data, forcing the need for highly resistant labels that cannot be altered or removed, directly linking label demand to the volume of new vehicle type approvals and registrations within the EU. |

| China | National Standards (GB Standards) for vehicle identification, safety warnings, and component traceability. | Drives demand for labels with specific regional content requirements, particularly for warning and safety labels in the national language. The large-scale domestic automotive market dictates significant volume demand for compliant track & trace and branding labels. |

________________________________________

Automotive Labels Market In-Depth Segment Analysis:

By Application: Interior

The need for interior automotive labels is undergoing a fundamental transformation driven by two converging market forces: the proliferation of advanced human-machine interfaces (HMI) and the consumer imperative for sustainable design. The shift toward digital cockpits and customized driver experiences, while reducing the need for traditional physical button labels, simultaneously increases the demand for specialized, high-definition Asset Labels and Branding labels that must adhere to non-traditional surfaces, often integrating into premium or soft-touch materials. This requires labels with superior optical clarity, haptic feel, and chemical resistance to common interior cleaning agents. Critically, the rise of sustainable interior components, where OEMs are replacing conventional plastics with natural or recycled materials, creates a new growth driver for labels with certified bio-based or recyclable substrates, which must also meet stringent outgassing and temperature performance standards to prevent fogging within the cabin. The functional requirement for operational labels (e.g., airbag warnings, fuse box schematics) remains non-negotiable, ensuring a stable, safety-driven baseline demand that emphasizes extreme adhesive permanence without causing surface damage upon mandated removal or inspection.

By Technology: RFID Tags

The need for RFID Tags is fundamentally driven by the automotive industry's continuous investment in sophisticated, automated manufacturing and supply chain management systems. RFID technology directly addresses key operational inefficiencies, primarily the high labor costs and inventory discrepancies associated with manual tracking methods like barcode scanning. The capability for automatic, non-line-of-sight reading allows for real-time tracking of components, work-in-progress assemblies, and even finished vehicles across the entire manufacturing flow, significantly improving inventory accuracy and enabling precise just-in-time logistics. This requirement is particularly acute in high-volume production countries, where a small efficiency gain translates to substantial cost reduction. The integration of RFID tags is an indispensable component of advanced factory automation, as the tag acts as the digital passport for the component, containing manufacturing data, quality checkpoints, and build specifications, thereby reducing the risk of incorrectly assembled products. Consequently, the utility of RFID is moving beyond simple asset tracking to becoming a core element of quality control and operational visibility, making it a powerful growth catalyst in the modern automotive supply chain.

________________________________________

Automotive Labels Market Geographical Analysis:

US Market Analysis (North America)

The US market is predominantly shaped by Federal Motor Vehicle Safety Standards (FMVSS) enforced by the NHTSA, particularly the stringent requirements for Warning & Safety and VIN labels. This regulatory environment mandates high durability and tamper-evidence for all essential identification labels, forming the critical base demand. Furthermore, the US is a leading market for the implementation of advanced logistics technologies, driving a strong need for RFID Tags in both manufacturing and post-sale asset tracking applications to optimize the complex North American distribution networks. The increasing production of specialized vehicles, including performance models and heavy-duty trucks, creates a niche, high-value demand for robust Polyester and metalized labels designed for severe environmental exposure.

Brazil Market Analysis (South America)

The Brazilian market is characterized by a high volume of locally manufactured vehicles and is heavily influenced by domestic regulations concerning vehicle registration and safety certification (e.g., CONTRAN resolutions). The necessity is centered around cost-effective, high-volume Branding and Track & Trace labels. While the adoption of advanced technologies like RFID is slower compared to North America and Europe, the primary growth catalyst remains the steady production of passenger and commercial vehicles, requiring economical Paper and basic Polypropylene labels for non-critical, internal applications. Price sensitivity is a more pronounced factor in procurement decisions than in developed markets, favoring suppliers with strong local production capacity and competitive material sourcing.

Germany Market Analysis (Europe)

Germany's market is characterized by the dual focus of premium engineering and regulatory rigor, driven by the Type Approval requirements of the European Union. German OEMs demand high-performance, precision-engineered labels, particularly for the Engine and Exterior application segments, requiring high-grade Polyester and Vinyl materials that can withstand the intense thermal and chemical stresses of high-performance vehicles. The shift towards e-mobility is a key growth driver, with a significant increase in specialized labels for high-voltage battery identification, cooling system warnings, and component tracking within complex EV powertrains. The focus is on quality and compliance, translating into a strong preference for high-quality, specialty label manufacturers.

Saudi Arabia Market Analysis (Middle East & Africa)

The market in Saudi Arabia is heavily influenced by the import and assembly of vehicles designed for high-heat and harsh climate conditions. Local vehicle assembly and customization for the regional environment necessitates labels that specifically address extreme UV exposure and high ambient temperatures. This creates a focused demand for high-durability, UV-resistant Vinyl and Polyester labels for both exterior and engine applications. Regulatory requirements are linked to local standards (e.g., SASO) for vehicle conformity and imported vehicle specifications, driving the requirement for compliant Warning & Safety labels translated for the domestic consumer base. The market profile is more niche, prioritizing thermal and environmental resistance over simple cost-efficiency.

China Market Analysis (Asia-Pacific)

China is the world's largest automotive production and sales market, making it the most significant volume driver for the global label sector. The market is fundamentally fueled by high-volume domestic vehicle production, stringent government mandates for component traceability, and the rapid adoption of New Energy Vehicles (NEVs). The government's push for advanced supply chain and quality control systems directly accelerates the adoption of QR codes and RFID Tags for component lifecycle management. Furthermore, the sheer scale of production dictates immense demand for every label type, from basic Paper and Polypropylene logistics labels to high-specification Branding and safety labels, favoring multinational manufacturers with substantial local production capacity and sophisticated logistics to serve the massive OEM base.

________________________________________

Automotive Labels Market Competitive Environment and Analysis:

The competitive landscape is dominated by a few multinational corporations that possess the scale, material science expertise, and certified manufacturing footprint required to serve the global automotive original equipment manufacturers (OEMs). Competition centers on material innovation, adherence to stringent global automotive quality standards (e.g., IATF 16949), and the ability to integrate advanced tracking technologies like RFID into label solutions. The high barrier to entry—mandated by the need for long-term reliability and compliance with safety regulations—favors entrenched players, creating a competitive environment driven by strategic acquisitions to expand regional presence and material specialization.

3M Company

3M maintains a strong strategic position built on its core material science capabilities, specifically in advanced adhesives and durable film technologies. The company leverages its expertise to supply high-performance, specialty label products, particularly in the arduous Engine and Exterior application segments. Their key offering includes specialized adhesive transfer tapes and high-temperature resistant vinyl and polyester films, which are critical for VIN plates, under-hood warning labels, and components subjected to extreme thermal cycling and chemical exposure. 3M's positioning is rooted in providing premium, engineered solutions where label failure is simply not an option, making them a key supplier for high-end and performance-focused OEMs.

Avery Dennison Corporation

Avery Dennison is positioned as a global leader, focusing heavily on pressure-sensitive materials science and the expansion of its intelligent labels platform. Their strategy centers on providing a broad portfolio of conventional and high-tech label substrates, including specialized films like Polypropylene and Polyester. A critical area of focus is the development and commercialization of RFID Tags and inlay technology, directly addressing the automotive industry's growing imperative for "Track & Trace" solutions across the supply chain. By integrating its material and digital tracking capabilities, Avery Dennison positions itself to capture the long-term growth in automated logistics and component authentication, moving beyond traditional labeling into functional technology solutions for the modern vehicle.

CCL Industries

CCL Industries operates through a decentralized global network, allowing it to meet the diverse local, high-volume production demands of global OEMs. The company's strategy involves leveraging its massive conversion capacity and broad range of printing and finishing technologies to offer competitive solutions across all market segments, from simple Branding and Paper logistics labels to complex technical labels. Their competitive edge lies in scale and regional proximity, enabling them to service just-in-time delivery requirements efficiently across major manufacturing regions. CCL's diversified portfolio provides a stable revenue stream less dependent on a single label material or technology segment, allowing it to compete effectively in both the high-volume (e.g., Asia-Pacific) and high-specification (e.g., Europe) markets.

________________________________________

Automotive Labels Market Recent Developments:

- October 2025: Taylor Corporation completed the acquisition of Gooten, a leading print-on-demand technology provider. The merger integrates Gooten's OrderMesh platform and fulfillment network with Taylor's manufacturing and global tech expertise. This move significantly scales up their print-on-demand offerings, which include labels and packaging, impacting supply chain capabilities for various industries, including automotive parts.

- July 2024: AWT Labels & Packaging acquired American Label Technologies (ALT), a major provider of innovative RFID and label solutions across North America. The acquisition significantly bolsters AWT's portfolio, particularly in high-growth areas like RFID and NFC printing technologies. This expansion directly addresses the increasing demand for advanced traceability and inventory management in the automotive and warehousing sectors.

________________________________________

Automotive Labels Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 6.349 billion |

| Total Market Size in 2031 | USD 8.406 billion |

| Growth Rate | 5.78% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Labels Market Segmentation:

- By Type

- Branding

- Track & Trace

- Warning & Safety

- Asset Labels

- Other Types

- By Technology

- Barcode

- QR Code

- RFID Tags

- By Application

- Interior

- Exterior

- Engine

- Other

- By Material

- Vinyl

- Polyester

- Polypropylene

- Paper

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America