Report Overview

Global Automotive Electric Power Highlights

Automotive Electric Power Steering Market Size:

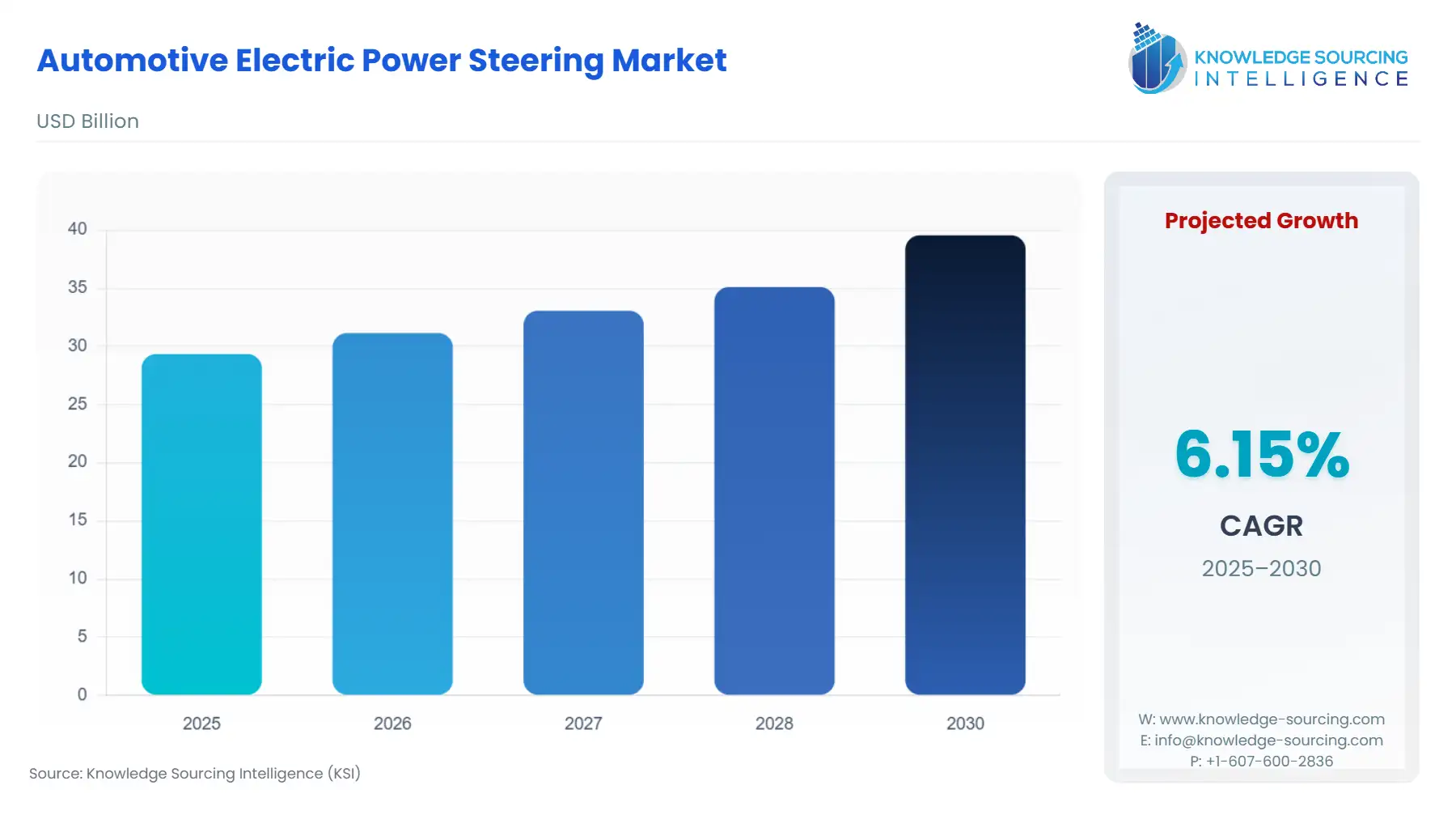

The Global Automotive Electric Power Steering Market is expected to grow from USD 29.346 billion in 2025 to USD 39.559 billion in 2030, at a CAGR of 6.15%.

Automotive Electric Power Steering Market Trends:

This growth is attributed to the increase in demand for better steering systems that minimize driver effort and make driving safer and more convenient.

Power steering is a type of steering system that provides assistance to the driver by increasing the steering effort needed to turn the steering wheel, thus making it simpler to turn. Electric power steering is a type of power steering system that is abbreviated as EPS or EPAS. It can also be called motor-driven power steering or MDPS. The electric power steering system uses an electric motor to provide power assistance to the driver while steering. There are sensors that detect the position and torque of the steering column and send this information to the electronic power steering module, which then controls the speed of the motor and provides the required torque according to different driving conditions and situations.

EPS system has many advantages as well such as they are very effective and fuel efficient due to the no running hydraulic pump. There is also there is no chance of leakage of hydraulic fluid. Another advantage is that there are no hydraulic pumps, hoses, or components mounted on the chassis. The key players are actively involved in bringing new technologies and making investments in improving the electric power steering market. For example, in October 2020, Nexteer Automotive introduced High-Output Electric Power Steering (EPS), which offers cutting-edge safety and comfort features as well as improved fuel efficiency for heavy-duty (HD) trucks and light commercial vehicles (LCVs). Also, in November 2020, Scania launched Electrically Assisted Steering. The electrically assisted steering improves the driving experience and enables new or improved driver support systems.

As the demand for better technologies in the steering systems of vehicles is rising, there are better technologies being incorporated in cars to improve the driving safety and driving experience so that people can enjoy a comfortable drive. These factors are driving the automotive electric power steering market.

Automotive Electric Power Steering Market Segmentation Analysis:

- By Product Type

On the basis of product type, the global automotive electric power steering market is segmented as C-EPS, P-EPS, and R-EPS. C-EPS holds a notable amount of share in the market owing to the fact that the demand for passenger cars is increasing and most of the passenger cars that are produced come with C-EPS.

- By Vehicle type

On the basis of vehicle type, the global automotive electric power steering market is segmented as passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles hold a significant amount of market share due to the increasing production and demand for passenger vehicles and more demand for better steering systems to improve driving safety and convenience.

- By Geography

By geography, the global automotive electric power steering market is segmented as North America, Europe, Middle East & Africa, Asia-Pacific, and South America. Asia-Pacific holds a significant share of the market owing to the fact that the demand and production of vehicles are greater in this region.

Automotive Electric Power Steering Market Competitive Landscape:

The presence of diverse international, regional, and local players makes the global automotive electric power steering market competitive. The competitive landscape details key players' strategies, products, and investments in various technologies and companies to increase their market presence.

Automotive Electric Power Steering Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 29.346 billion |

| Total Market Size in 2031 | USD 39.559 billion |

| Growth Rate | 6.15% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Vehicle Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Electric Power Steering Market Segmentation:

- By Product Type

- C-EPS

- P-EPS

- R-EPS

- By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America