Report Overview

Global Alternator Market - Highlights

Alternator Market Size:

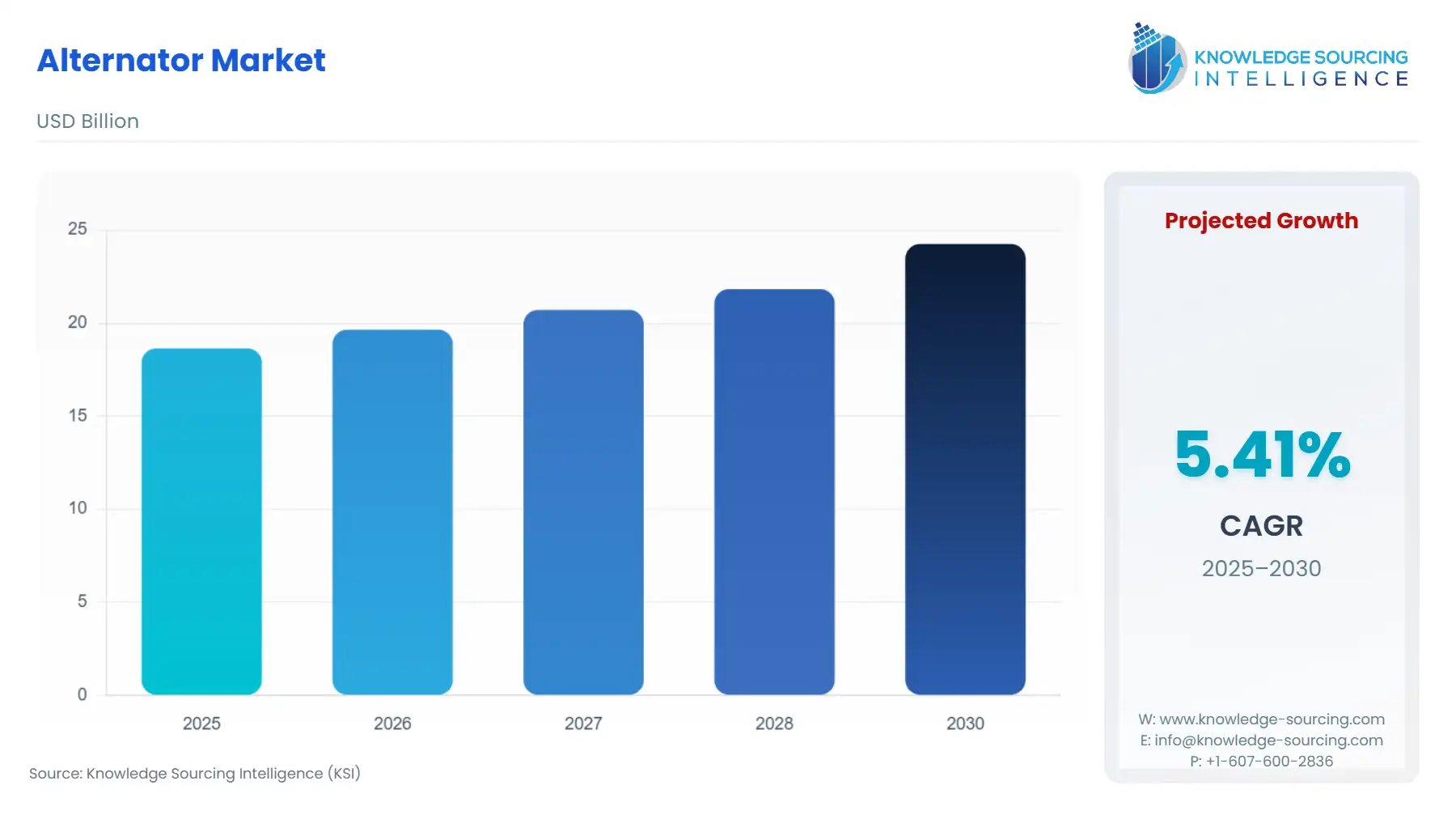

Global Alternator Market is forecasted to rise at a 5.25% CAGR, reaching USD 25.338 billion in 2031 from USD 18.642 billion in 2025.

An alternator is an electromechanical device that converts mechanical energy into electrical energy, and it works on the principle of electromagnetic induction. Different alternators include salient poles and cylindrical poles, which are applicable in the automotive, marine, oil & gas, and mining sectors as they provide a reliable electrical power source for various equipment and systems.

The increased automotive and oil & gas production and the rise in marine vessel manufacturing are driving the global alternator industry growth.

Alternator Market Growth Drivers:

Bolstering Automotive Production

Alternators are essential for vehicles as they provide electrical power to various systems and accessories. There is a higher need for alternators to support the electrical requirements of the vehicles, with more cars being manufactured. Additionally, advancements in automotive technology, such as integrating more electrical components and the growing popularity of electric and hybrid vehicles, further contribute to the global alternator market growth. According to the International Organization of Motor Vehicle Manufacturers (OICA), global car production increased by 6% in 2022 compared to the previous year.

Rise in Marine Vessel Production

There is an increased need for electrical power in vessels as marine activities expand, such as commercial shipping, offshore exploration, fishing, and leisure boating. Alternators are critical in supplying electricity for various marine systems, including propulsion, navigation, communication, lighting, refrigeration, and entertainment. The rise in vessel manufacturing propels the global alternator market expansion. According to the Food and Agriculture Organization, Africa's fleet and fishing vessels had increased compared to other countries and comprised 23.5% of the world’s fishing vessels.

Increased Oil & Gas Production

Alternators provide reliable and continuous electrical power for essential equipment, machinery, and systems involved in exploration, drilling, pumping, and processing activities. Increased oil and gas production is expected to drive the global alternator market growth. According to a U.S. Energy Information Administration report in 2023, OPEC crude oil production reached 37.66 million barrels per day in September 2023.

Alternator Market Geographical Outlook:

The Asia-Pacific region is anticipated to witness a notable rise in market share

The Asia-Pacific will account for a significant share of the global alternator market due to the growing marine activities, oil & gas, and EV production.

In 2021, under the 14th Five-Year Plan (2021-2025), the Chinese government implemented strategies like summarizing and analyzing the regulations to improve marine equipment production. Similarly, in December 2022, Mahindra & Mahindra planned to invest Rs 10,000 crore (US$ 1.2 billion) in an EV manufacturing plant in Pune, India. These developments drive the demand for alternators in Asia Pacific.

Alternator Market Recent Developments:

In April 2023, American Power Systems launched "lower turn-on RPM alternators". These allowed end-users to begin charging even at low or idling speeds and were ideal for use in vehicles with onboard lithium battery bank systems like yachts, work trucks, and sailboats.

In August 2022, Prestolite Electric introduced the "IdlePro Extreme™ M-Series alternators" to boost performance and protection against dust and particle infiltration in mining applications. Such products drive the alternator industry growth.

In May 2022, Dragonfly Energy acquired Wakespeed Offshore, an alternator regulator supplier, to offer complete alternator-connected systems to RV consumers and manufacturers.

In January 2022, Chengdu Huachuan Electric Parts Co., Ltd. acquired the type 3 alternator business of Denso Corporation to strengthen their product line in China in the priority fields.

In September 2020, DENSO launched the PowerEdge Heavy-duty J180 Mount Alternator. This expanded the coverage of DENSO's high-performance PE starters and alternators to more than 90% of all Class 8 trucks on the road today.

Alternators Market Players and Products:

Traction alternator WGX series: This ABB product is a three-phase alternator with a compact size, high speed, and traction that can be used for generators and locomotives.

RF2 AC 2: This product produced by RFL Alternators is a permanent magnet alternator series ideal for portable, industrial applications where minimal size and weight are required. The innovative permanent magnet alternators incorporate a fully embedded rotor design and are powered by strong rare earth Neodymium magnets.

Alternator Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 18.642 billion |

| Total Market Size in 2031 | USD 24.256 billion |

| Growth Rate | 5.41% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Phase, Power Output, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Alternator Market Segmentation:

By Type

Salient Pole

Cylindrical Rotor

By Phase

Single Phase

Three Phase

By Power Output

Up to 20 kW

20 to 100 kW

Greater than 100 kW

By End-User

Automotive

Marine

Oil & Gas

Manufacturing

Energy & Power

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others