Report Overview

Glass Installation Services Market Highlights

Glass Installation Services Market Size:

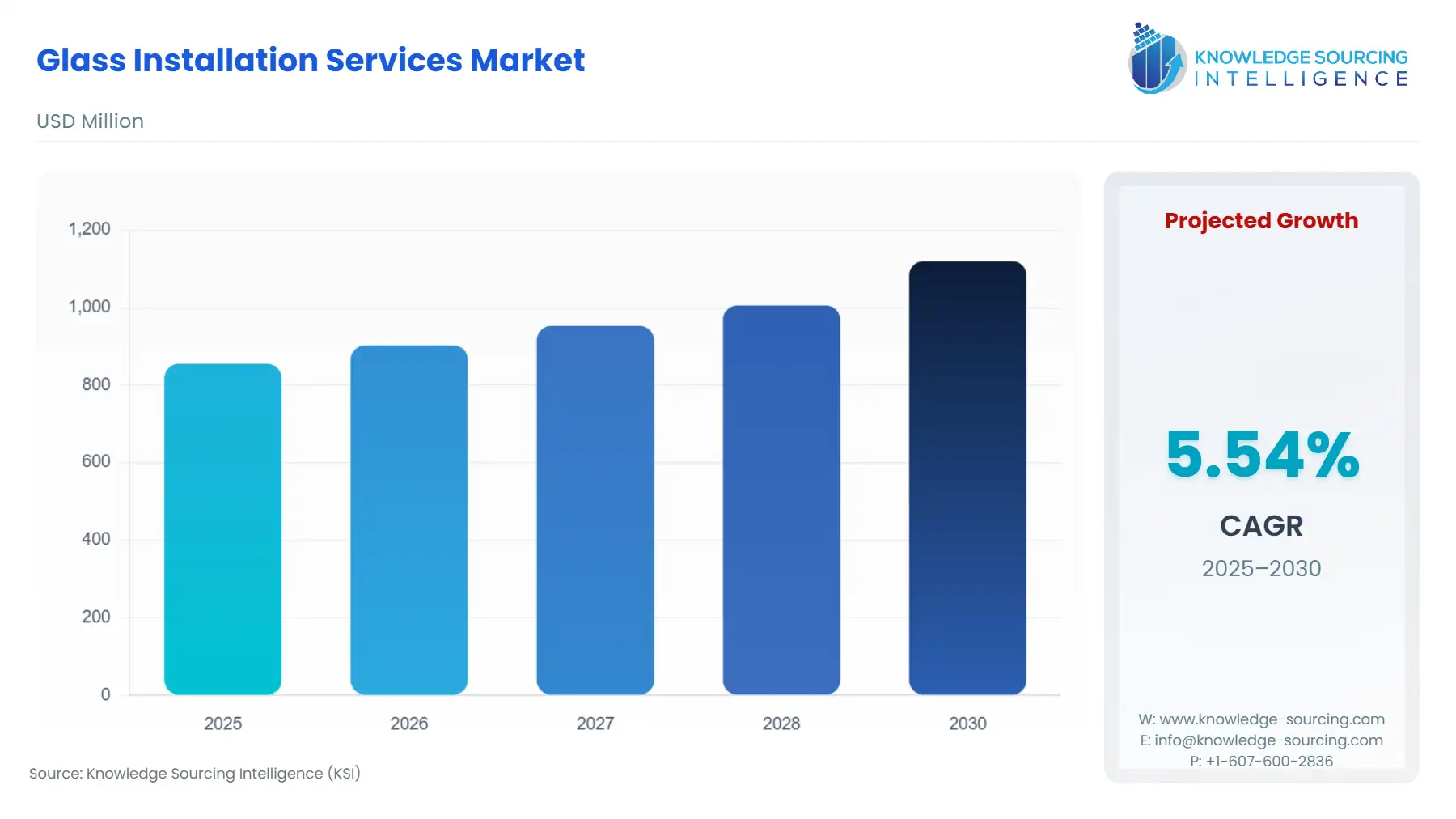

The Glass Installation Services Market is projected to grow at a CAGR of 5.54% and reach US$1,120.193 million in 2030 from US$855.475 million in 2025.

Multiple reasons drive the glass installation services market’s expansion. One major reason is the growing rate of urbanization, mainly from the developing regions of Asia and Africa. Glasses can reduce significant energy consumption along with thermal insulation. According to the World Bank, 56% of the world’s population already lives in cities. This urbanization is growing significantly, and it is expected that by 2050, nearly 7 out of 10 people will live in cities.

This propelling growth in urban settlements has significantly increased the demand for construction and industrial projects, boasting the glass installation services market.

Glass Installation Services Market Overview & Scope:

The Glass Installation Services Market is segmented by:

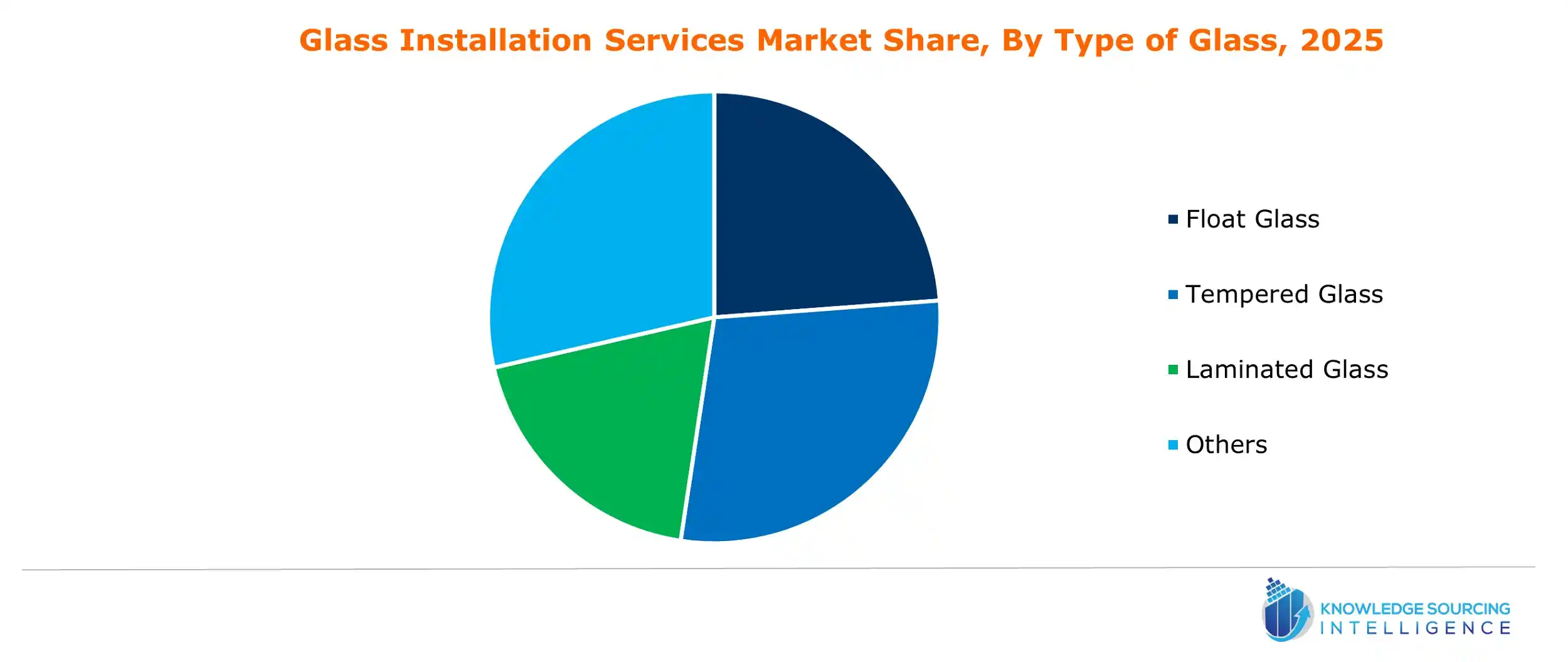

- Type Of Glass: By type of glass, the glass installation services market is segmented into float glass, tempered glass, laminated glass, smart glass, bulletproof glass, and others. The energy-saving and heat-resistance glasses have a major application during the forecast period.

- Application: The glass installation services market is segmented by application into construction, automotive, retail, healthcare, aerospace, and others. The construction industry is the major application of glass installation services, while the automotive sector will surge at a notable pace during the forecast period.

- Service Type: By service type, the glass installation services market is segmented into new installation, replacement services, repair and maintenance, custom fabrication and installation, and emergency services.

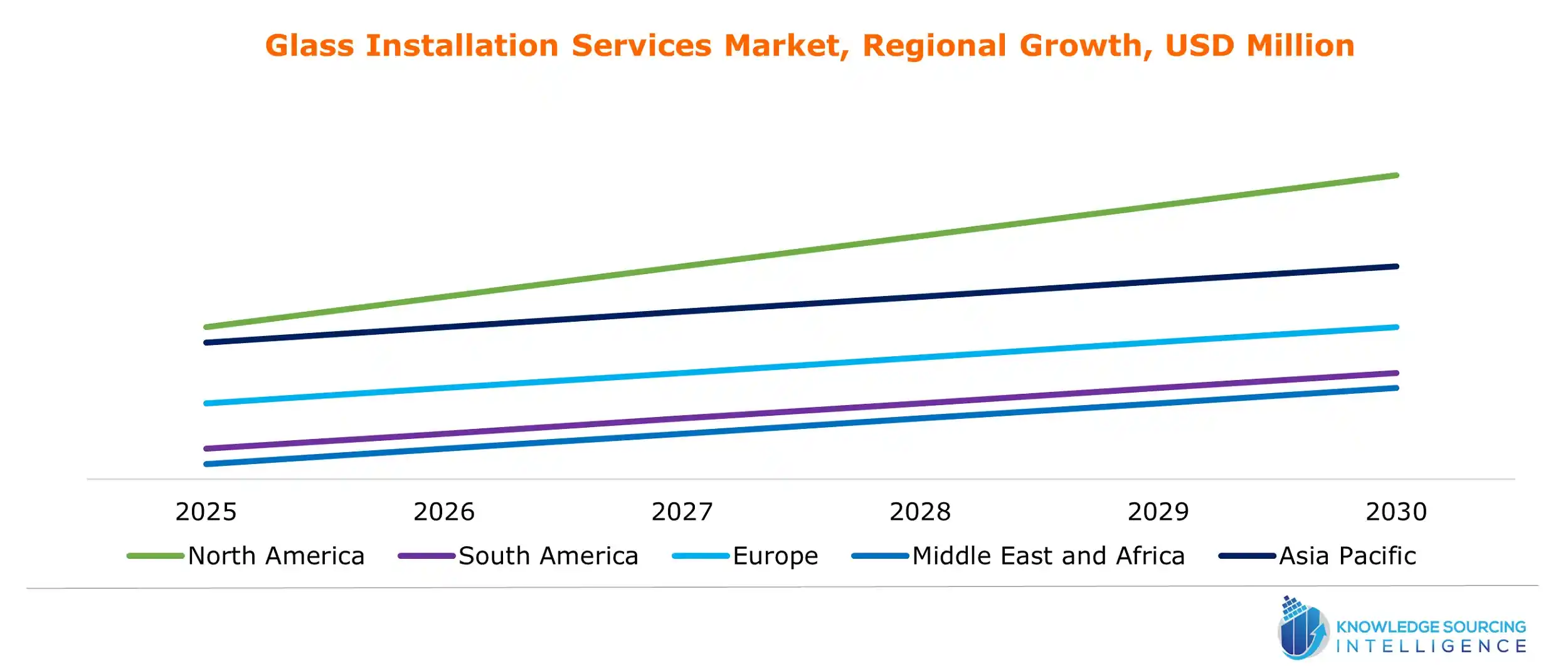

- Region: The glass installation services market is segmented by geography into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

Top Trends Shaping the Glass Installation Services Market:

1. Rising understanding of circularity:

- There has been a growing number of companies applying circularity in their overall operations. In September 2024, AGC Glass Europe and ROSI entered a strategic partnership agreement. This partnership will contribute to more circular and low-carbon production practices. It will create a more sustainable future for the solar and glass industries.

2. Advancement of Technology:

- Changing technological processes are notable in the glass industry. In September 2024, Glaston, the inventor of the Thermo Plastic Spacer, developed a new processing method suitable for installing thin glass into triple-insulating glass units. The construction industry’s tightening regulations for energy efficiency demands more from the architectural segment, which has been crucial for the application of better technologies.

Glass Installation Services Market: Growth Drivers vs. Challenges:

Opportunities:

- Rising demand for energy-efficient buildings: The increasing demand for smart solutions in buildings is driving the adoption of smart glass and glass installation services. These glasses can reduce buildings' heating and cooling loads, thus saving energy.

- Growth of urbanization: Rapid urbanization is leading to increased construction activities. Solar control glass blocks and absorbs sunlight and solar heat from entering the building. Solar Control Low-E glass can combine solar control properties and low emissivity in a single glass unit. These benefits while constructing new buildings are essential for the glass installation services market's growth.

Challenges:

- Price volatility: The price volatility due to the supply-chain constraint is a serious challenge in the industry.

Glass Installation Services Market Regional Analysis:

- Asia-Pacific: The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries. According to the World Integrated Trade Solution (WITS), in 2023, India imported 12,002,100 Kg of safety glass laminated for vehicles, aircraft, etc., and Japan 14,771,800 Kg of the same material.

Glass Installation Services Market: Competitive Landscape:

The market is fragmented, with many small and medium-sized players, including Asahi Glass Co., Ltd. (AGC), Central Glass Co., Ltd., Beijing Glass Group, Lowe's, Service on Wheel, Glass Doctor, Glass USA Inc., Portland Glass, Schott AG, Oldcastle BuildingEnvelope, Trulite Glass & Aluminum Solutions, and Jeld-Wen Holding, Inc., among others:

- Collaboration: In May 2024, Asahi India Glass Limited and INOX Air Products entered into a 20-year agreement for supplying Green Hydrogen. This would be India’s first-ever Green Hydrogen Plant for the Float Glass industry, paving the way for sustainable glass production.

- Acquisition: In September 2024, PGW Auto Glass, LLC acquired PH Vitres d’Autos and affiliates from Driven Brands. PH Vitres d’Autos is a leading provider of wholesale auto glass distribution, retail installation, and related services in eastern Canada.

- New Service: In January 2025, Glassoco launched its residential glass replacement and repair services. The residential glass replacement services offer cost-effective services.

Glass Installation Services Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Glass Installation Services Market Size in 2025 | US$855.475 million |

| Glass Installation Services Market Size in 2030 | US$1,120.193 million |

| Growth Rate | CAGR of 5.54% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Glass Installation Services Market |

|

| Customization Scope | Free report customization with purchase |

Glass Installation Services Market is analyzed into the following segments:

By Type of Glass

- Float Glass

- Tempered Glass

- Laminated Glass

- Smart Glass

- Bulletproof Glass

- Others

By Application

- Construction

- Automotive

- Retail

- Healthcare

- Aerospace

- Marine

- Energy

By Service Type

- New Installation

- Replacement Services

- Repair and Maintenance

- Custom Fabrication and Installation

- Emergency Services

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Our Best-Performing Industry Reports:

- Outsourced Semiconductor Assembly And Test Services (OSAT) Market

- Adaptive AI Market

- Animal Feed Market