Report Overview

Fuel Injection Market Report, Highlights

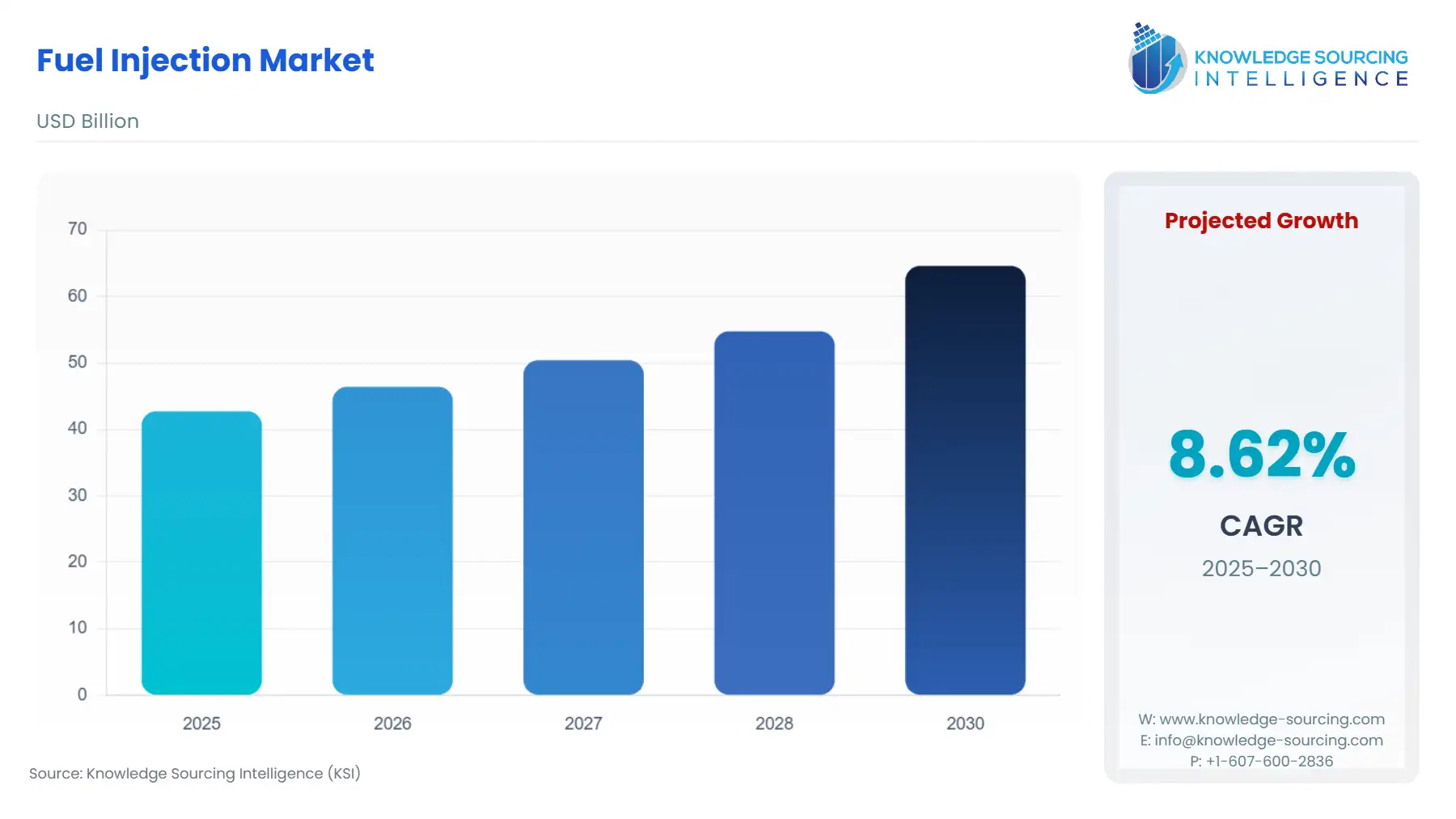

Fuel Injection Market Size:

The Fuel Injection Market is expected to grow from USD 42.741 billion in 2025 to USD 64.619 billion in 2030, at a CAGR of 8.62%.

Introduction to the Fuel Injection Market:

The fuel injection market is a critical segment of the global automotive and industrial sectors, underpinning advancements in internal combustion engine (ICE) technology and supporting the transition toward more efficient and environmentally sustainable transportation and machinery. Fuel injection systems, which deliver precise amounts of fuel into an engine’s combustion chamber, have become indispensable for optimizing performance, enhancing fuel efficiency, and reducing emissions in both automotive and non-automotive applications. These systems have largely replaced carburetors due to their ability to provide accurate fuel delivery, adapt to varying engine conditions, and comply with stringent environmental regulations. As the world navigates the complexities of decarbonization, electrification, and sustainable industrial practices, the fuel injection market remains dynamic, driven by technological innovation, regulatory pressures, and evolving consumer demands.

Fuel injection systems are integral to modern ICEs, used in vehicles (passenger cars, commercial vehicles, and two-wheelers), marine engines, aerospace applications, and industrial machinery. These systems come in various forms, including port fuel injection (PFI), direct injection (DI), and common rail direct injection (CRDI), each offering distinct advantages in terms of efficiency, power output, and emissions control. The market encompasses components such as fuel injectors, electronic control units (ECUs), fuel pumps, and sensors, which work in tandem to ensure precise fuel delivery and combustion. The global push for cleaner energy and stricter emissions standards, such as Euro 7 in Europe and Bharat Stage VI in India, has accelerated the adoption of advanced fuel injection technologies, particularly in regions with robust automotive industries like Asia-Pacific, Europe, and North America.

The fuel injection market is poised for steady growth through the late 2020s and early 2030s, driven by the continued relevance of ICEs in hybrid vehicles, heavy-duty transport, and industrial applications, even as electric vehicles (EVs) gain traction. According to a 2025 report by the International Energy Agency (IEA), while EVs are projected to account for a significant share of new vehicle sales by 2030, ICE vehicles, particularly hybrids, will remain dominant in many markets due to infrastructure limitations and cost considerations. This sustained demand for ICEs underscores the importance of fuel injection systems in achieving efficiency and compliance with environmental standards.

Fuel Injection Market Drivers:

- Stringent Emissions Regulations

Global efforts to combat climate change and reduce air pollution have led to increasingly stringent emissions standards, compelling manufacturers to adopt advanced fuel injection systems. Regulations such as the European Union’s Euro 7, set to take effect in 2027, mandate significant reductions in nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter from ICE vehicles. These standards require precise fuel delivery and combustion control, which modern fuel injection systems, such as CRDI and gasoline direct injection (GDI), are designed to achieve. Similarly, India’s Bharat Stage VI (BS-VI) norms, fully implemented by 2020 and reinforced through 2025, have driven demand for high-precision fuel injection systems in one of the world’s largest automotive markets. These regulations apply to passenger and commercial vehicles and to off-road machinery and marine engines, broadening the market’s scope. For instance, a 2025 press release from the European Commission highlights that Euro 7 will introduce real-world emissions testing, pushing manufacturers to integrate advanced fuel injection technologies to meet compliance. This regulatory pressure is a key driver, as non-compliance risks penalties and market exclusion.

- Demand for Fuel Efficiency

Rising fuel prices and consumer demand for cost-effective vehicles have intensified the focus on fuel efficiency, making advanced fuel injection systems critical. Systems like GDI and CRDI optimize the air-fuel mixture, enabling better combustion and reducing fuel consumption. A 2025 technical paper by the Society of Automotive Engineers (SAE) notes that GDI systems can improve fuel economy by up to 15% compared to traditional port fuel injection (PFI) systems, particularly in passenger cars and light commercial vehicles. This efficiency is especially vital in emerging markets like India and Southeast Asia, where fuel costs significantly impact vehicle operating expenses. Additionally, fleet operators in commercial sectors, such as logistics and construction, prioritize fuel-efficient vehicles to reduce operational costs. The push for efficiency also aligns with global sustainability goals, as lower fuel consumption directly reduces CO2 emissions, further incentivizing investment in fuel injection technologies.

- Growth in Hybrid Vehicles

The rise of hybrid electric vehicles (HEVs), which combine ICEs with electric powertrains, is a significant driver for the fuel injection market. Hybrids rely on efficient ICEs to complement their electric components, particularly in scenarios where EV infrastructure is limited or for applications requiring extended range. Fuel injection systems, particularly GDI and multi-point fuel injection (MPFI), enhance the performance of ICEs in hybrids, ensuring optimal power delivery and fuel economy. For example, Toyota’s hybrid models, such as the Corolla Hybrid, rely on advanced fuel injection systems to achieve high efficiency, as highlighted in their 2025 product specifications. This trend sustains demand for fuel injection systems even as the automotive industry shifts toward electrification.

- Advancements in Technology

Continuous innovation in fuel injection technologies is a major growth driver, enabling manufacturers to meet performance, efficiency, and regulatory requirements. High-pressure fuel injectors, advanced electronic control units (ECUs), and integrated sensors have improved the precision and reliability of fuel delivery. In 2025, Bosch introduced a 3,500-bar common rail system for diesel engines, which enhances fuel atomization, improves combustion efficiency, and reduces emissions by up to 10% compared to previous systems. Delphi Technologies launched an upgraded GDI system in 2025, designed for hybrid vehicles and high-performance engines, offering improved injector precision to meet Euro 7 standards. These advancements address regulatory demands and cater to consumer preferences for high-performance vehicles, particularly in premium and commercial segments, driving market expansion.

Fuel Injection Market Restraints

- Rise of Electric Vehicles

The swift adoption of EVs presents a significant long-term challenge to the fuel injection market. Governments worldwide are supporting EVs through subsidies, tax incentives, and investments in charging infrastructure, decreasing the demand for ICE vehicles in certain segments, especially passenger cars. The IEA projects that EVs may comprise 35% of global vehicle sales by 2035, with Europe and China at the forefront of the transition. Although hybrids and commercial vehicles will maintain demand for fuel injection systems in the short term, the long-term shift toward electrification poses a threat to the market for ICE components. This trend is especially pronounced in urban areas and developed markets, where EV adoption is rapidly accelerating.

- High Development Costs

The development of advanced fuel injection systems requires substantial investment in research, design, testing, and manufacturing. Technologies like high-pressure CRDI systems and sophisticated ECUs involve complex engineering and precision manufacturing, increasing costs for original equipment manufacturers (OEMs). Small and medium-sized enterprises (SMEs) struggle to compete with industry leaders like Bosch, Denso, and Delphi, who dominate the market due to their scale and R&D capabilities. Additionally, integrating advanced systems into vehicles raises production costs, which may be passed on to consumers, potentially limiting adoption in price-sensitive markets.

- Complexity of Maintenance

Advanced fuel injection systems, such as GDI and CRDI, are complex and require specialized maintenance, which can increase vehicle ownership costs. These systems rely on high-precision components like injectors and ECUs, which demand skilled technicians and specialized diagnostic tools for repairs. In regions with limited access to trained professionals or spare parts, such as parts of Africa and South Asia, this complexity can discourage adoption. A 2025 report by SAE highlights that GDI systems, while efficient, are prone to carbon buildup on intake valves, requiring periodic maintenance that can be costly for consumers. This maintenance burden may deter buyers in cost-conscious markets, constraining market growth.

Fuel Injection Market Segmentation Analysis:

- By Type of Injection, the direct injection segment is growing substantially

Direct injection, particularly GDI and CRDI for diesel engines, is the dominant type of fuel injection system due to its superior fuel efficiency, performance, and emissions control. Unlike single-point, continuous, central port, multipoint, or swirl injection, direct injection delivers fuel directly into the combustion chamber at high pressure, enabling precise control over the air-fuel mixture and combustion process. This results in improved fuel economy and reduced emissions, aligning with stringent regulations like Euro 7 and Bharat Stage VI. GDI systems are widely used in modern passenger cars and hybrids, while CRDI dominates in diesel-powered commercial vehicles and heavy machinery. In 2025, Bosch introduced a 3,500-bar CRDI system, enhancing fuel atomization and reducing emissions by up to 10% compared to previous systems. The global gasoline direct injection market was valued at USD 5.61 billion in 2023, with significant growth projected due to its adoption in hybrid and high-performance vehicles. Direct injection’s dominance is driven by its ability to meet regulatory demands and consumer preferences for efficiency and power, making it a cornerstone of modern fuel injection systems.

- By Application, the diesel engine vehicles segment is expected to rise robustly

Diesel engine vehicles represent the leading application segment for fuel injection systems, driven by their widespread use in commercial vehicles, heavy-duty trucks, construction equipment, and industrial machinery. Diesel engines rely heavily on advanced fuel injection systems like CRDI to achieve high efficiency, torque, and compliance with emissions standards. The global push for cleaner diesel engines, spurred by regulations such as Euro 7 (effective 2027) and India’s BS-VI, has accelerated the adoption of high-pressure CRDI systems, which optimize fuel delivery and reduce NOx and particulate matter emissions. For instance, Delphi Technologies’ 2025 CRDI system upgrade enhances injector precision, supporting compliance with stringent standards while improving fuel economy in heavy-duty applications. Diesel engine vehicles remain critical in regions with limited EV infrastructure, such as Asia-Pacific and parts of South America, where diesel-powered commercial fleets dominate logistics and transportation. This segment’s prominence is fueled by the durability and efficiency of diesel engines in high-demand applications, despite the long-term rise of electrification.

- By End-User, the automotive sector is anticipated to hold the largest market share

The automotive sector is the largest end-user segment for fuel injection systems, encompassing passenger cars, commercial vehicles, and two-wheelers. Fuel injection systems are integral to modern ICEs and HEVs, enabling compliance with emissions regulations and meeting consumer demands for fuel efficiency and performance. The automotive industry’s reliance on fuel injection is evident in the widespread adoption of GDI systems in passenger cars and CRDI in commercial vehicles. Innovations like Bosch’s 3,500-bar CRDI system and Delphi’s upgraded GDI system cater to automotive applications, enhancing efficiency and reducing emissions. The automotive sector’s dominance is underpinned by its scale, regulatory pressures, and the ongoing need for advanced fuel injection technologies in both traditional and hybrid vehicles.

Fuel Injection Market Geographical Outlook:

- The Asia-Pacific market is growing significantly

Asia-Pacific is the leading geographic segment for the fuel injection market, driven by its robust automotive industry, rapid industrialization, and large consumer base. Countries like China, India, Japan, and South Korea are key contributors, with high demand for fuel injection systems in passenger cars, commercial vehicles, and two-wheelers. China and India, in particular, have seen significant growth due to their large vehicle production volumes and stringent emissions regulations, such as China’s National VI and India’s BS-VI standards. For example, India’s BS-VI norms have driven the adoption of advanced CRDI systems in diesel vehicles. Japan and South Korea lead in hybrid vehicle production, with companies like Toyota and Hyundai integrating GDI systems for efficiency. The region’s market growth is further supported by industrial applications, such as construction and agricultural machinery, which rely on diesel engines. Asia-Pacific’s dominance is fueled by its economic growth, regulatory frameworks, and significant automotive manufacturing base.

Fuel Injection Market Key Developments:

- EU Euro 7 Implementation (2024): The upcoming Euro 7 regulations will enforce stricter emissions limits, driving demand for advanced fuel injection systems across Europe. Manufacturers are already adapting their product lines to meet these standards.

- Expansion (2024): Standard Motor Products, Inc. announced the expansion of its aftermarket-prominent gasoline fuel injection program which presents 2,100 parts inclusive of MFI, TBI and GDI injectors.

Fuel Injection Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Fuel Injection Market Size in 2025 | US$42.741 billion |

| Fuel Injection Market Size in 2030 | US$64.619 billion |

| Growth Rate | CAGR of 8.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Fuel Injection Market |

|

| Customization Scope | Free report customization with purchase |

Fuel Injection Market Segmentation:

- By Type of Injection

- By Application

- By End-User

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America