Report Overview

Food and Beverages Anti-Counterfeit Highlights

Food and Beverages Anti-Counterfeit Packaging Market Size:

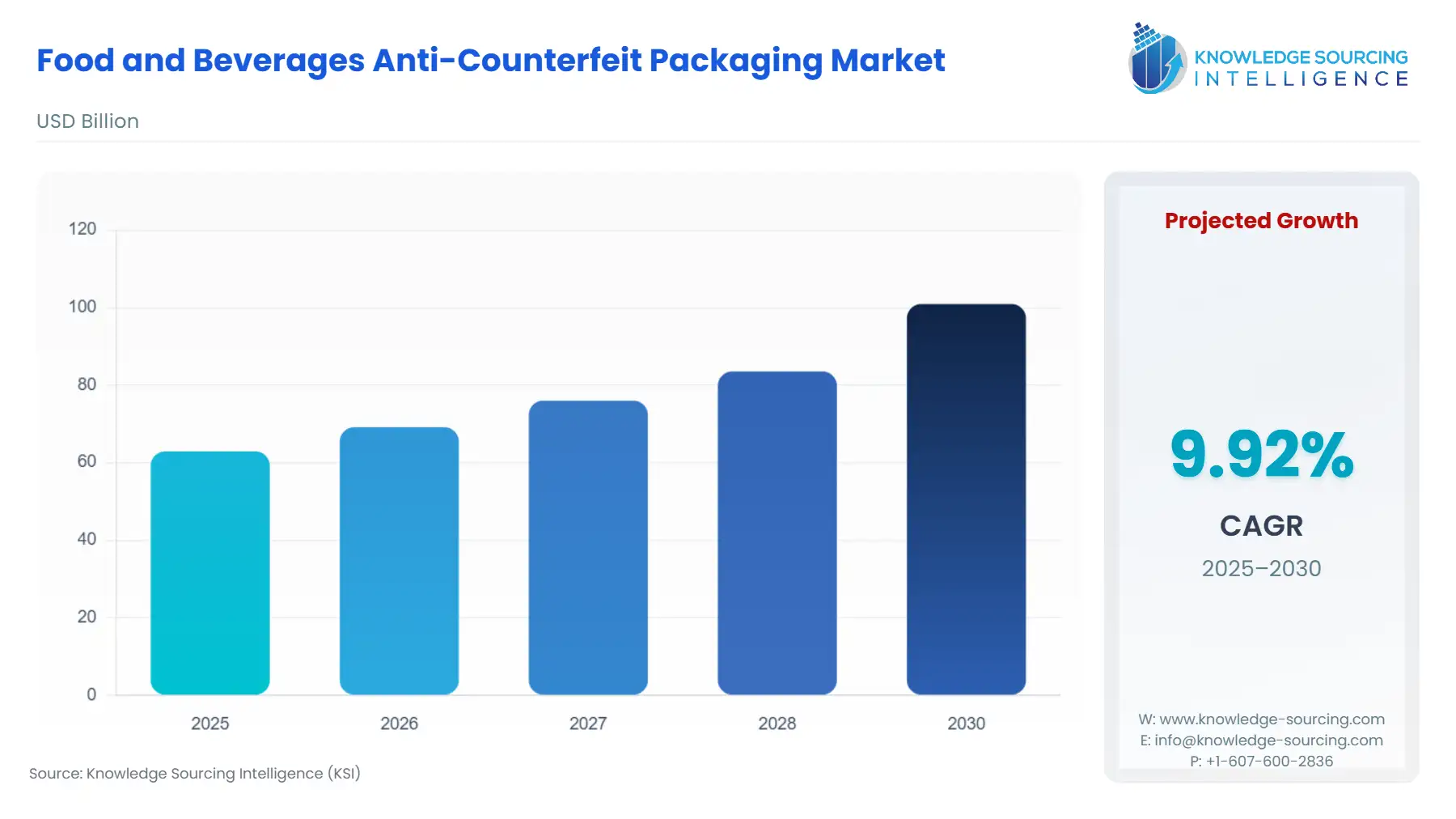

The Food And Beverages Anti-Counterfeit Packaging Market will reach US$100.952 billion in 2030 from US$62.917 billion in 2025 at a CAGR of 9.92% during the forecast period.

Food and Beverages Anti-Counterfeit Packaging Market Trends:

The demand for food and beverage anti-counterfeit packaging will surge due to the growing concerns regarding health risks associated with the sales and consumption of low-quality food products. Additionally, this, in turn, results in huge economic losses to the manufacturers and the company. Hence, with the adoption of anti-counterfeit authentication technologies, the market is poised to hold strong prospects for growth during the forecast period. Authentication is referred to as the act of establishing or confirming a product as genuine. This is of immense importance due to the prevalence of counterfeit food and beverage products owing to a lack of consumer awareness, which may lead to deleterious health effects. Hence, anti-counterfeit authentication technologies protect against the sale of false products. Authentication is done via overt or hidden features on the product packaging. These features include optical variable coatings with changing colours, thermochromic inks, and watermarks. Other features include barcodes, holograms, and RFID tags. Growing counterfeit concerns are further providing an impetus to fuel the market demand during the forecast period. The presence of regulations to take action against counterfeiting is also contributing to driving the market growth during the forecast period. Furthermore, the growing retail industry is further augmenting the market demand in the forecast period, especially with the rise in contactless shopping of food and beverage items.

- Additionally, technological advancements in anti-counterfeit technologies will provide an opportunity for the market to thrive during the forecast period.

The market is projected to rise during the course of the forecast period in the form of an opportunity provided by significant technological advancements made in the anti-counterfeit sector.

It has been observed that companies are adopting AI solutions for anti-counterfeit applications. The company provides artificial intelligence (AI)-based counterfeit solutions in quality control, image analysis and understanding, and many other applications. Today, the company offers digitally invisible anti-counterfeit and product authentication solutions to Forbes Global 2000 companies and, at present, protects more than 30 billion branded products throughout a wide range of industries at the global level. For the wine & spirits industry, the company offers a patented security solution, Crytoglyph® technology. Counterfeit alcoholic beverages are a growing problem for producers and consumers. To fight the growing wine and liquor fraud practices, the company’s products require no visible markings, no additional consumables, no special reading devices, and no changes to production processes. The product can be applied to spirits and aluminium closures and tin capsules by using regularly visible varnish and standard printing processes. Furthermore, advancements like the introduction of edible barcode technology are further providing an opportunity to drive market growth during the forecast period.

Food and Beverages Anti-Counterfeit Packaging Market Product Offerings:

- Zebra Technologies Corporation offers MC3330 integrated UHF RFID handhelds which are built for semi-industrial environments to bring a new level of speed, comfort, and accuracy to RFID applications. It has receiver sensibility which allows fast and accurate capture of the most difficult challenging RFID tags.

- Alien Technology an industry leader in electronic technologies like Radio Frequency Identification (RFID), and Ultra High Frequency (UHF) products and services unveiled its High-memory RFID IC and tags. Higgs 9 is the first product launched in its next generation of Higgs RFID semiconductor integrated circuits. It is a great asset tracking product as it has improved sensitivity coupled with an expanded memory capacity.

The global food and beverages anti-counterfeit packaging market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various anti-counterfeit packaging solutions and technologies, such as RFID tags, holograms, tamper-evident seals, and blockchain-based traceability, while exploring applications across industries including food safety, beverage authentication, and supply chain security. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Food and Beverages Anti-Counterfeit Packaging Market Segmentations:

Food and Beverages Anti-Counterfeit Packaging Market Segmentation by authentication technology:

The market is analyzed by authentication technology into the following:

Food and Beverages Anti-Counterfeit Packaging Market Segmentation by regions:

The study also analysed the food and beverages anti-counterfeit packaging market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Food and Beverages Anti-Counterfeit Packaging Market Competitive Landscape:

The global food and beverages anti-counterfeit packaging market features key players such as Cognex Corporation, Zebra Technologies Corporation, Alien Technology, LLC, Avery Dennison Corporation, and Flint Group, among others.

Food and Beverages Anti-Counterfeit Packaging Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by authentication technology, with historical revenue data and analysis.

- Food and Beverages anti-counterfeit packaging market is also analysed across different regions, with historical data, regional share, attractiveness and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the food and beverages anti-counterfeit packaging market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Food and Beverages Anti-Counterfeit Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Food and Beverages Anti-Counterfeit Packaging Market Size in 2025 | US$62.917 billion |

| Food and Beverages Anti-Counterfeit Packaging Market Size in 2030 | US$100.952 billion |

| Growth Rate | CAGR of 9.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Food and Beverages Anti-Counterfeit Packaging Market |

|

| Customization Scope | Free report customization with purchase |