Report Overview

Flow Cytometry Market - Highlights

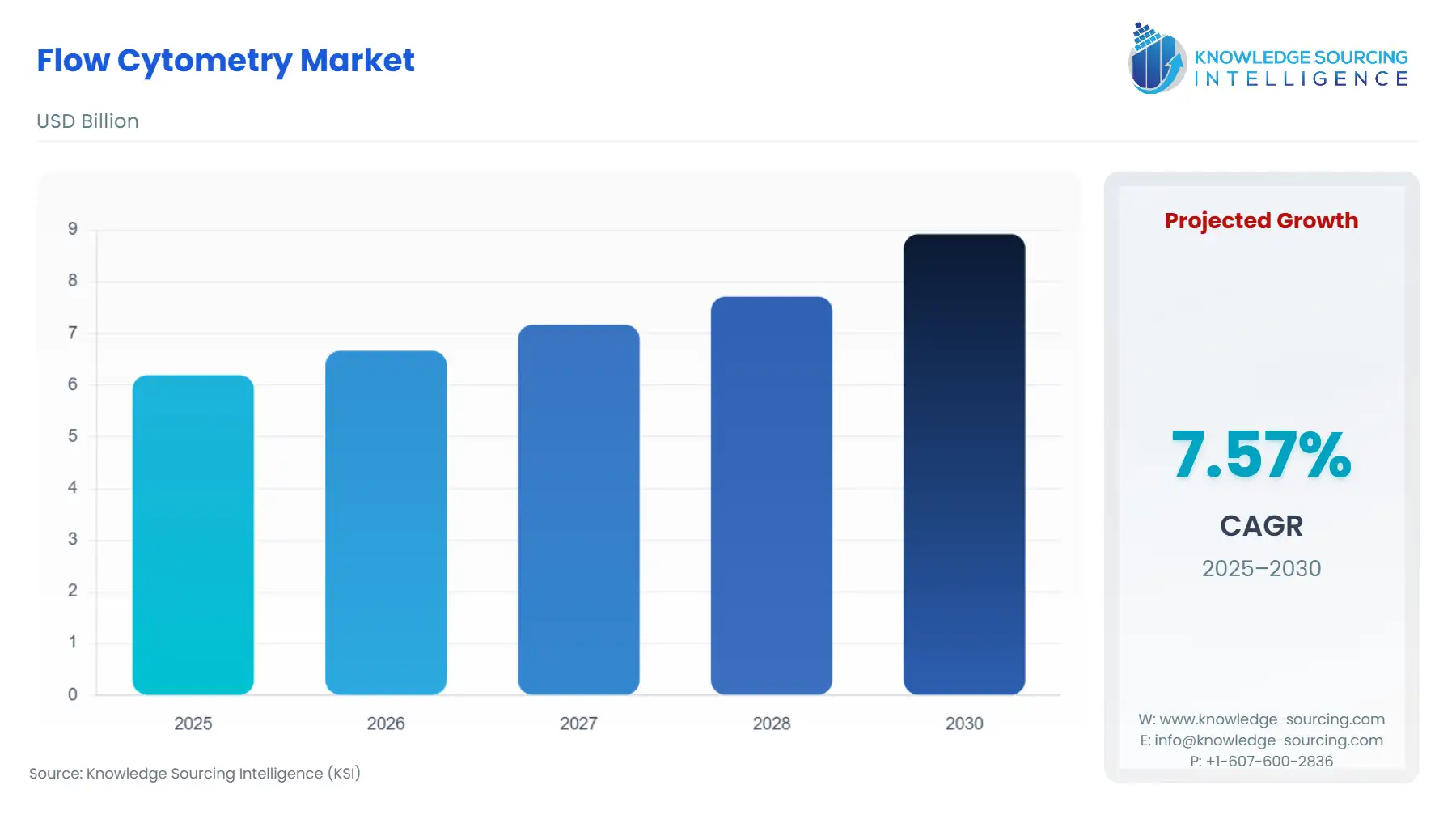

Flow Cytometry Market Size:

The flow cytometry market, at a 7.34% CAGR, is projected to increase from USD 6.196 billion in 2025 to USD 9.479 billion in 2031.

Flow cytometry is used to measure the characteristics of cells, intracellular proteins, certain functional immune characteristics, and biological effects. Wider application of cytometry in health benefits such as characterizing white blood cells in infectious diseases, and autoimmune disorders, and classifying leukemia or lymphoma is expected to boost the flow cytometry market. Moreover, the rising research initiatives backed by government investments and initiatives and recent technological advancements such as automation in flow cytometry are further expected to bolster the flow cytometry market. Additionally, there are rising cases of diseases such as HIV, cancer, and immunodeficiency disorders in which flow cytometry provides benefits is another growth driver of the flow cytometry market.

Flow Cytometry Market Growth Drivers:

Multiple Applications of Flow Cytometry

Flow Cytometry is used in a variety of procedures enabling the growth of the flow cytometry market. It provides a rapid analysis of single cells and their characteristics. It is used for immunophenotyping of a variety of specimens such as bone marrow, whole blood, serous cavity fluids, urine, cerebrospinal fluid, and solid tissues. It provides DNA and RNA content in the nucleus through fluorescent dyes such as propidium iodide. Moreover, it analyzes the red blood cell percentage, green cells, and other dull cells that provide the analysis of the heterogeneous population of cells. This rapid analysis and wider application in the healthcare and research domain is contemplated to expand the flow cytometry market size.

Rising HIV and Cancer Cases

Flow cytometry combined with PCR identifies the various HIV 1 subtypes and quantifies as few as 50 copies of the virus. The rising case of HIV globally is anticipated to boost the flow cytometry market size. According to WHO, around 38.4 million people were living with HIV in 2021 with around 6,50,000 deaths from HIV-related causes. Moreover, WHO considers HIV an epidemic, and since then, a total of 84.2 million people have been infected with HIV. The African region is the most affected region with almost 1 in 25 adults affected with HIV. According to the HIV Organization, around 85% of infected people were tested and knew their status while 15% remain unknown of their HIV status in 2021 demanding more HIV tests and studies.

Rising Immunodeficiency Disorders

Flow cytometry is used in immunophenotyping through the detection of fluorescent-enabled antigens causing immunodeficiency. Immunodeficiency disorders may result in partial or full impairment of the immune system with more than 300 primary immunodeficiency forms and secondary immunodeficiency. According to National Center for Biotechnology Information, around 6 million people are affected with primary immunodeficiencies with around 70 to 90% remaining undiagnosed. Primary Immunodeficiencies can expose people to various forms of bacteria, viruses, fungi, and protozoa leading to lifelong healthcare concerns such as cancer, inflammation, and other immune diseases. The application of flow cytometry in immunodeficiency and its adverse effects is another growth factor of the flow cytometry market during the forecast period.

Rising Research and Government Initiative

There are various research and government initiatives launched that are expected to drive the flow cytometry market throughout the forecast period. The CDC US aims to decrease the estimated number of HIV infections to 9,300 by 2025 and 3,000 by 2030 in the US which will boost the demand for low cytometry. In September 2021, US$31 million was granted to three researchers from Stanford University by the California Institute for Regenerative Medicine to launch first-in-human trials of stem cells to treat stroke, heart failure, and spinal cord tumors. Moreover, technological advancements such as a fully automated sample preparation system for flow cytometry enhancing the usage and efficiency are further expected to drive the flow cytometry market size.

Flow Cytometry Market Opportunities

Recent technological advancements and government-backed initiatives provide a profitable opportunity in the flow cytometry market in the coming years. NIST Flow Cytometry Standards Consortium was launched by NIST US to encourage the adoption of flow cytometry in the biomanufacturing of cells and genes. Rajiv Gandhi Center for Biotechnology launched a training program in May 2023 at the Central Flow Cytometry facility in India. These initiatives and technological innovations are providing a great opportunity in the flow cytometry market for new entrants with proper training and enhanced usage.

Flow Cytometry Market Geographical Outlook:

North America is expected to witness a notable CAGR during the forecast period

The North American region is expected to hold a significant share of the flow cytometry market during the forecast period. The factors attributed to this dominant share are the higher prevalence of HIV and cancer, technological advancements, and the adoption of flow cytometry in various research projects. According to the CDC US, there were around 34,800 new HIV cases in the US in 2019. Moreover, the presence of a strong healthcare system in the region with higher healthcare expenditure boosts the demand for flow cytometry in diagnostic centers thereby propelling the flow cytometry market in the region.

Flow Cytometry Market Players:

Apogee Flow Systems Ltd is a global leader offering flow cytometry solutions. The company offers MicroPLUS Flow Cytometer for small particle applications, Universal Cytometer for conventional applications, Micro-GxP Flow Cytometer for GMP, GLV, and IVD environments.

Bio-Rad Laboratories provides solutions in bioprocessing, clinical research, drug discovery and development of infectious diseases, newborn screening including others. The flow cytometry solutions offered by the company are flow cytometry antibodies that include application-specific kits validated reagents and flow cytometry IQ/OQ services to ensure the proper function of the system.

Sysmex Corp. is one of the leading clinical IVD and industrial applications of diagnostics. It provides clinical diagnostics in Hematology, urine analysis, clinical chemistry, flow cytometry, and essential healthcare. IVD flow cytometry product offered by the company is enabled with PS-10 sample preparation system and XF-1600 flow cytometer.

Flow Cytometry Market Key Developments:

In June 2023, Becton Dickinson and Company launched a new automated robotic sample preparation premium system BD FACSDuest™. A complete automated workflow solution is enabled by FACSDuest to improve standardization and reproducibility in cellular diagnostics.

In May 2023, Sysmex launched a clinical flow cytometry system in Japan. The system includes Flow Cytometer XF-1600, Sample Preparation System PS-10, antibody reagents, and other related products that will automate the entire flow cytometry testing process.

In February 2023, Agilent Technologies announced the launch of NovoExpress software, an integrated compliance tool for NovoCyte flow cytometer systems. It provides essential tools to ensure the reliability and authenticity of data and electronic records to meet GxP manufacturing compliance guidelines.

List of Top Flow Cytometry Companies:

Danaher Corp.

Becton Dickinson and Company (BD)

Sysmex Corp.

Agilent Technologies, Inc.

Apogee Flow Systems Ltd.

Flow Cytometry Market Segmentation:

By Product Type

Instruments

Reagents

By Technology

Laser-Based

Impedance-Based

By Application

Molecular Biology

Pathology

Immunology

Others

By End-User

Hospitals & Clinics

Academic & Research Institutes

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others