Report Overview

Flexible Heater Market Size, Highlights

Flexible Heater Market Size:

The flexible heater market is projected to grow at a CAGR of 5.61% over the forecast period, increasing from US$1.363 billion in 2025 to US$1.790 billion by 2030.

The flexible heater is a known adaptable heat sources, which can be conformed in any shape or surface with great flexibilities. These heaters are lightweight and thin enough that they can be applied wherever more conventional rigid heaters cannot. Offerings in size, form, and heating patterns add further value, making them applicable to different environments. They are often made from durable materials that resist damage from harsh environments. They are conveniently utilized for energy efficiency in diverse areas where it is much needed.

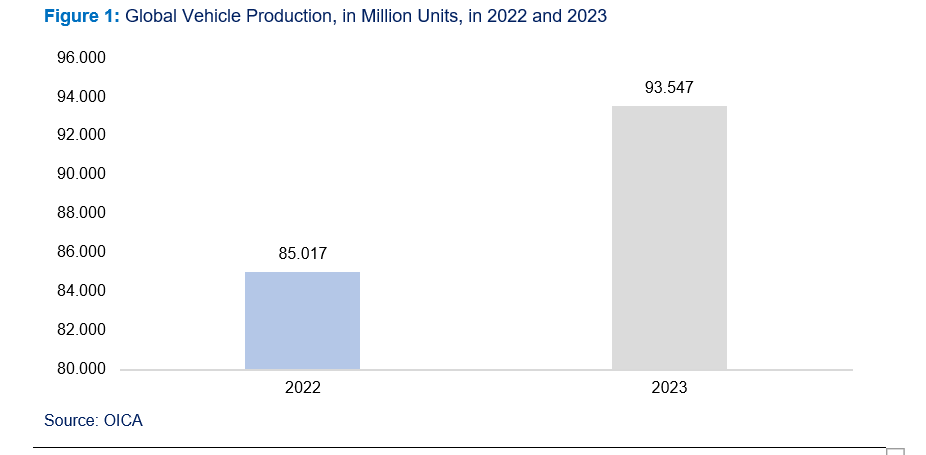

The flexible heater market is witnessing growth driven by increased electronics device consumption, advancement in material science, medical applications, the automotive industry, aerospace and defense, and industrial processes. OICA data reported an upward trend in global vehicle production with a reported volume of 93.547 million units in 2023, compared to 2022’s figure of 85.017 million units which signified 10% growth. Additionally, flexible heaters are integrated into consumer electronics, and they are employed in medical devices for accurate temperature control. Besides that, they are also applied to comfort and safety systems in automobiles, de-icing systems in aerospace and defense, industrial processing, and to enhance solar panel performance.

Moreover, the growing utilization in diverse industries will provide great prospects for flexible heaters applications such as in heated clothing and fitness wearables because the popularity of such new-generation wearable technology is increasing. These will significantly contribute to the flexible heater market growth in the coming years.

What are the Flexible Heater Market drivers?

- Rise in Electronic and Consumer Goods Consumption

The flexible heaters have penetrated many consumer electronics devices like smartphones, wearables, laptops, tablets, and gaming consoles to ensure temperature regulation, battery warming, localized heating, and performance enhancement. According to IDC Worldwide Quarterly Mobile Phone Tracker-Nov 2024, the world shipment of smartphones accounted for 314.6 million units in the third quarter of 2024, which is 3.6% higher than the same time in 2022, with 303.7 million units shipped. The expected increase in the technology-advanced mobile phones is set to bring improvement in the coming years which will provide an opportunity for the flexible heater industry's growth alongside these demands. Further, this growing consumer trend to acquire thinner and lighter electronic devices has increased demand for compact and flexible heating solutions. It is expected to propel the market development in the coming years.

- Oil and Gas segment is expected to major market share in the projected period.

operation. They are commonly applied in pipeline heating, tank heating, and equipment freeze protection applications to ensure that oil and gas flow smoothly even at extremely cold temperatures. Flexible heaters offer accurate and uniform heating, thus preventing condensation and minimizing downtime resulting from frozen or viscous materials. Their strength, ability to take different shapes, and resistance to severe environmental conditions make them irreplaceable for offshore rigs, refineries, and storage facilities.

Demand drivers behind flexible heaters in the oil and gas industry are improvements in operational efficiency, heightened demand for temperature control of sensitive infrastructure, and upgrading of heating technology that will counteract hostile operating environments. The increasing production and transportation of crude oil and natural gas are also likely to have a positive impact on the demand for flexible heaters, as they play a vital role in preventing equipment freezing, ensuring pipeline flow, and maintaining process reliability. For instance, according to the National Bureau of Statistics of China, the production of crude petroleum oil maintained growth steady. In August 2024, industrial enterprises with the designated size produced 17.83 million tons of crude petroleum oil, up 2.1 percent year on year, with an average daily output of 575,000 tons. Imports of crude petroleum oil came in at 49.10 million tons, down 7.0 percent from last year.

In addition, there has been a strong upward trend in the demand for flexible heaters due to the increasing crude oil processing activities. For example, according to the Indian Petroleum and Natural Gas Statistics (IPNG), India's crude oil processing increased from 221.77 million metric tons (MMT) in 2020-2021 to 241.70 MMT in 2021-22, reaching 255.23 MMT in 2023-24. This growth is reflective of the growing demand for flexible heating solutions, such as flexible heaters, in ensuring seamless operations in such critical applications as pipeline heating, tank heating, and freeze protection in the oil and gas sector.

What are the key geographical trends shaping the Flexible Heater Market?

- The United States is estimated to hold a substantial market share in the coming years.

Demand in the United States is driven by applications in various industries like electronics, automotive, aerospace, and oil & gas, as flexible heaters have broad applicability. Growth factors for this market include growing interest in energy efficiency and increasing usage of advanced heating solutions to increase operational reliability.

In addition, the growing electric vehicle market, rising demand for accurate temperature control in medical equipment, and advancements in manufacturing technologies further fuel the demand for flexible heaters in the United States. Additionally, the rapid growth in electric vehicle production is anticipated to have a positive impact on the flexible heater market in the projected period. For instance, as per the U.S. The EIA reported that 78.9% of total BEVs sold in the United States in the third quarter of 2024 were made in North America, with 7.3% manufactured in South Korea and 5.3% in Germany. The trend towards production at home and the higher demand for heating solutions in EV battery systems will drive market growth forward.

In addition, the growing use of flexible heaters in the oil and gas industry in the United States is expected to drive market growth shortly. For instance, the International Energy Statistics report that the United States produced more crude oil than any country at any time. In 2023, U.S. crude oil production, including condensate, averaged 12.9 million barrels per day (b/d), breaking the previous U.S. and global record of 12.3 million b/d set in 2019. Average monthly U.S. crude oil production also reached a record high in December 2023 at more than 13.3 million b/d. This surge in production will push the demand for flexible heaters, particularly pipeline heating and freeze protection for equipment in the oil and gas industry in the projected period.

Flexible Heater Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Flexible Heater Market Size in 2025 | US$1.363 billion |

| Flexible Heater Market Size in 2030 | US$1.790 billion |

| Growth Rate | CAGR of 5.61% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Flexible Heater Market | |

| Customization Scope | Free report customization with purchase |

Market Segmentation:

- BY TYPE

- Silicone rubber-based

- Polyimide-based

- Polyester-Based

- Mica-based

- Others

- BY INDUSTRY VERTICAL

- Healthcare

- Automotive

- Food and Beverage

- Electronics

- Oil and Gas

- Aerospace and Defense

- Others

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East And Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America