Report Overview

Femtech Market - Strategic Highlights

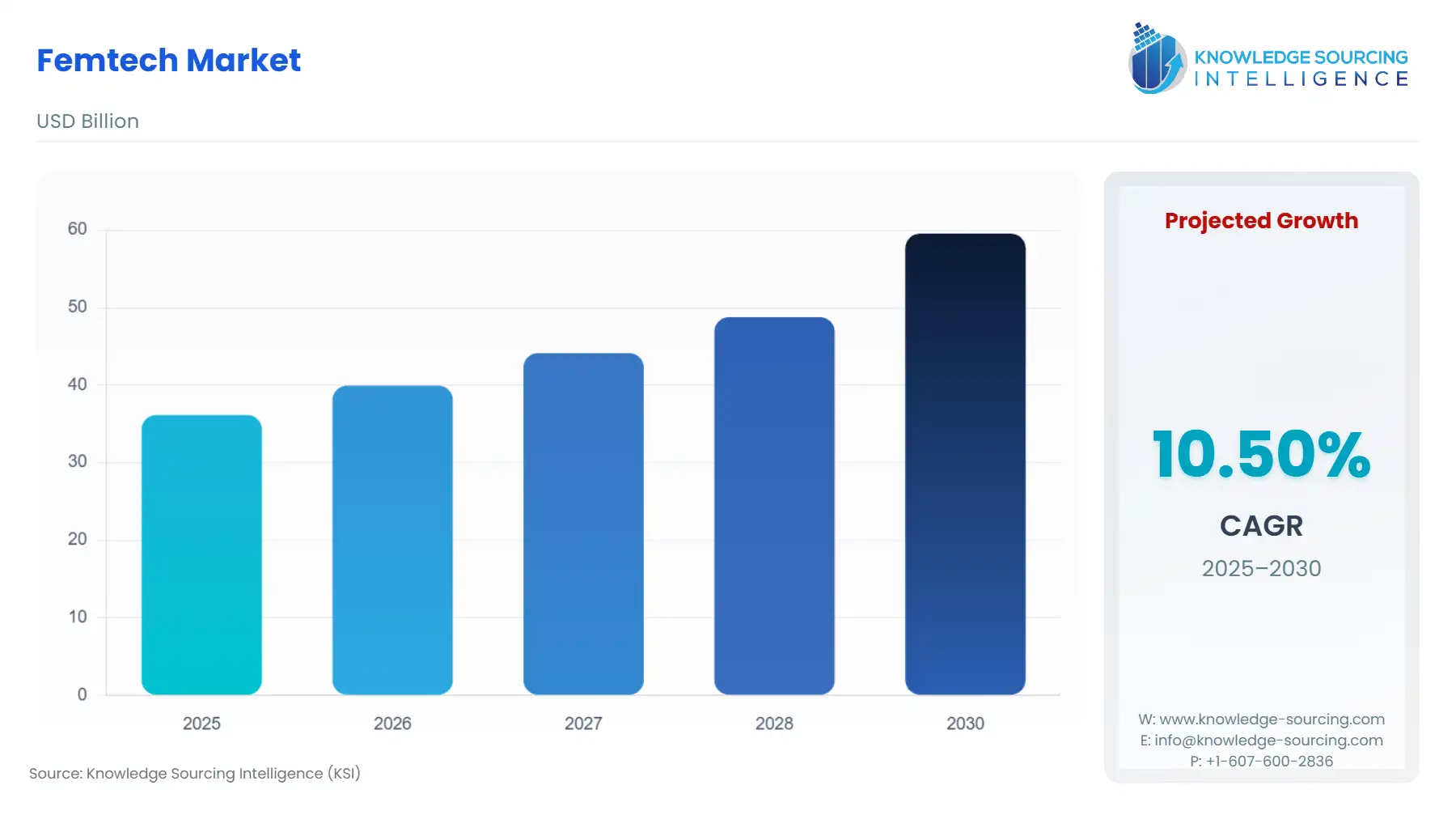

Femtech Market Size:

Femtech Market is forecasted to rise at a 10.18% CAGR, reaching USD 64.684 billion in 2031 from USD 36.146 billion in 2025.

The Femtech Market, encompassing a diverse array of software, services, and hardware tailored to women's health needs, has rapidly transitioned from a fringe concept to a central pillar of the digital health ecosystem. This sector addresses systemic biases and data gaps prevalent in conventional medical research, providing frictionless, data-driven, and highly personalized health solutions across the female lifespan, from puberty to menopause. Driven by escalating female health awareness and powerful advancements in digital health technologies, the market is characterized by high user engagement and a strong direct-to-consumer model. The imperative for the industry is to scale innovative solutions while rigorously navigating a fragmented and evolving global regulatory landscape, particularly concerning the uniquely sensitive nature of women's health data.

Femtech Market Analysis

Growth Drivers

Growing awareness of systemic gender bias in medical research and the resulting data gaps directly drives demand for Femtech products. As women become more empowered to seek personalized, data-centric health management, they actively reject generic, male-centric healthcare models. The proliferation of affordable and accurate digital health technologies, including smart wearables and AI-powered mobile applications, acts as a primary catalyst. These technologies facilitate continuous, discreet health monitoring, such as real-time hormone tracking and personalized health recommendations, which fundamentally increases consumer adoption and generates sustained demand for convenient, at-home, and non-invasive solutions.

Challenges and Opportunities

A major challenge for the Femtech market is the persistent issue of limited insurance coverage and reimbursement for many digital health and wellness solutions, which places a financial burden on individual users and constrains mass adoption. Regulatory ambiguity, particularly concerning the classification of certain applications as medical devices, also presents a significant hurdle for market entry and scaling. The primary opportunity lies in the expansion into emerging markets, where smartphone penetration is high but access to traditional in-person medical care is constrained. Furthermore, the integration of Artificial Intelligence and Machine Learning for predictive health diagnostics represents a critical pathway to higher clinical validation, which would unlock B2B demand from large healthcare providers and pharmaceutical partners.

Supply Chain Analysis

The Femtech market's supply chain is dual-layered, encompassing software and service provision (intangible) and the manufacturing of smart devices (physical). For the physical segment, the supply chain mirrors that of the broader wearable technology industry, with key production hubs concentrated in Asia-Pacific, particularly China, for the manufacturing and assembly of sensors, microchips, and batteries. Logistical complexities stem from the global sourcing of specialized components, such as advanced biosensors and high-grade plastics, which are subject to international trade tensions. A critical dependency is the reliable supply of semiconductors and specialized electronic components, which, if disrupted by geopolitical events or tariffs, directly impacts the cost of goods and the ability to scale hardware production.

Femtech Market Government Regulations

The regulatory environment for Femtech is fragmented, with data privacy laws exerting the most immediate and profound impact on market operation and consumer demand.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | FTC Act / Federal Trade Commission (FTC) | Enforcement actions against unauthorized data sharing (e.g., Flo Health) create a mandatory standard for transparency and privacy. This elevates compliance costs but increases consumer demand for providers who can credibly demonstrate data protection beyond HIPAA's traditional scope. |

European Union | General Data Protection Regulation (GDPR) | Classifies health data as "special category data" requiring heightened protection. This sets a stringent baseline for data processing across the EU, increasing the barrier to entry for non-compliant software platforms and channeling consumer demand towards privacy-first solutions. |

United States | Federal Food, Drug, and Cosmetic Act (FD&C Act) / FDA | Classification of software and devices (e.g., fertility trackers) as medical devices mandates rigorous pre-market clearance or approval. This process creates high development costs and long timelines, acting as a constraint on the market's rapid scaling but validating the clinical efficacy of cleared products, thus increasing provider demand. |

Femtech Market Segment Analysis

By Application: Menopausal Health

The Menopausal Health segment represents a major commercial opportunity due to its historically underserved nature and the large, financially empowered demographic it addresses. Demand in this segment is accelerating, driven by two key factors: increasing social destigmatization, which encourages women to proactively seek solutions, and the critical need for objective data to manage complex, often debilitating symptoms like hot flashes, sleep disruption, and mood changes. Specialized Femtech products, such as diagnostic labs offering personalized hormone level testing and digital platforms providing telehealth consultations and personalized treatment recommendations, directly meet this unmet demand. The market shift away from generalized wellness towards clinically focused, symptom-management tools is a powerful, long-term demand catalyst for sophisticated software and diagnostic services.

By End-User: Hospitals & Clinics

Hospitals and Clinics represent a critical B2B end-user segment for Femtech, driven by the imperative to improve clinical efficiency, meet quality metrics, and expand service accessibility, particularly in remote patient monitoring (RPM). Demand from these institutions is highly dependent on a Femtech solution’s clinical validation and regulatory clearance (e.g., FDA clearance for a maternal monitoring device). The integration of remote monitoring devices (wearables) and telehealth platforms into existing Electronic Health Records (EHR) systems increases demand for seamless, interoperable software solutions. By adopting RPM platforms for high-risk pregnancies or chronic conditions, clinics can reduce readmission rates and enhance patient engagement, translating directly into institutional demand for enterprise-grade, clinically validated Femtech platforms.

Femtech Market Geographical Analysis

US Market Analysis (North America)

The US market commands substantial influence, primarily driven by a robust venture capital ecosystem and a high concentration of technologically savvy consumers willing to adopt digital health solutions. The employer-sponsored health benefits model serves as a unique demand catalyst, with large corporations increasingly offering comprehensive fertility, parental, and menopausal health benefits through B2B Femtech platforms (e.g., Carrot Fertility). The ongoing uncertainty regarding reproductive rights and access to care in various states also catalyzes demand for secure, direct-to-consumer digital services that offer personalized and private health tracking, consultation, and prescription fulfillment.

Germany Market Analysis (Europe)

Germany's Femtech demand is shaped by the country's robust public health insurance system and its stringent privacy standards. Demand is driven by the formal recognition and reimbursement of Digital Health Applications (DiGAs) by the Federal Institute for Drugs and Medical Devices (BfArM). Solutions that achieve DiGA status gain immediate access to a large, state-funded market, providing a powerful incentive for companies to pursue regulatory clearance. This process prioritizes clinical evidence and data security, channeling institutional demand towards highly validated applications focusing on mental health, chronic disease management, and remote monitoring.

Brazil Market Analysis (South America)

Brazil represents a high-potential emerging market where Femtech demand is primarily fueled by high smartphone penetration coupled with fragmented access to specialized in-person healthcare, particularly in vast rural areas. The central demand driver is the need for accessible and affordable reproductive and maternal health information and services. Mobile applications for menstrual tracking, fertility awareness, and basic telehealth consultations fill immediate service gaps. The market is also experiencing demand growth for solutions that address chronic conditions prevalent in the region, supported by increasing female participation in the workforce and corresponding growth in disposable income for self-pay health management tools.

UAE Market Analysis (Middle East & Africa)

Demand in the UAE is characterized by a government-led push for advanced digital healthcare as part of broader national health innovation strategies. High-net-worth consumers and government-sponsored health initiatives drive demand for premium, high-end Femtech devices, particularly those focused on fertility management (e.g., IVF cycle optimization) and personalized wellness. The strategic demand vector is the integration of these technologies into private hospital networks and specialized fertility centers, where a premium is placed on cutting-edge technological solutions that align with the nation's ambitious healthcare modernization goals.

India Market Analysis (Asia-Pacific)

India's market is rapidly expanding, driven by the sheer size of the female population and the massive disparity in access to primary and specialized women's healthcare between urban and rural centers. The most powerful demand factor is the need for low-cost, high-reach software solutions for reproductive health tracking and maternal care monitoring. Mobile applications that offer multilingual content, community support, and basic diagnostic information are in high demand as first-line health tools. Furthermore, government initiatives aimed at improving maternal and infant health outcomes create institutional demand for platforms that facilitate community-based, large-scale remote data collection.

Femtech Market Competitive Environment and Analysis

The Femtech competitive landscape is highly fragmented, featuring numerous startups and specialized firms alongside larger technology and healthcare conglomerates. Competition is divided between pure software players (apps) focused on scalability and data analytics, and device makers focused on accuracy and clinical validation. The strategic battleground is shifting from simple cycle tracking to offering comprehensive, vertically integrated platforms that manage multiple health stages, from fertility to menopause.

Flo Health: Flo Health’s strategic positioning is as a leading pure-play software platform focused on Menstruation Care and Fertility Tracking. Its competitive advantage is derived from its massive, highly engaged user base of nearly 70 million monthly active users and its use of AI-powered machine learning algorithms to deliver personalized health predictions and insights. Following regulatory actions, Flo Health has prioritized data privacy, repositioning robust security as a key product differentiator, which sustains user trust and continuous subscription demand.

Elvie: Elvie focuses exclusively on developing smart, user-centric hardware for intimate women's health. Its flagship products, the Elvie Pump (a wearable, silent breast pump) and the Elvie Trainer (a pelvic floor trainer), position the company as a premium innovator in the Pregnancy and Nursing Care segment and Pelvic & Uterine Health. Elvie’s strategy targets the demand for discretion, convenience, and clinically effective at-home solutions, allowing it to command a strong presence in the physical device segment of the market.

Carrot Fertility, Inc.: Carrot Fertility operates as a B2B service platform, strategically targeting large employers and health plans. Its positioning is unique, offering a comprehensive, global fertility benefits solution that covers everything from in-vitro fertilization (IVF) to adoption and surrogacy. By focusing on the employer market, Carrot taps into high-value, enterprise demand, leveraging its network of clinics and telehealth platform to act as a crucial infrastructure layer for corporate women's health benefits.

Femtech Market Developments

December 2024: ConTIPI Medical and EVERSANA Announce U.S. Commercial Launch of ProVate

ConTIPI Medical and EVERSANA announced the U.S. commercial launch of ProVate, a non-surgical, disposable device for women experiencing Pelvic Organ Prolapse (POP). This product launch directly addresses the demand for convenient and less invasive treatment alternatives for a pervasive gynecological issue. The commercialization, focused on the U.S. market, signals a key development in expanding the Femtech product type beyond wearables and software into therapeutic medical devices.

Femtech Market Segmentation:

By Components

Hardware

Software

Services

By Application

Menstruation Care & Fertility Tracking

Pregnancy & Nursing Care

Menopausal Health

Others

By End-User

Hospitals

Fertility Clinics

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others