Report Overview

Feed Binders Market - Highlights

Feed Binders Market Size:

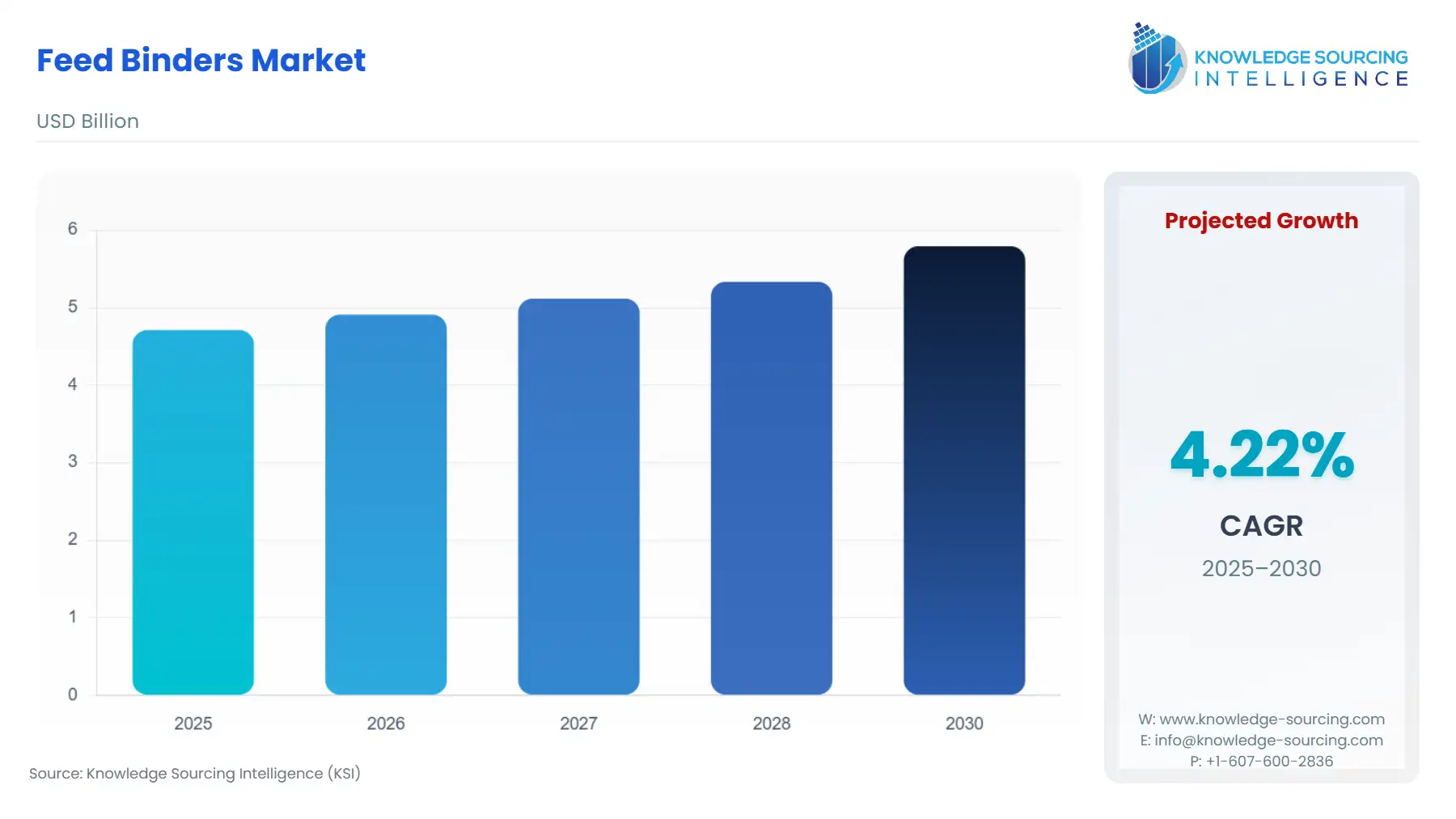

The Feed Binders Market is anticipated to rise from USD 4.711 billion in 2025 to USD 5.793 billion by 2030, registering a 4.22% compound annual growth rate (CAGR).

Feed Binders are components that bind, glue, or hold together various discrete food elements to give a steady from to the feed. Feed Binders were initially introduced to bind feed of aquatic animals and are quite crucial for the aquaculture industry as it is an efficient alternative of traditional feed mesh. The feed mesh was directly poured into the water body which led to the loss of nutrients and pollution of water. Feed pelleting is the process through which feed mesh is converted into pellets or capsules, using moisture, heat, and machine pressure. And unlike feed mesh, these pellets are convenient to stock and transport from one place to another. In addition to their accessibility, feed binders are gaining fame as they are easily digested by the animals and help in gaining nutrients. The prime factor driving the demand for this market is the growing demand for quality livestock products. The emerging health-consciousness along with changing trends towards protein-based diets has surged the demand for quality livestock products, which in effect, pressurized the producers to supply healthy livestock. Also, with technological developments, innovative equipment is introduced that produces pellets on farms using the pellet binding techniques.

Feed Binders Market Growth Drivers:

- Rising health concerns and protein-based diets

Another prime reason behind the rise in feed binders is a surge in health concerns and a protein-based diet. With growing disposable income and health consciousness, consumers are paying more attention to their dietary intake. Further, with easily available fitness alternatives and expanding gym culture, consumers are shifting towards a protein-based diet from an initial carbohydrates-rich diet. The feed binders and meat industry are complements. To produce quality, nutrient-rich meat, it is essential to feed the animal quality feed which improves their health and growth. And with the surge in the meat industry, the feed binders industry as well is predicted to grow at a noteworthy rate.

Feed Binders Market Segmentation Analysis:

- Poultry Farming is the leading segment

By livestock, the feed binders market is segregated among poultry, aquaculture, swine, cattle, pets, and others. The feed binders were initially developed to stop pollution and nutrient leaching in aquaculture and soon adapted in other market segments as well. The aqua-culture segment of the market is expected to grow at a significant rate. However, the poultry farm segment of the market is forecasted to grow at an exponential rate, owing to a surge in demand for poultry products. Poultry products are generally preferred to cover the protein requirements in the body. This in turn has boosted the poultry farming market. Further, with growing health and fitness concerns, consumers pay scrutinized attention to the quality of the meat and eggs. This will be obtained by providing the poultry animal nutrients rich food. Broiler’s chicken feed, by Purins Meat Bird Feed, contains 22% protein and required amino acids to support growth. The Swine and Cattle segments, as well, are predicted to grow at a noteworthy rate. And with the growing preference for adoption pets, the pet feed binders market is predicted to grow at a significant rate. Pets, particularly dogs, are clinically proven to curb stress and loneliness in human beings. Hence, households are adopting pets for better mental health. This trend has given rise to the demand for feed pellets which provide suitable nutrition to pet animals and build immunity along with growth. Pedigree Dentastix range, for instance, was launched by Mars Incorporated in June 2020. The Pedigree Dentastix Chewy Chunk is claimed by Mars to prevent plaque built-up throughout the day and come in numerous sizes.

- Natural Feed binders have a greater market share

By source, the feed binders market is segmented as natural and synthetic. Synthetic binders were developed first and initially dominated the markets. However, the synthetic binders had to be imported from other countries and proved to be costly for farmers, especially for small-scale farming firms. Natural feed binders were developed over time and dominate the market. They are expected to increase their market share and grow at a numerical rate in the forecasted period, owing to their natural ingredients and minimum chemical interference. The synthetic feed binders market as well is predicted to grow at a significant rate.

Feed Binders Market Geographical Outlook:

- Asian countries have a huge potential

The feed binders market has been further regionally classified as the North American market, European market, South American and Caribbean market, Central Asia and Pacific region, and African market. The North American and European market has a significant share in the market and is predicted to grow at a noteworthy rate in the analyzed period. The prime reason behind this irie growth is booming animal husbandry industries, particularly in countries such as China and India.

List of Top Feed Binders Companies:

- Bentoli

- Beneo

- Visco Starch

- Uniscope Inc.

- Darling Ingredients

Feed Binders Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.711 billion |

| Total Market Size in 2031 | USD 5.793 billion |

| Growth Rate | 4.22% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Source, Type, Form, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Feed Binders Market Segmentation:

- By Source

- Natural

- Synthetic

- By Type

- Lignosulfonates

- Clay

- Hemicellulose

- Gelatin

- Molasses

- Others

- By Form

- Powder

- Liquid

- By Function

- Pellet Quality Improvement

- Nutrient Preservation

- Anti-Dust Agent

- By Livestock

- Poultry

- Cattle

- Swine

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

- North America