Report Overview

Expanded Polystyrene Market Report, Highlights

Expanded Polystyrene (EPS) Market Size:

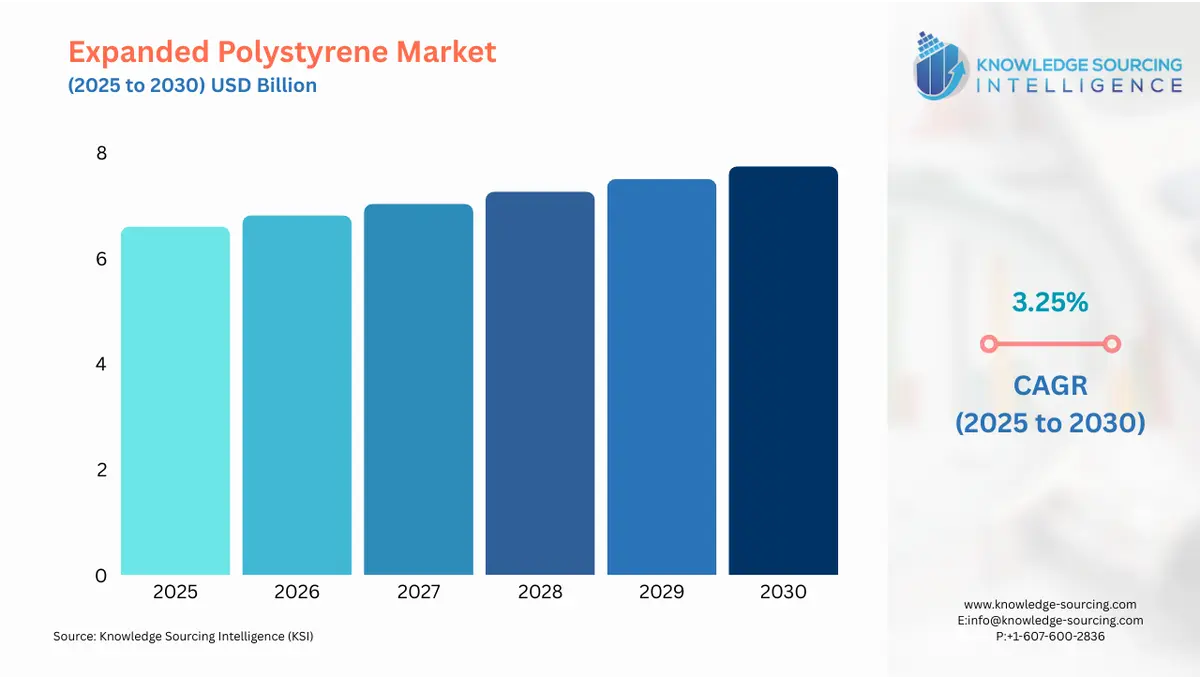

The Expanded Polystyrene (EPS) market is anticipated to reach a market size of USD 7.738 billion by 2030, growing at a 3.25% CAGR from a valuation of USD 6.596 billion in 2025.

Expanded Polystyrene (EPS) Market Introduction:

The Expanded polystyrene (EPS) market is expected to experience significant growth over the forecast period. Asia-Pacific is expected to be the key market, benefiting from booming demand in the packaging and construction segments. Some of the emerging factors being associated with the growth of this market include. An ever-growing global population and changing lifestyles are dictating the need for high-quality and added-value items like ‘green’ goods and the concepts of ‘fair trade’. A swiftly expanding application of the EPS in the marine flotation and floating decks. However, limitations such as high availability of products and environmental constraints continue to slow the growth of the market. However, amid these factors, the market is anticipated to grow owing to the rising necessity for bio-based polystyrene and emerging applications of EPS. There are other factors also that are fuelling this market’s growth.

The city population is collectively providing a tremendous contribution to the market growth of EPS. With the development of the scale of urbanization, the primary task remains to use packaging and insulating materials as efficiently as possible. Theraplast’s EPS product has good thermal insulation attributes, and it can also be considered environmentally friendly, which makes it ideal for meeting such requirements. Also, the technological development of various segments like electronics, automotive, and others has resulted in a higher demand for quality packaging materials. The already growing trend of e-commerce is complemented by the growing popularity of electric vehicles, which also fuels the demand for EPS. Therefore, the market for EPS is likely to experience a sustained level of growth due to the support it receives from these two sectors.

The EPS market is also fundamental on the back of the increasing needs of the global population for environmentally friendly packaging and building materials. People around the world are developing a consciousness of environmental conservation and would prefer goods that are ecologically friendly. EPS is thus preferred for packaging due to its low density and the benefits it has for environment-conscious businesses. In construction, EPS is also used for insulation, and it is economical. This means that Awareness of energy efficiency and green practices is also a factor that is promoting the use of EPS. Since more governments are putting in place measures to conduct or support the EPA and reduce waste on this material, the EPS market is anticipated to gain from these measures.

The need from emerging markets also constitutes one more factor that is playing a part in the popularity of the EPS market. Some of the areas that have grown rapidly over the recent past include China and India, where the population is urbanized, and the economies are growing at a fast pace, thus giving rise to the demand for packaging and construction materials. This growth in the middle class, which is a factor of growth in these countries, is now demanding packaged goods and consequently EPS. Additionally, supportive infrastructure that is rapidly being adopted in these countries has created a greater market for EPS, especially in construction projects. There are also emerging markets that are slowly but steadily expanding, and, therefore, with the increased market demand, the EPS market will have the opportunity to expand as well.

Expanded Polystyrene (EPS) Market Overview:

EPS is a popular material for protective packaging and insulation solutions because of its lightweight nature, superior thermal insulation, shock absorption, moisture resistance, and affordability. The use of EPS in roofing systems, panels, and insulation boards is being driven by the growing need for environmentally friendly building materials and energy-efficient building techniques. Furthermore, the use of EPS in packaging solutions is increasing due to the quick growth of the food delivery and e-commerce industries. This is because EPS keeps perishable goods at a consistent temperature while ensuring product safety during transit.

Additionally, in the market for EPS, the COVID-19 pandemic had a mixed but considerable effect, initially causing major disruptions but ultimately creating new growth opportunities. Supply chain interruptions, manufacturing closures, labor shortages, and a decline in construction activity were the main causes of the EPS market's early losses during the pandemic, especially in severely impacted areas like China, Europe, and North America. However, market dynamics have shifted and are witnessing consistent growth.

Moreover, other factors propelling the expanded polystyrene market are higher prevalence in rigid food service containers, CD cases, appliance housings, envelope windows, tub and shower products, automobile body panels, wind turbine parts, and many more goods. Various campaigns to encourage the usage of EPS are further driving the EPS market growth.

The automobile industry uses EPS components for lightweight car parts that improve fuel economy and lower pollutants, boosting market expansion. Nevertheless, the market is confronted with obstacles such as strict laws governing single-use plastics and environmental issues pertaining to trash from polystyrene. This is incentivizing producers to invest heavily in recycling technologies and developing environmentally friendly substitutes for EPS. Growing applications in emerging economies, continuous product improvements, and technological advancements all contribute to the expanded polystyrene market's promising future.

Growing environmental concerns, regulatory challenges, and the global push for circular economy practices have made recycling in the EPS sector a crucial emphasis. EPS has long been criticized for its poor biodegradability and tendency to accumulate in landfills and marine habitats, despite its lightweight and extremely protective qualities. To address these difficulties, the EPS sector is aggressively developing sustainable waste management systems and recycling technology. In many nations with established EPS collection networks, mechanical recycling—which entails gathering, cleaning, shredding, and reprocessing EPS waste into new products—is becoming increasingly popular.

EPS post-consumer package recycling rates in North America are above 30% (over 50% in China, South Korea, and Japan), whereas in the European Union, they are roughly 40% according to the British Plastics Federation. Recycling rates in several European nations are exceptional; in Norway, for example, recycling rates are above 70%, while in Denmark, Portugal, Belgium, Austria, and Ireland, recycling rates surpass 50%. Furthermore, Brazil also has EPS recycling rates of 30%.

Expanded Polystyrene Market Growth Drivers:

- The growing application of expanded polystyrene in the building and construction industry

The growing application of Expanded polystyrene (EPS) in the building and construction industry to make walls and roofs is a key driver of the EPS market's expansion. The advantages of EPS, such as energy efficiency, eco-friendliness, and recyclability, make it an excellent building material. The use of EPS for various purposes is increasing rapidly, especially because the construction and building industry is one of the most rapidly growing industries of the current era. EPS in the construction industry has come to prevail for its unique and unique ability to insulate, be lightweight, and versatile. In construction, EPS is widely used, especially in walls and roof insulation, and provides lightweight support for the foundations. Thanks to its shut-porosity and low thermal conductivity, it has been considered as an optimal solution for saving the energies in constructions. EPS insulation improves heating and cooling management, hence meeting the increasing demands for emissions reduction in the construction sector. Therefore, the widening building and construction industry augments the expanded polystyrene market’s growth.

For instance, overall investments in building construction in Canada increased from $17.74 billion in March 2024 to $18.78 billion in March 2025, as per Statistics Canada. Further, the highest investment was reported in the total residential construction, which was $12.19 billion in March 2025, while non-residential construction was estimated at $6.59 billion in the same timeframe.

Moreover, various housing programs and related construction initiatives by several nations are further boosting the building and construction market, thereby propelling the expanded polystyrene market. For instance, the revised April estimate of $511.3 billion represented a 0.1 percent (±1.5 percent) increase of public construction spending in May 2025, which came to $511.6 billion. At a seasonally adjusted annual rate of $111.8 billion, educational construction was 0.2 percent (±2.1 percent)* higher than the revised April estimate of $111.6 billion. The revised April estimate of $143.7 billion was 0.3 percent (±4.6 percent)* higher than the seasonally adjusted annual rate of $143.2 billion for highway construction.

Moreover, characteristics such as the material’s longevity, the inertness to termites and chemicals, and simple installation have reinforced the material’s reputation in the construction market. EPS is also used in the construction of Structural Insulated Panels (SIPs) that involve the insulation capability of the EPS and the structural capability of oriented strand boards or other facing materials. These SIPs are increasingly being used in constructing homes and small commercial structures since they aid in thermal and structural capacities.

The emission of sustainable construction activities, energy utilization, and cost-effective and more durable construction materials are among the reasons that have seen EPS gaining popularity in construction. With the advancement in the construction industry on the global level, the EPS application is predicted to sustain its demand in the market growth of expanded polystyrene.

Expanded Polystyrene Market Segmentation Analysis:

- The white EPS segment by type is likely to be the fastest-growing type during the forecast period.

The white EPS segment is expected to be the fastest-growing product type in the expanded polystyrene (EPS) market during the forecast period. This kind of growth has been brought about by the ever-growing market demand for white EPS for use in the packaging sector. White EPS is the most popular type of EPS and it is preferred by most builders. White EPS is also expected to gain popularity in the future due to its general-purpose nature and its applicability in different fields. When it comes to packaging, white EPS is heavily utilized for the production of protective as well as insulating products for various consumer’ goods, electronics, and foods. Some of the driving factors that have been attributed to this segment include: One of the major drivers for the need for white EPS in this segment is the growth in online shopping and the need for more superior packaging that is lightweight and has high strength and durability.

Further, the escalating food service industry and need for the appropriate and sustainable packaging including trays and cups constituted from white EPS is also adding up to the segment. Aside from its use in packaging, white EPS is also used as construction material in structures for wall insulation and padding of roofs and foundations because of its thermal capability of EPS. The growth in the construction industry including the focus of governments to incorporate energy-efficient buildings and the integration of and innovation of improved energy codes and regulations around the world are factors that are predicted to motivate the use of white EPS. Besides, the sales having white EPS along with furniture, sports equipment, and automotive are boosting the segment’s growth as well.

- The Grey and Silver EPS segment by type is likely to drive the growth of the market

The grey and silver EPS segment is expected to drive the growth of the Expanded polystyrene (EPS) market by type. Based on the type, the EPS market has been segmented as grey and silver, which is likely to show high growth rates for expanded polystyrene in the future. Specifically, it has been forecasted that grey EPS will experience higher growth than other products because of its excellent thermal insulating properties, more so when cost is taken into consideration. Flame retardants, graphite, and other additives have been brought into the new segment of ‘modified’ EPS, where competition has increased. The switches in society’s preferences towards ‘green’ products and solutions, inclusive of a growing importance on sustainable packaging and the promotion of energy efficiency and ‘green’ building, have continued to foster the global demand for grey and silver EPS. Not only this, the increasing use of protective packaging materials, especially in the e-communication sector, and the demand for lightweight and durable insulating material in construction aspects also supplement the growth of this segment. Consequently, the grey and silver EPS segment can be projected as a major EPS driving force in its market, complementing the industries’ increased use throughout the globe.

- By end-user, the building and construction segment will rise exponentially

By end-user industry, the expanded polystyrene market is segmented into building & construction, electrical & electronics, packaging, automotive, and others. The expanded polystyrene, besides being cost-effective and affordable to produce, also offers high-performance features such as thermal insulation, moisture resistance, light-weight and structural support, making it one of the integral materials used in construction applications such as wall and insulation panels. With a rapidly growing urban population, the housing demand has shown considerable growth in major economies, driving the demand for expanded polystyrene.

According to the recent construction spending data provided by the US Census Bureau, the total construction spending reached an annual adjusted rate of US$2,138.2 billion, from which total private construction spending constituted US$1,626.59 billion and the remaining spending was incurred in public construction. The same source also specified that spending on public residential construction witnessed a significant 8.4% in May 2025 compared to the same month preceding year.

Furthermore, infrastructure development and investment in commercial construction are also picking up traction in other major economies, namely China, India, South Korea and European Union, further boosting the demand for expanded polystyrene to be used in roads, bridges and wall panels, thereby enhancing the overall structural durbality and thermal insulation.

Expanded Polystyrene Market Geographical Outlook:

- The Asia-Pacific region is expected to dominate the market during the forecast period.

The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries. India and China have about 35.5% of the world's population. The Asia Pacific region is expected to dominate the expanded polystyrene market during the forecast period, owing to the region being the home of several countries, as mentioned above, constituting significant production capacities that are driving the demand for eco-friendly materials.

The Asia Pacific has been identified as leading in the Expanded polystyrene (EPS) market, resulting from population growth, rising urbanization, infrastructural developments, and increasing manufacturing industries. The exponential growth of e-commerce markets in developing countries such as China and India is projected to raise the demand for lighter packaging aids that offer protection to products, which, in turn, boosts the consumption rate of EPS. Furthermore, the constant economic development and the favorable government policies in the APAC contributed to a high market share and growth of the EPS industry.

Intense industrial and construction industries in the region are likely to support high EPS demand in markets such as insulation, packaging, and other uses. There is a large demand in this region for sustainable packaging and construction materials, for which EPS is a good fit as it is lightweight, recyclable, and cost-efficient. In addition, energy conservation and green building implementation in developed countries in the Asia-Pacific, such as China, Japan, and South Korea, are boosting EPS for construction usage and insulating materials. The population density is rapidly increasing throughout the region, and it is accompanied by the need for more housing and commercial areas, which in turn leads to a higher production demand for EPS usage for construction and packaging purposes. Altogether, factors such as the Asia-Pacific region’s economic progress, population, and infrastructure development for the EPS market align in favor of its growth, resulting in its global dominance.

Expanded Polystyrene Market Key Developments:

- In 2024, BASF invested in expanding its production capacity of Neopor at the Ludwigshafen site. Neopor products are EPS insulation materials; the expansion will result in growing production capacity by 50,000 metric tons per year.

- Development of Bio-Based EPS Alternatives (2024): Innovations in bio-based EPS formulations, using renewable feedstocks, have emerged to reduce environmental impact, targeting construction and packaging applications.

- Launch of Recyclable EPS Packaging Solutions (2023): Companies have introduced fully recyclable EPS packaging for food and electronics, addressing consumer and regulatory demands for sustainable materials while maintaining protective properties.

- Introduction of Enhanced Grey EPS for Insulation (2023): New grey EPS products with improved thermal insulation, incorporating graphite, have been launched for energy-efficient building applications in residential and commercial sectors.

Expanded Polystyrene (EPS) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Expanded Polystyrene (EPS) Market Size in 2025 | US$6.596 billion |

| Expanded Polystyrene (EPS) Market Size in 2030 | US$7.738 billion |

| Growth Rate | CAGR of 3.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Expanded Polystyrene (EPS) Market |

|

| Customization Scope | Free report customization with purchase |

The Expanded polystyrene market is segmented and analyzed as follows:

- By Product Type

- White EPS

- Grey and Silver EPS

- By Density

- Low Density

- Medium Density

- High Density

- By End-User Industry

- Building and Construction

- Electrical and Electronics

- Packaging

- Automotive

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

Navigation:

- Expanded Polystyrene (EPS) Market Size:

- Expanded Polystyrene (EPS) Market Highlights:

- Expanded Polystyrene (EPS) Market Introduction:

- Expanded Polystyrene (EPS) Market Overview:

- Expanded Polystyrene Market Growth Drivers:

- Expanded Polystyrene Market Segmentation Analysis:

- Expanded Polystyrene Market Geographical Outlook:

- Expanded Polystyrene Market Key Developments:

- Expanded Polystyrene (EPS) Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 25, 2025