Report Overview

Energy as a Service Highlights

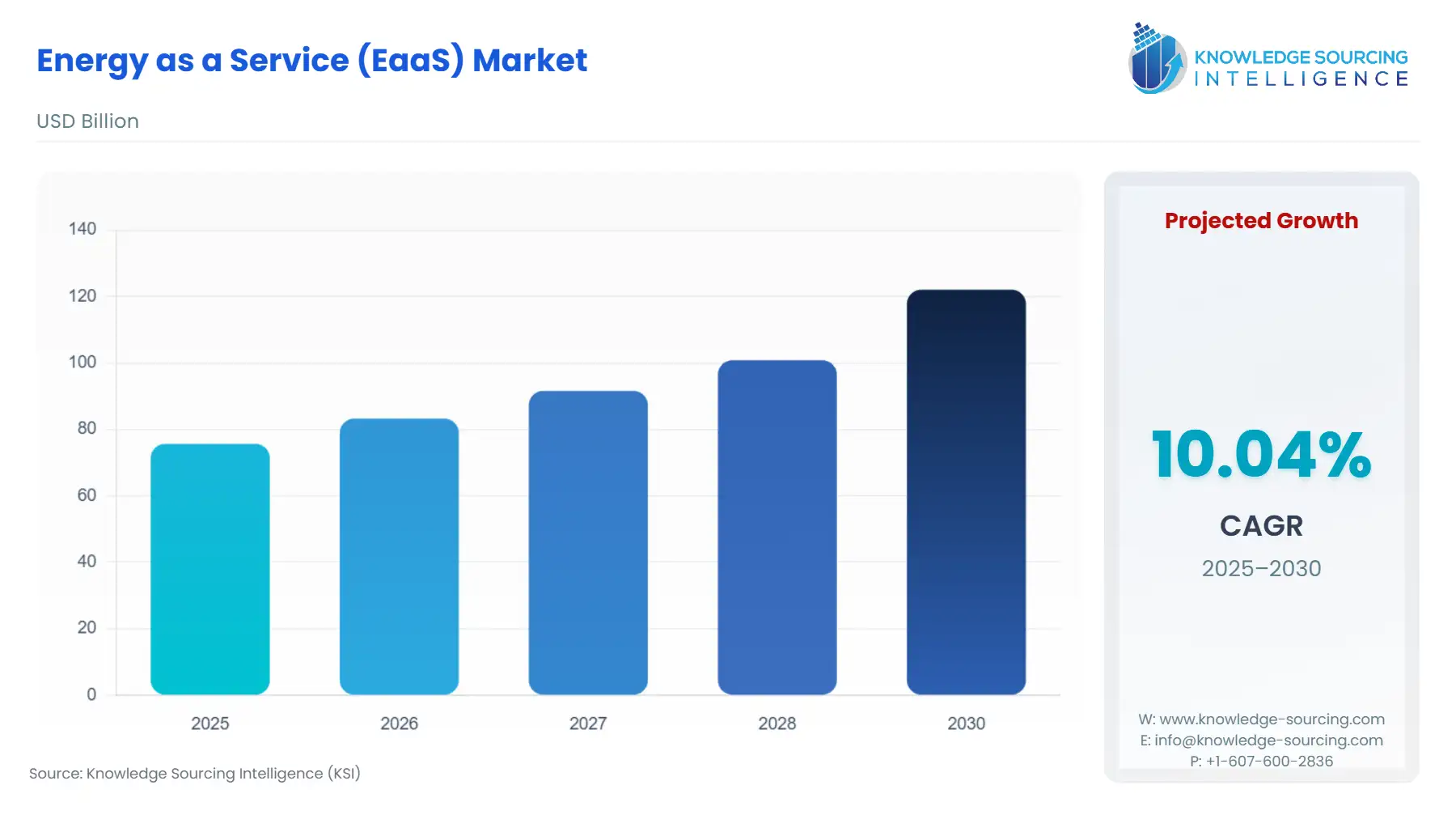

Energy as a Service (EaaS) Market Size:

The Energy as a Service (EaaS) Market will reach US$122.089 billion in 2030 from US$75.675 billion in 2025 at a CAGR of 10.04% during the forecast period.

The Energy as a Service (EaaS) market represents a fundamental transformation of the traditional energy supply relationship, moving away from the commodity sale of electricity to a performance-based subscription model. EaaS providers design, build, finance, operate, and maintain energy infrastructure assets, such as microgrids, solar arrays, and energy efficiency upgrades, on the customer’s premises, guaranteeing a specific energy outcome, usually cost savings or reliability, for a fixed monthly fee. This model effectively de-risks capital expenditure for customers, making it a compelling alternative for large commercial and industrial entities facing capital constraints yet needing to meet aggressive internal and regulatory decarbonization targets. The market’s rapid expansion is rooted in the convergence of falling renewable technology costs, the imperative for grid resilience against increasing climate events, and the widespread integration of advanced digital technologies like Artificial Intelligence (AI) to optimize energy flows in real-time.

Energy as a Service (EaaS) Market Analysis:

- Growth Drivers

Rising and volatile utility rates across major economies are compelling commercial and industrial customers to seek fixed, predictable operational energy expenses, directly increasing demand for EaaS contracts, which guarantee price stability. Concurrently, global corporate mandates for Net Zero and aggressive decarbonization targets necessitate verifiable renewable energy sourcing and efficiency improvements, driving entities to EaaS providers who can deliver turnkey, compliant solutions without requiring internal technical expertise or upfront capital. Finally, the increasing frequency and severity of extreme weather events underscore the need for resilient, off-grid-capable energy systems (microgrids and BESS), making the reliability component of EaaS a critical demand imperative for facilities like data centers and hospitals.

- Challenges and Opportunities

The primary headwind for EaaS adoption is the long and complex nature of contract negotiation, often spanning 15 to 20 years, which creates significant procurement and legal friction for customers unaccustomed to such long-term utility commitments. Furthermore, regulatory risks and a lack of standardized contract frameworks across different jurisdictions complicate providers' efforts to scale offerings internationally. The most significant opportunity lies in the intersection of EaaS with the burgeoning Electric Vehicle (EV) charging infrastructure market. EaaS providers can leverage their expertise in distributed power and financing to deploy, operate, and maintain mega-charging hubs and fleet charging depots, packaging the entire service, power, hardware, maintenance, and optimization into a singular, predictable monthly fee, thereby creating acute demand.

- Supply Chain Analysis

The EaaS supply chain is inherently asset-heavy and decentralized, primarily involving three critical hardware components: photovoltaic (PV) modules, Battery Energy Storage Systems (BESS) components, and advanced digital control systems (sensors, inverters, smart meters). The upstream supply is dominated by Asian manufacturing hubs, specifically China, for PV modules and battery cells (e.g., lithium-ion), creating a logistical dependency vulnerable to global trade restrictions and commodity price volatility. EaaS providers, who sit midstream, must manage the complex logistics of cross-border financing, hardware procurement, localized installation, and long-term O&M (Operation and Maintenance). Their success relies on robust, multi-year procurement contracts to stabilize the cost of materials and ensure the timely delivery of capital-intensive equipment.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Energy Efficiency Directive (EED) (EU/2023/1791) |

The EED mandates a binding target of 11.7% reduction in final energy consumption by 2030, which creates a direct, non-negotiable demand for EaaS solutions. This forces public and commercial sectors to procure efficiency-focused services and integrated energy management. |

|

United States |

Department of Energy (DOE) / Federal Energy Management Program (FEMP) |

Federal programs, such as Energy Savings Performance Contracts (ESPCs) managed by FEMP, act as a template for EaaS, explicitly enabling Federal agencies to procure energy efficiency and renewable projects with no upfront capital, directly stimulating market activity and validating the EaaS model. |

|

India |

Bureau of Energy Efficiency (BEE) / Energy Conservation Act, 2001 |

BEE's regulatory mandate for Energy Conservation Building Codes (ECBC) for commercial buildings and the Perform, Achieve and Trade (PAT) scheme incentivizes energy reduction. This creates demand for EaaS providers who can implement certified efficiency projects and help large industrial consumers meet or exceed PAT targets to earn energy-saving certificates. |

Energy as a Service (EaaS) Market Segment Analysis:

- By Service Type: Energy Optimization and Efficiency

The need for Energy Optimization and Efficiency services within the EaaS framework is driven primarily by the customer's cost-saving imperative and the regulatory push for net-zero operations. Unlike construction or O&M, this service segment is intangible and heavily dependent on digital technology, specifically AI-driven Building Energy Management Systems (BEMS). The key growth driver is the provider’s ability to guarantee a specified and verifiable reduction in energy consumption or cost (the outcome), rather than just supplying hardware. Customers in the Commercial sector are actively seeking EaaS contracts that integrate advanced data analytics to predict and modulate energy consumption in real-time, optimizing HVAC, lighting, and process loads. This shifts the risk of poor performance onto the service provider, making the EaaS model for efficiency more attractive than traditional capital expenditure on equipment whose return on investment is uncertain. The demand is further catalyzed by financial reporting requirements, where quantifiable energy savings directly translate into improved ESG metrics.

- By End-User: Industrial

The Industrial end-user segment—comprising large manufacturers, chemical plants, and heavy processing facilities- presents a distinct and high-value demand profile for EaaS driven by operational continuity and power quality requirements. Industrial customers view energy not as a commodity but as a critical input to production, where any power disruption results in immediate, quantifiable financial loss. The specific growth driver here is the provision of power resilience and redundancy, often delivered through a microgrid-as-a-service model incorporating on-site generation (e.g., solar, co-generation) and BESS. EaaS is highly attractive because it allows the industrial user to gain this mission-critical energy security without diverting their capital budget from core production equipment. Furthermore, the EaaS contract can incorporate the management of process-specific energy loads, such as steam or chilling, extending the scope beyond simple electricity to comprehensive, outsourced utility management. The complexity of industrial energy needs makes EaaS the optimal model for managing decentralized, multi-source power systems.

Energy as a Service (EaaS) Market Geographical Analysis:

- US Market Analysis

The US market is experiencing robust EaaS growth, fundamentally driven by the availability of sophisticated financing mechanisms, such as Federal ESPCs (Energy Savings Performance Contracts), which de-risk adoption for government facilities. Localized demand factors include increasing grid instability and the escalating risk of climate-induced power outages, particularly in states prone to extreme weather, which makes resilience-as-a-service (BESS and microgrids) a non-negotiable demand component for critical infrastructure like hospitals and data centers. Furthermore, corporate renewable energy procurement goals, heavily influenced by state-level Renewable Portfolio Standards (RPS), create strong, sustained demand.

- Brazil Market Analysis

The Brazilian EaaS market is concentrated around the supply services segment, particularly decentralized solar power generation for industrial and commercial consumers seeking to mitigate high, fluctuating grid electricity tariffs. The primary local factor driving demand is the regulatory framework for distributed generation (e.g., net metering), which creates a clear financial incentive for on-site PV systems. However, demand is constrained by higher perceived risk and more complex financial structuring, requiring EaaS providers to assume significant local development and regulatory navigation burdens.

- UK Market Analysis

The UK market is propelled by extremely ambitious national decarbonization targets and the legal requirement for large companies to report on streamlined energy and carbon reporting (SECR). These mandates create direct, urgent demand for EaaS solutions that can deliver measurable efficiency and renewable integration to meet compliance and reporting needs. The market is highly focused on the commercial sector, particularly public infrastructure and institutional buildings, which must align with government energy management frameworks, creating a strong market for O&M and energy optimization services.

- Saudi Arabia Market Analysis

The EaaS market in Saudi Arabia is being driven by the ambitious Vision 2030 program, which aims to diversify the economy and integrate massive volumes of renewable energy. The need for EaaS is largely top-down, focused on large-scale government and industrial projects, particularly in the development of new economic zones and cities. The local factor impacting demand is the high utilization of cooling and desalination plants, which necessitates robust, guaranteed power supply and high-efficiency EaaS models to manage extreme energy loads within a resource-intensive economy.

- China Market Analysis

China’s EaaS market is characterized by enormous scale and rapid implementation, spurred by national net-zero and energy-intensity reduction goals. The market is heavily concentrated in the Industrial end-user segment, where intense manufacturing activity requires both cost control and green-energy credentials for export compliance. Local factors include government-backed pilot projects and significant subsidies for the deployment of distributed energy resources (DERs) and energy management technologies, effectively accelerating the conversion of traditional energy users into EaaS customers.

Energy as a Service (EaaS) Market Competitive Environment and Analysis:

The EaaS competitive landscape is defined by three distinct segments: global industrial conglomerates leveraging their equipment and digital platforms, pure-play energy services companies (ESCOs) focused on long-term contracts, and utility-backed ventures. The market is competitive across the value chain, with differentiation based on financing capability, proprietary optimization software (AI/IoT), and project scale.

- Ameresco, Inc.

Ameresco, Inc. positions itself as a leading pure-play independent provider of comprehensive energy services, with a core strength in Federal, municipal, educational, and healthcare (MUSH) markets. Its strategic focus centers on large-scale Energy Savings Performance Contracts (ESPCs), Microgrids, and Renewable Energy Assets (including solar, BESS, and Renewable Natural Gas - RNG), directly embodying the EaaS model. The company assumes the upfront capital burden for customers, guaranteeing energy savings that repay the project over a long-term contract. Its key services span the entire EaaS spectrum, from initial project development and financing (Construction) to the long-term Operation and Maintenance (O&M) of distributed energy assets.

- Siemens AG

Siemens AG approaches the EaaS market from a position of technological and digital dominance, leveraging its Smart Infrastructure (SI) division. Its strategy is to integrate its extensive portfolio of industrial and building automation hardware, digital twin technology, and proprietary AI-driven building management systems (BMS) into EaaS contracts. Siemens targets large, complex Commercial and Industrial customers who require deep operational integration and sophisticated energy optimization solutions. Their EaaS offering is differentiated by the use of the Siemens EcoTech label on products, which provides transparent environmental performance data, directly meeting the customer demand for verifiable sustainability reporting.

- Tata Power

Tata Power is a critical competitor in the high-growth Indian market, strategically transitioning from a conventional utility to a comprehensive integrated-solutions provider centered on the EaaS model. Their competitive advantage is predicated on deep local market knowledge, strong government relationships, and a vertically integrated service offering that includes utility-scale renewables, microgrids, and EV charging infrastructure. The company focuses heavily on the Commercial and Residential segments with its Green Energy EaaS offerings, explicitly aiming to meet India’s ambitious clean energy targets and capture the burgeoning demand for rooftop solar and storage solutions.

Energy as a Service (EaaS) Market Developments:

- October 2025: Ameresco was awarded a $197 million energy infrastructure project with the U.S. Naval Research Laboratory. The project involves comprehensive energy efficiency upgrades, cyber-secure microgrid deployment, and renewable energy integration.

- March 2024: Tata Power commissioned India’s largest solar and Battery Energy Storage System (BESS) in Chhattisgarh, comprising a 100 MW solar photovoltaic project and a 120 MWh utility-scale BESS asset.

Energy as a Service (EaaS) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 75.675 billion |

| Total Market Size in 2031 | USD 122.089 billion |

| Growth Rate | 10.04% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Service Type, End-User, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Energy as a Service (EaaS) Market Segmentation:

BY SERVICE TYPE

- Construction

- Operation and Maintenance

- Energy Optimization and Efficiency

- Others

BY END USER

- Industrial

- Commercial

BY APPLICATION

- Healthcare Facilities

- Educational Institutions

- Hospitality Sector

- Data Centers

- Retail and Malls

- Government and Public Infrastructure

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others