Report Overview

Electric Vehicle Charging Stations Highlights

Electric Vehicle Charging Stations Market Size:

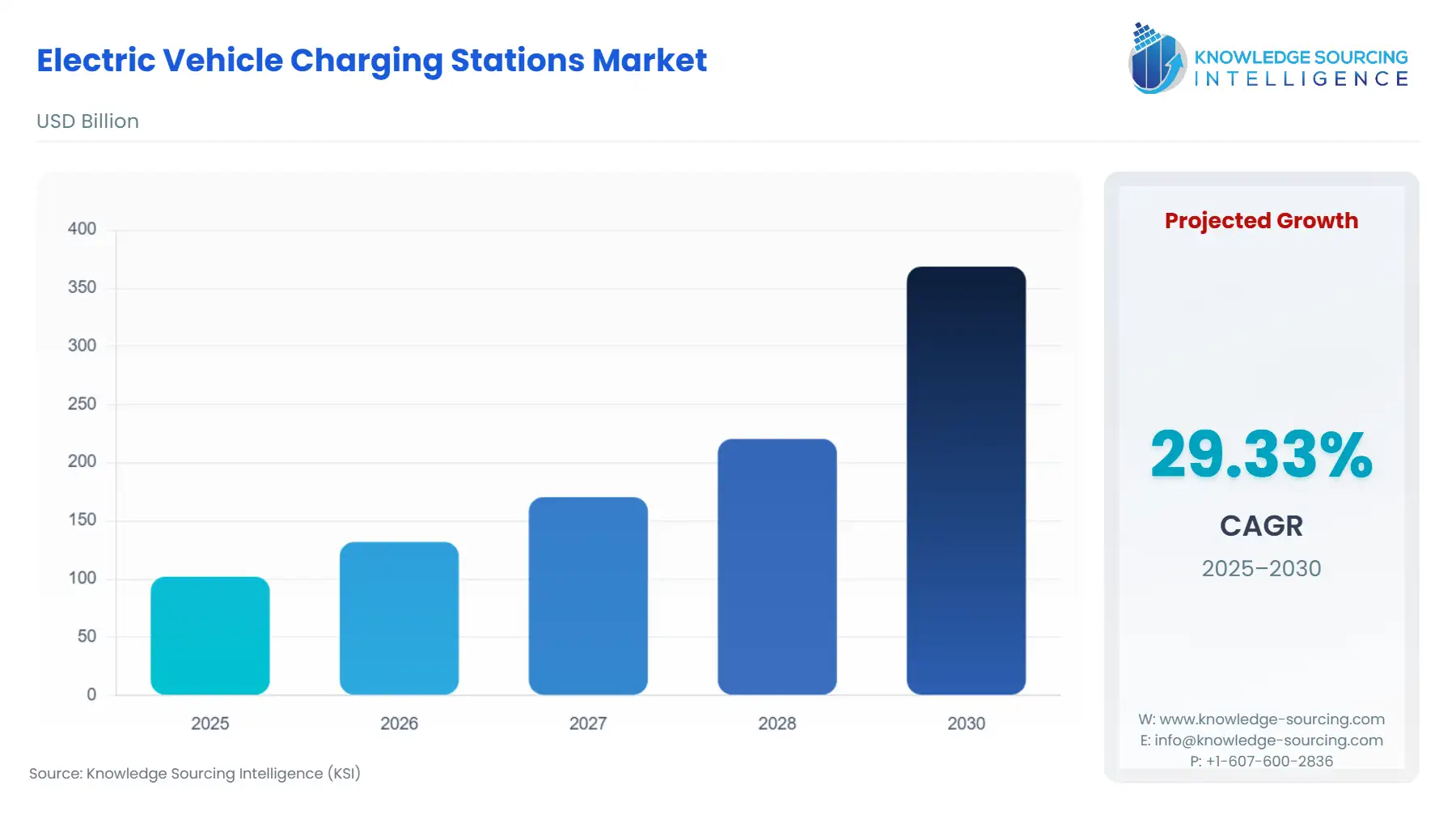

The electric vehicle charging stations market will grow from USD 101.917 billion in 2025 to USD 368.726 billion in 2030 at a CAGR of 29.33%.

Electric Vehicle Charging Stations Market Trends:

The electric vehicle (EV) charging stations market is witnessing robust growth as global efforts to reduce carbon emissions intensify. These stations are essential infrastructure, connecting electric vehicles and plug-in hybrids to a reliable power source, enabling safe and efficient recharging.

One of the main drivers behind this growth is the increasing focus on energy efficiency and the urgent need to shift away from fossil fuels. With fuel prices rising and fossil fuel reserves depleting, consumers and governments are turning to EVs as a sustainable alternative. This transition is further supported by substantial government initiatives, including tax rebates, subsidies, and zero-emission mandates, which are accelerating EV adoption across regions.

To support this surge, there is growing investment in both public and private charging infrastructure, ranging from fast-charging stations along highways to residential charging units in urban areas. Governments and energy companies are also collaborating to integrate renewable energy sources, such as solar and wind, into the charging network, making the EV ecosystem cleaner and more sustainable.

In addition, advancements in charging technologies, including ultra-fast chargers, smart grids, and app-based network management, are enhancing user convenience and reducing charging time. As EV adoption continues to rise, developing a wide-reaching, reliable, and intelligent charging infrastructure will be crucial to meet future demand and support the global shift toward clean mobility.

Electric Vehicle Charging Stations Market Growth Drivers:

Increasing Adoption of Electric Vehicles

An increase in the sales and adoption of electric vehicles is expected to drive the need for the development of charging infrastructure. According to the International Energy Agency, there were 95,00,000 battery electric vehicles in 2023. According to the same source, global sales of electric vehicles continued to rise quickly in 2022, with 2 million in sales in the first quarter, up 75% from the previous year in 2021. Therefore, due to the rise in the number of electric vehicles adopted by consumers, the electric vehicle charging stations market will be impacted positively in the coming years.

Favorable Government Investments

Investments by governments worldwide for the development of charging infrastructure and incentives offered to buyers are projected to create huge opportunities to expand the revenue stream. For instance, Bentley Motors will invest around US$3.4 billion over the next decade to become a 100% electrified premium brand by 2030. However, Bentley will rely on plug-in hybrid electric cars to transition to all-electric vehicles, unlike many major automakers. Beginning in 2026, the business intends to offer only electrified vehicles, including all-electric and plug-in hybrids. Additionally, Toyota wants to release plug-in hybrid versions of the Levin and Corolla.

Expanding R&D Activities by the Automobile Industry

Significant investments by automakers are also projected to aid the rising demand for these vehicles and, thus, play a huge role in the development of the market. Key EV market players like Tesla, Ford, Nissan, Volkswagen, BMW, and General Motors have allocated significant budgets to R&D to develop industry-leading EVs. OEMs offer various electric vehicles, from small hatchbacks like the Leaf to high-end sedans like the Tesla Model 3. This humongous range of product offerings has been successful in attracting a high number of customers, which has resulted in an increased market size for electric vehicles. For instance, in order to boost localization of cutting-edge components like electrical motors and automated transmissions, lower imports, and take advantage of the "China Plus One" trend, the Indian auto industry plans to spend USD 7 billion (Rs. 58,000 crores) by FY28.

Rising demand for passenger cars

Since most electric vehicles are passenger vehicles, a bigger portion of EV sales relates to passenger cars than any other type of EV. As a result, there is more demand for infrastructure to support them in terms of charging stations than for any other type of electric vehicle. Moreover, aimed at cutting down on greenhouse gas emissions and encouraging electric mobility, legislation or policy measures have largely targeted passenger vehicles. There are many countries offering tax breaks, requirements, and financial aid aimed at encouraging the wide adoption of electric cars, hence the demand for charging facilities for Electric Vehicles (EVs).

Advancements in battery technology

In the EV industry, a number of manufacturers are quickly developing their battery technologies. Accordingly, they are developing technologies that could make charging cars more convenient, like wireless chargers and autonomous charging robots. Furthermore, in order to meet the growing demand for quicker and more reasonably priced charging options, a number of power companies are making more and more investments in building the public charging infrastructure. For example, Ather Energy announced in October 2022 that the Ather Grid, the 580th public rapid charging point, will be installed in 56 Indian cities. By the end of FY23, Ather Energy intends to have installed 820 more grids, increasing its total to 1400 as the company grows across the country. With 60% of current installations in tier-II markets, Ether grids are carefully installed across markets.

Rising demand for commercial charging

The term "commercial application" describes the installation of charging infrastructure at places of business, public spaces, and parking lots used by electric vehicle owners while they are out and about doing things like working, dining, or shopping. In order to develop commercial charging networks and stations, a number of important companies are engaging in strategic partnerships with other players. For example, a memorandum of understanding (MoU) was signed by Siemens Limited and Switch Mobility Automotive Limited of the Hinduja Group in order to enter the Indian market for electric commercial vehicles. In a similar vein, BP partnered with Daimler Mobility and the BMW Group to advance electrification through digital charging solutions. In Digital Charging Solutions (DCS), one of Europe's top providers of digital charging solutions for automakers and fleet managers, BP will join forces with BMW Group and Daimler Mobility.

Electric Vehicle Charging Stations Market Geographical Outlook:

Asia Pacific is witnessing exponential growth during the forecast period

The Asia Pacific region is continuing to install public charging stations at a rapid pace, especially in China, India, and South Korea, due to the growing number of electric vehicle (EV) users.

For example, Ather Energy announced in October 2022 that the Ather Grid, the 580th public fast charging point, will be installed in 56 Indian cities. By the end of FY23, Ather Energy intends to have installed 820 more grids, increasing its total to 1400 as the company grows across the country. 60% of the current Ather Grid installations are in tier-II and tier-III cities, with the systems being strategically placed throughout markets. Aside from this, the Asia Pacific market is expanding thanks to supportive government initiatives.

Electric Vehicle Charging Stations Market Key Launches:

December 2025: bp pulse launched a major EV charging hub near Chicago’s O'Hare Airport, featuring 40 ultrafast bays as its sixth major U.S. airport opening in 2025.

October 2025: Tesla expanded its global Supercharger network to nearly 74,000 stalls across 7,800 sites, with new V4 cabinets delivering up to 500 kW per stall.

October 2025: Siemens unveiled the Sicharge Flex at Busworld 2025, a next-gen distributed charging system supporting power delivery from 480 kW up to 1.68 MW for heavy-duty fleets.

May 2025: ChargePoint and Eaton established a strategic partnership to co-develop bidirectional power flow and vehicle-to-everything (V2X) technologies for residential and commercial infrastructure.

April 2025: ABB E-mobility launched a unified platform-based portfolio including the MCS1200 for megawatt truck charging and field-upgradable A200/300 All-in-One chargers.

List of Top Electric Vehicle Charging Stations Companies:

ABB Ltd

Hong Kong EV Power Limited

General Electric

ChargePoint, Inc.

Xcharge, Inc.

Electric Vehicle Charging Stations Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 101.917 billion |

| Total Market Size in 2030 | USD 368.726 billion |

| Forecast Unit | Billion |

| Growth Rate | 29.33% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type of Electric Vehicle, Type of Charging Stations, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electric Vehicle Charging Stations Segmentation:

By Type of Electric Vehicle

Battery Electric Vehicles (BEVs)

Plug-In Hybrid Electric Vehicles (PHEVs)

By Type of Charging Stations

AC Charging Station

DC Charging Station

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

India

Thailand

Indonesia

Taiwan

South Korea

Others