Report Overview

Drum Brakes Market - Highlights

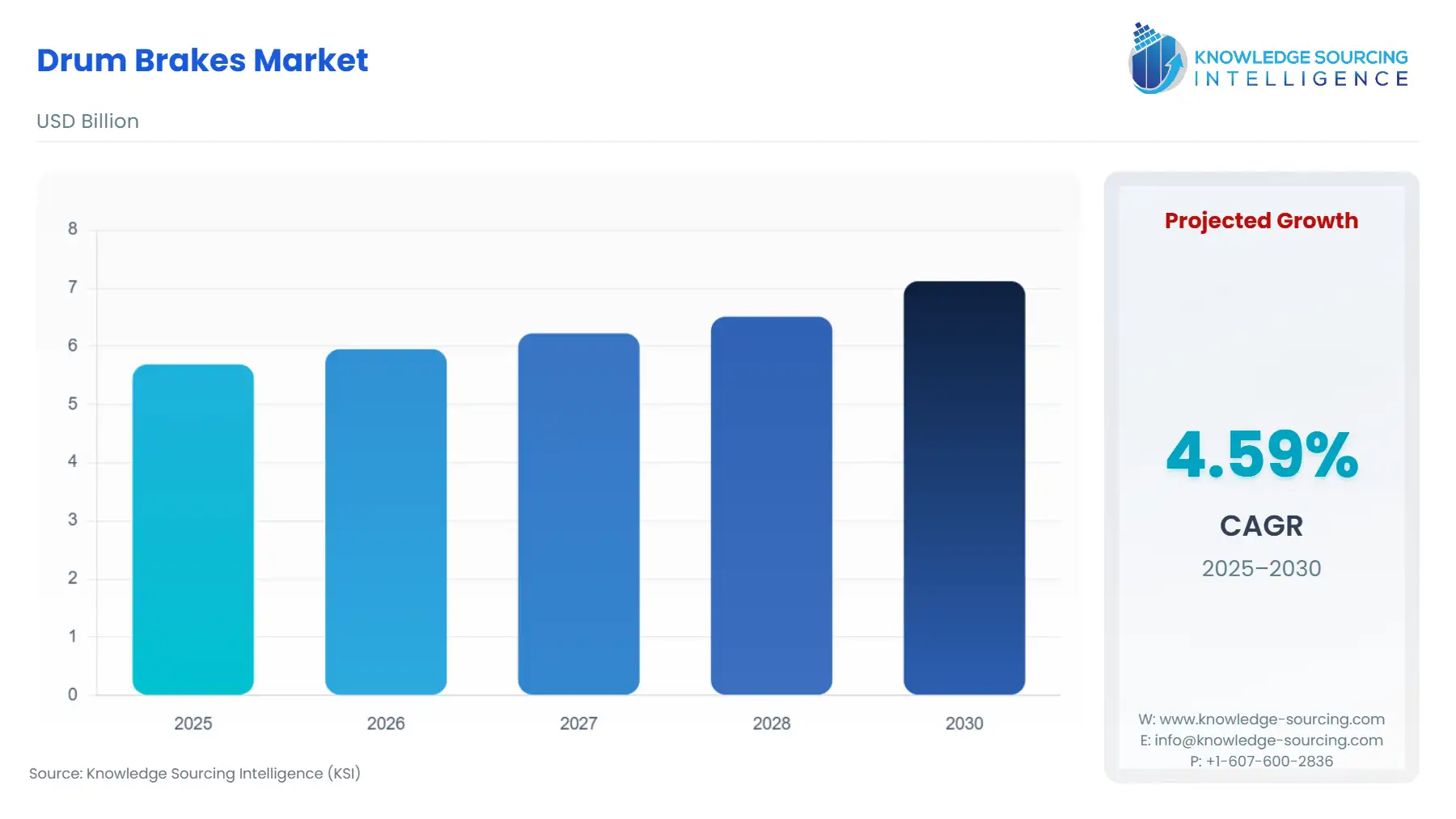

Drum Brakes Market Size:

The drum brakes market, growing at a 4.45% CAGR, is projected to achieve USD 7.391 billion in 2031 from USD 5.691 billion in 2025.

A drum brake is a type of brake that utilizes brake shoes or pads to create friction against a rotating brake drum for stopping or slowing down a vehicle. Drum brakes provide uniform braking force regardless of the vehicle's direction of travel owing to which such brakes are commonly employed as the rear brakes. The most common types of drum brakes are mechanical, hydraulic, and pneumatic-assisted. The drum brakes market growth is propelled by factors like the high production of vehicles and application in commercial and passenger vehicles.

Drum Brakes Market Growth Drivers:

The growth in vehicle production drives the drum brakes market growth.

The durability and reliability of drum brakes contribute to their demand, especially in emerging economies with increasing vehicle production and as the number of vehicles manufactured grows, there is a corresponding rise in the requirement for braking systems, including drum brakes. This is due to the recognized durability and reliability that drum brakes offer in meeting the braking needs of the expanding vehicle market, thereby expanding the drum brakes market size. According to the European Automobile Manufacturers Association, in 2022, global motor vehicle production reached 85.4 million units, reflecting a 5.7% increase compared to the previous year 2021.

Rise in commercial vehicle production

The demand for drum brakes is driven by their widespread usage in commercial vehicles. The growth of the commercial vehicle sector, encompassing trucks, buses, and trailers, directly contributes to the increasing demand for drum brakes. Drum brakes offer better heat dissipation than disc brakes due to their larger surface area and such advantage is particularly beneficial for commercial vehicles that frequently face heavy loads and continuous braking. According to the Society of Indian Automobile Manufacturers (SIAM) report in 2023, commercial vehicle production in India increased from 8.05 lakhs in FY 2021-2022 to 10.35 lakhs in FY 2022-2023.

Rise in passenger vehicle production

The increasing production of passenger vehicles is a key factor driving growth in the drum brake market, as the demand for passenger vehicles rises globally, so does the need for reliable and cost-effective braking systems. Drum brakes offer a viable solution, particularly in entry-level and mid-range vehicles, due to their durability and affordability. The growing drum brake industry in emerging economies, coupled with the aftermarket demand, further contributes to the expansion of the drum brake market. According to the International Organization of Motor Vehicle Manufacturers (OICA) in 2022, passenger car production in China increased from 21.4 million in 2021 to 23.83 million in 2022, which was an increase of 11.34%. According to the European Automobile Manufacturers Association, new commercial vehicle registrations of vans increased to 14.3%, wherein for trucks it increase by 23%, and buses by 18.5% in the first three quarters of 2023. Wherein the new car registrations accounted for a 9.2% increase in September 2023.

Drum Brakes Market Geographical Outlook:

Asia Pacific region is expected to dominate the market.

The Asia Pacific region is poised to be a dominant force in the drum brake market due to the region's high vehicle production rates and extensive manufacturing capabilities which have contributed to the increased demand for drum brakes. Additionally, the abundant availability of resources, such as raw materials and skilled labor, further strengthens the market's growth potential in this region. According to the Census and Economic Information Centre (CEIC), motor vehicle production in India reached 5,456,857 units in December 2022, marking an increase from the previous figure of 4,399,112 units recorded in December 2021.

Drum Brakes Market Restraints:

Shift toward disc brakes will restrain the drum brakes industry's growth

The automotive industry has been experiencing a gradual transition towards disc brakes, primarily driven by the safety features they offer. Disc brakes are preferred in passenger cars and high-performance vehicles due to their stopping power and efficient heat dissipation. As a result, the growing demand for disc brakes poses a challenge to the growth of the drum brake market size. According to the Journal of Sustainable Development of Transport and Logistics, due to the implementation of discs the stopping distance, potentially reduced by up to 30%, and decrease the occurrence of high-speed rear-end collisions involving large trucks, with a potential reduction of approximately 43.2%.

Drum Brakes Market Key Developments:

January 2023: At the Auto Expo 2023 on January 12, Brakes India, a TSF Group company and part of the erstwhile TVS group, introduced their newly designed and developed Motor on Drum brakes specifically for the passenger car segment.

November 2022: Continental, launches the innovative lightweight design of the drum brake reducing its overall mass by approximately 35%. This significant reduction brings the EPB-Si with a Lightweight Drum brake system closer in mass to a caliper and disc brake assembly

May 2022: ZF Aftermarket launched a new brake fluid on May 26, 2022, this brake fluid provides enhanced safety in all ABS (Anti-lock Braking systems) with the improved pedal feel and braking comfort with an additional high water tolerance feature.

Drum Brakes Market Company Products:

S-CAM brakes (drum): This product is made by MGM brakes and includes features such as an external breather tube system, epoxy-coated inside and out for extra protection in unusually tough, corrosive operating environments, extra parking force, and weld-reinforced mounting bolts.

Hydraulic Drum Brakes: Hydraulic drum brakes made by Knott Brake Company are a combination of the efficiency of drum brakes with the flexibility of a hydraulic actuation system, meaning that they are an excellent solution to any number of braking requirements.

ERD HBF Electrically Released Bi-functional Brake: This product is made by Warner Electric and is based on the Electro-Release Hydraulic amplified brake type ERDH. A low-magnetic moving armature is added between the armature and the friction disc assembly.

Service Brake: This is a product by Nifo that allows the vehicle to reduce the speed of a moving vehicle or machinery by transforming it into heat, through the friction of mechanical elements (jaws against the drums or pads against the discs), all through a mechanical or hydraulic drive.

Drum Brakes Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.691 billion |

| Total Market Size in 2031 | USD 7.122 billion |

| Growth Rate | 4.59% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Material, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Drum Brakes Market Segmentation:

By Type

Leading-Trailing Shoe

Twin-Leading Shoe

Duo-Servo

Others

By Material

Steel

Aluminum

Others

By Distribution Channel

OEM

Aftermarket

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

Light Duty

Heavy Duty

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others