Report Overview

Disinfection Cap Market - Highlights

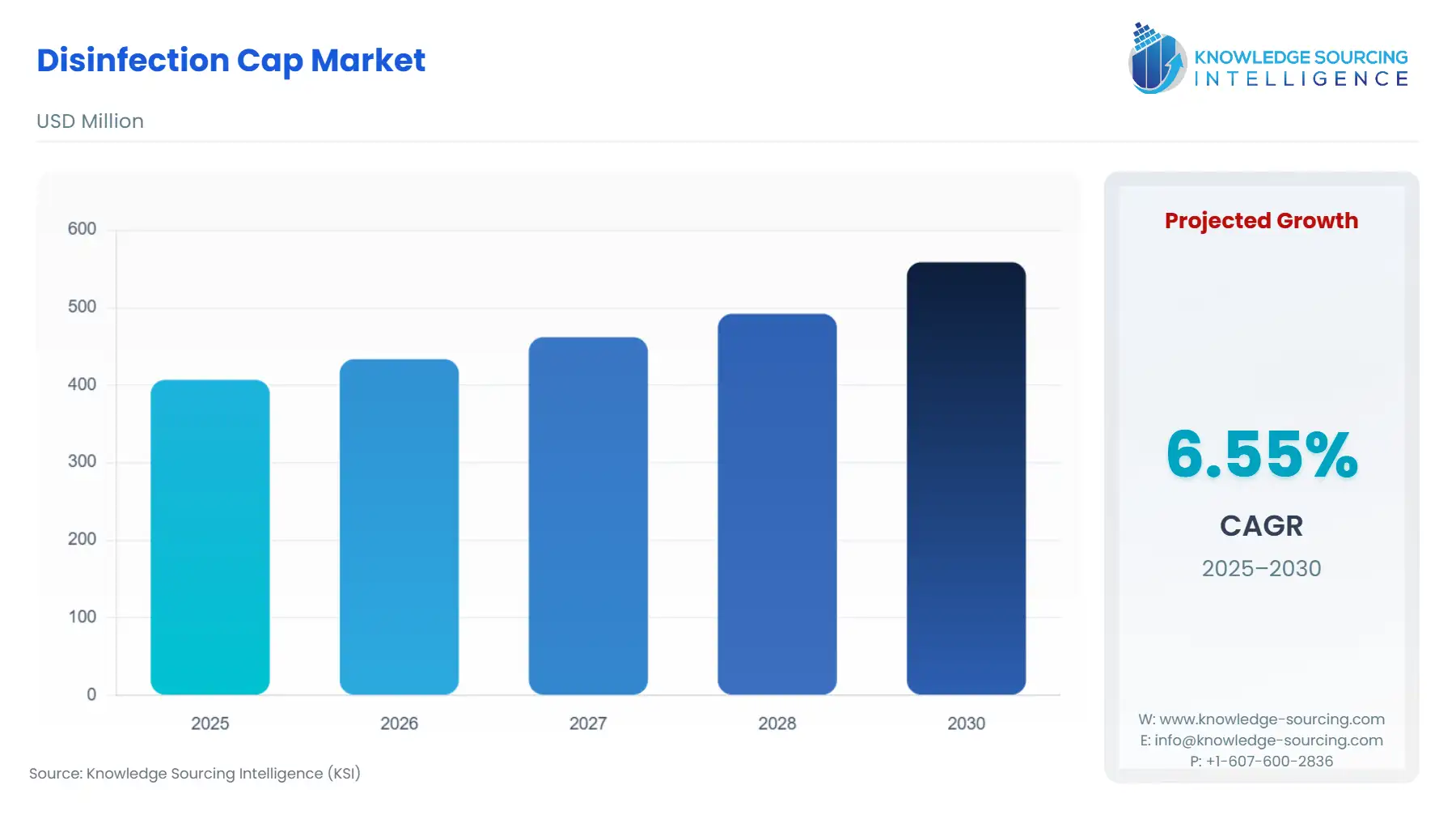

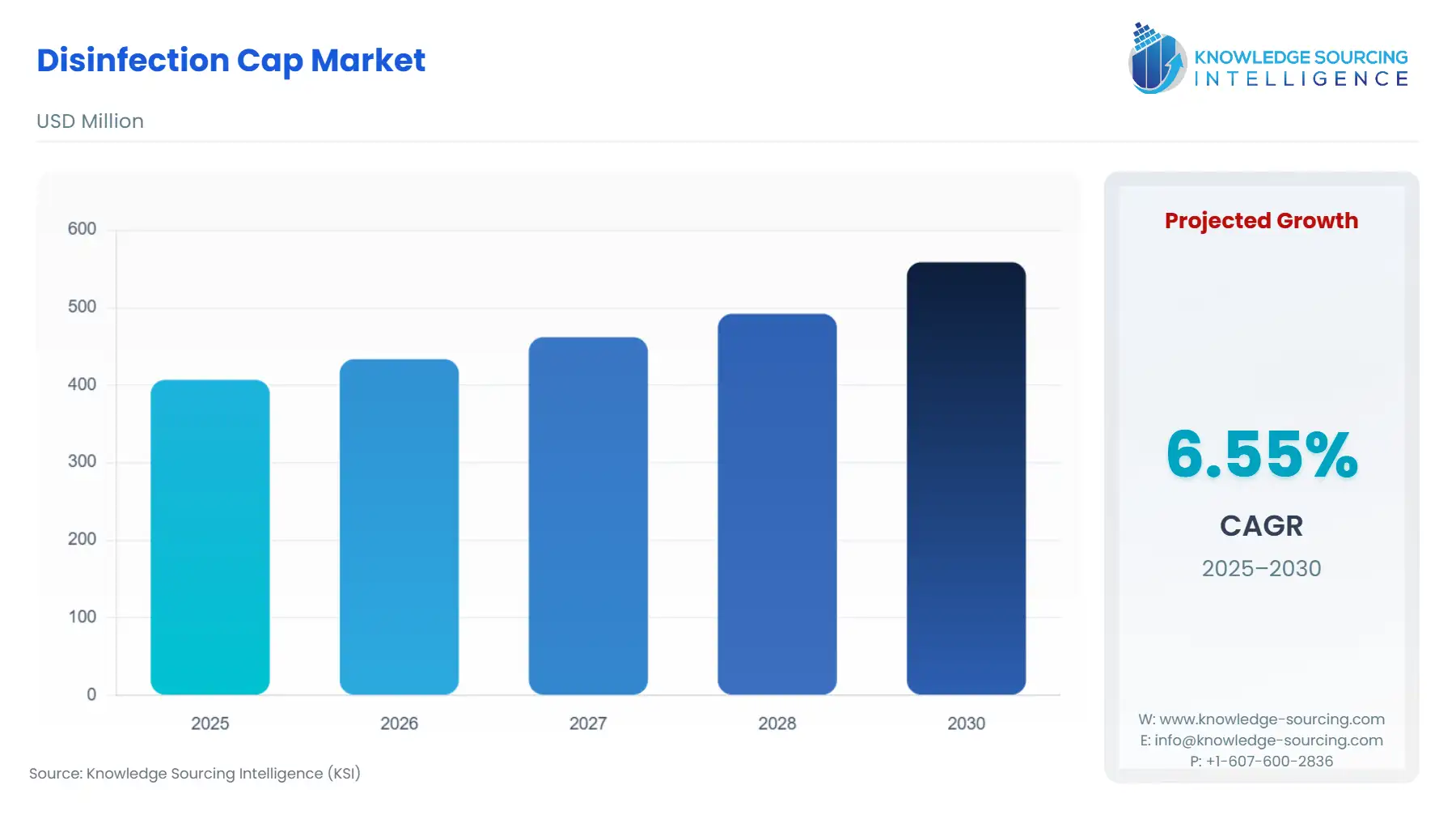

The Disinfection Cap Market, at a 6.35% CAGR, is expected to grow from USD 406.896 million in 2025 to USD 588.836 million in 2031.

Disinfection Cap Market Key Highlights

________________________________________________________________

The disinfection cap market occupies a critical position within the broader medical consumables and infection control sectors. These caps, typically pre-filled with an antiseptic agent such as Isopropyl Alcohol (IPA) or Chlorhexidine Gluconate (CHG), are designed to standardize the disinfection of needleless access sites on central venous catheters (CVCs) and peripherally inserted central catheters (PICCs). The fundamental market narrative is not driven by product innovation alone, but by the imperative to eliminate Hospital-Acquired Infections (HAIs), particularly CLABSIs, which impose substantial economic and mortality burdens on healthcare systems globally.

________________________________________________________________

Disinfection Cap Market Segment Analysis:

Growing Prevalence of Healthcare-acquired Infections (HAIs)

The growing prevalence of HAIs is a major growth driver of the disinfection cap market. According to the WHO, seven patients in high-income countries and 15 patients in low- and middle-income countries out of every 100 patients in acute-care hospitals acquire at least one healthcare-associated infection (HAI) during their hospital stay. On average, one in ten of these patients is expected to die from their HAI as per the WHO. Moreover, the methicillin-resistant Staphylococcus aureus (MRSA) prevalence rate in the USA increased by 14% in 2021 from 2020 and ventilator-associated events (VAE) increased by 12% in 2021 as per the CDC data.

Increasing Cancer Cases

The disinfection cap market is being driven in large part by the rising incidence of cancer as these are used to clean IV connections. For instance, cancer is the leading death cause with more than 10  Disinfection Cap Market Analysis

Disinfection Cap Market Analysis

Growth Drivers

The market expansion is fundamentally driven by verifiable clinical evidence and consequent regulatory pressure. Academic research confirms that the use of disinfection caps in central line bundles significantly reduces CLABSI incidence. This documented efficacy establishes the cap as a necessary standard of care, which directly increases the demand for prophylactic measures over reactive treatment. Furthermore, the persistent global aging population elevates the volume of patients requiring long-term IV access and critical care, substantially expanding the end-user base in high-acuity settings and creating a proportional increase in the total available market for consumable disinfection devices.

Challenges and Opportunities

The primary market challenge revolves around end-user compliance and cost-effectiveness analysis in resource-constrained environments. While caps are clinically effective, inconsistent adoption across different care settings—such as long-term care versus acute care—creates demand fragmentation. The key opportunity, however, lies in expanding the product application to peripheral IV lines (PIVs). PIVs, though lower-risk than CVCs, are far more numerous and often suffer from high failure and complication rates. Developing and marketing caps specifically validated for PIV maintenance presents a substantial opportunity to unlock new demand in a largely untapped high-volume segment, leveraging established success from the central line market.

Raw Material and Pricing Analysis

Disinfection caps are physical products primarily composed of medical-grade polymers, such as polypropylene and polyethylene, for the outer shell and housing. The critical functional component is the contained antiseptic solution, typically $70\%$ Isopropyl Alcohol (IPA) or CHG. The pricing dynamic is sensitive to global petrochemical market volatility, which influences the cost of the raw polymer resins. Furthermore, the cost of IPA, a commodity chemical, and its reliable supply chain directly dictate manufacturing expenditure. Manufacturers who maintain localized or diverse sourcing for these polymers and have long-term contracts for the antiseptic agents are better positioned to secure a favorable cost of goods sold (COGS), enabling more competitive pricing models and ensuring consistent supply to meet non-negotiable demand.

Supply Chain Analysis

The global supply chain for disinfection caps exhibits a high dependency on manufacturing hubs located in Asia-Pacific, particularly China and Southeast Asia, for the high-volume production of molded polymer components. The logistical complexity involves the specialized handling and transportation of medical devices containing flammable liquids (IPA/CHG), necessitating strict regulatory compliance for shipping and warehousing. A critical dependency is the availability of sterilization services (e.g., Ethylene Oxide, ETO), a process often outsourced to specialized facilities, which creates a potential bottleneck. Disruptions, whether from geopolitical events or environmental factors (such as hurricanes impacting US-based ETO facilities), threaten supply chain continuity, prompting major vendors to pursue regionalized production or strategic joint ventures to build redundancy and stabilize market growth.

Government Regulations

Governmental and trade association bodies establish the clinical necessity for disinfection caps. Reimbursement and public reporting metrics are the most powerful non-clinical growth catalysts, as hospitals face financial penalties or reputational damage for elevated CLABSI rates.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

United States | Centers for Medicare & Medicaid Services (CMS) / CDC | CMS non-payment for preventable hospital-acquired conditions (HACs) like CLABSIs creates a financial imperative. This directly drives demand for caps as a reliable, verifiable intervention for HAC score improvement. |

European Union | EU Medical Device Regulation (MDR) 2017/745 | Stricter requirements for clinical data, post-market surveillance, and device classification increase the regulatory burden on manufacturers. This pushes demand toward established, well-documented products and favors market leaders with extensive compliance resources. |

United Kingdom | National Institute for Health and Care Excellence (NICE) | NICE guidelines for CVC maintenance, which advocate for the use of adjuncts like disinfection caps, reinforce their inclusion in hospital procurement and drive demand through clinical standard adoption. |

________________________________________________________________

In-Depth Segment Analysis

By Type: Single Cap System

The Single Cap System, designed as a twist-on, one-time-use device for single-lumen connectors, dominates the market due to its inherent advantages in clinical workflow standardization and ease of use. This segment is principally driven by the push for simplified and consistent protocol adherence across various clinical skill levels. The mechanical action of twisting the cap onto the access port forces the antiseptic agent (usually IPA) directly onto the lumen, mitigating the inconsistency and variability associated with manual scrubbing (the "scrub the hub" protocol). Hospital Infection Control teams prioritize the Single Cap System because its passive disinfection mechanism offers a measurable improvement in staff compliance, directly translating to lower CLABSI rates. Furthermore, the single-use nature aligns perfectly with the strict sterility protocols in acute care, ensuring that a fresh, saturated device is used for every port access and thereby sustaining high, recurring unit demand from the hospital sector.

By End-User: Hospitals

Hospitals represent the foundational demand segment, with the entire purchasing dynamic centered on risk mitigation and financial accountability. The primary growth catalyst is the direct link between CLABSI rates and public quality reporting mandates from agencies like CMS and state health departments. A high CLABSI rate can trigger substantial financial penalties, including reduced Medicare/Medicaid reimbursements. Consequently, hospital purchasing managers view disinfection caps not merely as a medical supply but as an insurance policy against reimbursement cuts. Furthermore, the increased complexity of hospital patients, coupled with a higher average length of stay and frequent central line utilization in Intensive Care Units (ICUs) and oncology wards, makes infection prevention an operational imperative. This environment creates non-cyclical, high-volume demand for caps, as the cost of the consumable is negligible compared to the cost of treating a single CLABSI event, which can exceed $40,000 USD.

________________________________________________________________

Geographical Analysis

US Market Analysis (North America)

The US market exhibits robust, high-value demand, primarily driven by the pay-for-performance healthcare model. The Centers for Medicare & Medicaid Services' (CMS) Hospital-Acquired Condition (HAC) Reduction Program and other value-based purchasing initiatives penalize hospitals for high infection rates, including CLABSIs. This strong financial incentive drives immediate, large-scale adoption of verified infection-prevention technology. Additionally, high public awareness and active physician lobbying for patient safety protocols compel procurement teams to prioritize premium, evidence-based solutions like disinfection caps over lower-cost alternatives, sustaining high average selling prices and market volume.

Brazil Market Analysis (South America)

The Brazilian market is increasingly influenced by the expansion of the private hospital sector and the adoption of international accreditation standards. While public hospital procurement faces significant budgetary constraints, private facilities, which cater to a growing middle and upper class, prioritize quality and infection control to differentiate themselves. The pressure from national infection control agencies to reduce outbreaks in complex surgical and ICU cases also increases the unit volume for caps in large, high-tech private centers. However, logistics and fragmented distribution channels remain an enduring constraint on penetrating smaller, remote public facilities.

Germany Market Analysis (Europe)

The German market is characterized by a high standard of clinical practice and a focus on product quality and long-term cost-benefit. Its growth is driven by regional infection control networks (like the national HAI surveillance system, KISS) and their established guidelines. German hospitals place a strong emphasis on the standardization of care, meaning that once a disinfection cap is validated and integrated into a hospital's standard operating procedure (SOP), the resulting procurement demand is highly stable and recurrent. The stringent regulatory environment favors European or locally certified products, acting as a barrier to entry for lower-cost, non-MDR-compliant foreign manufacturers.

UAE Market Analysis (Middle East & Africa)

The UAE market, anchored by health hubs like Dubai and Abu Dhabi, is a high-growth segment fueled by massive government investment in world-class healthcare infrastructure and medical tourism. The drive to achieve internationally recognized accreditation (e.g., Joint Commission International - JCI) is a primary growth catalyst, as these standards mandate aggressive infection prevention protocols, including the use of advanced VAD maintenance devices. High per-capita healthcare expenditure and a strong focus on clinical excellence ensure that premium, single-use, pre-filled disinfection caps are readily adopted across major private and government-run facilities to meet accreditation and patient safety goals.

China Market Analysis (Asia-Pacific)

The Chinese market is rapidly accelerating due to large-scale hospital infrastructure modernization and the central government's efforts to standardize care quality. The introduction of national clinical guidelines for catheter care, coupled with an unprecedented volume of patients in newly built or expanded hospitals, generates immense unit volume demand. While pricing sensitivity remains a factor, the sheer scale of the patient population and the growing focus on quality-of-care metrics in urban centers are compelling local and multinational manufacturers to rapidly expand production and distribution networks, shifting the purchasing mandate from simple low-cost to standardized infection control efficacy.

________________________________________________________________

Competitive Environment and Analysis

The disinfection cap market is dominated by a few major players who leverage established distribution networks and vast vascular access portfolios to maintain market share. Competitive differentiation centers on validated clinical data, integration with existing VAD products, and supply chain reliability. The landscape is characterized by strategic acquisitions and portfolio consolidation aimed at capturing the entire VAD care continuum, from insertion to maintenance. Mid-tier companies compete by specializing in niche applications or offering aggressive pricing on single-cap systems.

3M Company

3M's strategic positioning leverages its broad expertise in patient safety and clinical solutions. Their flagship product, the Curos Disinfecting Port Protector, is one of the most clinically recognized brands globally, a fact supported by numerous published studies on its efficacy in CLABSI reduction. 3M's strength lies in its extensive global network and its ability to market the cap as a single solution for standardizing care across all hospital departments. The company focuses on robust clinical documentation, ensuring its products meet the highest evidence-based requirements, which directly supports their premium market positioning.

Becton Dickinson (BD)

BD is a formidable competitor due to its comprehensive and integrated vascular access management portfolio, spanning syringes, catheters, and informatics. BD's strategy is to position the disinfection cap as an essential component of a system solution rather than a standalone product. Their competitive advantage stems from their immense scale in the medical supplies sector and recent strategic actions that solidify their critical care presence. This integration allows BD to offer streamlined procurement and implementation to large Integrated Delivery Networks (IDNs) seeking vendor consolidation for all vascular access devices.

ICU Medical

ICU Medical maintains a strong market presence in infusion therapy and vascular access products, often competing on the basis of advanced safety features and supply chain agility. The company’s strategy involves securing market share through focused innovation in infusion and connectivity devices, making the disinfection cap a natural complement to its core product lines. ICU Medical recently emphasized supply chain stability, leveraging strategic partnerships to ensure continuity of critical consumables, a key differentiator in a market susceptible to material shortages and logistical bottlenecks.

________________________________________________________________

Recent Market Developments

February 2025: BD publicly announced its plan to spin off or otherwise separate the BD Biosciences and BD Diagnostic Solutions units into a new, independent entity, creating two distinct entities focused on clinical workflow and life science research, respectively. This planned strategic realignment aims to allow the remaining core Medical segment, which includes vascular access devices and consumables, to focus capital and resources more intensely on high-growth, high-margin opportunities within the interventional and surgical space. The separation is a financial move intended to unlock value and sharpen the focus of the Medical segment, directly impacting the long-term investment and commercial strategies for products like disinfection caps.

September 2024: Becton Dickinson (BD) finalized the acquisition of the Critical Care product group from Edwards Lifesciences. This strategic move expands BD’s Vascular Access Management (VAM) portfolio and enhances its presence within the Intensive Care Unit (ICU) and operating room settings. The newly acquired products, which include monitoring platforms, are intrinsically linked to the central venous catheters (CVCs) that disinfection caps protect. This acquisition directly expands BD's footprint in the high-acuity, high-demand end-user segment for disinfection caps, allowing the company to cross-sell its full range of vascular access safety solutions.

________________________________________________________________

Disinfection Cap Market Segmentation

By Product Type

Single Cap System

Dual Cap System

By Distribution Channel

Online

Offline

Pharmacies

Specialty Medical Stores

By Application

IV Lines

Catheter Hubs

Needle-Free Connectors

Others

By End-User

Hospitals & Clinics

Ambulatory Surgical Centers

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Disinfection Cap Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Disinfection Cap Market Size in 2025 | USD 406.896 million |

Disinfection Cap Market Size in 2030 | USD 558.671 million |

Growth Rate | CAGR of 6.55% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Disinfection Cap Market |

|

Customization Scope | Free report customization with purchase |