Report Overview

Discrete Diodes Market - Highlights

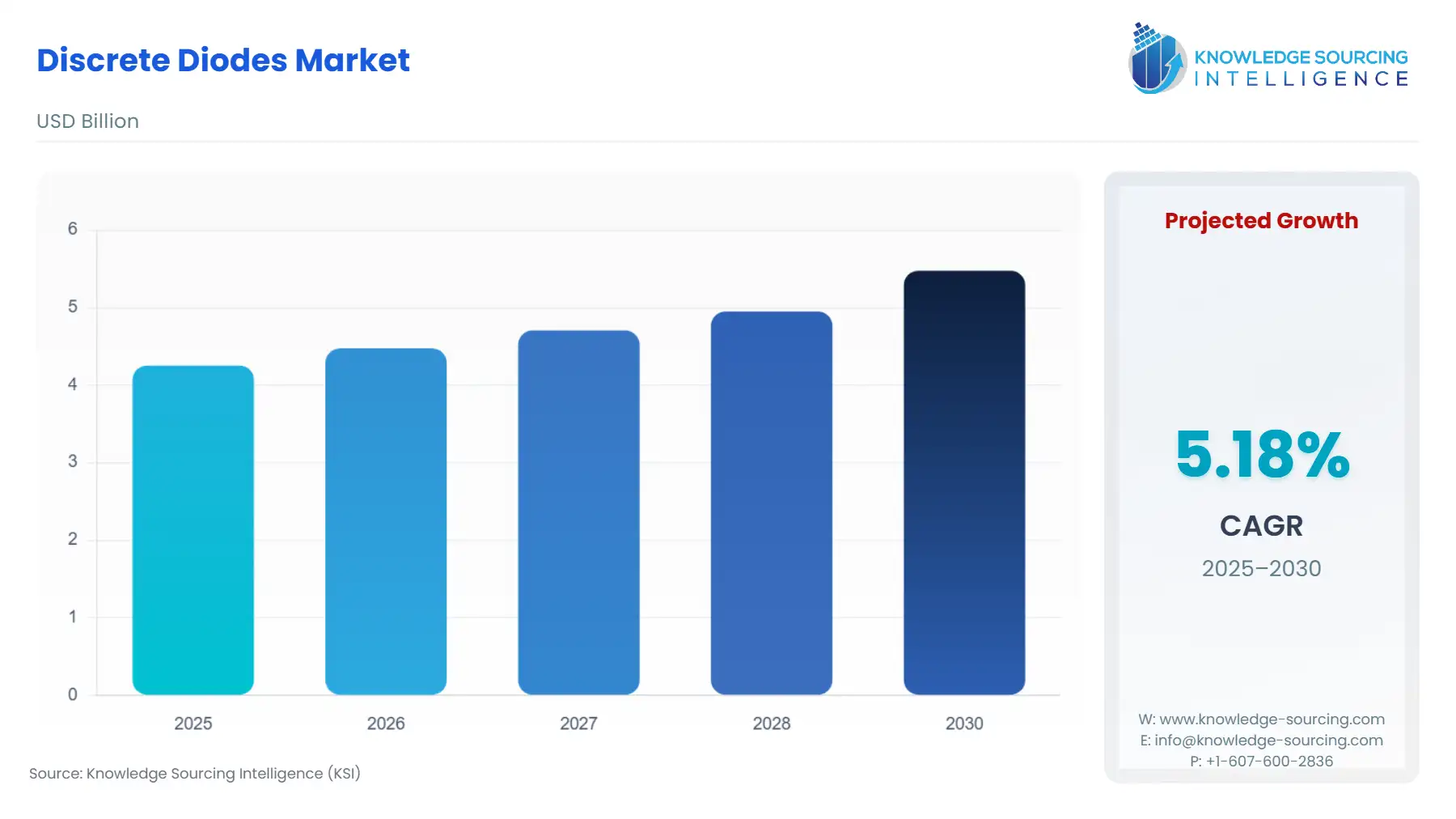

Discrete Diodes Market Size:

The discrete diodes market is expected to grow from USD 4.254 billion in 2025 to USD 5.477 billion in 2030, at a CAGR of 5.19%.

A diode, sometimes known as a discrete diode, is an electrical component that has ideally zero resistance to current in one direction and ideally infinite resistance in the other. The semiconductor diode is the most frequent form of diode employed because it conducts electricity when forward-biased, resulting in a lower voltage drop when compared to the flowing current. Some of the drivers driving demand in the discrete diodes market include rapid growth and proliferation of consumer, industrial, medical, and car electronics, as well as innovation in chip architecture and semiconductor production. The growing demand for IoT devices is also a factor propelling the discrete diode industry forward.

Discrete Diodes Market Growth Driver:

- In the data and communication industry, there is a growing demand for power-efficient semiconductors.

Due to digital transformation, an increase in remote work, and increased use of Internet services, traffic flow has been rising. Data centres and telecom base stations have seen an increase in capital investment as a result. As a result, there is an increase in demand for power supply equipment, and its market is anticipated to expand. For instance, Tagore Technology Inc will deliver a family of second-generation RF switches with 10-100W average power in September 2021. The TS8x product series is ideal for switching post-power amplifier (PA) harmonics filters in tactical and military communications, land mobile radios, and private mobile radios. Customers can use Tagore's TS8x switch family to replace all traditional PIN diode-based switches, which need several passive components and a high-voltage bias supply, saving substantial board space and total cost and simplifying RF front-end design.

Discrete Diodes Market Segment Analysis:

- Based on product type, the Schottky diode is expected to hold a significant share.

Schottky diode is predicted to have a considerable share based on product type due to its application in power-consuming sectors to mitigate power loss. Data centres and communication base stations are equipped with power semiconductors (diodes) that effectively convert (rectify) the AC power they get from utility companies into DC power. But, the power loss (steady-state loss), which occurs when power is delivered to semiconductors, continues to be the main problem. One approach to lowering power loss in power semiconductors is to make a thinner substrate element by shortening the distance that the energy travels. For instance, Fuji Electric Co., Ltd. announced the release of its 2nd-generation discrete Sic-Schottky Barrier Diode (SBD) line of power semiconductors in November 2021, which would help data centres and telecom base stations save energy. This series employs a SiC (silicon carbide) substrate that is about one-third the thickness of FE's traditional first-generation SiC-SBD Series, as well as a redesigned chip structure that has successfully decreased steady-state loss by 16%.

Discrete Diodes Market Geographical Outlook:

- Asia Pacific region is expected to hold a significant market share in the Discrete diodes market due to Increasing investment in smart city projects across developing nations.

A smart city is a type of urban development project in which a city's infrastructure is outfitted with various information and communication technologies. Countries throughout the Asia Pacific region are concentrating on the construction of smart cities to better manage assets and resources. The various market stakeholders, such as the respective government, ICT service providers, and smart device makers, play an important role in the implementation of smart city solutions. The development of network infrastructure to support communication will be accelerated by investments in smart city projects. Additionally, developing nations have made large investments in smart city initiatives. The smart cities project, for instance, stipulates that the Indian central government will provide Rs. 48,000 crores (US$ 6 billion) in money over five years to aid in the mission's implementation, or an average of Rs. 100 crore (US$ 12.5 million) every year for each city, as per its guidelines. The Smart Cities Mission will be fully executed by June 2023, and by that time, all smart cities are expected to have completed their efforts. As a result, there will be a rise in the need for linked products like smart lights, smart meters, smart appliances, and telecom equipment in the region, which will in turn raise demand for discrete diodes.

Discrete Diodes Market Key Developments:

- January 2023: Diodes Incorporated (Diodes) has released its first Silicon Carbide (Sic) Schottky barrier diodes (SBD). These wide-bandgap SBDs provide considerable improvements in efficiency and high-temperature dependability, while also meeting market needs for lower system operating costs and minimum maintenance. AC-DC, DC-DC, and DC-AC switching converters, photovoltaic inverters, uninterruptible power supplies, and industrial motor driving applications are all possible with these devices. These devices can also be employed in other circuits, such as power factor correction boost converters.

- January 2023: Vishay (VSH) has added additional rectifiers to its diode lineup. In its Gen 7 platform, VSH introduced two new 1200 V FRED Pt Hyperfast rectifiers, the VS-E7MH0112-M3 and VS-E7MH0112HM3c. These devices, which have higher reverse recovery energy and a shorter recovery time, can also be used as high-frequency rectifiers for bootstrap driver functionality. Given the above-mentioned powerful qualities, Vishay remains well-positioned to gain traction in industrial and automotive applications with this recent move.

List of Top Discrete Diodes Companies:

- Diodes Incorporated

- Infineon Technologies AG

- Littelfuse Inc

- Microchip Technology

- NXP Semiconductors

Discrete Diodes Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.254 billion |

| Total Market Size in 2031 | USD 5.477 billion |

| Growth Rate | 5.19% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Material, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Discrete Diodes Market Segmentation:

- By Product Type

- Zener Diode

- Schottky Diode

- Rectifier Diode

- Others

- By Material

- Silicon Carbide

- Gallium Nitride

- Others

- By End-User

- Automotive

- Consumer Electronics

- IT & Telecommunication

- Aerospace & Defense

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Others

- North America