Report Overview

Digital Isolator Market - Highlights

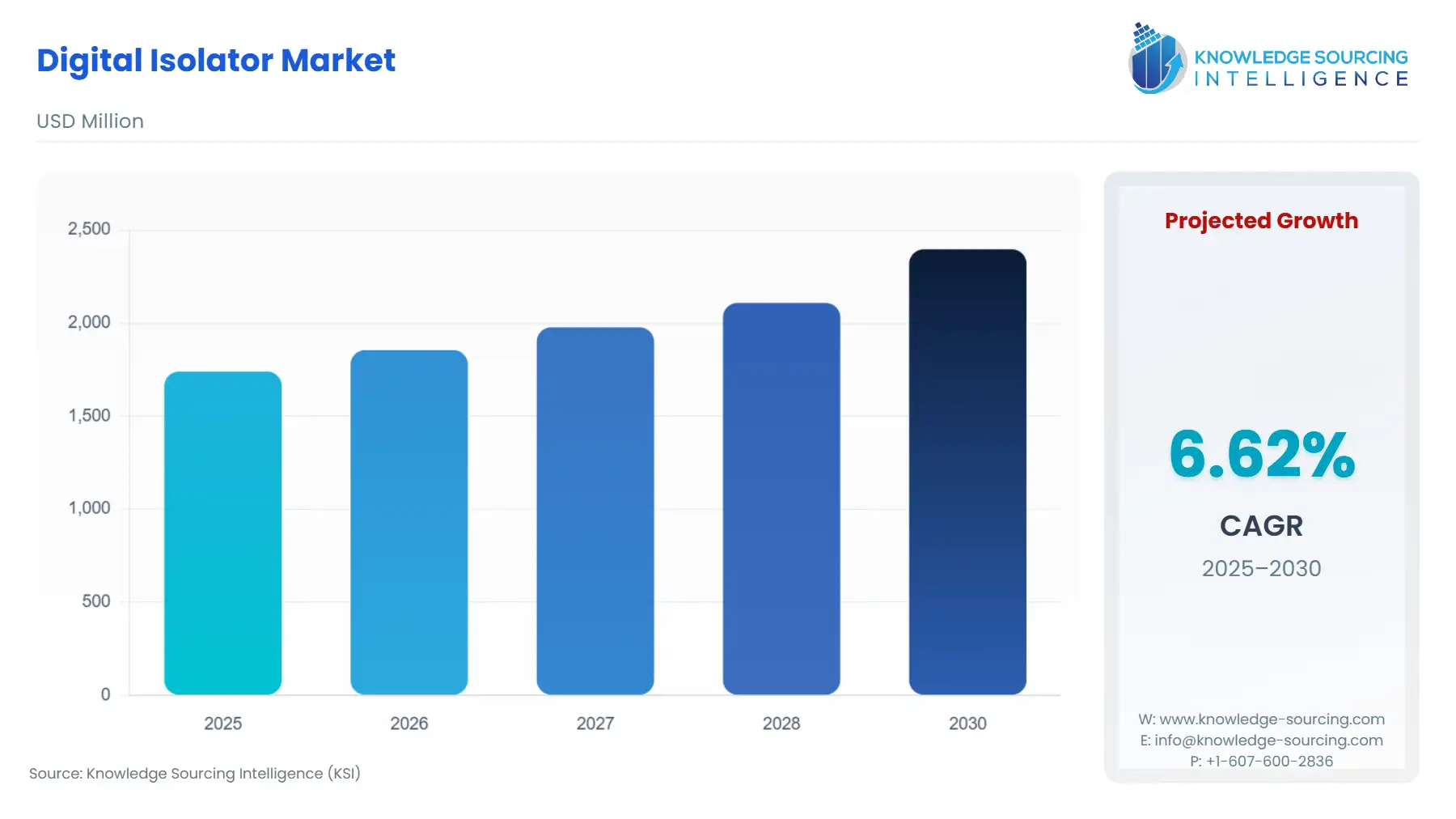

The Digital Isolator Market, with a 6.62% CAGR, is anticipated to reach USD 2.397 billion by 2030 from USD 1.740 billion in 2025.

Digital Isolator Market Key Highlights

The digital isolator market, a critical segment within the broader power and mixed-signal semiconductor landscape, provides galvanic isolation, enabling the safe and reliable exchange of digital signals between circuits operating at vastly different power potentials. These components are essential for protecting human operators and sensitive low-voltage electronics from high-voltage hazards, while also eliminating ground loops that corrupt signal quality. The contemporary market trajectory is fundamentally shaped by the confluence of high-growth sectors—namely, electric mobility, industrial digitalization, and high-density power conversion—all of which require performance levels that traditional optocouplers cannot consistently deliver.

Digital Isolator Market Overview

& Scope

Report Metric

Details

Total Market Size in 2026

USD 1.740 billion

Total Market Size in 2031

USD 2.397 billion

Growth Rate

6.62%

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

Segmentation

Type, Material, Application, Geography

Geographical Segmentation

North America, South America, Europe, Middle East and Africa, Asia Pacific

Companies

The Digital Isolator Market is segmented by:

- Type: The market is segmented into Capacitive Coupling, Magnetic Coupling, Giant Magnetoresistive, and Others. Capacitive coupling technology maintains its market leadership, driven by its inherent advantages in high-speed data transmission, which is critical for modern telecommunications infrastructure and advanced automotive applications. The technology is valued for its high Common-Mode Transient Immunity (CMTI) and robust performance in noisy electrical environments, making it suitable for high-frequency switching applications in power electronics and industrial drives.

- Material: The market segment consists of Polyimide-Based and Silicone-Dioxide (SiO2). Silicon Dioxide (SiO2) is a key insulation material used in capacitive digital isolators, providing high dielectric strength and long-term reliability. Its excellent thermal stability and integration compatibility with standard CMOS processes make it a preferred choice for high-volume manufacturing of robust isolation components required in automotive and industrial applications.

- Application: The market is segmented as Gate Drivers, DC/DC Converters, Analog-to-Digital Converters (ADC), and Others. Gate Drivers represent a critical application segment, fundamentally coupled with the rapid adoption of power switching devices. The need for digital isolators in gate drivers is escalating as Silicon Carbide (SiC) and Gallium Nitride (GaN) devices become standard in high-efficiency systems like EV traction inverters and solar power inverters, demanding isolators with superior Common-Mode Transient Immunity (CMTI) of 100 kV/µs or higher.

- End-User: Geographically, the market is expanding at varying rates depending on the location.

________________________________________________________________

Top Trends Shaping the Digital Isolator Market

Adoption of Advanced Isolation Technologies

More manufacturers are developing capacitive and magnetic coupling technologies in an effort to achieve higher data rates, improved noise immunity, and better power efficiency. These advancements in technology are thus a means of availing to the industrial market the increased demand for high-performance isolation and compliance with regulatory requirements, and contribute to reducing system complexity and component footprint throughout the supply chain.

Focus on Integrated Power and Signal Isolation

Increased demand for compact system designs and enhanced general performance goals of various companies are pushing the companies into adopting integrated solutions that combine signal isolation with isolated power supply on a single chip. This trend thus has implications of reduced system cost, improved reliability and increased attractiveness of the market to the automotive and industrial sectors concerned with space constraints.

________________________________________________________________

Digital Isolator Market Growth Drivers vs. Challenges

Drivers:

- Rising Industrial Demand Across Key Sectors: The digital isolator market is dominated by increasing demand from automotive, industrial automation, and renewable energy industries. The global transition to electrification dictates an acute demand for high-performance isolation in Electric Vehicles (EVs) for battery management systems, on-board chargers, and traction inverters. Concurrently, Industry 4.0 and automated factory floors drive the need for digital isolators in industrial motor drives and communication interfaces, where they ensure noise immunity and prevent ground potential differences from corrupting real-time control signals.

- Technological Advancements in Isolation Processes: Manufacturers are recognising the merits of using capacitive coupling and magnetic coupling techniques and are increasingly developing such methods for use in high-speed data transmission. The application of new techniques will increase data rates, improve noise immunity and end up with higher reliability digital isolators. These advancements in turn allow the new isolation solutions to manufacture various products for gate drivers, for power conversion, for data acquisition systems, etc. New techniques will also enable the companies producing digital isolators to comply with modern safety and environmental regulations and enable their operations to remain competitive.

Challenges:

- High Implementation Costs: The high initial Bill of Materials (BOM) cost associated with digital isolators, particularly those incorporating specialized insulation materials, can temper adoption rates in cost-sensitive consumer electronics applications.

________________________________________________________________

Digital Isolator Market Regional Analysis

- Chinese Market Analysis (Asia-Pacific): China is the single most dominant geographic segment, driven by its massive electronics manufacturing ecosystem and aggressive government-backed initiatives in new energy vehicles (NEVs) and renewable power generation. The sheer volume of production in industrial control systems, consumer electronics, and EV components ensures a colossal demand for all classes of digital isolators. Local factors, including the rapid scaling of Gigafactories for battery production and the world's largest roll-out of high-power charging infrastructure, fuel a demand for high-channel-count digital isolators for BMS and high-CMTI isolators for power modules, making China a critical center for both consumption and localized R&D/manufacturing.

________________________________________________________________

Digital Isolator Market Segmentation:

- By Type

- Capacitive Coupling

- Magnetic Coupling

- Giant Magnetoresistive

- Others

- By Material

- Polyimide-Based

- Silicone-Dioxide (SiO2)

- By Application

- Gate Drivers

- DC/DC Converters

- Analog-to-Digital Converters (ADC)

- Others

- By End-User

- Healthcare

- IT & Telecommunication

- Energy & Power

- Automotive

- Manufacturing

- Others

- By Geography

- Americas

- USA

- Europe, the Middle East, and Africa

- Germany

- France

- Netherlands

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- Americas