Report Overview

Digital Immune System Market Highlights

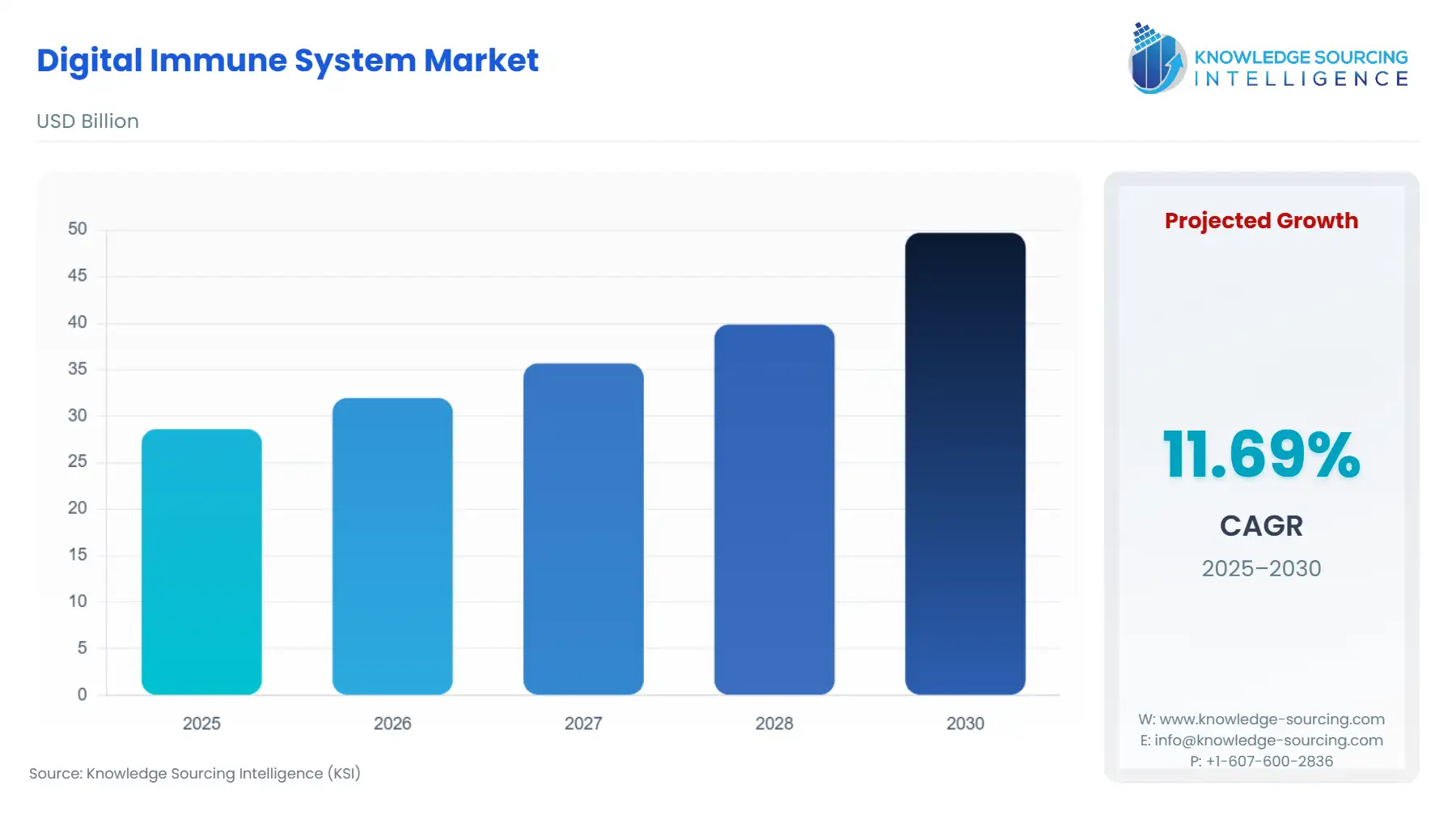

Digital Immune System Market, with a 11.34% CAGR, is anticipated to reach USD 54.498 billion in 2031 from USD 28.608 billion in 2025.

Digital Immune System Market Key Highlights

The Digital Immune System (DIS) market represents a strategic response to the fragility inherent in rapidly digitized enterprises. Defined as a combination of software engineering practices and technologies—including observability, AI-augmented testing, and auto-remediation—a robust DIS is an operational necessity to mitigate business risk and ensure superior, uninterrupted customer experience. Its core purpose is to make applications and services resilient, enabling rapid recovery from anomalies like software bugs and security flaws without the need for extensive human intervention. The market's current trajectory reflects the enterprise realization that traditional, perimeter-focused security models are insufficient for the dynamic, distributed nature of modern digital platforms. This structural vulnerability, amplified by the increasing volume and value of digital assets, establishes a strong foundational demand for adaptive, self-defending digital ecosystems.

________________________________________________________________

Digital Immune System Market Analysis

Growth Drivers

The surge in global cybercrime costs creates a high-stakes risk environment, propelling direct demand for DIS. Enterprises adopt DIS to safeguard against financial fraud and intellectual property theft, treating the investment as a proactive risk mitigation measure rather than a discretionary IT spend. The pervasive trend of Digital Transformation forces companies to rely on complex, interconnected digital systems, increasing the attack surface. This complexity mandates the adoption of DIS components like Observability and Chaos Engineering to maintain system resilience, directly driving the solution segment's consumption. Simultaneously, the proliferation of Internet of Things (IoT) and Bring Your Own Device (BYOD) policies introduces numerous, often insecure, endpoints, escalating the need for the continuous, real-time security scanning and automated response capabilities central to a DIS.

Challenges and Opportunities

The primary constraint on market expansion is the high initial implementation cost associated with integrating diverse, advanced DIS technologies, which presents a significant barrier to entry, especially for small and medium-sized enterprises (SMEs). This financial hurdle can decelerate the adoption of comprehensive solutions. Conversely, the market is poised for immense opportunity through the deepening integration of Adaptive AI and Machine Learning into DIS architectures. This technological advancement allows systems to learn from emerging threats, offering predictive rather than merely reactive defense mechanisms. Such innovation directly increases the value proposition of DIS products, creating a powerful incentive for enterprise investment and accelerating demand for next-generation, self-optimizing security platforms.

________________________________________________________________

Digital Immune System Market Growth Drivers vs. Challenges

Drivers:

Rising Industrial Demand Across Key Sectors: The surge in global cybercrime costs creates a high-stakes risk environment, propelling direct demand for DIS. Enterprises adopt DIS to safeguard against financial fraud and intellectual property theft, treating the investment as a proactive risk mitigation measure rather than a discretionary IT spend. The pervasive trend of Digital Transformation forces companies to rely on complex, interconnected digital systems, increasing the attack surface. This complexity mandates the adoption of DIS components like Observability and Chaos Engineering to maintain system resilience, directly driving the solution segment's consumption.

Technological Advancements in Security Processes: The market is poised for immense opportunity through the deepening integration of Adaptive AI and Machine Learning into DIS architectures. This technological advancement allows systems to learn from emerging threats, offering predictive rather than merely reactive defense mechanisms. Such innovation directly increases the value proposition of DIS products, creating a powerful incentive for enterprise investment and accelerating demand for next-generation, self-optimizing security platforms.

Challenges:

High Implementation Costs: The high initial implementation cost associated with integrating diverse, advanced DIS technologies presents a significant barrier to entry, especially for small and medium-sized enterprises (SMEs).

________________________________________________________________

Digital Immune System Market Regional Analysis

US Market Analysis (North America): The US market for Digital Immune System solutions is characterized by high technological maturity, a significant concentration of global technology vendors, and a stringent compliance landscape. Large enterprises heavily influence demand in the Financial Services and Technology sectors that operate at scale and are subject to state-level regulations like the CCPA, alongside industry-specific mandates like HIPAA for healthcare. The imperative for resilient infrastructure is particularly pronounced due to the rapid adoption of multi-cloud environments, which increases systemic complexity. This market prioritizes advanced DIS components such as Applied Observability and Adaptive AI for real-time risk scoring and automated governance, reflecting an established willingness to invest in cutting-edge security architectures to protect vast digital capital.

Brazil Market Analysis (South America): The Brazilian market is primarily catalyzed by the ongoing, rapid pace of digital payment system adoption and increasing government focus on data protection. The introduction of the Lei Geral de Proteção de Dados (LGPD), the Brazilian data protection law, is the principal regulatory driver compelling local and international companies to implement robust DIS measures. Adoption is concentrated among major banks and telecommunications firms that require enhanced fraud detection and service resilience. The market exhibits a higher preference for Cloud-based deployment models due to lower initial capital expenditure requirements compared to on-premise infrastructure, though budgetary constraints for comprehensive DIS rollouts remain a consistent headwind.

Germany Market Analysis (Europe): The German market is defined by its deep manufacturing and industrial base, making it a critical hub for the Industry Vertical: Manufacturing segment. The imperative to secure Operational Technology (OT) and highly automated Industrial Internet of Things (IIoT) systems from sophisticated nation-state and industrial espionage attacks drives the demand for DIS. While GDPR provides a foundational compliance layer, the specific need to maintain high-availability production lines focuses demand on DIS solutions that incorporate Chaos Engineering and real-time Auto-Remediation to prevent catastrophic downtime. This market's technical sophistication necessitates solutions that integrate seamlessly with complex legacy industrial systems.

Saudi Arabia Market Analysis (Middle East & Africa): Saudi Arabia's Vision 2030, which promotes massive government-led digital transformation projects, is the primary accelerator of DIS growth. The market is characterized by significant public sector and critical infrastructure investments (e.g., energy and utilities) that demand top-tier, resilient cybersecurity. The growth is not just driven by compliance but by a strategic, national security imperative to safeguard newly digitized assets. Due to high per-capita government IT spending, the market displays a strong preference for On-Premise and highly customized DIS solutions, which offer greater control and adherence to national data sovereignty and security mandates for critical national data.

China Market Analysis (Asia-Pacific): The Chinese market is heavily influenced by state-mandated cybersecurity and data localization policies. The Cybersecurity Law of the People's Republic of China and related regulations impose strict requirements for the protection of Critical Information Infrastructure (CII). This legal framework directly creates non-negotiable demand for DIS solutions that comply with domestic standards and are capable of integrating with state-monitored cybersecurity architectures. Local firms primarily drive adoption, focusing on large-scale deployments in the IT and Telecom and Manufacturing sectors. The scale of the digital ecosystem necessitates highly scalable DIS platforms, often developed by domestic technology leaders.

Digital Immune System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Digital Immune System Market Size in 2025 | USD 28.608 billion |

Digital Immune System Market Size in 2030 | USD 49.716 billion |

Growth Rate | CAGR of 11.69% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Digital Immune System Market |

|

Customization Scope | Free report customization with purchase |

Digital Immune System Market Segmentation

By Component

Solution

Services

By Deployment Mode

On-Premise

Cloud

By Industry Vertical

IT and Telecom

BFSI

Manufacturing

Education

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others