Report Overview

Dental Implants Market Size, Highlights

Dental Implants Market Size:

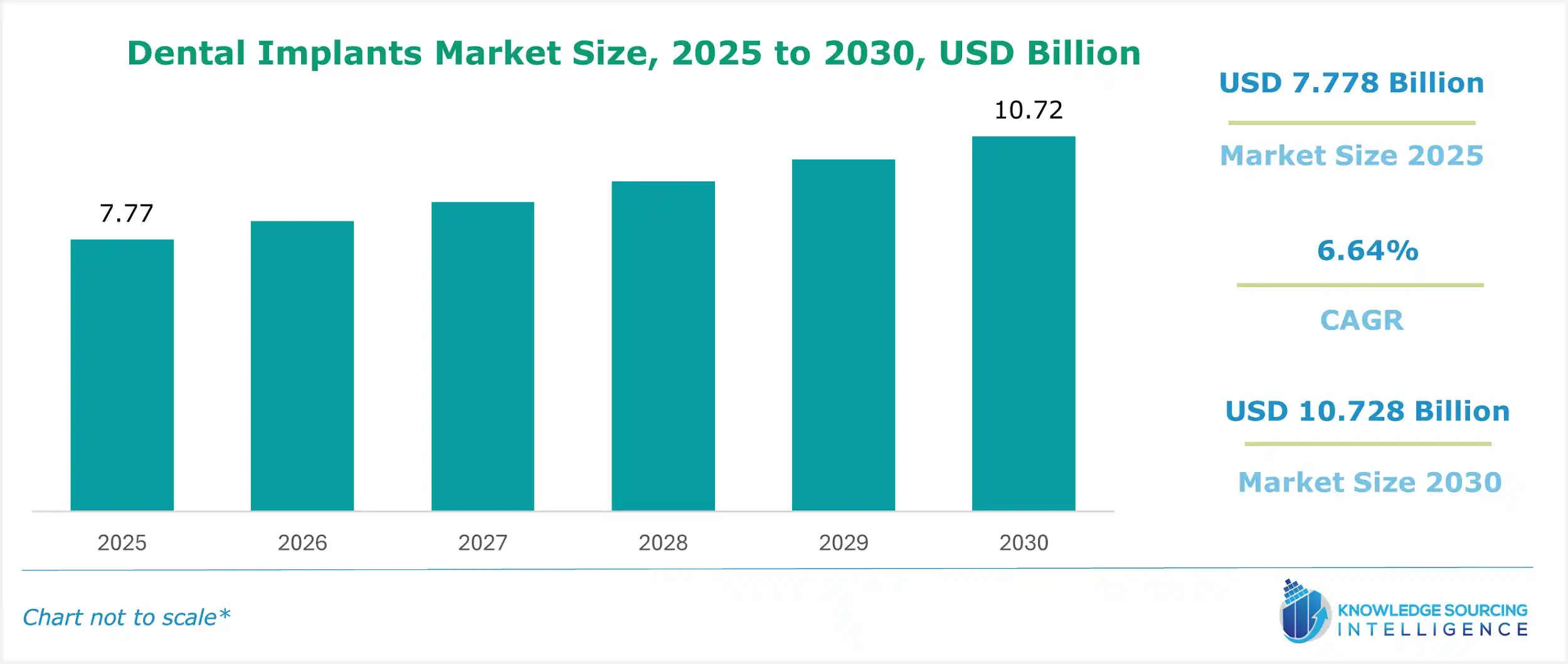

The Dental Implants Market is expected to grow from USD 7.778 billion in 2025 to USD 10.728 billion in 2030, at a CAGR of 6.64%.

The dental industry is witnessing robust growth in dental implantology, driven by rising demand for advanced tooth replacement solutions. The need for oral implants is expanding as innovations in prosthetic dentistry enhance patient outcomes and aesthetic appeal. Maxillofacial implants are gaining popularity, addressing complex reconstructive needs in the oral and facial structures. The demand for tooth replacement is evolving with cutting-edge materials and techniques, improving durability and functionality. These advancements are reshaping clinical practices, offering market players opportunities to leverage precision-driven technologies and meet the growing expectations of patients for reliable, long-lasting dental solutions in a competitive global landscape.

Dental Implants Market Trends:

The dental market is evolving rapidly, propelled by major trends shaping clinical and commercial landscapes. Dental care for the aging population drives demand for durable, functional solutions like bone regeneration implants, addressing bone loss in elderly patients. Rising need for dental aesthetics fuels innovations in minimally invasive implantology, offering enhanced patient comfort and recovery. Periodontal disease treatment remains critical, with advanced therapies improving outcomes. Additionally, the influence of dental tourism is crucial, as cost-effective, high-quality treatments attract patients worldwide. The market players must adapt to these shifts, leveraging cutting-edge technologies to meet growing expectations for precision, aesthetics, and accessibility in a dynamic market.

The growth in urbanization is also expected to play a major role in market growth in the coming years. According to the World Bank, the global urban population is expected to surge to 68% by 2050, up from 55% in 2018. There has also been a surge in the applications of dental implants in several types of therapeutic areas, which also includes a rise in the demand for prosthetics. Major companies have been playing a major role in the market growth in the past few years. For instance, in September 2021, Straumann Group, a major provider of orthodontic and tooth replacement solutions, announced a partnership with Aspen Dental Management Inc. to provide dental implant solutions, CAD/CAM, and abutment options to over 1000 ADMI and its affiliated offices across the 45 US states. This development is expected to play a major role in market growth, along with the rise in investments in innovation and product development.

The market is expected to surge in the coming years, due to the rise in the number of geriatric people worldwide. According to the data given by the United Nations, in 2019, there were around 703 million persons who were aged 65 years or more worldwide. The number has been projected to double to 1.5 billion in 2050. Moreover, the total share of the global population that was aged 65 years or more had increased from 6% in 1990 to around 9% in 2019. The proportion is expected to rise to around 16% in 2050. Older adults have been expected to account for several oral implant prostheses. Dental implant therapy has proven to be a safer and more predictable method of permanent tooth replacement, especially in older people. Dental implants are also long-lasting and effective in older people. It also enhances older people’s daily life and provides them with more confidence, and improves their physical health.

Major companies have been making significant developments in the market in the past few years. For instance, Implant Logistics has been offering several types of dental implants to its customers. The company offers Implant One Series 300, 400 & 500 implants. Other players have also been offering dental implants to their patients. Cortex has been offering several models of dental implants that provide and allow doctors and patients to enjoy more convenient, quicker dental implant procedures.

The market for the subperiosteal implant is expected to increase owing to the rise in the aging population and bone-linked deficiencies among them. With growing age, a surge in cases of deficiencies in bone and bone problems has been observed. Aged people tend to have a lower bone mass, which makes it difficult for other types of plants to sustain themselves. The Subperiosteal Implant, on the other hand, is placed over the bone by making a small incision in the gums, and hence is proven to be a more effective implant among patients with lower bone mass. Furthermore, the installation of these implants is less painful as they do not involve drilling in the jawbone.

Titanium is a commonly used material to manufacture subperiosteal implants. Panther Dental offers a next-generation titanium subperiosteal implant, which is developed through the latest CAD/CAM field technology. AB Dental Device is another leading subperiosteal implant manufacturer that offers customized subperiosteal implants.

Dental Implants Market Drivers

Global Urbanization Trends: Rapid urbanization is a significant catalyst for the dental implants market. According to the World Bank, the global urban population is projected to rise from 55% in 2018 to 68% by 2050. Urban environments foster greater access to advanced dental care, higher disposable incomes, and increased awareness of oral health, driving demand for dental implants. Urban consumers, particularly in developed and emerging markets, prioritize aesthetic and functional dental solutions, boosting the adoption of implants for cosmetic and therapeutic purposes.

Aging Global Population: The rising geriatric population is a primary driver of market growth. The United Nations reports that the global population aged 65 and older reached 703 million in 2019, projected to double to 1.5 billion by 2050, with their share increasing from 9% in 2019 to 16% by 2050. Older adults often require dental implants due to age-related tooth loss and reduced bone density. Dental implants offer a safer, more predictable, and long-lasting solution compared to traditional dentures, enhancing quality of life by improving chewing ability, speech, and confidence. The reliability of implants in geriatric patients fuels market expansion.

Technological Advancements and Industry Partnerships: Innovations in implant design, materials, and manufacturing processes, such as CAD/CAM technology, have improved the precision, durability, and accessibility of dental implants. Strategic partnerships among major players further accelerate market growth. For instance, in September 2021, Straumann Group partnered with Aspen Dental Management Inc. to supply dental implant solutions, including CAD/CAM abutments, to over 1,000 offices across 45 U.S. states. Such collaborations expand market reach and enhance product offerings, driving adoption in both developed and emerging markets.

Rising Demand for Prosthetics: The increasing application of dental implants in various therapeutic areas, such as restorative and cosmetic dentistry, is propelling market growth. The demand for prosthetics, including crowns and bridges supported by implants, is rising due to their superior functionality and aesthetic appeal compared to traditional solutions. This trend is particularly pronounced in urban centers and among aging populations seeking durable tooth replacement options.

Dental Implants Market Restraints

High Costs of Dental Implants: The high cost of dental implant procedures, including surgery, materials, and follow-up care, remains a significant barrier, particularly in price-sensitive markets. While implants offer long-term value, the upfront investment can deter patients, especially in regions with limited insurance coverage or lower disposable incomes. This restraint is particularly pronounced in developing economies, where access to advanced dental care is limited.

Complex Procedures and Skill Requirements: Dental implant procedures require specialized training and expertise, limiting their availability in regions with underdeveloped dental infrastructure. Complications such as implant failure or infection, though rare, can further deter adoption, particularly among risk-averse patients or practitioners with limited experience.

Regulatory and Reimbursement Challenges: Stringent regulatory requirements for implant approval and varying reimbursement policies across regions can hinder market growth. In some markets, limited insurance coverage for dental implants restricts patient access, particularly for elective or cosmetic procedures.

Dental Implants Market Segment Analysis

- By Type: Subperiosteal Implants

Subperiosteal implants are gaining traction due to their suitability for patients with low bone mass, a common issue among the aging population. Unlike endosteal implants, which require drilling into the jawbone, subperiosteal implants are placed over the bone through a small incision in the gums, making them less invasive and more suitable for patients with bone deficiencies. Titanium, a biocompatible material, is commonly used in their manufacture, with companies like Panther Dental leveraging advanced CAD/CAM technology to produce next-generation subperiosteal implants. AB Dental Device also offers customized solutions, enhancing patient outcomes. The segment’s growth is driven by the rising prevalence of bone-related deficiencies in geriatric patients.

- By Material: Titanium

Titanium dominates the dental implants market due to its biocompatibility, strength, and corrosion resistance, making it ideal for long-term use in the oral environment. Its ability to osseointegrate with bone ensures implant stability, driving its adoption in both subperiosteal and endosteal implants. Innovations in titanium surface treatments, such as nanostructured coatings, enhance osseointegration rates, further boosting this segment’s growth. Companies like Implant Logistics, offering Series 300, 400, and 500 titanium implants, cater to diverse patient needs, reinforcing the segment’s market dominance.

Dental Implants Market Geographical Outlook:

- The North American region is anticipated to hold a substantial market share over the forecast period, owing to the rising geriatric population in the region.

The dental implants market has been classified into North America, South America, Europe, the Middle East, and Africa, and the Asia Pacific. The North American region is anticipated to hold a substantial market share over the forecast period owing to the rising geriatric population in the region. Furthermore, the presence of better dentistry facilities, better awareness of dental issues and their impacts on people, and increasing investments in the sector are some of the factors anticipated to propel the dental implant market growth in North America. As per data from the World Bank, the share of the U.S. population aged 65 years and above has increased from 12.98% in 2010 to 16.63% in 2020, while the total population aged 65 years and above has reached 54.796 million in 2020, from 40.156 million in 2010. The rising geriatric population is one of the prominent factors projected to boost the growth of the U.S. dental implant market during the forecast period.

The Asia Pacific is expected to have steady growth in the market, due to the rising healthcare expenditure in the region, leading to improved access to healthcare facilities, along with the rise of disposable income.

List of Top Dental Implants Companies:

- Institut Straumann AG

- Danaher (Envista)

- Osstem UK

- Dentsply Sirona

- Dentium USA

Dental Implants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Dental Implants Market Size in 2025 | USD 7.778 billion |

| Dental Implants Market Size in 2030 | USD 10.728 billion |

| Growth Rate | CAGR of 6.64% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Dental Implants Market |

|

| Customization Scope | Free report customization with purchase |

Dental Implants Market Segmentation:

- By Type

- Subperiosteal Implant

- Endosteal Implant

- Zygomatoc Implant

- By Material

- Zirconium

- Titanium

- Cellulose Material

- Others

- By End User

- Hospitals

- Clinics

- Academic And Research

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- Uk

- Spain

- Others

- Middle East And Africa

- Saudi Arabia

- Uae

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

- North America