Report Overview

Dental Appliance Market Size, Highlights

Dental Appliance Market Size:

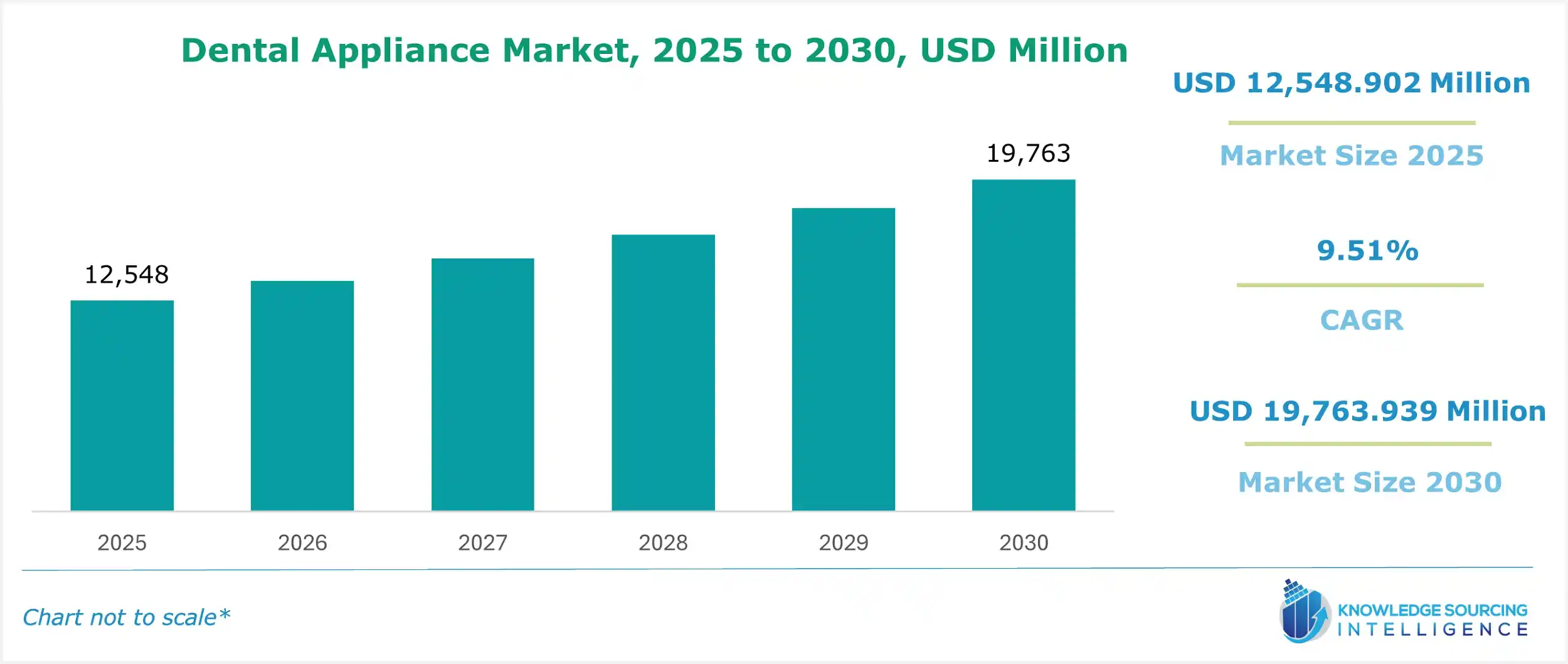

The dental appliance market is expected to attain US$19,763.939 million in 2030 from US$12,548.902 million in 2025, growing at a CAGR of 9.51%.

Dental appliances are common parts of dentistry and orthodontics and are defined as any device involved in a dental treatment procedure. These appliances can be either permanent or removable. These help in repairing a damaged tooth or teeth or replacing missing teeth, providing the best outcome from orthodontic care and improving overall oral health. The market is projected to grow during the forecast period due to the rising dental health awareness among individuals globally. People prefer visiting dentists to maintain their oral health. The growing disposable income and increasing purchasing power have further allowed individuals to focus on enhancing their looks and dental beautification. Hence, people are opting for teeth alignment and are using braces, further propelling the market expansion. Furthermore, booming dental tourism is further providing an impetus to fuel the market growth during the forecast period.

Dental Appliance Market Overview & Scope:

The dental appliance market is segmented by:

- Type: By type, the dental appliance market is categorized into permanent and removable. The removable category is estimated to grow greatly. The removable dental appliances, including braces and aligners, offer comfort and aesthetics with improved dental hygiene.

- Product Type: By product type, the market is divided into crowns & fillings, bridges, braces, and others. The crowns & fillings category is estimated to grow significantly as they help protect weaker and repair broken teeth.

- Distribution Channel: By distribution channel, the dental appliance market is divided into online and offline. The online category is estimated to attain a major market share due to the increasing development of e-commerce platforms.

- Region: North America is projected to hold a significant share of the global dental appliances market owing to its advanced dental healthcare facilities. Furthermore, in the United States, there is a shift from volume-based care to value-based care, contributing to market growth during the forecast period.

Top Trends Shaping the Dental Appliance Market:

1. Digital Orthodontic Platforms

The introduction of digital orthodontics platforms is among the key factors propelling the market growth during the forecasted timeline. The digital platforms for orthodontics include multiple features like AI, cloud-based treatment, and intraoral scanners, enhancing the efficiency of orthodontic services and increasing its demand.

Dental Appliance Market Growth Drivers vs. Challenges:

Opportunities:

- Surging demand for cosmetic dentistry: One of the major reasons driving the increasing need for dentists includes the increasing global demand for cosmetic dentistry. This growing demand for cosmetic dentistry is further supported by the surging disposable income of consumers willing to spend on their appearance.

- Growing dental tourism industry: Dental tourism is gaining popularity worldwide, with Hungary, Costa Rica, and Malaysia allowing an inflow of tourists every year and becoming hubs providing efficient dental care. Patients are willing to travel to have access to dentists with extensive knowledge. In addition, they are offering advanced dental treatments too, at affordable costs. Due to the many options available, individuals travel to find the best deals and pay for superior services that are cheaper than in their own country. The most popular places for dentures and crowns include the United Kingdom, Mexico, the Philippines, Costa Rica, and India.

Challenges:

- Higher cost of dental equipment: A major factor challenging the global dental appliances market growth.

Dental Appliance Market Regional Analysis:

- Asia Pacific: The Asia Pacific region is predicted to experience high growth prospects owing to the rising disposable income of consumers and the increasing dental health awareness among individuals.

Dental Appliance Market Competitive Landscape:

The market is fragmented, with many notable players, including Align Technology, Inc., Institut Straumann AG, Dentsply Sirona, NuSmile Ltd., DentCare Dental Lab Pvt. Ltd., Ruthinium Group Pvt. Ltd., 3M, DB Orthodontics, Panthera Dental, DynaFlex, Great Lakes Dental Technologies, Specialty Appliances, and Ormco (Envista), among others.

- Product Launch: In June 2024, LM Dental, a part of the Planmeca Group, launched the My LM-Activator appliance, which is aimed at early orthodontics treatment. The product range features advanced and more optimized designs and features.

Dental Appliance Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Dental Appliance Market Size in 2025 | US$12,548.902 million |

| Dental Appliance Market Size in 2030 | US$19,763.939 million |

| Growth Rate | CAGR of 9.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Dental Appliance Market | |

| Customization Scope | Free report customization with purchase |

The Dental Appliance Market is analyzed into the following segments:

By Type

- Permanent

- Removable

By Product Type

- Crowns & Fillings

- Bridges

- Braces

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa