Report Overview

Deep Brain Stimulation Devices Highlights

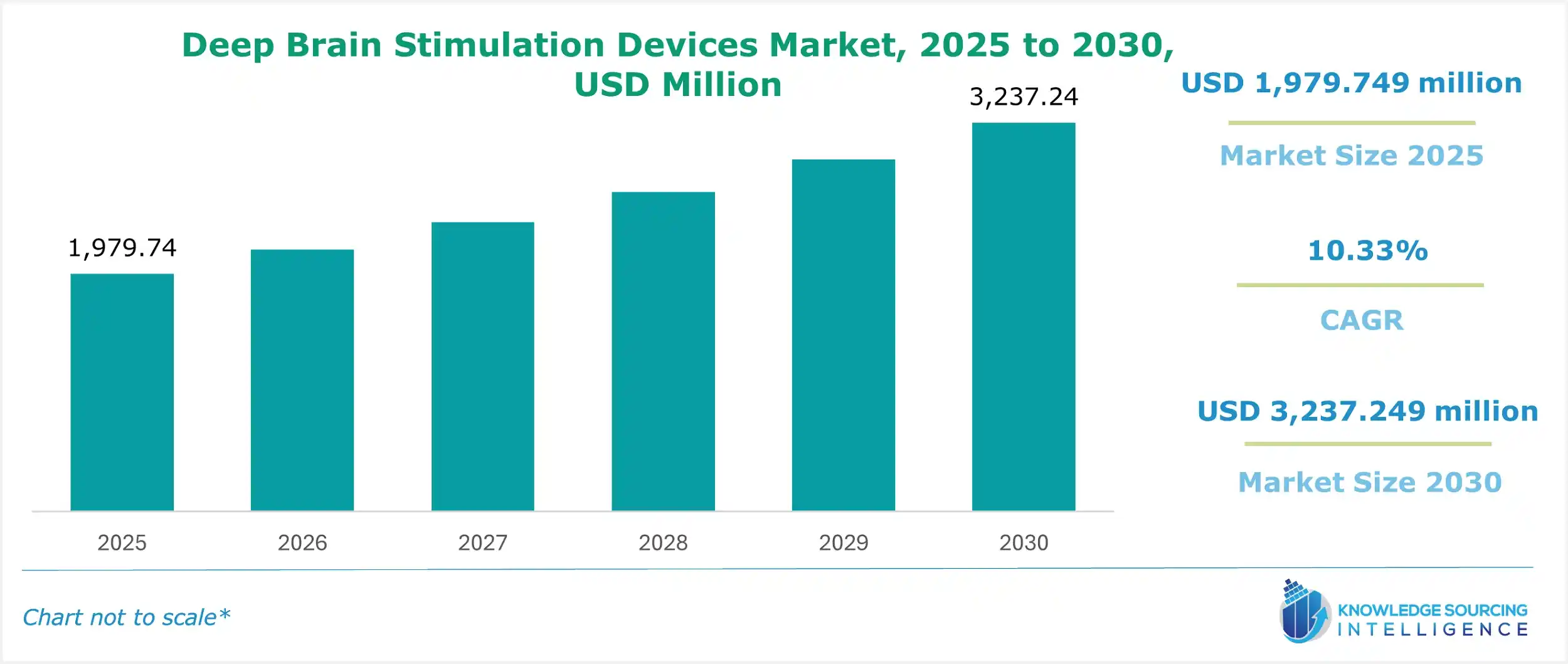

Deep Brain Stimulation Devices Market Size

The Deep Brain Stimulation (DBS) Devices Market is set to witness robust growth at a CAGR of 10.33% during the forecast period to be worth US$3,237.249 million in 2030 from US$1,979.749 million in 2025.

Deep Brain Stimulation Devices Market Trends

The global deep brain stimulation device market is expected to witness major growth due to the increasing global prevalence of neurological diseases, like Parkinson's disease and dystonia, among others, and the rising technological advancements in the healthcare sector.

Furthermore, the increasing global acceptance and awareness of deep brain stimulation are also among the key factors propelling the DBS device market’s expansion during the forecast period. The introduction of key governmental initiatives and policies are among the factors propelling the global acceptance and awareness of DBS technology. Furthermore, innovations and investments in this market will likely provide more effective devices in the global DBS sector.

Deep Brain Stimulation Devices Market Growth Factors:

The Deep Brain Stimulation Devices Market is witnessing significant growth driven by two major factors:

- Growing prevalence of neurological disorders: The major factor propelling the global deep brain stimulation devices market’s growth is the increasing prevalence of neurological disorders worldwide. These include diseases like Parkinson's Disease, OCD, epilepsy, essential tremors, and dystonia.

- Increasing technological advancement: The growing technological advancement in the healthcare equipment and technology sector is among the major factors propelling the DBS device market growth during the forecasted timeline. The introduction of key governmental policies and investment opportunities are among the major factors pushing the technological advancements in the healthcare sector.

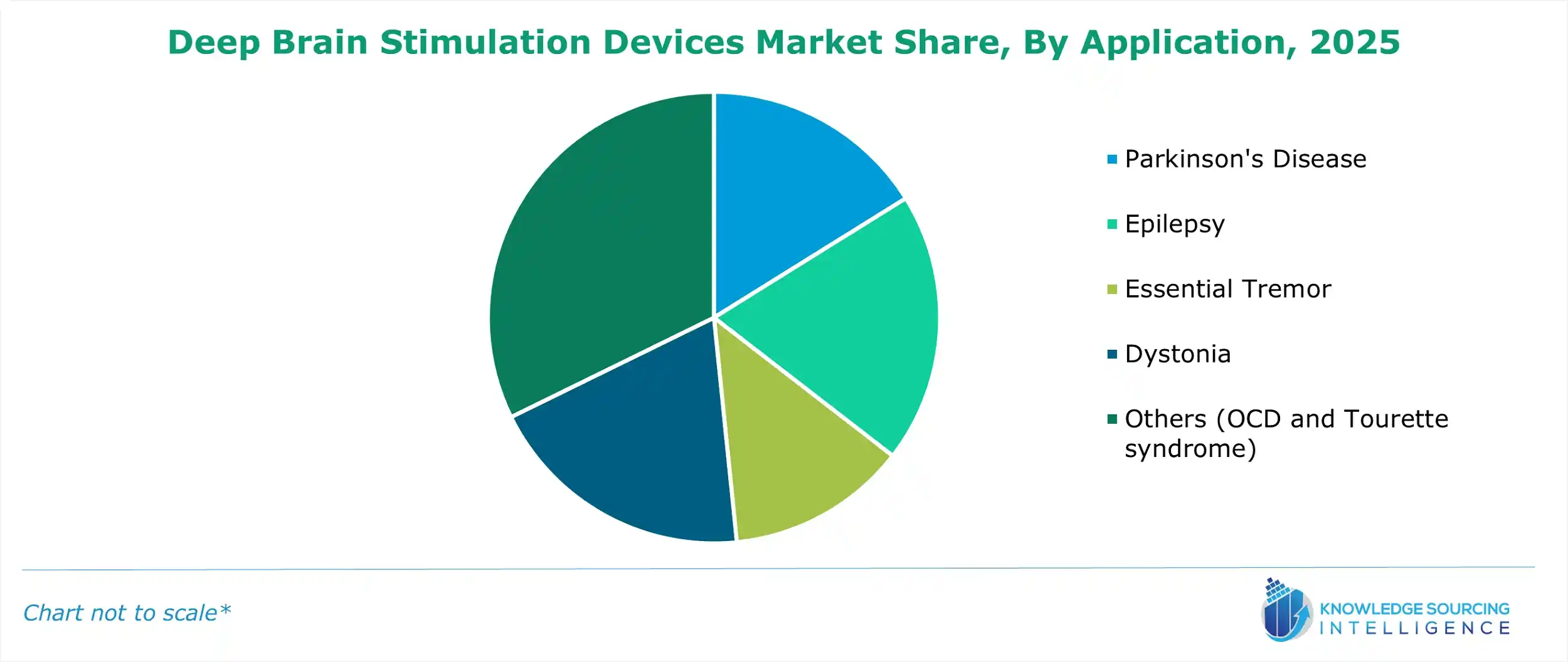

Deep Brain Stimulation Devices Market Segmentation Analysis by Application

- Parkinson's Disease: The global cases of Parkinson's Disease witnessed major growth, boosting the DBS device market expansion. Multiple studies conducted worldwide stated that DBS therapy offers key applications in treating Parkinson's disease.

- Epilepsy: In the therapy of epilepsy diseases, DBS therapy offers key applications, which majorly include therapy for seizure management.

- Essential Tremor: In the cases of essential tremor, deep brain stimulation therapy offers enhanced capabilities, as it helps in targeting the thalamus and regulates brain signals.

- Dystonia: In treating dystonia, DBS offers greater efficacy than conventional therapies. DBS devices help in delivering electrical impulses to the targeted areas of the brain.

- Others (OCD and Tourette syndrome): For the treatment of OCD, the DBS devices help in modulating the CSTC circuitry of the brain, whereas in the therapy of Tourette syndrome, DBS targets the basal ganglia and thalamus.

Deep Brain Stimulation Devices Market Segmentation Analysis by Product Type

- Single-channel Deep Brain Stimulators: Single-channel DBSs are devices that are specifically designed to offer a simpler application. This device includes a compact implantable pulse generator and a single lead with multiple electrodes.

- Dual-channel Deep Brain Stimulators: The dual-channel DBS are among the most common and efficient types of DBS devices. These devices are commonly used in stimulating internal globus pallidus and Parkinson's disease.

Deep Brain Stimulation Devices Market Segmentation Analysis by End-User

- Hospitals: Hospitals are among the primary users of deep brain stimulation devices, mainly due to the availability of advanced facilities and higher patient inflow.

- Ambulatory Surgical Centers: An ambulatory surgical center is a type of modern healthcare facility specializing in outpatient surgical procedures. With the increasing adoption of deep brain stimulation therapy worldwide, the adoption of DBS technology in ambulatory surgical centers is expected to increase.

- Neurological Clinics: The demand for DBS devices in neurological clinics is expected to increase significantly as these clinics specialize in treating neurological disorders.

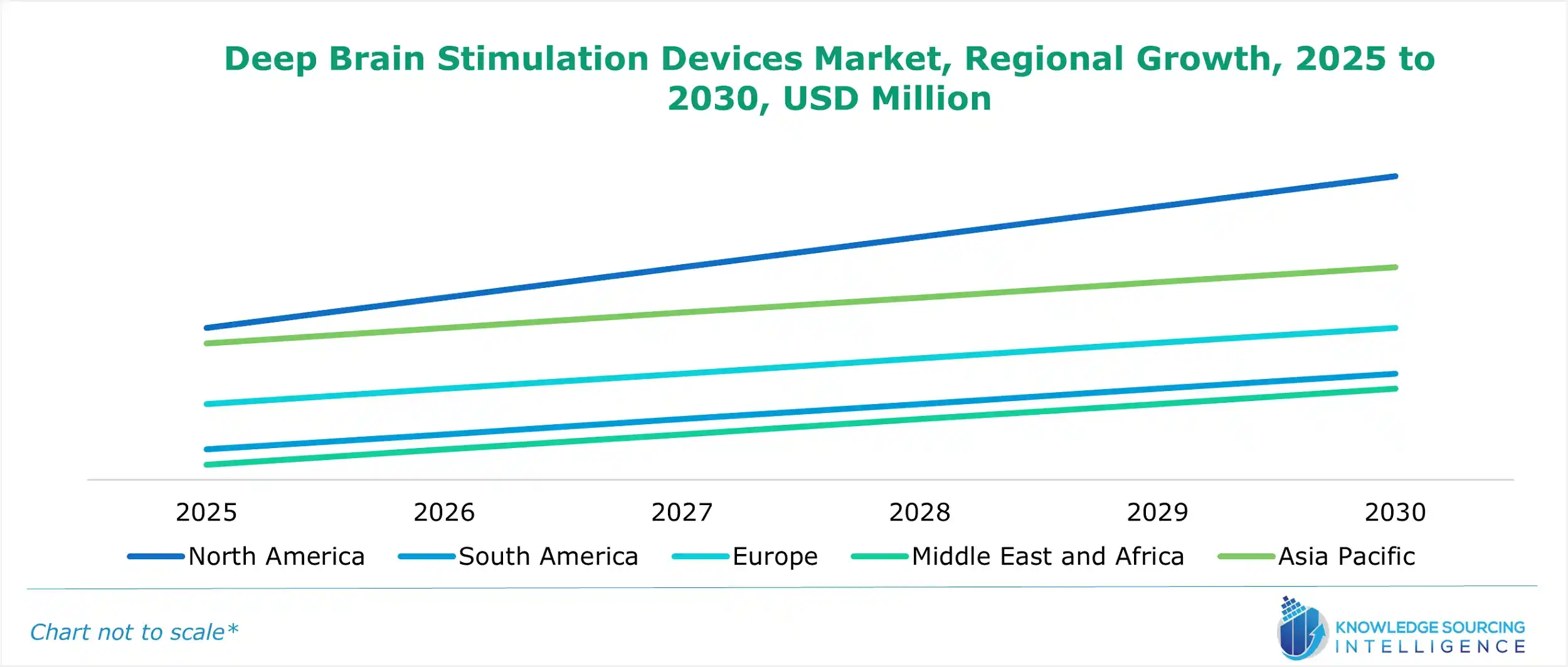

Deep Brain Stimulation Devices Market Geographical Outlook:

The deep brain stimulation devices market report analyzes growth factors across the following five regions:

Deep Brain Stimulation Device Market – Competitive Landscape

- Boston Scientific Corporation: The company is focused on advanced DBS technology, with the Vercise DBS, designed to provide a therapeutic benefit for the treatment of Parkinson's disease and other neurological conditions through the stimulation of specific neurons.

- Abbott: Well-known major market player focused on neuromodulation devices offering cutting-edge devices that advance the therapy options in movement disorders such as Parkinson's disease. Solutions from the company are highly valued for leveraging technology to drive the best outcomes in patients.

- Medtronic plc: Leader in DBS treatments, with its Percept RC device having FDA approval for the treatment of a range of movement disorders. The company emphasizes continuous innovation and patient-centric designs to enhance therapeutic efficacy.

- Renishaw plc: An expert in cutting-edge neurostimulation technologies, with a particular emphasis on DBS customisation and accuracy. Through customized therapy, their systems seek to increase the effectiveness of treatment for neurological diseases.

These companies are the leaders in developing and supplying deep brain stimulation devices, offering a wide range of DBS devices in the global market. They are contributing extensively to innovation and development in the healthcare sector.

Deep Brain Stimulation Devices Market Latest Developments

- In August 2024, RebrAIn, a French healthcare technology leader, announced that the company achieved FDA approval for an AI-powered neurosurgical targeting technology. The technology helps in expanding the efficiency of the company's DBS devices.

- In January 2024, Medtronic plc, a global leader in healthcare technology, announced the FDA approval for the company's Percept RC Neurostimulator, which features BrainSense technology. The solution is a rechargeable neurostimulator, a type of deep brain stimulation system offered by the company.

Deep Brain Stimulation Devices Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Deep Brain Stimulation Devices Market Size in 2025 | US$1,979.749 million |

| Deep Brain Stimulation Devices Market Size in 2030 | US$3,237.249 million |

| Growth Rate | CAGR of 10.33% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Deep Brain Stimulation Devices Market |

|

| Customization Scope | Free report customization with purchase |

The Deep Brain Stimulation Devices Market is analyzed into the following segments:

- By Application

- Parkinson's Disease

- Epilepsy

- Essential Tremor

- Dystonia

- Others (OCD and Tourette syndrome)

- By Product Type

- Single-channel Deep Brain Stimulators

- Dual-channel Deep Brain Stimulators

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Neurological Clinics

- By Geography

- North America

- United States

- Canada

- Mexico

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Indonesia

- Others

- South America

- Brazil

- Argentina

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- North America